The story of MemeStrategy is a reflection of the recent intertwining trends of the cryptocurrency market and the stock market in Hong Kong.

Written by: TechFlow

In the West, there is MicroStrategy; in the East, is there MemeStrategy?

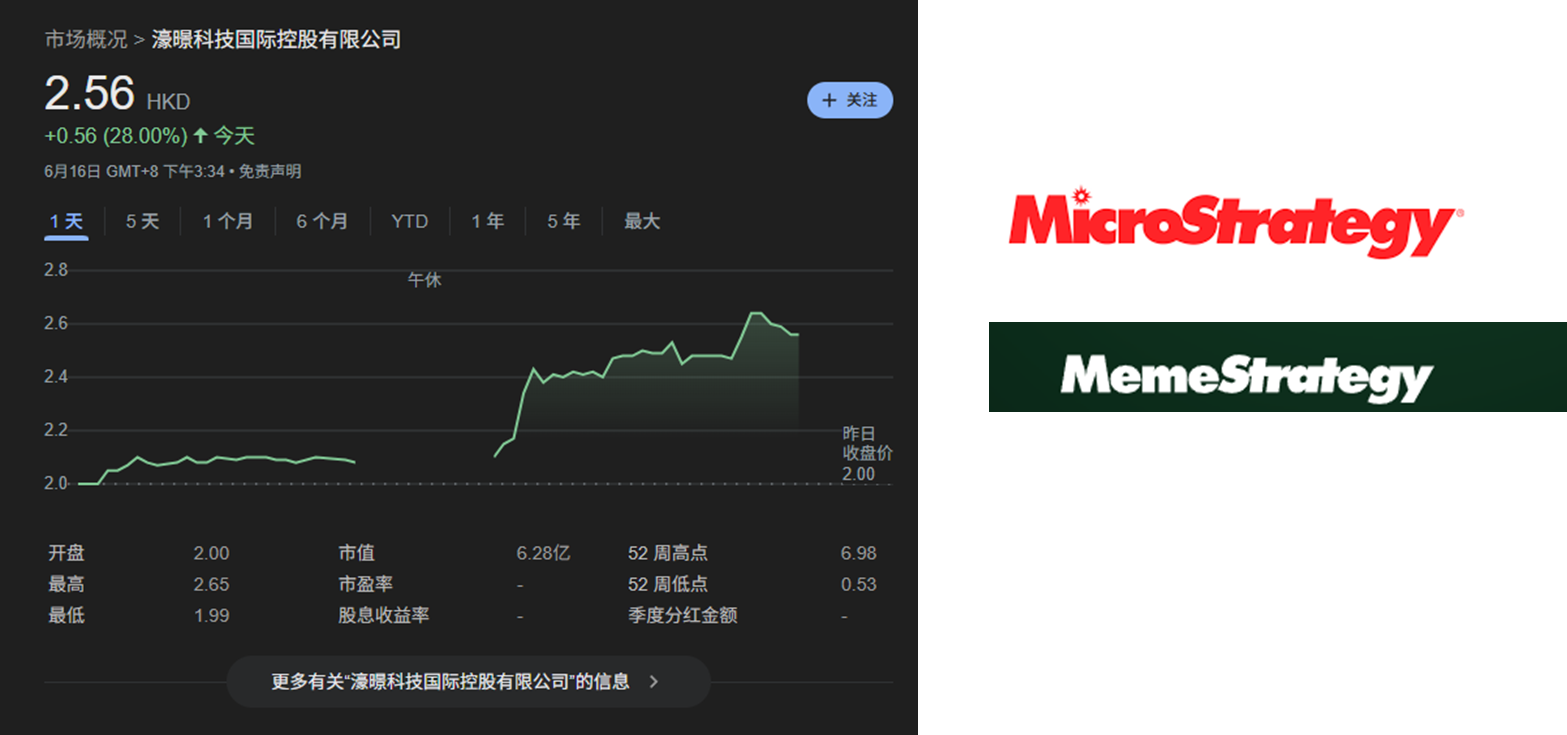

On June 16, the stock price of Hong Kong-listed company MemeStrategy surged by 25% before beginning to decline.

This newly renamed company has a name strikingly similar to the U.S. listed company, the "Bitcoin giant" MicroStrategy, and even the style of its logo is identical.

It is hard to say this is a coincidence; it feels more like a deliberate imitation and following.

Since 2020, MicroStrategy has gradually increased its Bitcoin holdings, with its stock price hitting new highs due to the crypto investment boom. MemeStrategy announced today that it has purchased 2,440 SOL and plans to allocate Bitcoin.

However, there is a detail — MemeStrategy's previous name was Howking Technology Holdings, and this move is a combination of announcing the purchase of SOL and the company’s name change. The intention is quite clear: by borrowing the name change and aligning closely with the brand effect of MicroStrategy, it aims to ride the wave of crypto asset enthusiasm and attract speculative funds.

Currently, the market views it as "Hong Kong's first meme stock," but this high-profile naming strategy is far from simple on the surface; the capital operations and past records of the team behind it hide a deeper story.

Board and Shareholding Restructuring, 9GAG Team Joins

The renaming and transformation of MemeStrategy began on April 1, 2025.

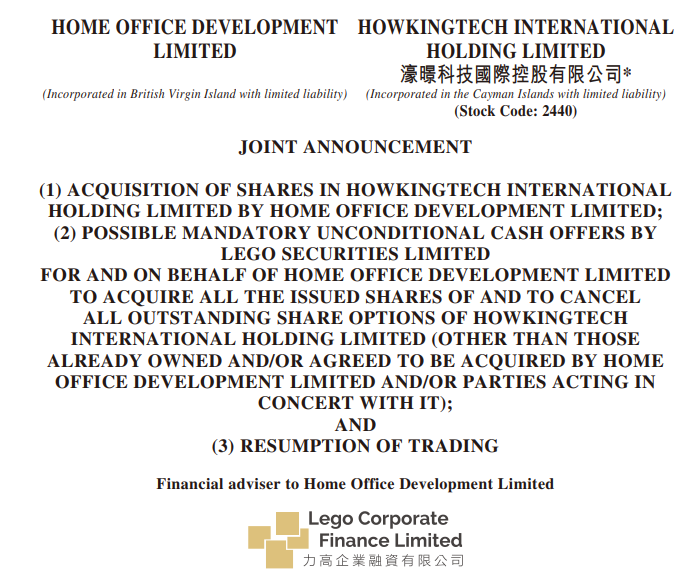

According to Hong Kong media Sing Tao Daily, at that time, 9GAG co-founder Chen Zhancheng acquired 53.83% of Howking Technology Holdings through his holding company Home Office Development Limited for approximately HKD 79.65 million (about USD 10.2 million), increasing his stake to 70.11% after the acquisition.

(Data source: PR Newswire; HKEX Announcement)

The company was subsequently renamed MemeStrategy, claiming to create "Asia's first publicly listed virtual asset ecosystem enterprise," integrating 9GAG's social media resources, focusing on investments in virtual assets like Solana, and planning to allocate Bitcoin.

You may not be familiar with 9GAG, but you might have heard of the Memeland project and its corresponding MEME token.

9GAG is the parent company behind Memeland, established in 2008 and headquartered in Hong Kong, attracting young users with humorous memes and jokes.

The acquisition and renaming by the 9GAG co-founder also involved changes to the original company's shareholding and board structure.

Before the acquisition, Howking Technology Holdings Limited held 53.83% of the shares, and the board consisted of 7 members from the original company; after the acquisition, the original team from 9GAG and individuals from the Hong Kong crypto circle became the key figures:

Former 9GAG co-founder Chen Zhancheng will serve as the chairman and CEO, leading the company's strategic development and business operations, while his brother Chen Zhanjun will take on the role of Chief Brand Officer at MemeStrategy, having previously served as 9GAG's Chief Product Officer.

The former Chief Business Officer of 9GAG will also take the same position at MemeStrategy, and Li Minghong, former CEO of OSL and head of strategic planning and institutional relations at HashKey Group, will serve as Chief Investment Officer. Notably, the 2,440 Solana purchased by MemeStrategy was also assisted by OSL. Additionally, Peng Cheng, co-founder of Scroll, will serve as an independent non-executive director of the company.

The concentration of shareholding and the overhaul of the board mark the 9GAG team's complete control over MemeStrategy.

Howking Technology was originally an IoT technology company providing data transmission and processing services, covering IoT antennas, 5G devices, and maintenance, serving industries such as manufacturing, transportation, and energy, with a market value of about HKD 500 million, referred to by Hong Kong media as a low market value "penny stock";

The technology-related business attributes and low market value made it an ideal target for 9GAG to go public through a shell.

Currently, on MemeStrategy's official website, the company focuses on ABC business, namely AI, blockchain, and culture, claiming to be Asia's first publicly listed digital asset enterprise.

Recently, in the traditional capital market, it has become common for individuals from the crypto circle to use small companies' shells for crypto asset reserves. This wave has ultimately reached the Hong Kong stock market.

(Related reading: Buying coins, the new wealth code for U.S. listed companies)

9GAG and Memeland's Crypto Past

In 2022, 9GAG launched Memeland, positioning it as a Web3 startup studio.

In the previous hot rhythm of NFTs and memes, Memeland issued the MEME token and NFT projects such as Captainz and Potatoz.

Currently, the market value of the MEME token is only around USD 80 million, having shrunk by over 80% from its peak in 2023; in comparison, the recent on-chain meme coin LABUBU, themed around Pop Mart's Labubu, has a market value of around USD 50 million.

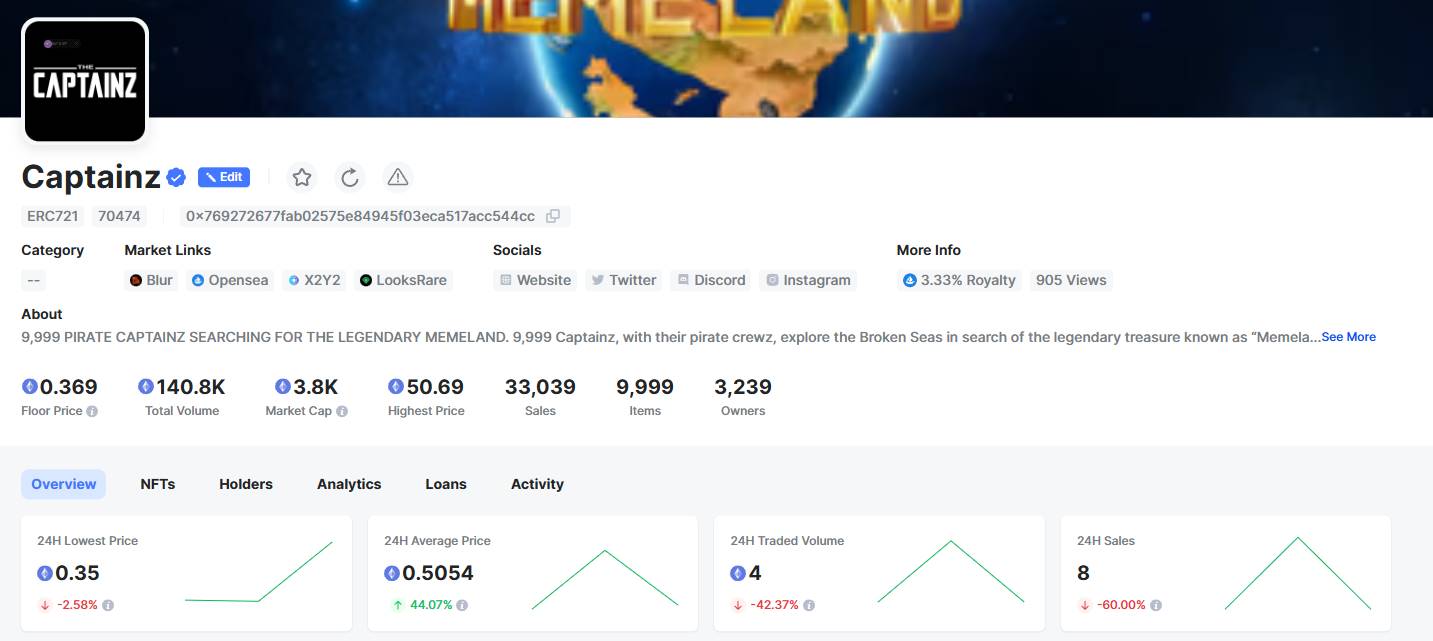

The NFT series Captainz and Potatoz under Memeland are facing an even harsher market environment.

The current floor price for Captainz is only 0.3 ETH, with only single-digit transaction volumes in the past day, and the transaction prices are far from the peak price of 50 ETH.

As glorious as the past was, it is now equally desolate.

In 2024, the cooling of the crypto market further hit Memeland's business model. The NFT boom has faded, competition among meme coins has intensified, and Memeland's profitability has significantly declined.

The setbacks in the crypto circle may be a significant motivation for 9GAG to shift to the Hong Kong stock market, leveraging the low market value shell resources of Howking Technology. The investment in SOL and the Bitcoin plan continue the crypto logic of Memeland and can also be seen as another opportunistic move following the trend.

The story of MemeStrategy is a projection of the recent intertwining trends of the cryptocurrency market and the stock market in Hong Kong. Beyond the marketing hype, whether the Hong Kong version of MicroStrategy can truly navigate this space remains to be tested by the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。