Stablecoins have become a hot topic in the global financial sphere, with the founder of a cross-border payment unicorn expressing frustration to investors and directly criticizing stablecoins. This statement quickly faced rebuttals from various parties within the crypto community.

Written by: Nancy, PANews

Stablecoins have become a hot topic in the global financial sphere, with the founder of a cross-border payment unicorn expressing frustration to investors and directly criticizing stablecoins.

Recently, a tweet from Airwallex CEO ignited a public debate within the crypto community. In this statement, the traditional finance elite questioned the value of stablecoins in terms of foreign exchange costs, settlement efficiency, and practical applications in mainstream markets, revealing a reserved and skeptical attitude towards this emerging payment tool.

Unexpectedly, this statement was met with swift rebuttals from various sectors of the crypto community. From the efficiency of on-chain settlements to payment freedom in emerging markets, and the compliance process of stablecoins, the comment section turned into a battleground between old and new payment systems.

This is not just a clash of opinions but reveals a financial logic reconstruction that is accelerating. Today, stablecoins are no longer marginal tools in the crypto space but are substantively penetrating the core scenarios of traditional finance, reshaping cost structures and settlement mechanisms, and shaking the vested interests of intermediary institutions.

Airwallex CEO publicly questions the value of stablecoins, facing multiple rebuttals

On June 8, Airwallex co-founder and CEO Jack Zhang publicly expressed profound doubts about the value of stablecoins.

"Investors always ask me about stablecoins and how they can reduce foreign exchange fees; but if you are remitting from USD to EUR, and the recipient still needs to deposit in EUR, I don't see how stablecoins can reduce costs—because the process of converting stablecoins to the target fiat currency is often more expensive than traditional interbank foreign exchange rates," Jack Zhang stated in his tweet.

Jack Zhang further mentioned that he has never truly understood the cryptocurrency space, and compared to technologies like AI, he has yet to see a single practical use case for cryptocurrencies in the past 15 years. In his view, this purely financial product has not created any real value for society, merely a zero-sum game. Even if stablecoins have lower volatility, he does not believe they are helpful for B2B transactions unless they involve very niche currencies, which inherently have low liquidity.

Jack Zhang believes that in trading between G10 currencies, the existing financial system (such as bank transfers) is already efficient enough, with costs close to free and real-time. The exit transaction costs from stablecoins to the recipient's currency are much higher than interbank foreign exchange transactions. Stablecoins may provide regulatory arbitrage opportunities in emerging markets like Latin America or Africa, but their advantages in mainstream currency trading are not obvious.

In response, Simon Taylor, strategy director of the crypto compliance product platform Sardine, argued that Jack's understanding of stablecoins is limited to superficial cost comparisons, overlooking their fundamental significance. The value of stablecoins lies not in reducing off-ramping or last-mile costs. Stablecoins are not only cheaper but also better. Currently, stablecoins are not a significant transformation of financial infrastructure, but merely another option. He believes that the upcoming U.S. regulations will mark a turning point for stablecoins as a financial track.

Richard Liu, co-founder of Huma Finance, emphasized that if viewed solely from the perspective of optimizing existing foreign exchange flows, stablecoins indeed do not help much. However, he pointedly noted, "Don't deceive yourself into thinking you've pushed foreign exchange costs to the limit; your clients are still suffering from high fees and entry barriers, and these issues are rooted in the very system you rely on—a dated and predatory banking infrastructure. Blockbuster once thought its cost structure was optimized enough, but its business model was built on a flawed foundation: logistics. We all know how that story ended. Stablecoins will drive the next wave of global payment trends, not just a tweak to traditional financial tracks, but a new paradigm built on an entirely different architecture. Its rise does not depend on the participation of existing institutions, including Airwallex."

Matt Sorg, the technical lead at the Solana Foundation, shared progress on the practical applications of stablecoins, stating that some euro stablecoins are now being gradually adopted. Converting from USD stablecoins to euro stablecoins incurs only a few basis points in fees on-chain. Stablecoin issuers are establishing low-cost channels from euro stablecoins to fiat bank accounts. Although there are still some costly intermediaries in this process, there are also cheaper options if you know who to look for. Essentially, different participants are addressing cost issues at each stage.

"You can completely achieve this by issuing your own stablecoin. The benefits brought by stablecoins are enough for you to easily subsidize zero-fee deposit and withdrawal services while also earning extra profits. Moreover, the crypto economy has essentially formed a parallel system. Once the dollar is in digital form, you can use and consume it more broadly in the crypto space. Many merchants are actually willing to accept USDC or USDT. Ultimately, you may not even need to convert it back to fiat. And the transaction fees within this parallel system are also lower," suggested Stijn Paumen, co-founder and CEO of Helio.

Helio CEO Mert also shared a personal experience, stating that a bad experience using the Airwallex API for cross-border transfers in the past motivated him to dive into cryptocurrency, indirectly supporting the potential of stablecoins as an alternative solution.

"When we offer a stablecoin yield of 4% annually (risk-free), users will increasingly lack the motivation to convert their funds back to fiat. This will drive up demand for the dollar and weaken demand for the euro. The more the euro depreciates, the more people will tend to hold dollars—ultimately creating a downward spiral until everyone chooses to use only dollars. In the end, the euro will only become something Europeans have to buy to pay taxes," believes Mike Belshe, CEO of crypto custody platform BitGo, who sees stablecoins as enhancing the effect of dollar hegemony.

Nic Carter, founding partner of Castle Island Ventures, directly criticized Jack for having a shallow understanding of stablecoins, lacking basic curiosity and comprehension.

Under the full-scale assault from the crypto community, Jack Zhang's latest response stated that stablecoin wallets can serve as an alternative payment method and enhance liquidity in emerging markets. He acknowledged that stablecoins do have a place in financial markets, but he does not believe they possess disruptive significance at any level.

From regulatory margins to the mainstream stage, traditional finance's "cheese" is slipping away

Jack Zhang's skepticism actually reflects the general confusion and instinctive wariness of traditional finance practitioners towards the crypto world. To them, stablecoins are neither traditional currencies nor clearly defined assets, but rather a middle-layer tool that operates on the regulatory edge. However, this seemingly marginalized financial tool is accelerating its entry into the mainstream financial view, even beginning to shake the "cheese" that the traditional financial system relies on for survival.

It is well known that the core value of stablecoins is not merely their price anchoring mechanism; more importantly, it is the financial structural changes they provoke. They not only possess characteristics such as on-chain instant settlement, global circulation, and programming logic support, but also inherently embed a dimensionality reduction attack on the existing financial "account - bank - clearing network" system.

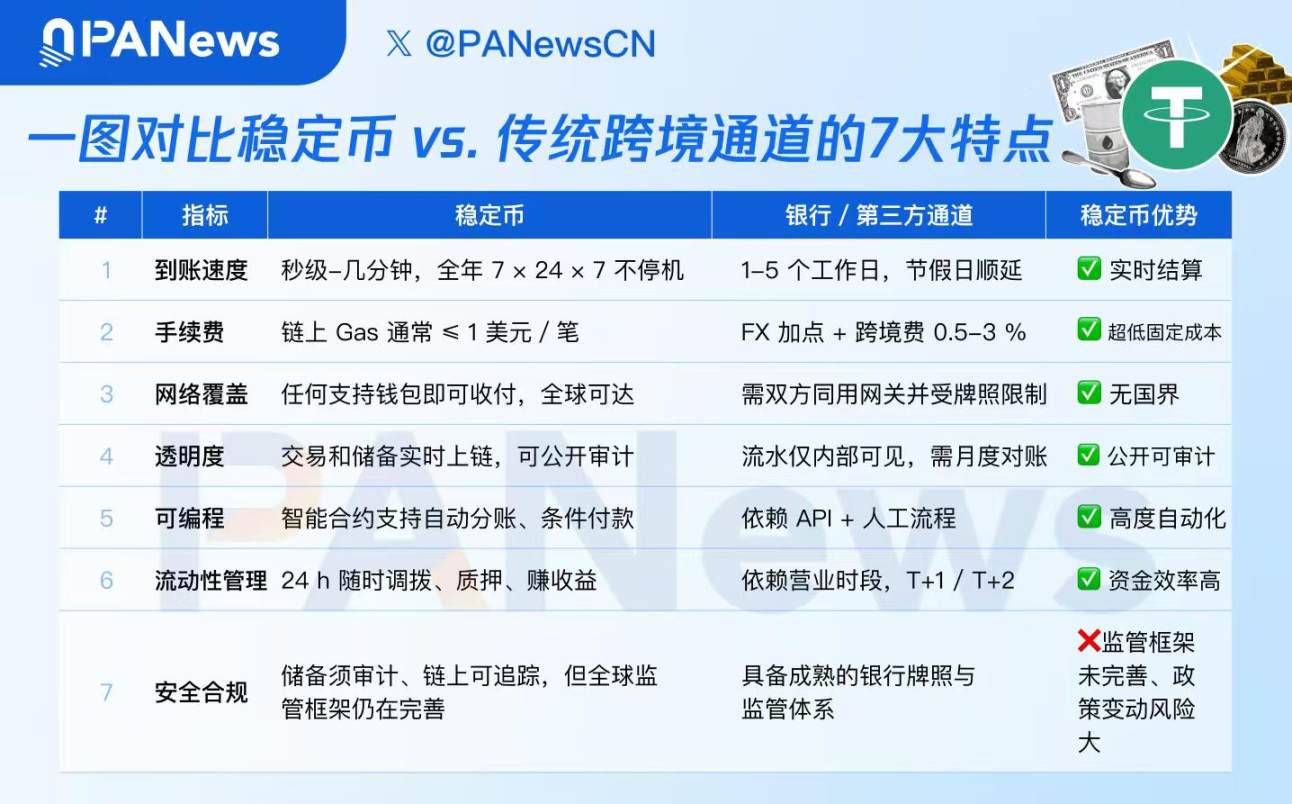

From the perspective of cross-border payments, it is clear to see the impact of stablecoins on the old system. In the traditional financial system, cross-border remittances must traverse multiple national banking systems, clearing networks, and foreign exchange markets, often taking days, incurring high costs, and lacking transparency. Stablecoins, on the other hand, achieve real-time arrival and full-chain transparency through on-chain peer-to-peer transfers and smart contract settlements. This is not only an improvement in efficiency but also a paradigm shift: funds no longer rely on a bank network backed by national sovereignty but are directly held and transferred through on-chain addresses in an open network.

More importantly, stablecoins break the geographical limitations and barriers of financial services. Due to the compliance costs, risk control restrictions, and commercial viability of traditional banks, over 1 billion people globally still lack access to financial services. Stablecoins, through the combination of "smartphones + digital wallets + internet," allow users to gain the rights to save, pay, conduct cross-border transactions, and participate in global financial activities, achieving true decentralized financial inclusion. For example, in regions like Latin America, Africa, and Southeast Asia, an increasing number of users are beginning to use USDT and USDC for daily savings, salary settlements, product payments, and small cross-border remittances. This is not the "regulatory arbitrage" that Jack refers to, but a true reflection of a new financial order taking root in marginalized areas.

For this reason, the impact of stablecoins on traditional fintech companies is fundamental.

Taking Airwallex as an example, its business model is built on connecting existing financial networks, constructing payment paths through bank accounts, the Swift network, clearinghouses, and foreign exchange markets. Stablecoins bypass this network logic, fundamentally breaking the business structure that relies on bank accounts, clearinghouses, and exchange networks. This means that stablecoins are gradually compressing the profit margins of fintech companies, and once the global compliance system for stablecoins is perfected, this impact will become systemic and irreversible.

At the same time, the global trend towards stablecoin compliance is gradually making them legitimate competitors in the traditional financial sector, with the U.S., Hong Kong, Singapore, and the UAE all accelerating the establishment of stablecoin regulatory standards. For instance, the U.S. is advancing the GENIUS Act for stablecoins, bringing them into a formalized track; Hong Kong's "Stablecoin Ordinance" will take effect on August 1, marking a milestone in promoting the sustainable development of Hong Kong's stablecoin and digital asset ecosystem. In this process, crypto-native compliance enterprises like Circle are gaining a first-mover advantage, while traditional institutions are lagging due to rigid internal structures and technological shortcomings.

Moreover, it is noteworthy that the core user group of stablecoins is rapidly becoming younger. Generation Z and millennials, who have grown up in a digital-native environment, have a natural acceptance and affinity for on-chain wallets, stablecoin payments, and smart contract operations. This inherent digital behavior is increasingly eroding the moats of these institutions.

However, an increasing number of traditional financial and tech giants are actively embracing stablecoins. For example, Deutsche Bank is currently researching stablecoins and tokenized deposits, considering issuing tokens or joining industry initiatives; large tech companies like Apple, X, and Airbnb are engaging with crypto firms to explore stablecoin payment integration solutions; Uber is considering using stablecoins to reduce cross-border payment costs and is actively assessing their application potential; payment company Stripe is considering collaborating with banks to promote the development of stablecoin payments; and Spain's Santander Bank plans to launch stablecoins and expand cryptocurrency services… These market dynamics also indicate that stablecoins may become a core variable in the new round of financial structural reshaping.

In summary, the debate sparked by Airwallex's skepticism towards stablecoins showcases the increasingly intense game and ideological clash between traditional finance and crypto finance. It is undeniable that as the compliance process advances and mainstream institutions actively experiment, stablecoins are gradually evolving from marginal tools to an important force in mainstream finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。