Author: Erik Torenberg, a16z Partner

Translation: Deep Tide TechFlow

Deep Tide Introduction: In the traditional narrative of venture capital (VC), the "boutique" model is often praised, with the belief that scaling loses its essence. However, a16z partner Erik Torenberg presents a contrasting view in this article: as software becomes the backbone of the American economy and the arrival of the AI era, the demand from startups for capital and services has qualitatively changed.

He argues that the VC industry is transitioning from a "judgment-driven" model to a "deal-crafting capability-driven" paradigm. Only "large institutions" like a16z, which possess scalable platforms and can provide comprehensive support to founders, will succeed in trillion-dollar level competitions.

This represents not just an evolution of the model, but also the VC industry's self-evolution under the wave of "software eating the world."

The full text is as follows:

In ancient Greek literature, there is a meta-narrative that transcends all: respect for the divine and irreverence towards it. Icarus was scorched by the sun, not primarily because of his ambition, but due to his disrespect for the sacred order. A more contemporary example is professional wrestling. You can distinguish between heroes (Faces) and villains (Heels) by simply asking, “Who respects wrestling, and who disrespects it?” All good stories take on this form or another.

Venture capital (VC) has its own version of this story. It goes like this: “VC has been and always will be a boutique business. Those large institutions have become too big, and their aspirations too high. Their demise is predestined because their approach is utterly disrespectful to the game.”

I understand why people want this story to be true. But the reality is, the world has changed, and so has venture capital.

Today, there are more software, leverage, and opportunities than ever before. There are also more founders looking to build larger-scale companies than ever. Companies are remaining private for longer periods. Moreover, founders’ demands on VC have increased. Nowadays, founders building the best companies need partners who can truly roll up their sleeves and help them succeed, rather than just writing checks and waiting for results.

Thus, the primary goal of VC firms now is to create the best interfaces that help founders win. Everything else—how to staff, how to deploy capital, how large to fundraise, how to assist in completing deals, and how to allocate power for founders—derives from this.

Mike Maples has a saying: your fund size is your strategy. Equally true is that your fund size reflects your belief in the future. This is your bet on the scale of startup outputs. Raising large funds over the past decade might have been seen as “arrogant,” but fundamentally, this belief is correct. So when top institutions continue to raise massive funds to deploy over the next decade, they are betting on the future, demonstrating their commitment with real capital. Scaled Venture is not an erosion of the VC model; it represents the maturation of the VC model, adopting the characteristics of the companies they support.

Indeed, VC firms are an asset class

In a recent podcast, Sequoia’s legendary investor Roelof Botha presented three arguments. First, although the scale of venture capital is expanding, the number of “winners” each year is fixed. Second, the scaling of the VC industry means too much funding is chasing too few great companies—therefore, VC cannot scale; it is not an asset class. Third, the VC industry should shrink to match the actual number of winning companies.

Roelof is one of the greatest investors of all time and also a great person. But I disagree with his argument here. (It’s also worth noting that Sequoia has scaled: it is one of the largest VC firms in the world.)

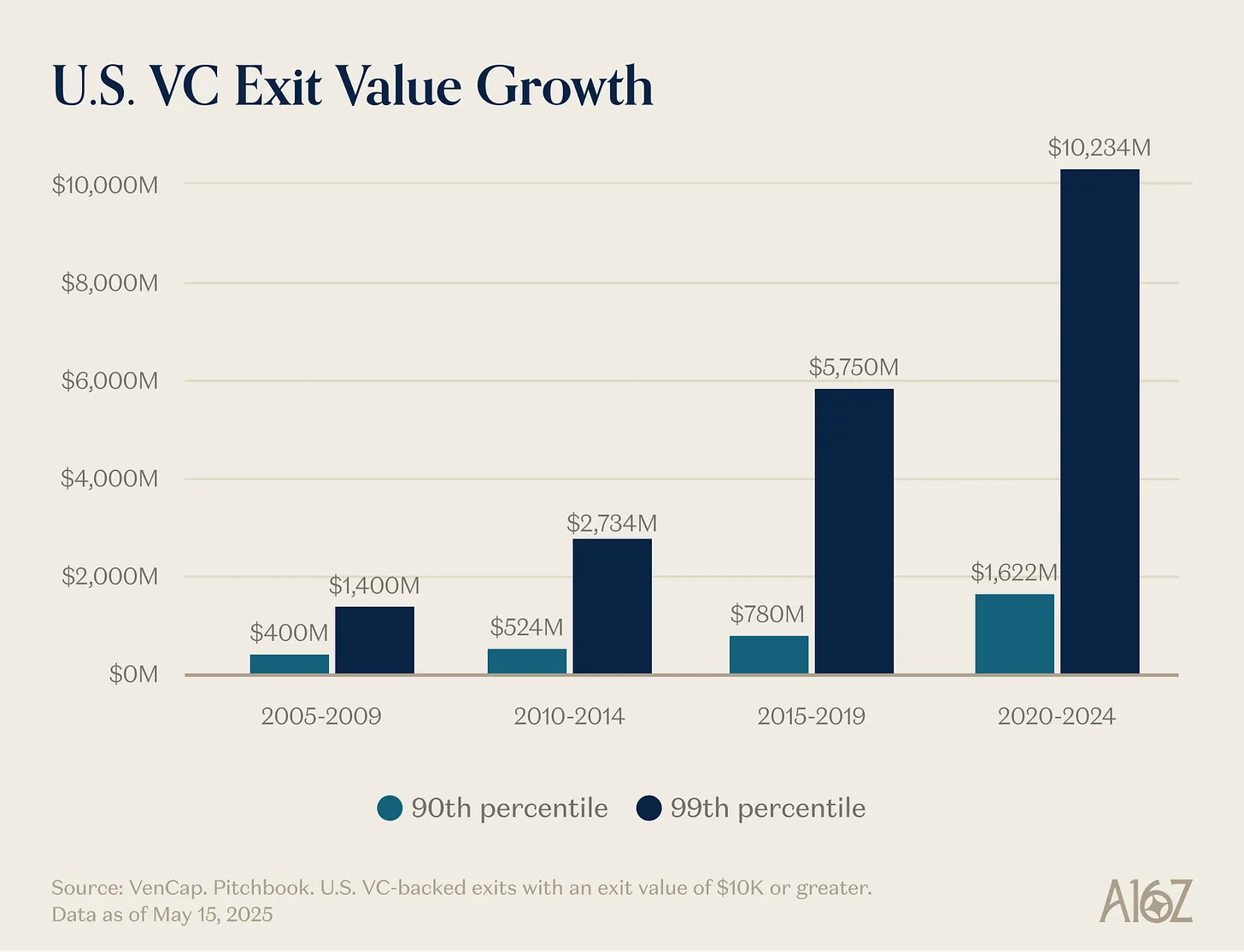

His first argument—the number of winners is fixed—is easily falsifiable. About 15 companies used to generate $100 million in revenue each year; now there are around 150. Not only are there more winners than before, but their scale is also larger. Although entry prices are higher, outputs are significantly greater than before. The ceiling for startup growth has risen from $1 billion to $10 billion, and now to $1 trillion and beyond. In the early 2000s and 2010s, YouTube and Instagram were considered massive acquisitions valued at $1 billion: back then, such valuations were so rare that we referred to companies valued at $1 billion or more as “Unicorns.” Now, we straightforwardly assume that OpenAI and SpaceX will become trillion-dollar companies, with several other companies to follow.

Software is no longer a marginal sector in the American economy composed of quirky, misfit individuals. Software is now the American economy. Our biggest companies, our national champions, are no longer General Electric and ExxonMobil; they are Google, Amazon, and Nvidia. Private tech companies account for 22% of the S&P 500 index. Software has not finished consuming the world—in fact, accelerated by AI, it has only just begun—it is more important now than it was fifteen, ten, or even five years ago. Therefore, the scale that a successful software company can reach is greater than before.

The definition of a “software company” has also changed. Capital expenditures are significantly increasing—large AI laboratories are becoming infrastructure companies, with their own data centers, power generation facilities, and chip supply chains. Just as every company has become a software company, now every company is becoming an AI company, perhaps also an infrastructure company. More and more companies are entering the atomic world. The boundaries are becoming blurred. Companies are aggressively verticalizing, and the market potential of these vertically integrated tech giants is far greater than anyone imagines for pure software companies.

This leads to why the second argument—that too much capital is chasing too few companies—is incorrect. Outputs are significantly larger than before, competition in the software world is fiercer, and companies are going public later than before. All of this means that great companies require far more capital than before. The existence of venture capital is to invest in new markets. What we learn time and again is that, in the long run, the size of new markets is always much larger than we expect. The private market has matured enough to support top companies reaching unprecedented scales—look at the liquidity a top private company can access today—investors in both private and public markets now believe the output scale of VC will be astonishing. We have consistently misjudged how large scale VC as an asset class can and should reach, while venture capital is scaling up to catch up with this reality and opportunity set. The new world requires flying cars, global satellite grids, abundant energy, and intelligence that is cheap enough to be negligible.

The reality is that many of today’s best companies are capital-intensive. OpenAI needs to spend billions on GPUs—much more than anyone can imagine in terms of the computational infrastructure available. Periodic Labs needs to build automated laboratories at an unprecedented scale for scientific innovation. Anduril needs to build the future of defense. And all these companies need to recruit and retain the best talent in the most competitive talent market in history. The next generation of large winners—OpenAI, Anthropic, xAI, Anduril, Waymo, etc.—are all capital-intensive and have completed massive initial funding at high valuations.

Modern tech companies often need hundreds of millions in funding because the infrastructure required to build world-changing cutting-edge technology is exceedingly expensive. During the dot-com bubble, a “startup” entered a blank slate, envisioning the needs of consumers still waiting for dial-up. Today, startups are entering an economy shaped by thirty years of tech giants. Supporting “Little Tech” means you have to be prepared to arm David against the few Goliaths. Companies in 2021 indeed received over-funding, with a large portion of capital flowing towards sales and marketing to sell products that didn’t even get 10x better. But today, funds are flowing into R&D or capital expenditures.

Thus, the scale of winners is far greater than ever before and often requires raising significantly more capital right from the start. Therefore, the venture capital industry must necessarily become much larger to meet this demand. Given the scale of the opportunity set, this scaling makes sense. If VC scale were too large for the opportunities that venture capitalists invest in, we would expect to see the biggest institutions underperform. But we simply do not see that. As it expands, top VC institutions have repeatedly achieved extremely high multiple returns—so have the LPs (limited partners) able to access these institutions. A well-known venture capitalist once said that a $1 billion fund can never achieve a 3x return: because it is too large. Since then, some companies have exceeded a tenfold return for a $1 billion fund. Some people point to underperforming institutions to criticize this asset class, but any industry that conforms to a power-law distribution will have huge winners and a long tail of losers. The ability to win deals without relying on price is the reason institutions can maintain sustained returns. In other main asset classes, products are sold or loans are taken from the highest bidder. But VC is a typical asset class that competes along other dimensions besides price. VC is the only asset class with significant persistence among the top 10% of institutions.

Lastly—saying the VC industry should shrink—is also incorrect. Or at least, it is bad for the tech ecosystem, for the goal of creating more generational tech companies, and ultimately for the world. Some people complain about the second-order effects of increasing venture capital (there certainly are some!), but this has also come with substantial increases in startup valuations. Advocating for a smaller VC ecosystem likely also advocates for smaller startup valuations, resulting in slower economic growth. This may explain why Garry Tan said in a recent podcast: “Venture capital can and should be ten times larger than it is now.” Admittedly, if there were no more competition, an individual LP or GP could benefit from being the “only player.” But if there is more venture capital than today, then that is clearly better for founders, for the world.

To further illustrate this point, let’s consider a thought experiment. First, do you think there should be far more founders in the world than today?

Second, if we suddenly had many more founders, what kinds of institutions would best serve them?

We won’t spend too much time on the first question because if you are reading this article, you probably already know our answer is clearly yes. We don’t need to tell you much about why great founders are so excellent and so important. Great founders create great companies. Great companies create new products that improve the world, organizing and directing our collective energy and risk appetite towards productive ends, and creating disproportionately new enterprise value and interesting job opportunities in the world. And we can’t have possibly reached a state of equilibrium where every capable person who can found great companies has already founded one. That’s why more venture capital helps unleash more growth in the startup ecosystem.

But the second question is more interesting. If we wake up tomorrow and the number of entrepreneurs is ten times or a hundred times that of today (spoiler alert: this is happening), what should the entrepreneurial institutions in the world look like? How should VC institutions evolve in a more competitive world?

Come to win instead of losing everything

Marc Andreessen likes to tell a story about a famous venture capitalist who said the VC game is like being in a revolving sushi restaurant: “A thousand startups go by, and you meet them. Then occasionally, you reach out and pick one out from the conveyor belt and invest in it.”

The type of VC Marc describes—well, for most of the past few decades, almost every VC has been like that. Back in the 1990s or 2000s, winning deals was that easy. Because of this, the only real skill that mattered for a great VC was judgment: the ability to distinguish good companies from bad ones.

Many VCs still operate this way—basically the same way VCs did in 1995. But a huge change has occurred beneath their feet.

Winning deals used to be easy—it was as easy as picking sushi off the conveyor belt. But now it is extremely difficult. People sometimes describe VC as poker: knowing when to pick a company, knowing what price to enter at, etc. But that may obscure the total war one must wage to secure the right to invest in the best companies. Old-school VCs reminisce about when they were the “only players” who could dictate terms to founders. But now there are thousands of VC firms, and founders find it easier than ever to get term sheets.

The paradigm shift is thatthe ability to win deals is becoming as important as picking the right companies—evenmoreimportant. If you can’t get in, what does it matter to pick the right deal? Several things have contributed to this change. First, the explosion of VC firms means that venture capitalists need to compete with each other to win deals. Since there are now more companies competing for talent, customers, and market share than ever before, the best founders need strong institutional partners to help them win. They need institutions with resources, networks, and infrastructures to give their portfolio companies a competitive advantage.

Second, since companies are remaining private longer, investors can invest later—at a point when companies have already gained more validation—making deal competition fiercer—and still achieve venture-like outputs.

The last reason, and the least obvious one, is that picking has become slightly easier. The VC market has become more efficient. On one hand, more repeat entrepreneurs are continuously creating iconic companies. If Elon Musk, Sam Altman, Palmer Luckey, or a genius repeat entrepreneur starts a company, VCs quickly line up to try and invest. On the other hand, companies are reaching crazy scales faster (with staying private longer, the upside potential is also greater), thus the risk of product-market fit (PMF) has decreased compared to the past. Lastly, since there are now so many great institutions, it is also much easier for founders to reach out to investors, making it difficult to find deals that other institutions aren’t already pursuing. Picking is still the core of the game—selecting the right evergreen company at the right price—but it is no longer the most crucial aspect for now.

Ben Horowitz hypothesizes that the ability to win repeatedly automatically makes you a top institution: because if you can win, the best deals will come to you. Only when you can win any deal do you have the right to pick. You may not have picked the right one, but at least you had that opportunity. Of course, if your institution can repeatedly win the best deals, you will attract the best pickers to work for you because they want to get into the best companies. (As Martin Casado said when recruiting Matt Bornstein to join a16z: “Come here to win deals, not to lose them.”) Therefore, the ability to win creates a virtuous cycle that enhances your picking ability.

Because of these reasons, the rules of the game have changed. My partner David Haber described in his article the transition that venture capital needs to make in response to this change: “Firm > Fund.”

In my definition, a fund has only one objective function: “How do I generate the most carry with the fewest people in the least amount of time?” Whereas a firm, in my definition, has two objectives. One is to deliver excellent returns, but the second is equally interesting: “How do I build a source of compounded competitive advantage?”

The best firms will be able to reinvest their management fees to strengthen their moats.

How can I help?

I entered the venture capital field ten years ago, and I quickly noticed that among all VC firms, Y Combinator played a different game. YC was able to secure excellent deal terms for great companies at scale, while also seemingly able to serve them at scale. Relative to YC, many other VCs played a commoditized game. I would go to Demo Day and think: I am at the betting table, and YC is the casino dealer. We were all happy to be there, but YC was the happiest one.

I quickly realized that YC had a moat. It had positive network effects. It had several structural advantages. People used to say that venture capital firms couldn’t have moats or unfair advantages—after all, you are just providing capital. But YC clearly has one.

This is why YC remains so powerful even after scaling. Some critics don’t like that YC has scaled; they predict that YC will eventually fail because they feel it has lost its soul. There have been predictions of YC’s demise for the past decade. But that hasn’t happened. During that time, they replaced their entire partner team, and still, the demise hasn’t occurred. A moat is a moat. Just like the companies they invest in, scaled venture firms have moats that are not merely about branding.

Then I realized I didn’t want to play the commoditized venture capital game, so I co-founded my own firm and several other strategic assets. These assets are highly valuable, producing strong deal flow, so I tasted the perks of differentiated games. Around the same time, I began observing another firm build its own moat: a16z. Thus, when the opportunity to join a16z arose years later, I knew I had to seize it.

If you believe in venture capital as an industry, you—by definition—believe in power-law distribution. But if you really believe the venture capital game is governed by a power law, then you should also believe that venture capital itself will follow a power law. The best founders will cluster around those institutions that help them win most decisively. The best returns will concentrate in those institutions. Capital will follow.

For founders trying to build the next iconic company, scaled venture firms provide an extremely attractive product. They provide the expertise and comprehensive services needed for rapidly expanding companies—recruiting, go-to-market strategies (GTM), legal, finance, public relations, government relations. They provide sufficient capital to truly get you to the destination, rather than forcing you to penny-pinch while struggling against well-funded competitors. They offer vast reach—connecting you with everyone you need to know in business and government, introducing you to every important Fortune 500 CEO and every significant world leader. They offer access to a hundred times talent, with a network of tens of thousands of top engineers, executives, and operators worldwide, ready to join when your company needs them. And they are everywhere—for the most ambitious founders, this means anywhere.

At the same time, for LPs, scaled venture firms are also an extremely attractive product on the most important simple question: Are the companies driving the most returns choosing them? The answer is simple—yes. All major companies are working with scaled platforms, usually at the earliest stages. Scaled VC firms have more swings at bat to capture those important companies and more ammunition to persuade them to take their investment. This is reflected in the returns.

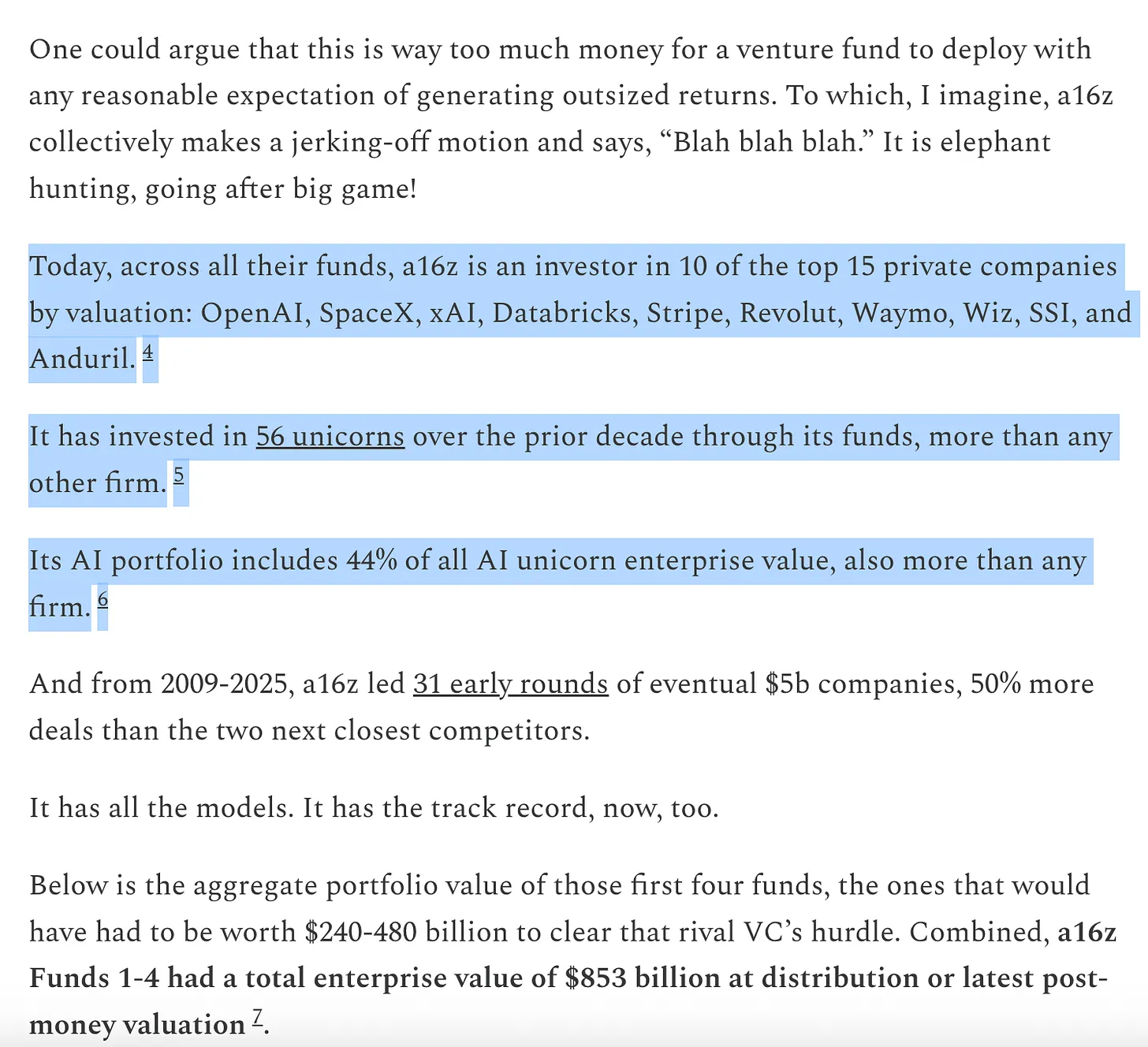

Excerpt from Packy's writing: https://www.a16z.news/p/the-power-brokers

Consider where we stand at this moment. Eight out of the ten largest companies globally are venture-backed firms headquartered on the West Coast. Over the past few years, these companies have accounted for much of the growth in new enterprise value globally. Meanwhile, the world’s fastest-growing private companies are also predominantly venture-backed firms located on the West Coast: those companies that were born a few years ago are rapidly moving towards trillion-dollar valuations and the largest IPOs in history. The best companies are winning more than ever, and they all have the support of scaled institutions. Of course, not every scaled institution is performing well—I can think of some epic cases of collapse—but almost every great tech company has the support of a scaled institution.

It’s either big or boutique

I do not believe the future lies solely with scaled venture firms. Like all areas that the internet touches, venture capital will become a “barbell”: on one end are a few super-large players, and on the other end are many small, specialized firms that operate in specific fields and networks, often collaborating with scaled venture firms.

What is happening in venture capital is typical of what happens in the services industry when software consumes it. On one end are four or five large, powerful players, often vertically integrated service firms; on the other end is a long tail of highly differentiated small suppliers that have been created due to the disruption of the industry. Both ends of the barbell will thrive: their strategies are complementary and empower each other. We have also supported hundreds of boutique fund managers outside of institutions and will continue to support and collaborate closely with them.

Scaling and boutique models will both do well; it is the institutions in the middle that will have trouble: these funds are too large to afford to miss the giant winners, yet too small to compete with larger institutions that can structurally provide better products to founders. What makes a16z unique is that it exists at both ends of the barbell—it is both a group of specialized boutique firms and benefits from a scaled platform team.

Institutions that can best collaborate with founders will win. This may mean super-large backup capital, unprecedented reach, or a vast complementary service platform. Or it could mean unreplicable expertise, outstanding advisory services, or sheer unbelievable risk tolerance.

There is an old joke in the venture capital world: VCs believe every product can be improved, every great technology can be scaled, and every industry can be disrupted—except for their own.

In fact, many VCs do not like the existence of scaled venture firms at all. They believe scaling sacrifices some soul. Some say Silicon Valley has become too commercialized and is no longer a haven for misfits. (Anyone claiming there aren’t enough misfits in tech has definitely not attended tech parties in San Francisco or listened to the MOTS podcast.) Others resort to self-serving narratives—that change is “irreverence towards the game”—while ignoring that the game has always served the founders, and has done so historically. Of course, they would never express the same concerns about the companies they support, whose existence is predicated on achieving massive scale and changing the rules of the game in their respective industries.

To say that scaled venture institutions are not “real venture capital” is like saying that NBA teams shooting more three-pointers are not playing “real basketball.” You may not think so, but the old rules of the game no longer hold dominion. The world has changed, and a new model has emerged. Ironically, the manner in which the rules of the game here have changed mirrors how the startups that VCs support change the rules in their industries. When technology disrupts an industry and new scaled players emerge, something is always lost in the process. But much more is gained. Venture capitalists understand this trade-off firsthand—they have always been backing that trade-off. The disruptions that venture capitalists wish to see in startups should equally apply to venture capital itself. Software has eaten the world, and it certainly won't stop at VC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。