Cardano Introduces Cardinal to Bring Non-Custodial Bitcoin to DeFi

In a bold move for Cardano, founder Charles Hoskinson has officially introduced Cardinal on his social media X (previously Twitter). It is the first Bitcoin DeFi protocol developed for the Cardano network. The announcement has stimulated strong interest in both the ADA and BTC communities, and got majorly positive reactions. This development could become a turning point for Cardano’s DeFi journey and bring in new liquidity from Bitcoin holders.

Source: Charles Hoskinson X handle

Cardinal: A New Way to Use BTC in DeFi

It is a cross-chain Defi protocol that enables BTC holders to stake, borrow, or lend against their crypto. It does not require them to give the custody of their coins. This has been possible by leveraging MuSig2, it is a cryptography method that enables more than two parties to authorise transactions with safety. Cardinal employs this to get trust-minimized cross-chain flows. It eliminates the requirement of conventional and centralised bridges with risks.

Bitcoin users have the option to use their BTC UTXOs straight in the Cardano ecosystem. Cardinal has made it possible to use Ordinals inscriptions, with the feature allowing people to add unique digital assets to Bitcoin and use them for financial purposes.

Cardano’s DeFi world now benefits from Bitcoin, and users can join in without risking their assets. The network is making a strong move by catching up to Ethereum in the area of decentralized finance.

Why It Matters

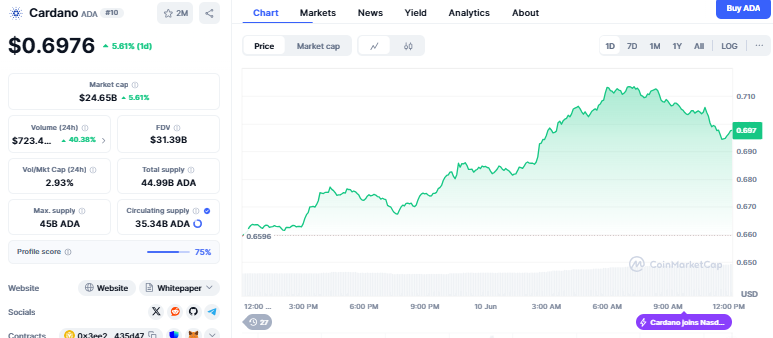

Till now, Bitcoin has generally been left out of new DeFi ecosystems unless users were willing to use centralized bridges or alter their cryptocurrencies into tokenized forms for example wBTC. Cardinal transforms this by enabling actual BTC to access platform’s DeFi tools directly while ensuring safety. Within the last 24 hours ADA has experienced an increase of 5.61 in the price and trading volume has also spiked by 40%, currently standing at $0.6976.

Source: CoinMarketCap

The framework of Cardinal consists of an off-chain system named BitVMX, which promotes faster and private transfers. The team is also thinking of incorporating zero-knowledge (ZK) proofs. It is an advanced privacy technology, for future updates. The objective of these features is to minimise the risk of single points of failure. It will strengthen users' trust.

If successful, this feature could help Cardano attract Bitcoin whales and new users looking for safer DeFi alternatives apart from Ethereum. It may also grow the total value locked (TVL) of Cardano and on-chain activity. These are two key aspects for measuring the health and adoption of a blockchain. BTC is currently trading at $109,634 with an increase of 3.78% within a day and trading volume has also skyrocketed by 50%. traders and whales are being bullish towards Bitcoin .

ADA Gains Institutional Momentum

In another big update, Nasdaq filed on June 2, 2025, to include ADA in its Crypto Index (NCI), with other prominent tokens like SOLANA and XRP. If it gets approval from the US SEC, it could promote Cardano ETF products to track the ADA price, mimicking the way BTC and ETH ETFs operate now.

This step has been regarded as a significant marker of Cardano's institutional development. This indicates that big financial players are beginning to give more attention to the project and its ever-changing environment.

Final Thoughts

Cardinal is a daring step that would potentially place Cardano in the limelight with regards to real-world use of DeFi. With trust-minimized BTC integration, Ordinals support, and upcoming ZK features, it's shooting high. But actual success will be based on whether users, particularly big Bitcoin holders, will trust and utilize it.

As ever, keep an eye on BTC inflows and ADA's DeFi usage for hints at whether Cardinal will make good on its huge promises.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。