Original Author: 0xJeff

Compiled by|Odaily Planet Daily (@OdailyChina)

Translator|CryptoLeo (@LeoAndCrypto)

Editor’s Note: 2025 is set to be a year of growth for the stablecoin sector. The U.S. has introduced the "GENIUS Act," and South Korea's new president, Lee Jae-myung, is fulfilling his campaign promise to allow local companies to issue stablecoins. On a national level, with Standard Chartered and Huakong leading the way, and companies like JD.com and Ant Group following, domestic and international corporate giants are exploring the issuance of various stablecoins.

Crypto AI researcher Jeff has published an analysis of the existing issues in current crypto + AI projects, noting that these projects are too "AI-friendly and crypto-averse," which prevents them from establishing a foothold in DeFi. Additionally, Jeff lists noteworthy AI + stablecoin projects, as compiled by Odaily Planet Daily.

Stablecoins are one of the most important infrastructures created for cryptocurrencies. Without stablecoins, we would not have a stable currency unit for investors to invest in (which would make it very difficult to build CEX, DEX, Perps, money markets, and any other verticals).

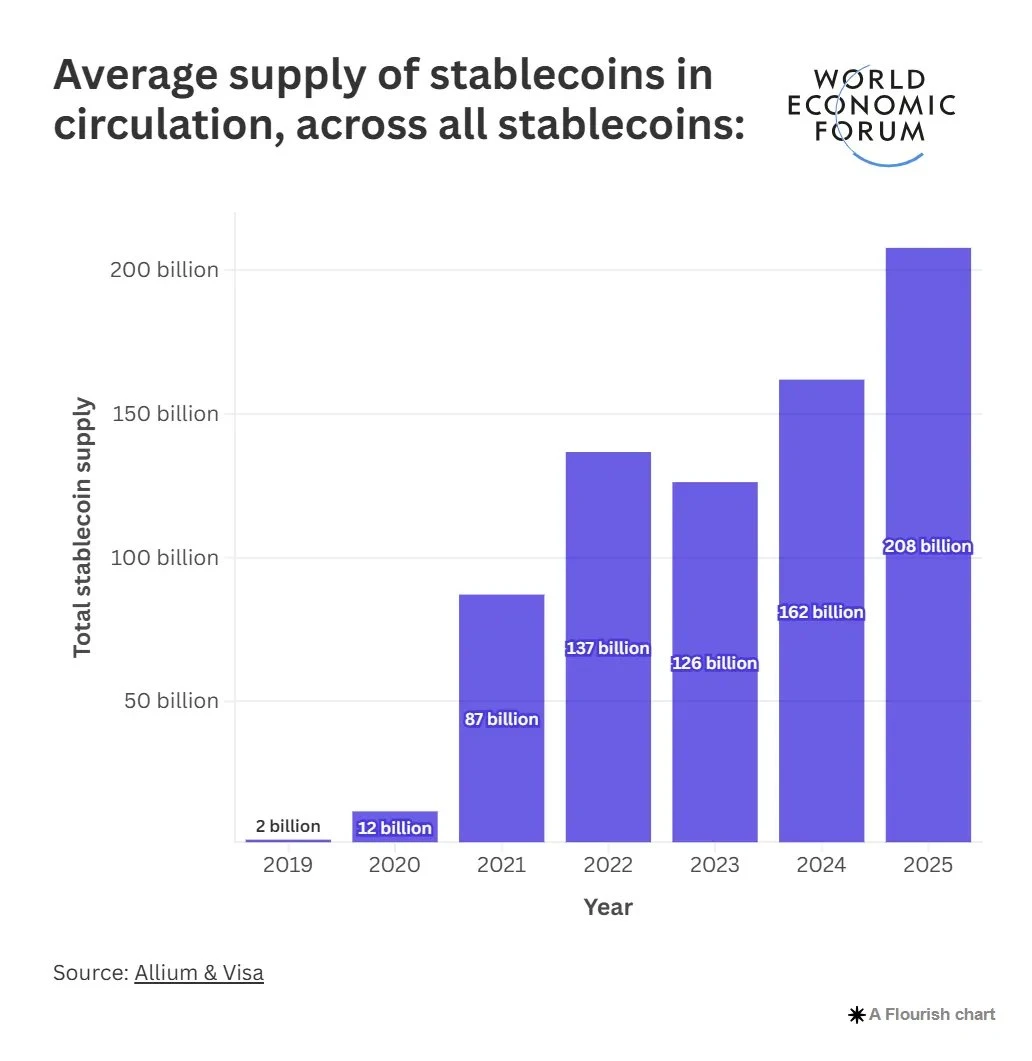

Stablecoins are rapidly gaining popularity—between 2023 and 2025, the total supply, trading volume, and circulation speed (the frequency of stablecoin transactions) are expected to rise sharply, especially in payments and cross-border transactions.

In addition, we are seeing clearer regulatory guidelines and further institutional adoption of stablecoins, such as Stripe launching stablecoin financial accounts in 101 countries, Société Générale planning to launch a dollar-backed stablecoin, and major banks (Bank of America, JPMorgan Chase, Citibank, Wells Fargo) exploring joint issuance of stablecoins. Large enterprises are also exploring stablecoin payment options to reduce transaction fees with Visa and Mastercard.

Recently, CRCL (Circle) went public, sparking a wave of interest in stablecoins and attracting more stakeholders. We see further adoption in TradFi while also witnessing some innovations in stablecoins emerging in the AI field, aimed at addressing the challenges faced by service providers and users in Web3 AI.

The First Challenge

Although AI teams typically design AI tokens as key components of the AI ecosystem (payments, governance, utility), they often allocate fewer resources to DeFi and more to AI products.

Examples:

Virtuals Protocol uses their VIRTUAL/AGENT LP, which brings good value appreciation to VIRTUAL, but simultaneously makes it difficult for the agent team and liquidity providers to provide liquidity (due to impermanent loss);

Aethir uses the ATH token as payment for computing power, which boosts the token but also increases its volatility;

Bittensor uses dTAO (alpha subnet token) to pay miners, validators, and subnet owners, requiring participants to sell alpha tokens for stablecoins to maintain their operations;

While these two examples can be seen as flywheels for AI tokens, the volatility caused by their design can also deter some key participants from getting involved. (By the way, these three examples are relatively good, but many AI teams have done quite poorly in token design, especially certain fair launch teams).

The increase in the number of tokens in the market, combined with suboptimal design, leads to lower liquidity, making it difficult to build DeFi Lego blocks.

Projects Addressing the "Uneven Resource Allocation" Issue

MAITRIX—AI Stablecoin Layer

Maitrix has launched an over-collateralized AI native stablecoin (AI USD) tailored for each independent ecosystem, essentially transforming unstable (but high-yield) AI economies into predictable, composable, and vibrant economies with AI native stablecoins.

Key components of Maitrix:

CDP: Users deposit AI tokens and their derivative assets (liquid-staked or staked AI tokens) through CDP to mint and burn AI USD;

Stablecoin Launchpad: AI projects can create their own AI stablecoins using their native tokens and derivatives;

Curve War ve(3,3) incentives: ve governance of MAITRIX tokens, emission redirection, and bribery mechanisms similar to ve(3,3)

StableSwap DEX: Facilitates trading between various AI USD tokens.

Supported AI Dollar Assets (so far)

Aethir USD (AUSD)—a stable payment method for computing power

Vana USD (VanaUSD)—a data-based stablecoin

Virtual USD (vUSD)

ai16z USD (ai16zUSD)

0G USD (0USD)

Nillion USD

More partnerships are in discussions.

Currently, there is limited detailed documentation on each AI stablecoin use case, but I will provide a detailed technical overview once their white papers are released. For now, Maitrix is the only team building this layer for AI projects and has already established partnerships with top AI ecosystems.

Maitrix is currently gaining attention on the testnet. The public mainnet is about to launch.

The Second Challenge

With the continuous acceleration of AI development and the expansion of its application scope, the demand for computing power resources is also growing. Data centers and cloud operators need to plan their expansions in advance to meet future demands.

Enterprise-grade GPUs (such as NVIDIA's H100 and H200) are typically expensive and require significant funding.

Traditional financing methods, such as bank loans or equity investments, are often slow and complex, preventing data centers from quickly scaling to meet demand. This is where the next two AI projects, Gaib and USDAI, focus.

Projects Addressing the "Demand Issue"

The first project is Gaib.

GAIB AiFi—The first economic layer of AI and computing power, Gaib tokenizes the future cash flows of GPUs to help data centers efficiently raise funds while providing investors with yield-bearing assets backed by real assets (GPUs).

Its basic operation is:

Cloud/data centers package future GPU cash flows into financial products;

These cash flows are tokenized on a 6-12 month cycle;

Investors purchase these tokens and start receiving periodic rewards;

They refer to this AI synthetic dollar as "AID."

Each AID token is backed by a GPU financing transaction portfolio and treasury bonds or other liquid asset reserves.

The floating yield is expected to have an APY of about 40%, largely depending on the portfolio of GPU transactions, whether debt financing or equity trading (with equity accounting for over 60-80%, and debt yielding 10-20% annually).

So far, they have accumulated about $22 million in TVL incentive deposits, which exist in the form of "Spice" points, giving investors the right to future airdrop rewards.

Additionally, Gaib has partnered with Aethir and conducted its first GPU tokenization pilot earlier this year. This pilot is merely for GPU tokenization/securitization, as part of its roadmap, expanding into GPU-backed stablecoin "AID."

The second project is USD.AI

USDAI is a yield-bearing synthetic stablecoin supported by RWA launched by Permian Labs. It is somewhat similar to Gaib but also different, USDAI is a stablecoin collateralized by hardware assets (such as GPUs, telecom equipment, solar panels), operating under debt financing transactions, where borrowers (asset owners) obtain loans from USDAI, pay interest, and these interest earnings belong to USDAI token holders.

Permian Labs is backed by metastreet, a top structured credit market that offers NFT-backed loans, structured credit for illiquid assets/risk-weighted assets (watches, artworks), and products similar to Pendle's NFT yield rights transfer (PT YT).

USDAI has not yet launched, but its target yield is an APY of 15-25%, with the asset portfolio divided into three phases, from 100% treasury bonds to 100% hardware assets. USDAI uses CALIBER, a system that simplifies the loan/issuance process and complies with legal standards for putting GPUs on-chain.

Odaily Note: CALIBER: Collateralized Asset Ledger: Insurance, Bailment, Evaluation, Redemption. This system is based on the U.S. Uniform Commercial Code (UCC) Section 7, transforming real-world assets (such as infrastructure) into legally acceptable collateral for on-chain financing through asset tokenization and legal frameworks.

To clarify, USDAI focuses on debt, with a broader range of asset types. With its CALIBER model, it can cover various use cases (regardless of where the demand is), while Gaib focuses more on equity, offering higher expected yields.

You can fill out the form to apply to become an early user, and USDAI will provide additional rewards for early participants.

Other AI-related Stablecoin Products

Almanak recently launched alUSD, an ERC-7540 version token (an extension of ERC-4626), which is a tokenized AI yield optimization strategy, aimed at maximizing risk-adjusted returns on stablecoin investments in Aave, Compound, Curve, Yearn, and more.

The Almanak team will soon initiate a points activity to guide liquidity and continue to expand the composability of DeFi, allowing people to use alUSD as collateral or to recycle it to maximize returns.

The AIxFI project is a vault that can automatically deploy USDC in DeFi protocols. Initially, it will be rule-based, gradually introducing AI for decision-making. It will launch this month on Virtuals Protocol.

Future Trends

We are likely to see the rise of the Ethena project, which focuses on leveraging GPUs to bring high yields to stablecoins. More importantly, how they manage their 1:1 dollar peg and ensure that the price can return to $1 in critical situations.

In the future, we will also see more tokenized AI strategies emerging. We have already witnessed how AI can better optimize yields by considering gas fees, rebalancing costs, slippage, and other dynamic variables. Imagine tokenizing these strategies into highly composable "vaults," which can serve as collateral and be recycled to achieve 5-10x leveraged returns.

As participants like Maitrix build stablecoin infrastructure for top AI ecosystems, we will begin to see an increase in Web3 AI liquidity. More AI value will start to become more composable and flow into DeFi, enhancing the value appreciation of the entire Web3 ecosystem.

While these teams are very interesting, risk/peg management/redemption/liquidation mechanisms are crucial when it comes to stablecoins. Conduct a thorough risk assessment before making investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。