BTC reaches new highs, ETH awaits a breakthrough, patiently waiting for altcoin season

Author: @arndxt_xo

Translation: Baihua Blockchain

The market is doing what it does best: testing your faith.

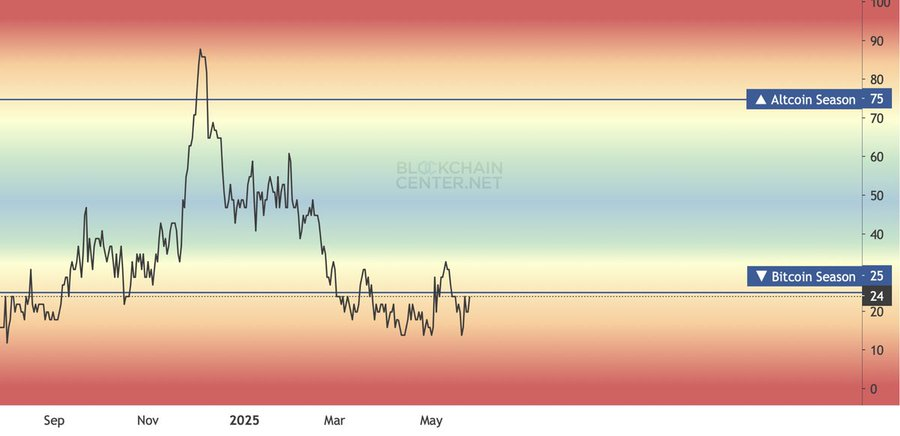

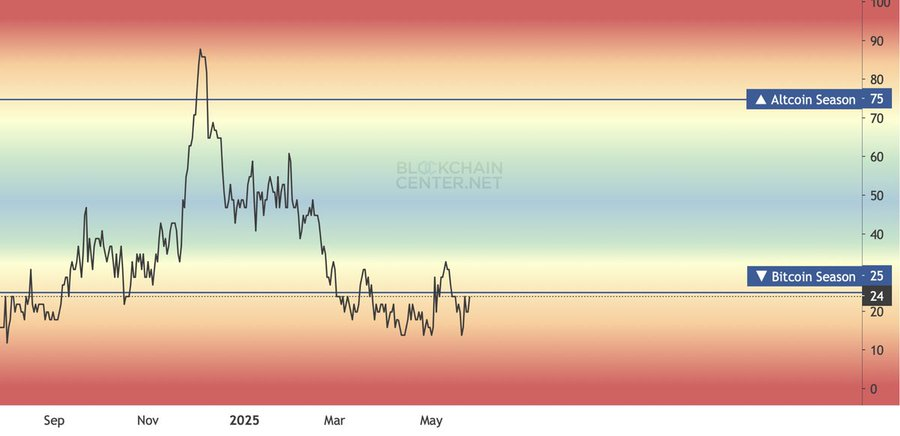

Altcoins continue to decline against BTC, with BTC's dominance nearing a cycle high. Market sentiment is divided; some are watching coldly, while others are aggressively going long on low market cap coins.

This is not a signal to shout "altcoin season" tomorrow, so don't FOMO.

- Yes, we are still in a bull market, but you are not late

Bitcoin remains the main character. From ETF inflows to corporate allocations (GameStop, Trump Media, Strive), institutional confidence in BTC keeps its engine running hot.

This is also one reason for the weak performance of altcoins—BTC has absorbed most of the liquidity. Before this trend cools down, ETH and large-cap coins will not take off, let alone low-cap coins.

Altcoin season will begin when BTC's dominance clearly declines, not while it is still consolidating at a cycle high.

- The cycle is important, but market structure is equally crucial

Indeed, the crypto market roughly follows a four-year cycle, driven by BTC halving, liquidity conditions, and technology adoption cycles. From a broader perspective, 2025 looks like the second half, where parabolic trends usually emerge.

But this is also a phase where false signals are frequent. In 2021, after ETH surpassed BTC, altcoins surged. What about now? ETH/BTC remains weak. If you jumped into low-cap coins before ETH flipped, you came too early and have too much risk exposure.

A smarter approach is to accumulate strong assets. Track large-cap coins that show real accumulation (like $AAVE, $UNI, $LINK).

- Short-term opportunities are better, but not yet confirmed

It is correct for traders to focus on key areas. Breaking through the upper range could ignite a rally in high beta altcoins, but position management requires discipline:

Use BTC as a trigger signal, not as a trading target.

Accumulate spot positions in trending altcoins like $HYPE, $AAVE, $CRV, which are low risk.

Pay attention to ETH/BTC. Without ETH's strength, there is no real altcoin season.

- No, you won't get rich overnight with 200x returns

True asymmetric returns come from early positioning and heavily investing in narratives that genuinely attract attention:

On-chain perpetual contracts (Hyperliquid, Virtual)

ETH LRT protocols with real cash flow

DeFi projects that conduct actual buybacks (AAVE)

Chain-native winners (Base, Solana, BNB—still not micro-cap coins)

The sequence for the start of altcoin season:

BTC hits an all-time high (completed).

ETH breaks through (pending).

Large-cap coins rise (some signs).

Mid-cap coins follow.

Low-cap coins take off vertically.

We are currently between Phase 1 and Phase 2.

Stay patient and add positions during pullbacks.

Article link: https://www.hellobtc.com/kp/du/06/5878.html

Source: https://x.com/arndxt_xo/status/1929511847650377877

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。