For mature investors, the current environment presents a rare fusion of clear regulation, technological advancement, and market undervaluation.

Written by: Cryptofada

Translated by: Felix, PANews

On June 9, a roundtable meeting of the cryptocurrency special working group chaired by SEC Chairman Paul Atkins hinted at a potentially favorable situation for cryptocurrency and DeFi participants in several ways. This marks the most supportive stance from U.S. regulators towards DeFi in history, although most people have yet to realize it. While formal legislation has not yet been enacted, these statements:

Create a regulatory atmosphere that encourages innovation

Strengthen the legitimacy of self-custody and on-chain participation

Suggest the formulation of more lenient and sensible rules for DeFi experimentation

This is likely to be the catalyst for a new wave of DeFi revival led by the U.S., and if you are in the crypto space, you know this undoubtedly sends a signal: a new era of DeFi regulated by the U.S. is being born. This is not just a regulatory shift, but a game of investment.

Key Positive Signals from the SEC Roundtable

1. Financial Independence

Atkins linked economic freedom, innovation, and private property rights to the spirit of DeFi. This narrative redefines DeFi as a continuation of the American spirit of financial independence rather than a regulatory threat. This stands in stark contrast to the previously confrontational attitude.

2. Eliminating Uncertainty of the Howey Test: Staking, Mining, and Validators—Not Securities

It was clearly stated that staking, mining, and validator operations are not securities transactions, eliminating a significant regulatory cloud that has long hindered institutional participation in consensus mechanisms. This addresses the fundamental concern that network participation itself could trigger securities regulation due to the Howey test. This clear provision directly benefits the $47 billion liquid staking market. The U.S. SEC explicitly stated that participating as a miner/validator in proof-of-stake or proof-of-work, or participating in staking-as-a-service, is essentially not a securities transaction. This reduces regulatory uncertainty in the following areas:

Liquid staking protocols (e.g., Lido, RocketPool)

Validator infrastructure companies

DeFi protocols with staking capabilities

3. On-Chain Product Innovation Exemption

Atkins proposed a "conditional exemption" or "innovation exemption" policy that allows for rapid experimentation and launch of new DeFi products without cumbersome SEC registration. The proposed "conditional exemption" mechanism creates a regulatory sandbox specifically designed for DeFi innovation. This approach draws on successful fintech regulatory frameworks in jurisdictions like Singapore and Switzerland, allowing for controlled experimentation without fully meeting securities registration requirements: this could pave the way for:

Permissionless innovation

Launch of U.S. DeFi products

Faster integration with traditional finance

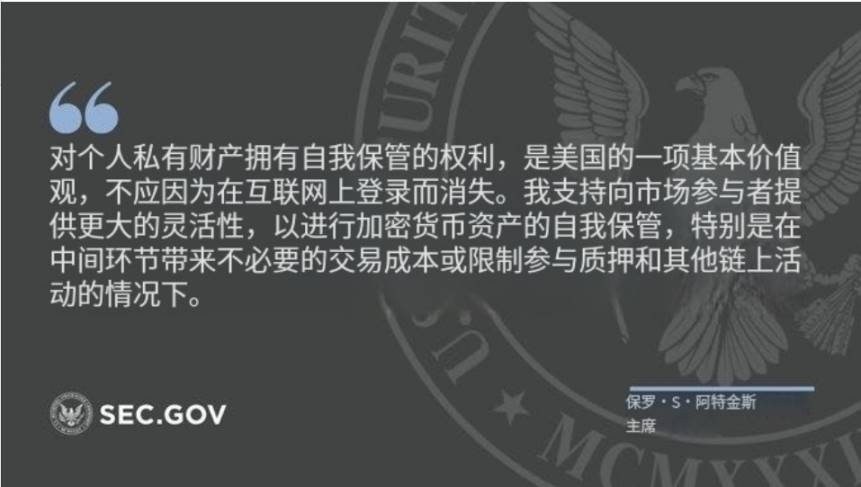

4. Protection for Self-Custody

Atkins advocated for the right to self-custody of digital assets, calling it a "fundamental American value." This supports the following types of products:

Wallet providers (e.g., MetaMask, Ledger)

Non-custodial exchanges (e.g., Uniswap)

On-chain trading and investment tools

5. Public Support for Trump's Pro-Crypto Agenda

Atkins mentioned Trump's goal of making the U.S. the "global cryptocurrency capital," aligning the regulatory tone with the current political leadership. As the dust settles from the 2024 U.S. elections, this political alignment may unleash more favorable regulatory policies and promote government-led cryptocurrency infrastructure development.

6. Encouragement of On-Chain Resilience

Atkins cited data from S&P Global, praising DeFi's ability to remain operational during the collapse of centralized financial systems (such as FTX and Celsius). This is a direct acknowledgment of DeFi's reliability under pressure.

Strategic Positioning Framework

Layer One: Core Infrastructure Protocols

The most direct beneficiaries of regulatory clarity are the protocols that form the backbone of DeFi infrastructure. These protocols typically have high total value locked (TVL), mature governance structures, and clear utility functions that align with traditional financial services.

Liquid Staking Protocols: With the clarification of staking rules, protocols like Lido Finance ($LDO), Rocket Pool ($RPL), and Frax Ether ($FXS) are expected to attract institutional capital seeking compliant staking solutions. With the removal of regulatory barriers, the $47 billion liquid staking market could see significant growth.

Decentralized Exchanges: Uniswap ($UNI), Curve ($CRV), and similar protocols benefit from self-custody protection and enjoy innovation exemptions. These platforms can launch more complex financial products without facing regulatory delays.

Lending Protocols: Aave ($AAVE), Compound ($COMP), and MakerDAO ($MKR) can expand their institutional-facing products under clearer regulations, especially in automated lending and synthetic asset creation.

Layer Two: Real-World Asset Integration

The innovation exemption framework is particularly beneficial for protocols connecting traditional finance and DeFi. Real-world asset (RWA) protocols can now experiment with tokenization models without cumbersome securities registration processes.

Leaders in the RWA Space: Ondo Finance, Maple Finance, and Centrifuge are expected to accelerate institutional adoption of tokenized securities, corporate credit, and structured products. The current TVL in the RWA space is approximately $8 billion, and with clearer regulatory pathways, this sector could expand rapidly.

Layer Three: Emerging Innovation Categories

The conditional exemption mechanism creates opportunities for entirely new categories of DeFi products that had previously stalled due to regulatory uncertainty.

Cross-Chain Infrastructure: Protocols supporting secure asset transfers across chains can now develop more complex products without worrying about inadvertently violating securities laws.

Automated Financial Products: Yield optimization protocols, automated trading systems, and algorithmic asset management tools can now be developed and deployed more quickly in the U.S. market.

How to Prepare for the Future DeFi Bull Market?

- Double Down on High-Reliability DeFi Protocols

Focus on those protocols likely to benefit from regulatory clarity:

Staking and LST: Lido, RocketPool, ether.fi, Coinbase's cbETH

Decentralized Exchanges: Uniswap, Curve, GMX, SushiSwap

Stablecoin Protocols: MakerDAO, Ethena, Frax

RWA Protocols: Ondo, Maple, Centrifuge

- Accumulate Governance Tokens

Tokens of core DeFi infrastructure (especially those with high TVL and good regulatory compliance) may benefit: $UNI, $LDO, $AAVE, $RPL, $MKR, $FXS, $CRV.

- Participate in On-Chain Governance

Engage in governance forums and participate in delegated voting. Regulators may be more inclined to favor protocols with transparent and decentralized governance.

- Build or Contribute in the U.S. Crypto Ecosystem

The SEC's signals will make the following parties feel more secure:

On-chain startups

Wallet developers

Staking-as-a-service companies

Open-source software contributors

Now is the time to:

Launch or contribute to public goods

Apply for grants or participate in DAO ecosystem building (e.g., Optimism Retro Funding, Gitcoin)

Join U.S. DeFi organizations or DAOs

- Get Ahead with Projects Involving Institutional Participation

Focus on institutional capital inflows and innovation exemption pilot projects:

Build positions in liquid DeFi protocols that institutions can integrate

Watch for pilot announcements from companies like Coinbase, Franklin Templeton, and BlackRock

Keep a close eye on the Ethereum ecosystem, especially given the clarity around staking and high adoption of infrastructure.

- Closely Monitor "Innovation Exemption" Guidelines

If the U.S. SEC releases clear standards, you can:

Launch new DeFi tools that meet exemption criteria

Obtain airdrops or incentives from compliant protocols

Create content or services that simplify the exemption framework

Institutional Adoption Catalyst Analysis

Capital Flow Predictions

Regulatory clarity opens multiple previously blocked pathways for institutional adoption:

Traditional Asset Management Firms: Companies like BlackRock and Fidelity can now explore integrating DeFi into their businesses for revenue growth, portfolio diversification, and operational efficiency. Currently, institutional adoption of DeFi is less than 5% of traditional asset management scale, indicating significant growth potential.

Corporate Treasury Management: Corporations can now consider using DeFi protocols for treasury management, including yield generation on cash reserves and automated payment systems. The corporate treasury management market has approximately $5 trillion in assets, some of which may migrate to DeFi protocols.

Pension Funds and Sovereign Wealth Funds: Large institutional investors can now view DeFi protocols as a legitimate asset class for allocation. These investors typically invest in the range of $100 million to $1 billion, representing a potential order-of-magnitude increase in protocol TVL.

Innovation Acceleration Metrics

The innovation exemption framework can significantly accelerate the development of DeFi:

Product Development Cycle: Previously, new DeFi products required 18 to 24 months of legal review, potentially involving the U.S. SEC. The exemption framework is expected to shorten this cycle to 6 to 12 months, effectively speeding up financial innovation.

Geographic Repatriation: Due to regulatory uncertainty in the U.S., many DeFi protocols have been developed overseas. The new framework may attract these projects back to U.S. jurisdiction, increasing domestic blockchain development activity.

Case Study: Transforming $10,000 to $100,000

The above strategic framework can be applied to different capital scales, targeting specific asset allocation strategies based on varying risk preferences and investment horizons.

Timeline: 12 to 24 months

Capital Range: $10,000 to $100,000

Target Investment Return: Achieve a 10x return through a portfolio strategy

Retail Investor Strategy (Capital Range: $10,000 to $25,000)

For retail participants, the focus should be on mature protocols with clear regulatory positioning and strong fundamentals. A conservative strategy may allocate 60% of funds to liquid staking protocols and mainstream DEXs, 25% to lending protocols, and 15% to emerging categories with high upside potential.

The key is to gain governance participation rights and yield generation opportunities that were previously only available to professional investors. Under clear regulations, these protocols can offer more transparent and accessible mechanisms.

High Net Worth Strategy (Capital Range: $25,000 - $100,000)

This capital range can support more complex strategies, including direct participation in protocols, delegated governance, and the use of institutional-grade DeFi products. Strategic allocation may focus on governance tokens of major protocols (40%), direct staking positions (30%), exposure to RWA protocols (20%), and innovative stage protocols (10%).

High net worth participants can also engage more actively in governance and create potential additional value through governance mining and participation in early protocol development.

Institutional Strategy (Capital Range: $100,000 and above)

Institutional-scale capital can participate in wholesale DeFi operations, including directly operating validation nodes, managing protocol treasuries, and adopting complex yield strategies. These participants can also engage in protocol collaborations and customized integration development.

Institutional strategies should emphasize operational protocols and establish clear regulatory compliance frameworks, robust governance structures, and institutional-grade security measures. At this scale, direct staking operations become feasible, potentially offering higher risk-adjusted returns compared to liquid staking protocols.

Return Potential Analysis

Conservative predictions based on past DeFi application cycles indicate the potential returns that may be achieved within these capital ranges:

Token Appreciation: With accelerated institutional adoption and enhanced protocol utility, regulatory clarity typically positions governance tokens for appreciation of 3 to 5 times.

Yield Generation: DeFi protocols offer annual yields of 4-15% through various mechanisms such as staking rewards, trading fees, and lending interest. As institutional capital enters the market, regulatory clarity can stabilize and potentially increase these yields.

Innovation Access: Early participation in innovation exemption protocols may yield exceptionally high returns (5 to 10 times), as these projects develop new financial primitives and capture market share in emerging categories.

Compounding Effect: The combination of token appreciation, yield generation, and governance participation can produce compounded returns, significantly exceeding traditional investment options over a 12 to 24-month period.

Implementation Timeline Considerations

Phase One (Q3 to Q4 2025): Implementation of initial regulatory guidelines, early institutional pilot projects, and appreciation of governance tokens of favorable protocols.

Phase Two (Q1 to Q2 2026): Broader institutional adoption, launch of new products under innovation exemptions, and significant growth in TVL of major protocols.

Phase Three (Q3 to Q4 2026): Full institutional integration, potential launch of products merging traditional finance and DeFi, and implementation of a mature regulatory framework.

The DeFi roundtable held by the U.S. SEC in June 2025 not only marks the evolution of regulation but also heralds the dawn of the DeFi institutional era. The combination of regulatory clarity, political support, and technological maturity creates a unique opportunity for early positioning to avoid missing out before broader market recognition drives valuations higher.

For mature investors, the current environment presents a rare fusion of clear regulation, technological advancement, and market undervaluation. Protocols and strategies that can attract institutional capital flows in the next 18 months are likely to determine the next phase of growth and value creation in DeFi.

The transition from experimental technology to regulated financial infrastructure signifies a fundamental shift in the value proposition of DeFi. Those strategically positioned during this regulatory transition may benefit from the immediate effects of institutional adoption and the long-term value creation brought by mature, regulated financial markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。