On June 13, alarms sounded across Israel as it launched a preemptive strike against Iran. Israeli Defense Minister Katz announced a nationwide state of emergency, stating that after Israel's attack on Iran, missile and drone strikes targeting Israel and its civilians are expected in the near future.

Following the outbreak of conflict, Bitcoin briefly fell below $102,000, with a 24-hour decline of 5%; Ethereum briefly dropped below $2,500, with a 24-hour decline of 9%.

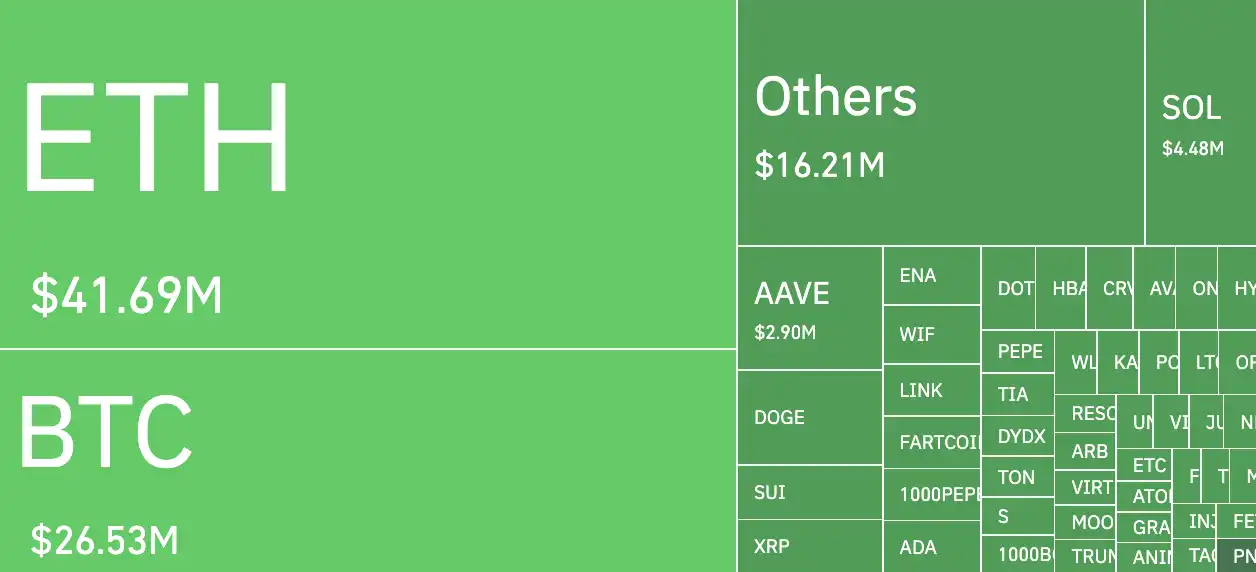

According to Coinglass data, after Israel's attack on Iran, $1 billion was liquidated across the network in the past 12 hours, with long positions liquidated at $937 million and short positions at $67.71 million.

War has once again erupted in the Middle East, causing severe turbulence in the cryptocurrency market. Over the past few years, localized wars have occurred frequently, and for Bitcoin, each conflict represents a test of its safe-haven properties and significant fluctuations in market sentiment.

Russia-Ukraine War

At the onset of the Russia-Ukraine war in 2022, the role of cryptocurrency as a safe-haven asset, a value transfer tool, and a means of political fundraising was significantly amplified.

On February 17 of that year, prior to the conflict with Russia, Ukraine announced the legalization of Bitcoin.

On February 24, Putin announced a "special military operation" against Ukraine, leading to a sharp decline in Bitcoin prices and a black Thursday for global stock and cryptocurrency markets. By 6 PM on February 24, Bitcoin plummeted from about $39,000 to $35,094.2, a 24-hour decline of 10% and a 7-day decline of 20.4%.

In the wake of market expectations that sanctions would push Russian funds into cryptocurrency, Bitcoin briefly rose back to $45,000 after the initial drop. However, when reports emerged of an attack on a Ukrainian nuclear power plant, Bitcoin fell back to around $41,000.

At that time, Bitcoin's hash rate and trading volume in Ukraine and Russia accounted for a very small percentage of the global total. There were rumors that Ukraine's largest Bitcoin mining farm was hit by a Russian missile, causing a 33% drop in hash rate. However, according to data from OKLink, Bitcoin's overall network hash rate did not change significantly. Therefore, the Russia-Ukraine war itself was not sufficient to technically cause significant fluctuations in Bitcoin's price; more factors were at play in the market itself.

Russia's invasion of Ukraine has been referred to as "the world's first crypto war," as both sides discovered the advantages of a borderless, unrecognized currency. In this crisis, cryptocurrency emerged as a significant means of donation and payment, generating substantial support on Twitter.

On February 26, just two days after the war began, the Ukrainian government announced official donation addresses for BTC, ETH, and USDT, stating that it would accept cryptocurrency donations. Thousands of people donated millions of dollars in cryptocurrency to help Ukraine fight against Russia. Crypto Twitter also mobilized to raise funds for Ukraine, with Pussy Riot founder, Trippy Labs, and PleasrDAO members launching "Ukraine DAO" to assist those affected by the invasion.

Israel-Palestine Conflict

On October 7, 2023, the Palestinian armed group Hamas clashed with the Israel Defense Forces, marking the official start of military conflict between Israel and Palestine. Following the outbreak of conflict, Bitcoin's price briefly plummeted to $27,000. As of October 15, the conflict had resulted in over 4,000 deaths.

After the war broke out, both sides attempted to raise funds through cryptocurrency for military expenses and aid. The Israeli crypto community established Crypto Aid Israel, while the Palestinian side also raised funds through cryptocurrency.

Bitcoin's price continued to decline until a week later, primarily due to a false tweet from crypto media Cointelegraph on the evening of October 16, claiming that the U.S. SEC had approved BlackRock's iShares Bitcoin spot ETF.

Throughout October, armed conflict continued, but Bitcoin's price fluctuated upward during the escalation of the conflict. The main reasons behind this were evident on three levels. First, the market had gradually developed "immunity" to regional conflicts; Bitcoin is a global asset, and historically, its response to regional conflicts has often been limited unless the war escalates into a global crisis (like the early stages of the Russia-Ukraine war). Although the Israel-Palestine conflict was intense, its geographical scope was relatively small, and the market viewed it as a "non-systemic risk."

Second, the Middle East has long been in an environment of financial instability and restricted capital flows; the escalation of conflict instead stimulated regional funds to seek safe-haven transfers through USDT or BTC, providing actual buying support for Bitcoin.

Finally, October 2023 coincided with a decline in U.S. inflation and heightened expectations of peak interest rates, while the anticipation of spot Bitcoin ETF approvals continued to rise, becoming a major macro backdrop for market gains. Even in the face of localized risk events, the liquidity environment remained loose, and institutional accumulation logic did not change; for instance, during the period of BlackRock's ETF application news, market risk appetite had already increased.

Reviewing the market performance during the last two geopolitical conflicts reveals a clear pattern. Sudden war news often triggers panic selling, leading to on-chain leveraged liquidations, creating a resonance decline in both technical and emotional aspects; after the liquidations are cleared, the market may gradually stabilize or even rebound due to safe-haven demand returning and improved macro liquidity expectations. The current conflict between Israel and Iran may also follow a similar path.

Unlike traditional financial markets, the role of crypto assets in the face of war is more complex. On one hand, it is a highly volatile risk asset, initially impacted by emotional shocks. On the other hand, it is also a borderless, censorship-resistant financial tool, often becoming the last free channel for funds during extreme events. For this reason, each geopolitical sudden event is not only a test of market sentiment but also a stress test of the real functions of crypto assets.

Whether future wars will trigger similar reactions may depend not on the intensity of the conflict itself, but on whether it touches the threshold of systemic risk and whether it leads to a reassessment of global liquidity and confidence. However, we hope for world peace, and that war will never again become a regular variable in market fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。