The world's second-largest stablecoin giant, Circle, submitted its prospectus at the end of May, preparing for a Nasdaq listing, with an expected valuation of $5.4 billion.

Unexpectedly, a few days later, perhaps due to the popularity of the stablecoin + RWA concept, Circle announced that the valuation had been raised to $7.2 billion.

The RWA concept has been significantly different since the beginning of this year compared to previous years. The favorable stablecoin policies in the U.S. and Hong Kong, combined with Wall Street's focus on RWA projects represented by BlackRock, as well as the influx of old money into stablecoins, have allowed the RWA and stablecoin concepts to quickly gain traction, even leading to limit-up trading in stablecoin concepts in both Hong Kong and A-shares.

As the third native Nasdaq IPO giant in the cryptocurrency industry (after Coinbase and Antalpha), what related targets can be speculated on in the crypto space?

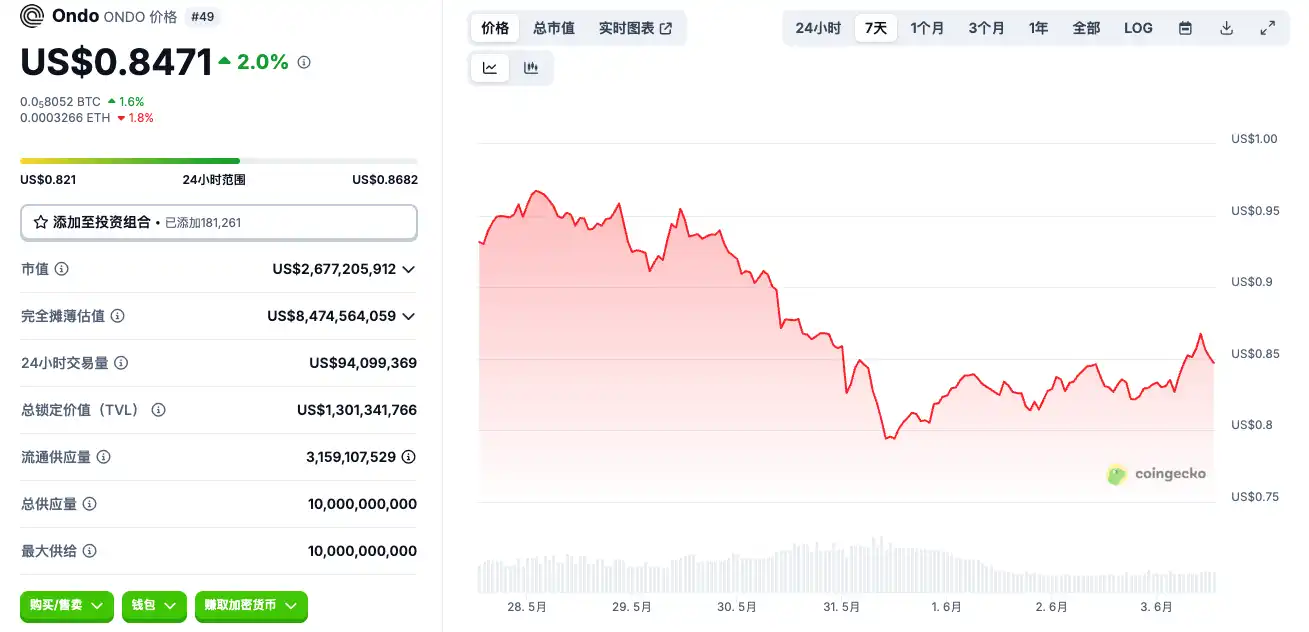

ONDO

BlackRock announced at the end of May that it had purchased 10% of Circle's IPO shares, becoming a new shareholder of Circle. BlackRock's most important partner in the RWA space is Ondo. The U.S. Treasury token OUSG issued by Ondo uses BlackRock's BUIDL fund as one of its core underlying assets, meaning that purchasing OUSG is equivalent to indirectly holding shares in BlackRock's U.S. Treasury fund.

However, the issue is that the market cap is a bit high, with ONDO currently at a market cap of $2.6 billion.

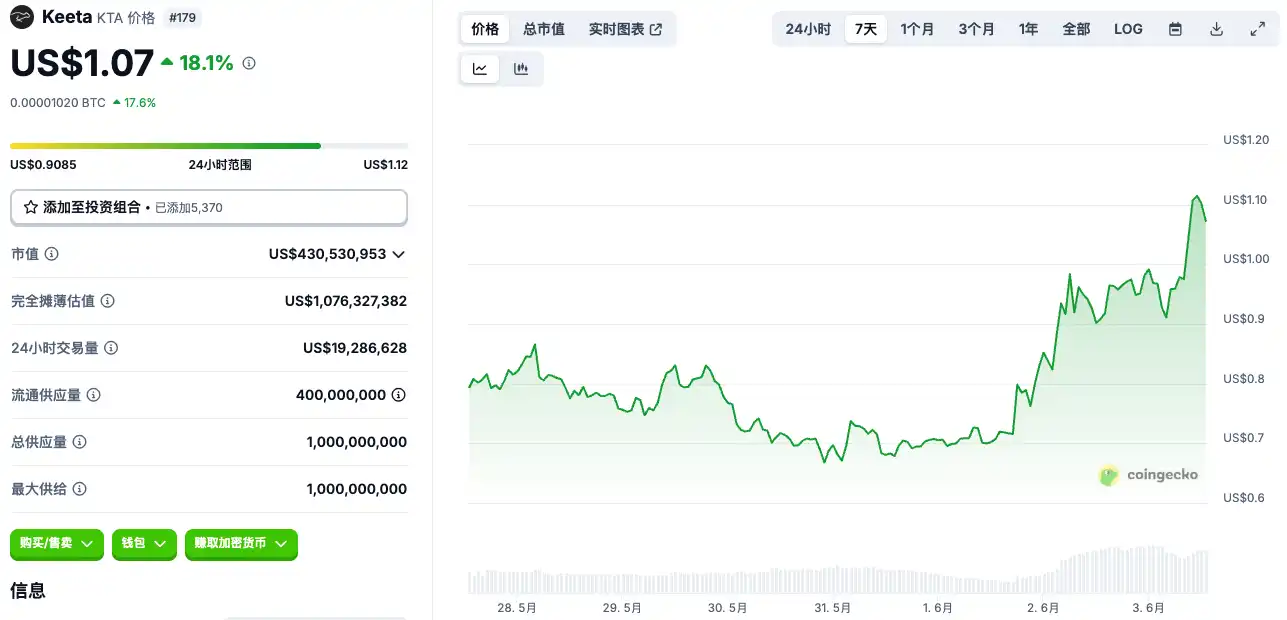

KTA

The close relationship between Coinbase and Circle needs no elaboration, so Circle's listing not only benefits the COIN stock but also allows for exploration of the Base public chain. The funds have already provided an answer, with the RWA public chain KTA on Base increasing tenfold in a month, now with a market cap of $400 million. In hindsight, with Base + RWA + small market cap, it is indeed very appropriate for funds to choose KTA as the leader.

ENA

Although not closely related to Circle, it is still a target that is often prioritized in the stablecoin concept and has previously experienced explosive trading. Coinbase urgently included ENA in its listing plan a few hours ago, seemingly anticipating the actions of funds. With a market cap of $1.9 billion, it appears to be slightly better than ONDO.

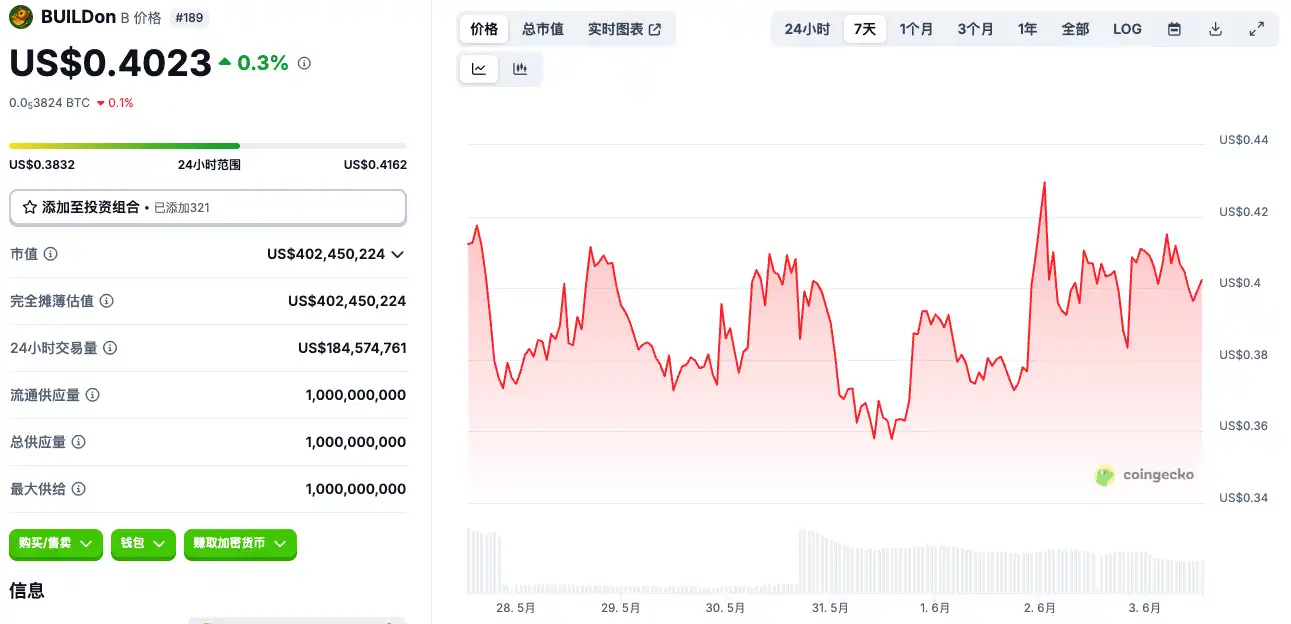

B

This is a very obscure route. Previously, Rhythm BlockBeats asked @vapor0x to analyze USDC, mainly because the issuance of USDC has changed from the past, but the destination of these dollars is unknown, which is very strange.

After @vapor0x's analysis, it was concluded that starting from January 2024, Circle's treasury address has been continuously transferring USDC to Binance, likely in preparation for the IPO to increase activity. He stated: "More dramatically, on the same day as the first large USDC transfer—January 31, 2024—Binance Earn launched a limited-time promotional event that included USDC, and the coincidence of this timing is almost impossible to be a coincidence."

Therefore, with the support of USDC + USD1, it remains to be seen whether the $400 million stablecoin meme B on BSC will be chosen by funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。