On May 30, the Monetary Authority of Singapore (MAS) officially released the final response document regarding the licensing system for Digital Token Service Providers (DTSP). Initially, this policy did not attract widespread attention until a few days later when an article on a public account went viral, prompting the entire industry to realize its impact. The document clearly states that all projects operating in Singapore without a license must cease operations by June 30. This has caused anxiety among many crypto practitioners in Singapore.

What impact will this new regulation have on the crypto space? Are we facing a "Wandering Earth"-style migration wave? On the evening of June 12, BlockBeats specially invited Christopher Liu, Chief Compliance Officer of Matrixport, Chen Wu, CEO of EX.IO, Ye Su, founding partner of ArkStream Capital, and Valentina, Global BD Director of Herring, to engage in an in-depth dialogue on the topic "The End of Web3 Paradise? What is the Impact of the Singapore DTSP Bill?" to analyze the regulatory logic behind the bill and its far-reaching effects on industry development.

BlockBeats: Tonight, we have invited several senior guests from frontline institutions such as compliance VCs and trading platforms to discuss the intentions behind Singapore's policy and its short-term and long-term impacts on the Web3 industry in Singapore. Let's start with a brief self-introduction from the guests.

Ye Su: Thank you for the invitation. I am Ye Su, a partner at ArkStream Capital. We are a crypto fund established in 2020, primarily involved in primary market investments and liquidity strategies. Over the past five years, we have invested in more than 100 projects, including recently launched Space and Time, Kernel, and Particle Network, and we have close collaborations with several institutions represented here.

Although I am not currently residing in Singapore, half of our LPs are from Singapore, many of whom are licensed institutions. Currently, about 20% of our sixth fund is allocated to Singapore. I personally lived in Singapore for over a year in 2022, but due to the regulatory system and overall living environment, I did not continue to reside there. I am glad to discuss this in depth with all the guests today. Thank you.

Chen Wu: Hello everyone, I am Chen Wu, the founder and CEO of the compliance exchange EX.IO in Hong Kong. We are currently one of the licensed exchanges in Hong Kong and also the only key enterprise introduced by the Hong Kong government. We have a traditional financial background and are committed to compliant development.

Although we do not have an official business presence in Singapore at the moment, before deciding to apply for a Hong Kong license, we researched compliance pathways in various regions globally, with Singapore being one of the key focuses. Ultimately, we chose Hong Kong based on an overall assessment of its history, economy, and policy environment. I will also share our considerations later.

I would also like to take this opportunity to introduce our upcoming joint events with multiple institutions, including CTO Lab (City University of Hong Kong) and the event organizer BlockBeats, to hold a four-city tour in mainland China, focusing on talent cultivation, project incubation, and ecological development. This is part of our corporate social responsibility, and we hope to encourage more universities and young people to participate in the Web3 industry. Thank you all.

Christopher Liu: Hello everyone, I am Chris, the Chief Compliance Officer of Matrixport Group. Matrixport is a crypto asset platform covering multiple business segments such as OTC and custody, which you may be familiar with. I have been in Singapore and have worked in banking, payment industries, and regulatory agencies, and I have been in the crypto industry for three and a half years. My comments today represent my personal views and do not reflect the company's position. Thank you for the invitation, and I look forward to our discussion.

Valentina: Hello everyone, I am Valentina from Herring Global. Our entire team started in Singapore, including traders and founders, so we have been on a compliance path since our inception. After the DTSP bill was introduced, our institution was actually already on the official "license exemption list." As a liquidity provider, our services cover both centralized and decentralized scenarios, providing liquidity solutions for projects and VCs. We also collaborate with the institution where Ye Su is located. I have previously worked on DeFi projects and am now with Helen Global. I am glad to discuss the latest changes in Singapore's compliance path with all the guests today.

BlockBeats: The public reaction to Singapore's new DTSP regulation seems quite severe. What is your perception of this matter, and is it really that serious?

Christopher Liu: Okay. In fact, this Financial Services and Markets Act (FSA) is not new; it has been in the works since 2020. Although the effective date has only recently been clarified, the industry in Singapore has long been aware that this regulatory system was about to be implemented. Its core background comes from the requirements of the Financial Action Task Force (FATF) in 2019, which clearly stated that member countries should establish regulatory mechanisms covering local licensed institutions and companies conducting cross-border business from the local area. Therefore, Singapore released relevant consultation documents in 2020, initially called the Omnibus Act, which later officially evolved into the Financial Services and Markets Act (FSA) in 2022.

So, the implementation of this policy is not a sudden attack, and the industry is not surprised. MAS has communicated and consulted with industry organizations before and after the policy was released. Regarding the question of "Is it really that serious?" if we only look at the Chinese community or some media reports, it does indeed seem that the wording is extreme, as if Singapore is completely cutting off external business. However, after the document was released on May 30, MAS promptly clarified that licensed institutions can still conduct business and recruit users externally.

The ones truly affected are those unlicensed companies that are conducting international business. MAS has also mentioned that they have identified some affected platforms and are assisting them in transitioning, such as applying for licenses. Overall, MAS has not shown a one-size-fits-all attitude.

Valentina: Our institution is currently in a "license exemption" status. We have clearly taken a compliance route from the beginning and have maintained continuous communication with the regulators. The current status is that MAS has granted us an exemption during the evaluation process, but this does not mean we can operate without a license in the long term. The exemption status ultimately has three possible outcomes:

- Obtaining a formal license, which may not necessarily be DTSP but could be another type of license.

- The company decides to exit the business and no longer applies for a license.

- MAS discovers issues during the annual review and requires the business to cease operations.

At the beginning of this new policy's release, there was indeed some panic in the industry, especially among some exchanges and custody service providers. However, for those institutions that are already on a compliance path and have been in continuous communication with MAS, the actual impact is not too significant. The core of Singapore's regulation is not to stifle innovation but to hope for technological exploration within a compliance framework. MAS still supports the development of emerging technologies such as DeFi, stablecoins, and AI, but the premise is to establish anti-money laundering mechanisms and implement KYC/KYB requirements. Therefore, the "seriousness" of the policy actually depends on whether companies truly regard compliance as part of their development strategy.

Chen Wu: Let me clarify that we are a licensed exchange in Hong Kong, not a local virtual asset trading platform in Singapore. To be honest, when we saw the panic in the Chinese community regarding Singapore's policy, we internally felt a bit of "secret joy." At that time, we also saw some KOLs suggesting that Singapore might no longer be an ideal place for Web3 startups, and some even began to talk about returning to Hong Kong, Dubai, or other regions.

Many people are also comparing Hong Kong's VATP (Virtual Asset Trading Platform) license with Singapore's DTSP framework. Some believe that VATP is more lenient and more suitable for retail investors. However, we have interacted with many projects deeply rooted in Singapore and found that the number of institutions truly "preparing to leave" is not many. Most still hope to develop locally. Ultimately, this is because although the DTSP has been introduced, its regulatory details, thresholds, and applicable scope are still not clear enough. Including who can apply, who can be exempted, and which businesses are restricted, there are no clear standards.

We have seen discussions in the community, such as whether DeFi projects are restricted, whether they can continue to operate in Singapore, and whether they can evade regulation, with significant differences in interpretation. This further confirms my decision to choose Hong Kong. Although the compliance path in Hong Kong is strict, at least the policies are clear and the thresholds are defined. The guidelines for the VATP license we applied for are nearly 300 pages long, with detailed rules and strong operability. This is also a difference we have observed: in Dubai, the regulatory system is also constantly updating, and although it is not lengthy, it is continuously iterated and optimized every year to enhance clarity and transparency.

In contrast, although Singapore announced the policy three years in advance, it only officially released the details a month before the deadline, leaving significant uncertainty. This ambiguity may not only affect whether existing projects stay but also whether new projects dare to enter and whether capital is willing to invest. Therefore, I believe the true impact of DTSP may not be about "driving away who," but rather "who can still be attracted." This question is currently lacking sufficient discussion in the community. I would also like to hear Ye Su's views on this from a VC perspective.

Christopher Liu: I would like to add one point. Many people, especially some KOLs online, see the introduction of the DTSP framework and assume that this is Singapore's main regulatory logic for the entire industry, but that is not the case.

The regulations currently applicable to the crypto industry in Singapore are actually the Payment Services Act (PSA). In the past two years, when we communicated with MAS, the regulators repeatedly emphasized that if you plan to provide services like exchanges, custody, OTC, etc., in Singapore, you should apply for a PSA license, specifically the Major Payment Institution (MPI) category. The introduction of DTSP is to fill the gray areas that PSA cannot cover, such as companies registered in Singapore but primarily serving overseas users and not holding a PSA license.

The fundamental reason for launching DTSP is still the FATF's requirements for anti-money laundering regulation. The expansion of the regulatory framework is to include teams that were previously not covered by PSA but are operating overseas businesses. If you are a practitioner genuinely intending to operate Web3 in Singapore long-term, such as OTC, custody, or trading platforms, you still need to apply for the MPI license under PSA, not DTSP.

When MAS released the DTSP document, they also specifically stated that they would not "double regulate" and would not require the same institution to apply for multiple licenses simultaneously. If you already hold a PSA license or are in the compliance application process, then the impact of DTSP on you is very limited.

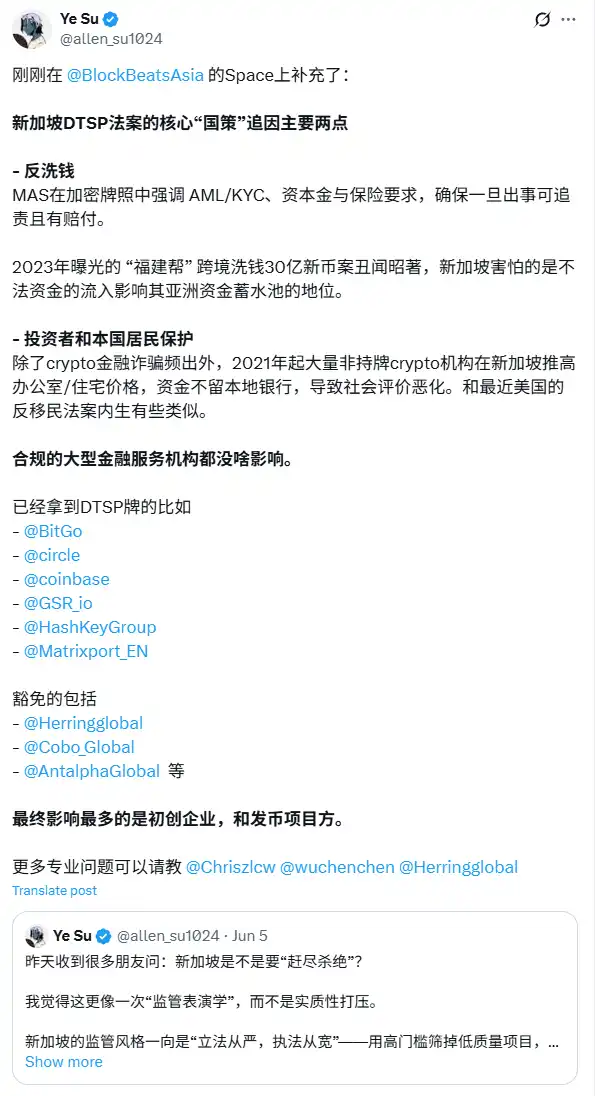

BlockBeats: Teacher Ye Su previously referred to this policy on Twitter as a "regulatory performance." Could you elaborate on your viewpoint?

Ye Su: I posted that tweet because I saw some very intense reactions to this policy, with terms like "mass purge" being used. When I introduced the concept of "regulatory performance," it was not meant to be derogatory, but rather to encourage everyone to look at this from a different perspective: this is a strategic rhythm arrangement by the government.

To draw an analogy, it's like a project conducting a "haircut event," which also has its roadmap. The first phase is to broadly attract user participation; the second phase requires participants to complete KYC and AML; the third phase retains quality users and promotes project ecosystem development. I believe Singapore's regulatory evolution for Web3 is quite similar.

Since 2017, Singapore has encouraged all Web3 enterprises to establish themselves, which was the "open period." By 2021, it entered the "screening period," emphasizing compliance; now, with the formal implementation of DTSP, it has entered the "closure period"—only truly compliant and capable institutions are welcomed for long-term development.

From the scope of the new law, it is very broad, covering not only token issuance, custody, trading, payment, matching, and staking, but even remote work is considered within the operational scope. The only exemptions are purely technical consulting and non-trading advertising promotions. I also referenced two previous similar policy evolution paths in Singapore: one was the payment industry rectification in 2019, when it was announced that 90% of payment institutions would be phased out, but in reality, a three-year buffer was provided, and ultimately about 40% were approved. The second was the family office tax exemption policy in 2023, where the exemption threshold was raised from 5 million SGD to 20 million SGD, which also did not implement a one-size-fits-all approach but set a transition period.

Essentially, these policy goals are highly consistent: retain compliant enterprises that do real work and eliminate gray market arbitrageurs. Formally, it appears as "strong regulation," but in reality, it is "selectively welcoming." So I say this is a "regulatory performance," a proactive voice from Singapore in the global compliance narrative. From this perspective, it is a strategic expression and represents their desire to position themselves as a "global compliance innovation center."

Ye Su's tweet

BlockBeats: Why did Singapore issue this guideline? How do you view the mid- to long-term impact of this new regulation on the development of the Web3 industry in Singapore?

Christopher Liu: In terms of regulatory clarity, Singapore is actually one of the first countries in the Asia-Pacific region to establish a licensing system for the crypto industry. Since it began processing PSA licenses in 2020, a relatively mature regulatory logic has been formed.

The introduction of DTSP is an extension of the existing system, making the entire framework more complete. MAS has also made it clear: institutions that already hold a PSA or are on a compliance path can still provide services to local and overseas clients. So for institutions with existing compliance arrangements, this is a further "confirmation."

Additionally, MAS has expanded the regulatory definition of "digital currency" in recent years and has allowed formal applications for custody business licenses since last year. These details indicate that MAS is not suppressing the industry but is gradually refining the regulatory boundaries, especially in balancing "preventing retail investors from blindly speculating" and "supporting industry development." In the mid- to long-term, Singapore will continue to exist as a compliance hub for Web3 and hopes to encourage compliant platforms to use Singapore as a base to radiate throughout the Asia-Pacific market.

Valentina: Overall, Singapore has always sought to find a balance between "encouraging innovation" and "ensuring financial stability." The emergence of the DTSP regulation fills some regulatory gaps that the original PSA could not cover, especially after frequent industry blow-ups, which indeed revealed blind spots in regulation.

In the mid- to long-term, this policy may bring several impacts: First, the entry barriers for the industry will be raised. For some early-stage projects with limited resources, compliance costs will become a barrier to entry. Singapore will be more suitable for project teams that are long-term rooted and have compliance awareness. Second, it will accelerate industry clearing. Some teams that are unwilling or unable to follow the compliance path will be forced to exit, and Singapore's digital asset ecosystem will evolve towards "high quality, transparency, and standardization." Third, it will be easier to attract traditional financial capital to enter. For large institutions, the most important factor is regulatory clarity. The introduction of DTSP effectively opens the door for these institutions. For example, family offices, banks, and other traditional players with high compliance requirements are expected to formally participate in the Web3 ecosystem under Singapore's clear policies.

In summary, I believe the implementation of DTSP is not a "strike," but a "reconstruction": it will help Singapore establish a truly integrated mid- to long-term ecosystem that combines traditional capital with crypto innovation.

Chen Wu: I completely agree with the viewpoints of the two previous speakers. Ultimately, the government's purpose in implementing this policy is to optimize and enhance the overall economic structure of the country. The core focus of DTSP is actually the issue of anti-money laundering (AML). The essence of all compliance regulation boils down to two points: one is AML, and the other is investor protection.

Currently, most global compliance frameworks start with AML. Why? Because this is the basic bottom line of the international financial system. From this perspective, to understand why Singapore made this decision, we must think from the level of its national strategy.

Many people mention that Singapore is one of the financial centers in Asia, alongside Hong Kong. But if you look at the data, Singapore is actually not as "dependent on finance" as we imagine. Finance accounts for about 13% of its GDP, while Hong Kong can reach 23-24% at its peak. As a sovereign nation, Singapore's foundation lies in its irreplaceable geographical position—an important trade hub connecting the East and West.

Its economic development began with transshipment trade, gradually expanding into high-value-added processing and supply chain services, complemented by elite governance, education, technology, and real estate policies, creating a strong national system. Therefore, from a macro perspective, Singapore does not need a large influx of "no-threshold capital" but places more emphasis on stable, high-quality, and controllable capital.

Returning to finance itself, Singapore has a clear advantage in the banking sector: total assets, profitability, bad debt rates, and payment clearing capabilities all lead Hong Kong; however, it is relatively weak in capital markets, with IPO numbers consistently low, and daily trading volumes around 800 million to 1 billion USD, far below Hong Kong; yet in asset management, Singapore is in a leading position in Asia.

The rise of its asset management industry is inseparable from the influx of a large number of high-net-worth individuals and family offices. They value Singapore's wealth security and hedging value, but this situation of "capital coming in without projects landing" has also brought hidden dangers—such as capital not paying taxes, driving up housing prices, and increasing social costs. Especially after the exposure of the "Fujian Gang money laundering case" in 2023, the external image of the crypto industry has faced some degree of questioning.

Therefore, this regulatory upgrade is not just a response to international pressure but a systematic action at the national policy level to "regulate the financial gray market and improve capital quality."

Ye Su: Although our fund is not registered in Singapore, most of our LPs in Asia are concentrated there, and many of our LPs come from licensed institutions or large enterprises. Overall, the core logic of Singapore's policy can be summarized in two points: AML and investor protection.

From a micro perspective, we have also observed some very real social issues: crypto companies renting luxury offices, not paying local taxes, driving up local housing prices and car ownership costs, while local residents have no sense of participation and do not enjoy the industry dividends. This phenomenon of "resource occupation" has actually prompted the government to respond to public opinion through regulation. Coupled with the money laundering case in 2023, the entire regulatory system has entered a "fine governance stage," which is not simply tightening but rather the government adjusting the structure of foreign capital and stabilizing social trust.

Additionally, from the distribution of institutions, the list of licensed and exempt entities issued by MAS this time includes large platforms such as Circle, Coinbase, and HashKey, as well as some platforms engaged in OTC, custody, or derivatives. The ones truly impacted are more the project parties and startups, as Singapore's startup ecosystem is not as vibrant as Hong Kong, and these types of projects are the most affected by policy adjustments.

BlockBeats: What are the thresholds and considerations for relevant parties currently applying for the DTSP license?

Valentina: In fact, in the media statement released by MAS on June 6, there was a very key statement: they will set high licensing thresholds and "will not issue licenses lightly." The meaning is very clear: the difficulty of applying for a DTSP license is very high.

So I suggest everyone start by understanding the two basic types of licenses: one is PSA (Payment Services Act), and the other is CMS (Capital Markets Services). These two types of licenses are currently the most basic regulatory framework recognized by MAS. If you plan to apply for a license, the first thing is to ensure that the institution has a complete KYC/AML strategy and a fund segregation mechanism. This is not just a paper process but must be implemented in daily operations, technical systems, and data management. Singapore places a high emphasis on technological compliance and operational transparency; without long-term systematic planning, it is difficult to truly navigate the application process. Therefore, I recommend that project parties thoroughly research the applicability and compliance paths of PSA and CMS before considering DTSP.

Christopher Liu: Okay, let me add something. First, to clarify, we at Matrixport are one of the 33 licensed enterprises in Singapore, and we are also applying for another type of license, so we are firsthand participants in the practical operations. I agree with Tina's point that Singapore's regulatory logic is very clear: DTSP is meant to supplement the parts not covered by PSA, but the entire regulatory backbone remains PSA. MAS has also made it clear that they will not duplicate regulation, and the same business does not need to apply multiple times.

From my past experience applying in various regions, one advantage of Singapore is centralized regulation: OTC, custody, stablecoins, exchanges, etc., are all managed by MAS as a single institution, which enhances communication efficiency and consistency in processes. Of course, regulatory requirements are also continuously increasing. Initially, the focus may have only been on AML and technology risk management (TRM), but now it has expanded to include user protection, conflict of interest, and other requirements. Especially after the series of industry blow-ups in 2022, regulators' focus has become more comprehensive.

Overall, Singapore remains a very rational regulatory environment. Although the media sometimes portrays it as quite intense, in reality, DTSP is not a "ban" but rather a "completion." Almost all regions globally are strengthening their licensing mechanisms, which will become an irreversible long-term trend.

BlockBeats: Thank you very much for your insights, Liu. One last small question: Will DTSP affect this year's TOKEN2049 event?

Christopher Liu: I don't think so. TOKEN2049 is a commercial event and does not fall under the licensing regulatory scope. Even during the period when advertising was banned at F1, various promotions could still take place within the TOKEN2049 venue. This indicates that Singapore still welcomes industry exchanges and technology showcases, just with higher requirements for financing and business aspects. So everyone can participate with confidence.

BlockBeats: Thank you once again to all the guests for your wonderful speeches. From today's discussion, it is clear that the regulatory red lines are becoming increasingly clear, and compliance is no longer an "optional" aspect but a "pass" to enter the market. The future of Web3 will no longer be in opposition to regulation but will need to co-build a new order with policies.

Space link: https://x.com/i/spaces/1ypJdZOleOoKW

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。