This week, decisive signals emerged from both the U.S. economy and the regulatory landscape for digital assets. The latest CPI data for May was unexpectedly mild, significantly alleviating market concerns about inflation stickiness and opening up possibilities for a shift in the Federal Reserve's monetary policy.

At the same time, the GENIUS Act made procedural breakthroughs in the U.S. Senate, indicating that U.S. crypto regulation is moving from ambiguity to clarity.

Economic Signals: CPI Data Below Expectations, Rate Cut Expectations Heat Up

According to data released by the U.S. Bureau of Labor Statistics (BLS) on June 11, the CPI for May 2025 rose 2.4% year-on-year, below the market expectation of 2.5%, and slightly up from 2.3% in April; the seasonally adjusted monthly CPI recorded only 0.1%, below the expected 0.2%. More notably, the core CPI (excluding food and energy price fluctuations) was particularly mild, rising 0.1% month-on-month, below the expected 0.3%, with an annual rate of 2.8%, also lower than the market expectation of 2.9%. This marks the fourth consecutive month that core CPI has fallen short of expectations, indicating that inflation stickiness is gradually dissipating.

The market reacted quickly and significantly to this data. Following the release, S&P 500 futures shifted from a slight decline to a 0.5% increase, and the yield on 10-year U.S. Treasury bonds slightly retreated to 4.1%. On platform X, analysts generally believe that the mild CPI data provides a basis for the Federal Reserve to further ease monetary policy. A well-known economist posted on X, stating, "The May CPI data indicates that inflation is steadily approaching the 2% target, and the probability of a rate cut by the Federal Reserve in September has risen to 85%." Although the new tariff policy of the Trump administration had raised market concerns about inflation, the May data suggests that the short-term impact of tariffs has yet to materialize. Food prices fell 0.1% month-on-month, with egg prices dropping 12.7% due to the waning impact of avian influenza, becoming a key factor in lowering CPI.

However, the core CPI annualized rate of 2.8% is still above the Federal Reserve's 2% target, indicating that price pressures have not completely dissipated. Analysts point out that the Federal Reserve may rely more on indicators such as core PCE (Personal Consumption Expenditures Price Index) in the coming months to decide whether to accelerate rate cuts in the second half of 2025. The market generally expects the Federal Reserve to maintain the current interest rate at the July meeting, but the likelihood of a 25 basis point rate cut in September has significantly increased.

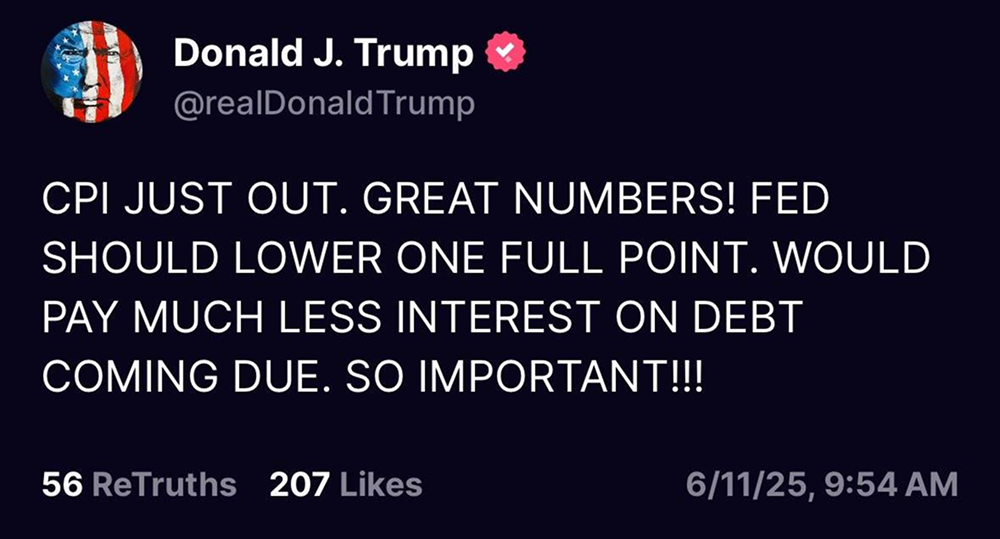

In response, Trump posted on social media: "The CPI data has just been released, and the data is very good! The Federal Reserve should cut rates by a full 1%. This will significantly reduce interest payments on maturing debt. This is very important!"

Regulatory Progress: The GENIUS Act Moves Toward Final Vote, Stablecoin Compliance Framework Takes Shape

Meanwhile, the U.S. Senate has made breakthrough progress in the field of cryptocurrency regulation. On June 11, the Senate passed a procedural motion (cloture) for the GENIUS Stablecoin Act by a vote of 68 to 30, officially opening up debate in the chamber and paving the way for a final vote as early as June 16. The voting results show a rare bipartisan consensus on stablecoin regulation, with 16 Democratic senators crossing party lines to vote in favor, highlighting broad support for the bill.

The GENIUS Act aims to establish a clear regulatory framework for payment stablecoins pegged to the U.S. dollar, clarifying their legal status and excluding their classification as securities or commodities.

Supporters of the bill believe that this framework will inject certainty into the stablecoin market, promote its widespread use in payments, and mitigate potential financial risks. Senate Banking Committee Chairman Sherrod Brown stated on X: "The GENIUS Act will ensure that the stablecoin market develops healthily under strong regulation, avoiding a repeat of the 2022 algorithmic stablecoin collapse."

Opponents worry that the strict requirements on issuers may limit the innovative space for small and medium-sized enterprises and further tilt market dominance toward large financial institutions.

One user commented: "If the bill passes, USDC and USDT will enter a new era of compliance, but smaller players may be pushed out of the market." Analysts expect that if the bill passes smoothly, the stablecoin market may see a new round of consolidation by early 2026, with compliant issuers gaining more trust from institutional investors.

Analysis and Outlook: Market Prospects Under Dual Progress

The easing of inflation data and the clarification of stablecoin regulation together paint an optimistic picture of coexistence between optimism and order. The macroeconomic benefits are expected to inject liquidity and confidence into risk markets, including crypto assets. If the GENIUS Act is ultimately passed, it will mark a significant advance for the U.S. in the global digital asset regulatory race, providing strong compliance backing for the global expansion of U.S. dollar stablecoins and potentially having a profound impact on the EU's MiCA regulations and the regulatory paths of other major economies.

However, the outlook is not entirely smooth. Whether the short-term decline in inflation can evolve into a long-term trend remains subject to uncertainties in global supply chains and geopolitical factors. Additionally, before the final vote on the GENIUS Act, there may still be intense negotiations over details such as state-level licensing and consumer protection. For investors, this means a coexistence of opportunities and uncertainties, and closely monitoring the Federal Reserve's policy signals and legislative dynamics in Washington will be key to grasping market trends in the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。