We are building a global financial system where everyone can see each other's cards. This is not a feature; it is a catastrophic flaw.

Written by: Rishabh Gupta

Compiled by: Block unicorn

Introduction

In December 2024, three German marketing professors did something that should terrify every business accepting cryptocurrency payments. They decoded 22.7 million retail stablecoin transfers and reconstructed complete customer intelligence for eight direct-to-consumer (D2C) brands—everything from wallet shares, order frequency, average order value, to peak sales periods.

No hacking skills required. No internal permissions needed. Just public blockchain data and a few lines of Python scripts.

This is the stablecoin privacy paradox of 2025.

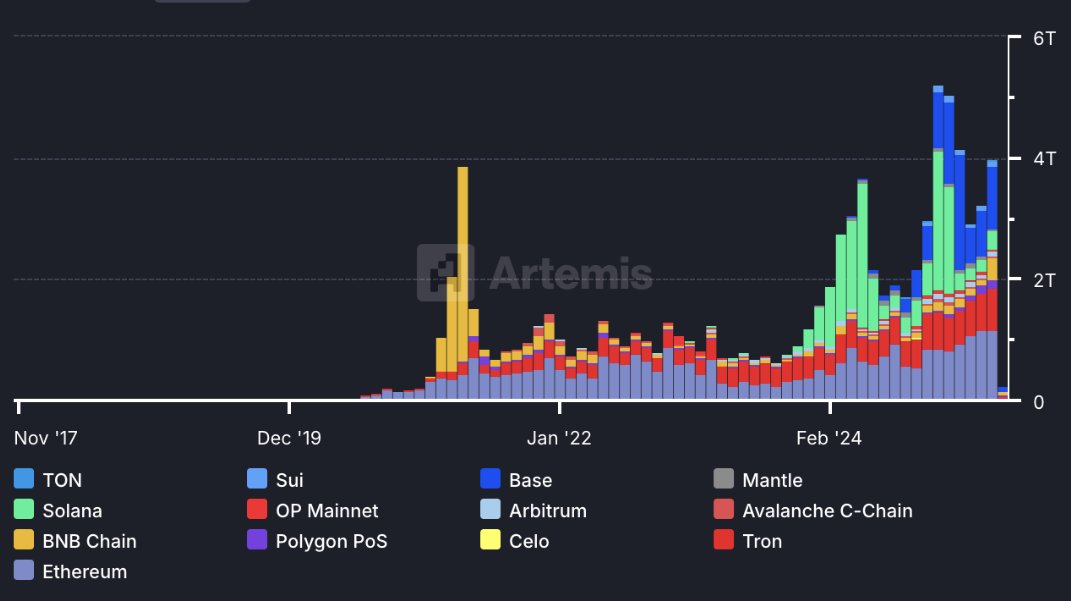

Stablecoins are achieving tremendous success. The data is shocking: stablecoin usage on Base is no longer a niche experiment. Analysis from Token Terminal shows that in just the first quarter of 2025, the total transaction volume on L2 reached approximately $3.81 trillion—setting a new historical high, surpassing the early growth curve of mainstream credit card networks.

Stablecoin transaction volume on major chains

Even after accounting for internal jumps, this figure still reaches trillions. 65% of Ethereum's total locked value—approximately $130 billion—is now concentrated in stablecoins. Tether holds nearly $120 billion in U.S. Treasury bonds, with quarterly profits reaching a billion dollars. Businesses using Stripe for stablecoin payments have twice the number of countries covered compared to those not using stablecoin payments.

From all key metrics, stablecoins have achieved product-market fit, and their scale is large enough to compel traditional fintech companies to take them seriously.

So why am I writing an article about privacy for an industry that is already raking in profits?

Because the success of stablecoins has made them one of the most dangerous payment methods in the world. Not dangerous for users, but dangerous for businesses.

Every transaction you make is a data point for your competitors to analyze. Every salary you pay becomes workplace intelligence. Every invoice you settle exposes your supply chain. Every customer payment reveals your business model. In the rush to adopt stablecoins, we have built a global financial surveillance system where your business intelligence can be accessed with a simple search on Etherscan.

Ironically, we have created the most efficient cross-border payment system in history, but it broadcasts your financial strategies to anyone interested in looking.

This is not about ideology or cyberpunk dreams. This is a harsh reality: your competitors may know your customer acquisition costs better than your Chief Marketing Officer.

As stablecoin payments are expected to reach $2 trillion by 2028, this issue will only worsen.

Why are we heading towards $5 trillion, and why is that frightening?

Stablecoins have shattered every growth record in the crypto space. 65% of Ethereum's total locked value—approximately $130 billion—is now in stablecoins, with institutional funds pouring in at an unprecedented rate, witnessing a complete transformation of global payments.

The promise is real: instant cross-border transactions, minimal fees, 24/7 operation. No wonder businesses using stablecoin payments sell products in twice as many countries as those not using stablecoin payments.

But few mention: all these benefits come with a hidden cost—complete financial transparency.

Current privacy nightmares

Salary Comparison Trap

Alice, a founder who just raised $500,000, of which $200,000 is in cryptocurrency. She hired three developers from India, Vietnam, and Argentina, with salaries set according to local market rates. Everyone preferred cryptocurrency payments—because they are faster, cheaper, and hassle-free without bank procedures.

Then reality hit. Each developer discovered the salaries of the others on-chain. Those with lower salaries began hinting at raises. Alice wanted to help, but the budget was tight. Despite each salary being competitive locally, the transparency sparked discontent. "Jealousy tax" research proves this is not an isolated case—but a quantifiable phenomenon. Companies either pay more to high performers or accept the reality of damaged team morale.

This is not theoretical. It is happening in many crypto-native (and now internet capital market, non-crypto-native) startups.

Privacy Nightmare

Bob is a blockchain developer working for a well-known L2 protocol, earning $12,000 a month. He deposits his salary into a hardware wallet—secure and professional. But now he needs to buy groceries, pay rent, and live his life.

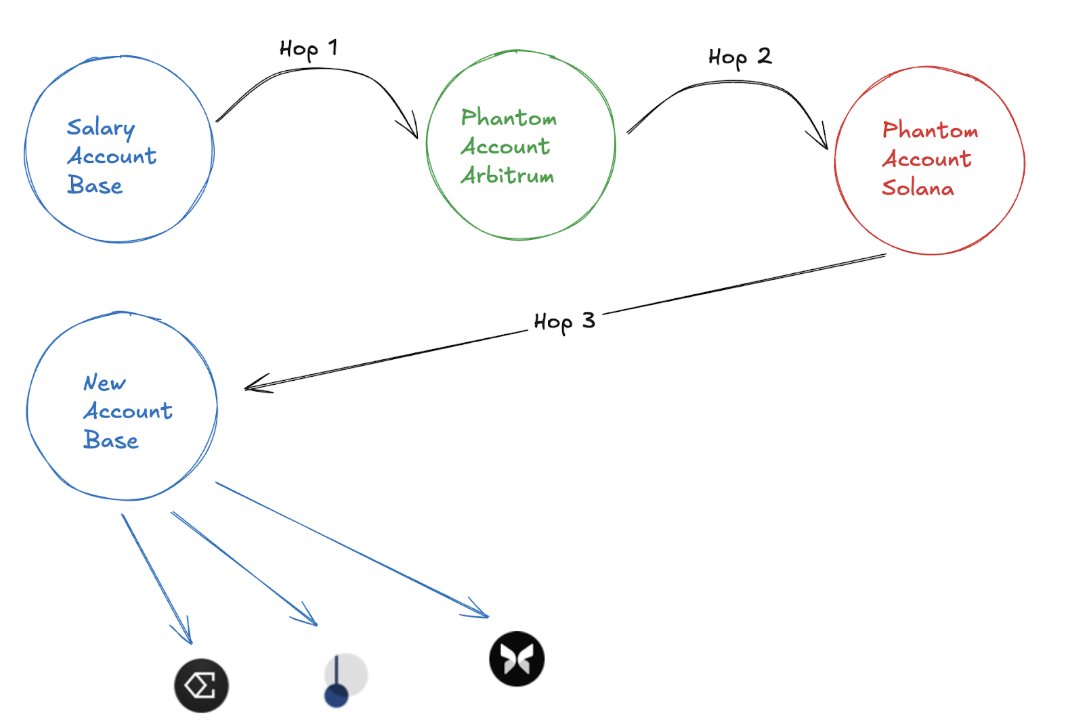

If he spends directly from his salary account, his landlord, ex, and competitors can accurately know his income and assets. So, Bob did what thousands of others do: he "mixed" funds through a centralized exchange or obscured his financial trail through 3-4 bridging transactions and multiple exchanges.

Ironically, we built decentralized finance (DeFi) to escape intermediaries, but privacy issues force users back to centralized services—now with added costs, tax complexities, and compliance risks.

Competitive Intelligence Disaster

Charlie runs a successful online pharmacy in Argentina, accepting USDC payments. His competitor Don noticed Charlie's growth and decided to investigate. After hours of on-chain analysis, Don discovered that 80% of Charlie's transactions concentrated in specific time frames. Further digging revealed Charlie's entire customer acquisition strategy—target demographics, regions, effective marketing channels.

Don obtained Charlie's hard-earned business intelligence for free. No corporate espionage required. Just Etherscan.

Institutional Time Bomb

These are just retail-level issues. The implications at the institutional level are life-and-death.

When every flow of funds is visible, when every strategic transaction is public, when your competitors can track your cash flow in real-time—how do you compete? How do you negotiate? How do you maintain a strategic advantage?

The financial reality for businesses: imagine a Fortune 500 multinational considering reallocating $2 billion among its Asian subsidiaries. Traditional channels: 3 days for settlement, $50,000 in fees, zero transparency. Transparent stablecoins: instant settlement, $100 in fees, but complete strategic exposure.

Certain financial reallocations reveal regional performance. Every vendor payment exposes supply chain relationships and pricing. Every internal transfer between jurisdictions indicates which markets are prioritized and underperforming. Payment timing patterns could leak company plans or market entry strategies months in advance.

Using stablecoins, the efficiency gains are enormous. But the privacy costs are deadly.

Institutions claim privacy is their top concern, yet they build on transparent chains. This disconnect between established demand and actual infrastructure is a disaster.

But the problem is: they have no choice. Most activities occur on public chains. Liquidity dominates there. 90% of DeFi protocols operate there. Stablecoins settle there. The composability with existing infrastructure is non-negotiable for many participants. For example, Paypal was the first to launch its stablecoin on Solana.

A central crypto bank I spoke with mentioned that their current "solution" is to handle order execution in separate departments, with one team managing position information and another handling execution—this is to ensure no one has the full picture.

Even Michael Saylor, the biggest corporate advocate for Bitcoin, understands this danger. He strongly warns against publicly disclosing wallet addresses, stating, "No institutional or corporate security analyst would think it's a good idea to make all traceable wallet addresses public."

However, despite Saylor's cautious approach, the blockchain analysis platform Arkham Intelligence has gradually tracked MicroStrategy's Bitcoin holdings. In February 2024, they announced they had identified 98% of MicroStrategy's Bitcoin holdings, and by May 2025, they discovered an additional 70,816 BTC, tracking a total of 525,047 BTC (approximately $54.5 billion)—accounting for 87.5% of the company's total holdings.

The danger is not limited to finances. In France, four masked men recently attempted to kidnap Paymium CEO Pierre Noizat's daughter and grandson in broad daylight in downtown Paris. The family became a target precisely because blockchain transparency exposed their wealth to criminals.

This is not an isolated incident. Jameson Lopp maintains a comprehensive database documenting hundreds of physical attacks against crypto holders. The pattern is clear: blockchain transparency leads to real-world violence.

Every year there are new cases:

Home invasions, with victims tortured to reveal private keys

Kidnappings demanding cryptocurrency ransoms

Targeted robberies at conferences and gatherings

Attacks on family members to force compliance

When your wallet address is public, you expose not just your financial strategies. You and your family become targets. The "five-dollar wrench attack" is no longer a theoretical issue—it has become a growing pattern with hundreds of verified cases.

Scaling Disaster

What is truly terrifying is that these issues multiply as adoption scales.

$100 billion: annoying but manageable

$1 trillion: serious competitive disadvantage

$5 trillion: complete collapse of trade secrets

We are building a global financial system where everyone can see each other's cards. This is not a feature—it is a catastrophic flaw.

As stablecoin payments are expected to reach $2 trillion by 2028, we are not discussing a future problem. We are already experiencing it. With each passing day, more business intelligence leaks, more salary data becomes public, and more competitive advantages evaporate.

The issue is not whether stablecoins need privacy, but whether we will implement privacy protections before the cost of transparency becomes too high.

Why All "Solutions" Have Failed (So Far)

The crypto industry has been trying to solve the privacy issue for years. Billions in venture capital, thousands of hours of developer time.

Yet by 2025, Bob still needs to perform four bridging operations to pay his rent privately.

Let’s be honest about why all solutions (other than mixers) have failed to scale.

Privacy Chains

"We will build privacy from the ground up!" A dozen L1 and L2 chains have promised.

Reality check:

Bridging delays: Funds take 20 minutes to transfer in, and another 20 minutes to transfer out.

New wallet setup: Download special software, create new keys, learn a new interface.

Chain synchronization issues: "Why does my balance show zero? Oh, still syncing…"

Liquidity deserts: Want to swap? Good luck dealing with 15% slippage.

Ghost town problem: Privacy transactions only work under network effects.

Why they fail: Asking users to leave their current chain for privacy is like asking them to move to another country for better privacy laws. This friction kills the application before it even starts.

Additional Privacy Tools

Some protocols have tried different methods: providing privacy on existing chains. But there are downsides:

User experience:

Requires downloading new software (hopefully not malware).

Requires generating zero-knowledge proofs (ZK proofs).

Requires paying 10 times the gas fees for privacy transactions.

Requires trusting other users to be compliant (they often are not).

Praying that smart contracts have no vulnerabilities (they might).

Centralized Exchange (CEX) Mixing

The reality is: people use Binance or other CEXs as privacy tools. Deposit from one address, then withdraw to another address. Centralized mixing requires extra steps.

Problems:

KYC (Know Your Customer) contradicts the purpose.

Exchanges may freeze your funds.

A tax nightmare for many users.

Not available in many jurisdictions.

User experience significantly declines.

Why it is "effective": Because it is readily available. This illustrates the current state of privacy tools.

Are there regulatory concerns about introducing privacy features into stablecoins?

Keep in mind that regulators are not against confidentiality itself—they are against privacy facilitating malicious actors and law enforcement being unable to take action.

Here are the measures we believe are necessary:

Key access review: There should be an appropriate access control list allowing certain keys to be checked when issues are discovered.

On-demand transparency: Amounts and counterparties are encrypted by default, but court orders can unlock the full transaction trail—no forks, no reissuing tokens.

Real-time anti-money laundering/anti-terrorist financing screening—every time liquidity is brought into a privacy protocol, it should be checked to ensure its source is legitimate, or whether the address has interacted with high-risk addresses, or is itself a high-risk address. This is not limited to sanctions but also covers terrorism financing, human trafficking, and other significant vulnerabilities.

Anti-mixing safeguards: Funds should not be completely untraceable.

Emergency freeze switch: Tokens can be immediately locked through multi-signature, but due process must be followed.

While providing regulators with subpoena-level access similar to today, avoid letting the whole world permanently see everyone’s salaries, invoices, and trading strategies.

What’s Next?

Stablecoins are one of the most efficient payment systems in history, but unfortunately, they resemble a surveillance network where every business transaction is public data. With stablecoin transaction volumes nearing $5 trillion, every dollar broadcasts your strategy to competitors. This is not a sustainable plan in the long term. Clearly, the solution is not to abandon stablecoins—but to add privacy protections that are compatible with existing infrastructure and regulatory requirements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。