Exploring the Structural Challenges of Ethereum in the RWA Market and the Rise of New Tokenization Platforms.

Written by: Chi Anh, Ryan Yoon, Tiger Research

Translated by: AididiaoJP, Foresight News

Abstract

Thanks to its first-mover advantage, past institutional cases, deep on-chain liquidity, and decentralized architecture, Ethereum remains a leader in the RWA market.

Layer 1 blockchains with faster transaction speeds and lower costs, as well as RWA-specific chains designed for compliance, are addressing Ethereum's limitations in cost and performance. These emerging platforms position themselves as the next generation of RWA infrastructure by offering superior technical scalability or built-in compliance features.

The key growth of the next phase of RWA will depend on three factors: on-chain regulatory compatibility, a service ecosystem built around real-world assets, and sufficient on-chain liquidity.

In what areas is the RWA market currently developing?

Tokenization of real-world assets (RWA) has become one of the mainstream trends in the blockchain industry. Global consulting firms like Boston Consulting Group (BCG) have released extensive market forecasts, and Tiger Research has found that the industry is increasingly growing in emerging markets like Indonesia.

So, what exactly are RWAs? They refer to the conversion of tangible assets (such as real estate, bonds, and commodities) into digital tokens. The tokenization process is inevitably tied to blockchain infrastructure. Currently, Ethereum occupies a leading position in the infrastructure supporting such tokenization.

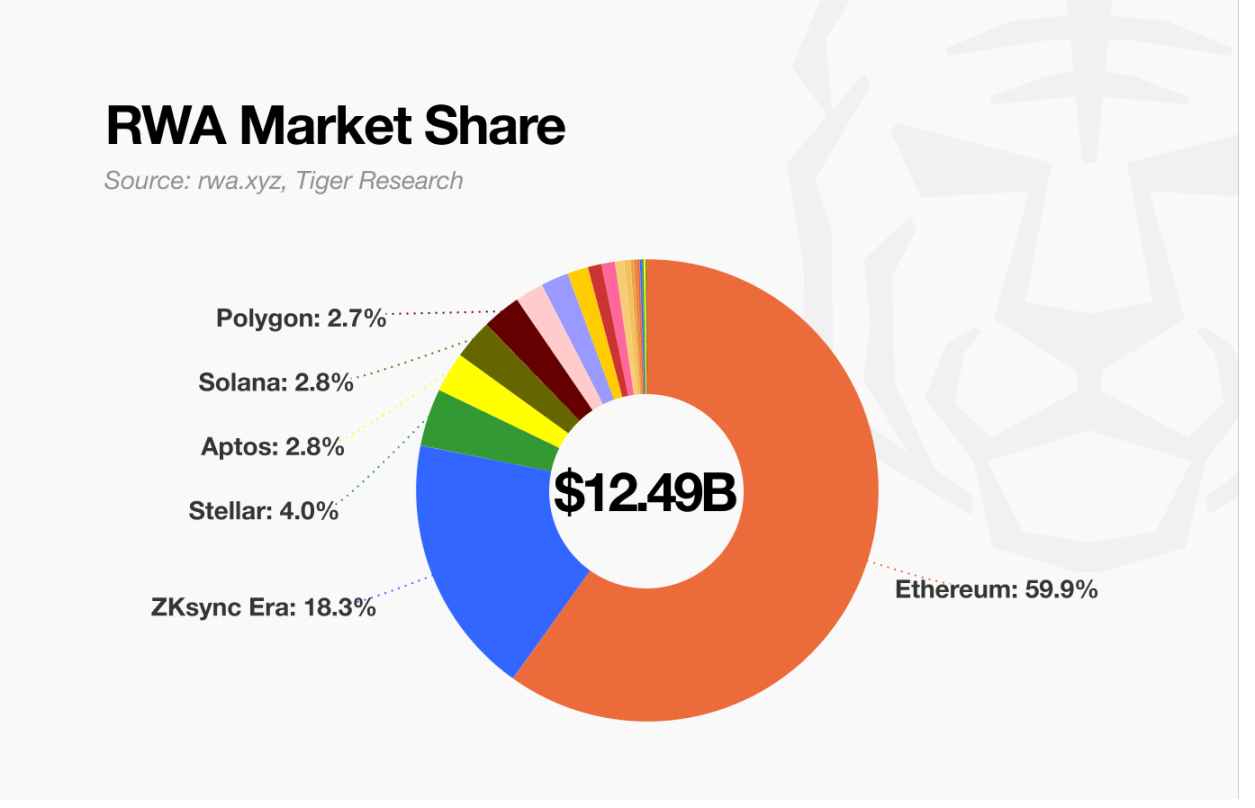

Source: rwa.xyz, Tiger Research

Despite increasing competition, Ethereum still maintains a dominant position in the RWA market. Some RWA blockchains have emerged, and platforms like Solana, which has established a foothold in the DeFi space, are also expanding into the RWA domain. Nevertheless, Ethereum still accounts for over 50% of market activity, highlighting its solid market position.

This report examines the key factors that currently enable Ethereum to dominate the RWA market and explores the critical elements that may influence the next phase of growth and competition.

Why does Ethereum remain ahead?

2.1. First-Mover Advantage and Institutional Trust

The reasons for Ethereum becoming the default platform for institutional tokenization are evident. It was the first to establish key tokenization smart contract standards and actively prepared for the RWA market.

With the support of a highly active developer community, Ethereum established key tokenization standards such as ERC-1400 and ERC-3643 before competing platforms emerged. This early foundation provided the necessary technical and regulatory groundwork for institutions to attempt RWA projects.

Many institutions prioritize evaluating Ethereum before considering alternatives. Significant initiatives from large financial companies or institutions have helped Ethereum become an important infrastructure in the RWA market:

JPMorgan's Quorum and JPM Coin (2016-2017): To support enterprise use cases, JPMorgan developed the permissioned fork chain Quorum based on Ethereum, while JPM Coin can be used for interbank transfers. This indicates that Ethereum's architecture can meet regulatory requirements for data protection and compliance, even in private forms.

Société Générale Bond Issuance (2019): Société Générale FORGE issued €100 million in covered bonds on the Ethereum public mainnet. This demonstrates that regulated securities can be issued and settled on a public blockchain while minimizing the involvement of intermediaries.

European Investment Bank Digital Bond (2021): The European Investment Bank collaborated with Goldman Sachs, Santander Bank, and Société Générale to issue €100 million in digital bonds on Ethereum. The bond was settled using central bank digital currency (CBDC) issued by the French bank, highlighting Ethereum's potential in fully integrated capital markets.

These successful pilot cases have enhanced Ethereum's credibility. For institutions, trust is built on verified use cases and recommendations from other regulated participants. Ethereum continues to attract interest and forms a self-reinforcing adoption loop.

Source: Securitize

For example, in 2018, Securitize announced in official documents that it would build tools on Ethereum to manage the entire lifecycle of digital securities. This initiative laid the groundwork for BlackRock's eventual launch of BUIDL (currently the largest tokenized fund issued on Ethereum).

2.2. Continuous Inflow of Traditional Capital into Blockchain

Another key reason for Ethereum's continued dominance in the RWA market is its ability to convert on-chain liquidity into actual purchasing power.

Tokenizing real-world assets is not just a technical process. A properly functioning market requires capital that can actively invest in and trade these assets. In this regard, Ethereum stands out as the only platform with deep and deployable on-chain liquidity.

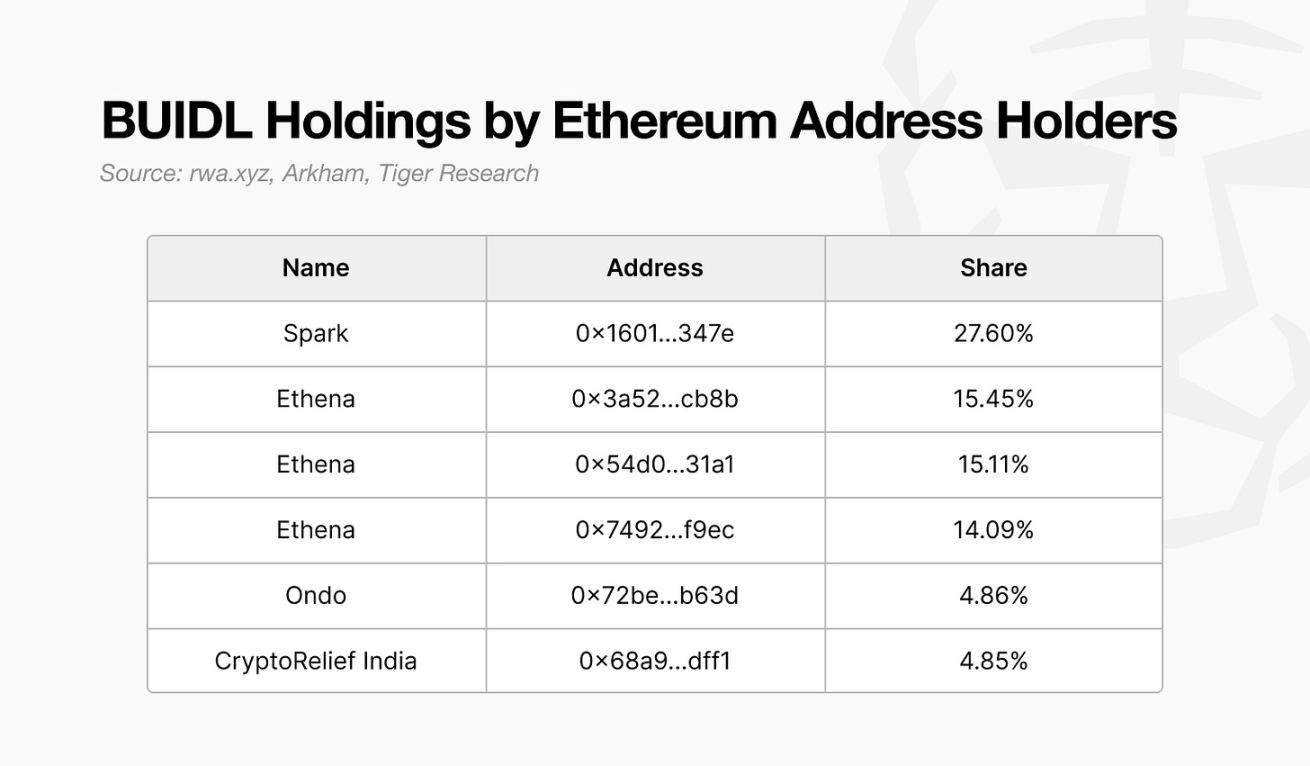

Source: rwa.xyz, Arkham, Tiger Research

This is particularly evident on platforms like Ondo, Spark, and Ethena, which hold significant amounts of tokenized BUIDL funds on Ethereum. These platforms have attracted hundreds of millions in funding by offering products based on tokenized U.S. Treasuries, stablecoin-based lending, and synthetic yield-generating dollar tools.

Ondo Finance has locked in over $600 million in total value locked (TVL) through its Treasury-backed products USDY and OUSG.

Spark Protocol utilized MakerDAO's DAI liquidity to purchase over $2.4 billion in Treasuries.

Ethena built a bankless yield infrastructure on Ethereum using its synthetic stablecoins USDe and sUSDe, attracting institutional demand and DeFi liquidity.

These examples demonstrate that Ethereum is not just a platform for asset tokenization. It provides a robust liquidity foundation that supports investment and asset management by large institutions or financial companies. In contrast, many emerging risk asset management platforms struggle to ensure sustained capital inflow or maintain active secondary market activity after the initial token issuance.

The reasons for this disparity are clear. Ethereum has integrated stablecoins, DeFi protocols, and compliant infrastructure, creating a comprehensive financial environment that ensures issuance, trading, and settlement can all occur on-chain.

Thus, Ethereum is the most efficient environment for converting tokenized assets into actual purchasing activities, which has become a structural advantage for Ethereum.

2.3. Building a Trust Foundation through Decentralization

Decentralization plays a crucial role in establishing trust. Tokenizing real-world assets requires transferring ownership and transaction records of high-value assets onto the chain. In this process, institutions focus on the reliability and transparency of the system. This is where Ethereum's decentralized architecture offers a unique advantage.

Ethereum is a public chain supported by thousands of independently operating nodes worldwide. The network is open to everyone, and all changes are determined by participant consensus rather than centralized control. Therefore, it can avoid single points of failure, resist hacking and censorship, and maintain uninterrupted normal operation.

In the RWA market, this structure creates tangible value. Transaction records are stored on an immutable ledger, thereby reducing the risk of fraud. Smart contracts enable trustless transactions without intermediaries. Users can access services, sign agreements, and participate in financial activities without centralized approval.

Features such as transparency, security, and accessibility make Ethereum an ideal choice for institutions exploring asset tokenization. Its decentralized system meets the key requirements for operating in high-risk financial environments.

Emerging challengers reshaping the landscape

Ethereum has made tokenized finance feasible. However, it has also exposed some structural limitations that hinder broader institutional adoption. These obstacles mainly include limited transaction throughput, latency issues, and unpredictable fee structures.

To address these challenges, Layer 2 Rollup solutions such as Arbitrum, Optimism, and Polygon zkEVM have emerged. Major upgrades, including Merge (2022), Dencun (2024), and the already launched Pectra (2025), have enhanced Ethereum's scalability. However, the network still cannot surpass traditional financial infrastructure. For example, Visa processes over 65,000 transactions per second, while Ethereum has yet to reach this level. For institutions requiring high-frequency trading or real-time settlement, these performance gaps remain a critical constraint.

Latency and finality also pose challenges. The average block generation takes 12 seconds, and additional confirmations required for secure settlement can lead to finality times of up to three minutes. During network congestion, delays can further increase, posing challenges for time-sensitive financial operations.

More importantly, the volatility of gas fees is concerning. Transaction fees can exceed $50 during peak times, and even under normal conditions, fees often exceed $20. This fee uncertainty complicates business planning and may undermine the competitiveness of Ethereum-based services.

Securitize is a case in point. After encountering Ethereum's limitations, the company expanded to other platforms like Solana and Polygon while also developing its own blockchain, Converage. Although Ethereum played a crucial role in early institutional experiments, it now faces increasing pressure to meet the demands of a more mature and performance-sensitive market.

3.1. High-Throughput and Cost-Effective General Blockchains are Emerging

As Ethereum's limitations become increasingly apparent, more institutions are exploring general blockchains that can serve as alternatives to Ethereum. These platforms can address Ethereum's key performance bottlenecks, particularly in transaction speed, fee stability, and finality time.

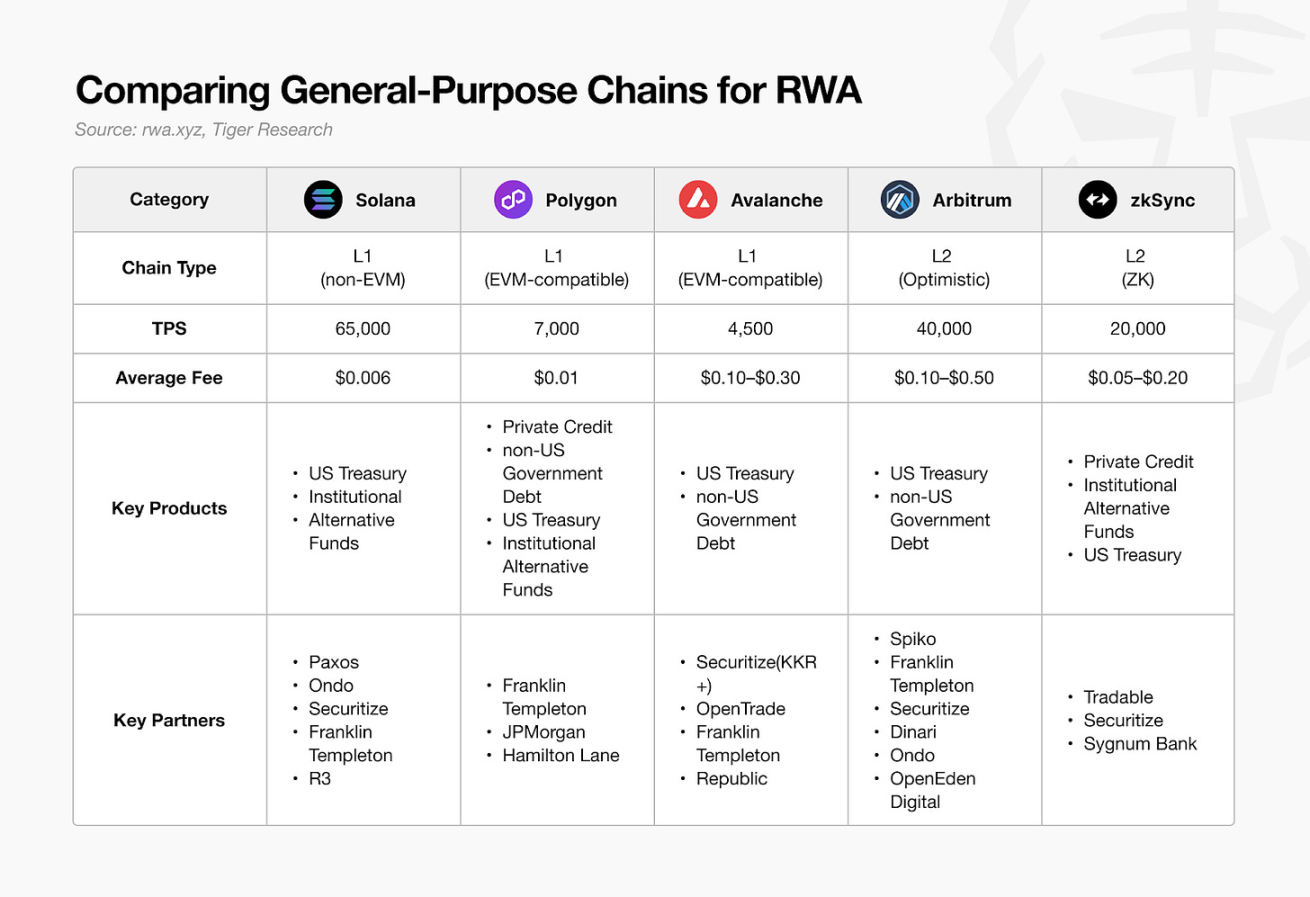

Source: rwa.xyz, Tiger Research

Despite ongoing collaborations with institutional investors, the actual scale of tokenized assets (excluding stablecoins) on these platforms remains far below that of Ethereum. In many cases, tokenized assets launched on general-purpose chains still follow a multi-chain deployment strategy dominated by Ethereum.

Nevertheless, there are signs that emerging platforms are making meaningful progress. In the private credit sector, new tokenization solutions are emerging. For example, on zkSync, the Tradable platform has gained attention, capturing over 18% of the activity share in this field, second only to Ethereum.

At this stage, general-purpose blockchains are just beginning to establish themselves. Platforms like Solana, which have achieved rapid growth in their DeFi ecosystems, now face a strategic question: how to translate this momentum into a sustainable position in the RWA space. Simply having superior technical performance is not enough. Solana needs to meet the trust and compliance expectations of institutional investors.

Ultimately, the success of these blockchains in the RWA market will depend less on raw throughput and more on their ability to provide tangible value. The differentiated ecosystems built around the unique advantages of each chain will determine their long-term positioning in this emerging field.

3.2. The Emergence of RWA-Specific Blockchains

An increasing number of blockchain platforms are abandoning general designs in favor of focusing on specific domains. This trend is also evident in the RWA space, where a new wave of RWA-specific chains is emerging, optimized for the tokenization of real-world assets.

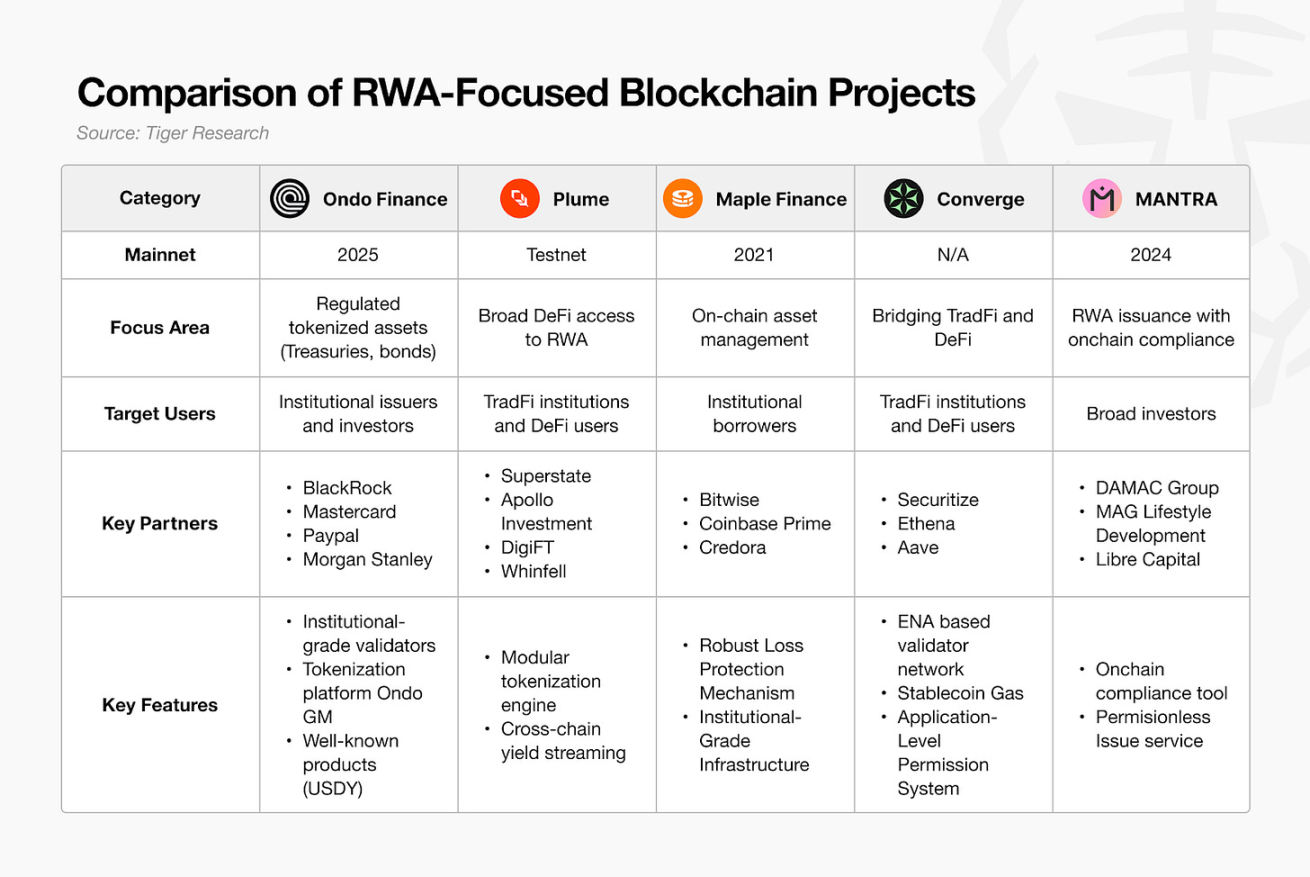

Source: Tiger Research

The concept of RWA-specific blockchains is clear. Tokenizing real-world assets requires direct integration with existing financial regulations, which often makes the use of general blockchain infrastructure inadequate. RWA-specific blockchains need to fundamentally address special technical requirements, particularly in terms of regulatory compliance.

Compliance handling is a key area. KYC and AML procedures are crucial for tokenization workflows, but these processes are often handled off-chain. This approach merely wraps traditional financial assets in a blockchain format without redesigning the underlying compliance logic.

The current shift is towards fully on-chain compliance capabilities. There is a growing demand for blockchain networks that can not only record ownership but also natively execute regulatory requirements at the protocol level.

Some blockchains focused on RWA have begun to offer on-chain compliance modules. For example, MANTRA includes decentralized identity (DID) features that support compliance execution at the infrastructure layer. Other RWA-specific blockchains are expected to adopt similar initiatives.

In addition to compliance, many platforms are also targeting specific asset classes and leveraging deep domain expertise. Maple Finance focuses on institutional lending and asset management, Centrifuge specializes in trade finance, and Polymesh is dedicated to regulated securities. These blockchains are not tokenizing widely held assets like sovereign bonds or stablecoins but are instead pursuing vertical specialization as a competitive strategy.

Despite this, many platforms are still in the early stages. Some have yet to launch their mainnets, and most platforms remain limited in scale and adoption. While general-purpose chains are just beginning to gain attention in the RWA space, specialized chains are still at the starting line.

Who Will Replace Ethereum in the RWA Market?

Ethereum's dominance in the RWA market is unlikely to remain unchanged. The current market size for tokenized assets is less than 2% of its potential, indicating that the industry is still in its early stages. Ethereum's advantages to date largely stem from its early product-market fit (PMF). As the market matures and scales, the competitive landscape will undergo significant changes.

Signs of this shift are already emerging, as institutions are no longer solely focused on Ethereum. Other general-purpose blockchains and RWA-specific blockchains are undergoing market testing, and an increasing number of services are exploring custom chain deployments. Tokenized assets initially issued on Ethereum are now expanding into multi-chain ecosystems, breaking the previous monopoly.

A key turning point will be the realization of on-chain compliance. For blockchain finance to truly embody innovation, regulatory processes like KYC and AML must be conducted directly on-chain. If specialized chains can successfully provide scalable protocol-level compliance and drive industry-wide adoption, the current market landscape could be completely upended.

Equally important is actual purchasing power. Tokenized assets only hold investment value when there is active capital willing to buy them. Regardless of the technology used, the utility of tokenization will be limited without effective liquidity. Therefore, the next generation of RWA platforms must build a robust service ecosystem based on tokenized assets and ensure that users have ample liquidity to participate.

In short, the next leading RWA platform is likely to achieve the following three goals simultaneously:

A fully integrated on-chain compliance framework

A service ecosystem built around tokenized assets

Deep and sustainable liquidity to ensure real purchasing power

The RWA market is still in its infancy, and those platforms that can provide exceptional solutions will replace Ethereum as the dominant player: platforms that can meet institutional needs while unlocking new value in the tokenized economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。