Author: 0xWeilan

The information, opinions, and judgments regarding markets, projects, currencies, etc., mentioned in this report are for reference only and do not constitute any investment advice.

The strong performance of the risk equity market has left Wall Street hedge funds astonished, making everyone question what implicit information they might have missed.

Following the rebound in April, the three major U.S. stock indices continued to rise strongly, while BTC reached a new all-time high.

Behind this, although the "reciprocal tariff war" has eased, there has been no breakthrough in reaching an agreement, and the "Russia-Ukraine war" remains stuck in negotiations and offensives.

However, capital inflows are surging, with over $2.7 billion flowing into the BTC Spot ETF channel. Long positions are approaching high levels, and exchange holdings continue to decline, indicating a very strong supply-demand situation for BTC.

On the policy front, the BTC reserve bill at the state level in the U.S. has also achieved a historic breakthrough. The "GENIUS ACT," related to stablecoins, has passed the Senate vote.

The U.S. economic employment data is strong, inflation continues to decline, and GDP expectations are beginning to rise. This may be the fundamental reason for the market's strength. However, the tariff war is not over, and the panic caused by the "Beautiful Big Plan" regarding U.S. debt has not dissipated. The performance of U.S. stocks and BTC this month has already included the most optimistic estimates, and the market may oscillate to eliminate uncertainty while waiting for interest rate cuts in the third quarter.

Macroeconomic Finance: The Impact of "Reciprocal Tariffs" is Giving Rise to a "Mild Recession" in the U.S. Economy

In the April report, we pointed out that "the most painful moment has passed, and once Washington and the Federal Reserve return to a rational game state, the market should be able to return to its own operating rules." The facts show that global geopolitical games, as well as the victory of the U.S. democratic system over the ambitions of the "mad king" Trump, have led market expectations to ultimately return to rationality, ushering in a sustained rebound and achieving the most optimistic pricing.

The consecutive "triple kill" of stocks, bonds, and currencies has triggered violent fluctuations in the U.S. financial market. Coupled with strong opposition from the business community, Trump was forced to concede, and the "reciprocal tariff war" he initiated quickly entered the second phase of "negotiation" in May and began to enter the third phase, first reaching a tariff agreement with the UK.

In early May, the U.S. and China held the first round of trade negotiations in Switzerland, pausing the intense tariff war that had lasted over a month. On May 12 (Eastern Time), both sides issued a joint statement promising to mutually reduce the previously imposed high tariffs over the next 90 days and stated that they would continue to negotiate on economic and trade relations. On that day, the S&P 500 jumped 3.26%.

In early April, as Trump "softened," U.S. stocks launched a major counterattack, essentially recovering the losses since the start of the tariff war by the end of April. In May, with the formal engagement of U.S.-China negotiations, the previously stagnant U.S. stock market received another boost and continued to rise. By the 31st, the Nasdaq, S&P 500, and Dow Jones indices recorded monthly gains of 9.56%, 6.15%, and 3.94%, respectively.

We view the rebound in U.S. stocks in April as a reflection of the end of panic selling and Trump's softening, representing a rapid pricing adjustment following the completion of the first phase of the "reciprocal tariff war." The rise in May indicates optimistic pricing for the second phase (negotiation) of the "reciprocal tariff war." Based on currently available information, this pricing is sufficient and optimistic. We believe that continuing to price significantly upward before new developments in the tariff war, interest rate cuts by the Federal Reserve, and further progress in the "Russia-Ukraine war" would be imprudent.

The pricing in May has already covered the relatively "strong" performance of the fundamentals of the U.S. economy and employment.

Economic data released at the end of May indicated that the U.S. economy contracted at an annualized rate of 0.2% in the first quarter. This figure was slightly revised up from the previously reported initial value (a contraction of 0.3%) but still shows that the U.S. economy has suffered some damage since the beginning of the year due to consumer spending and imports.

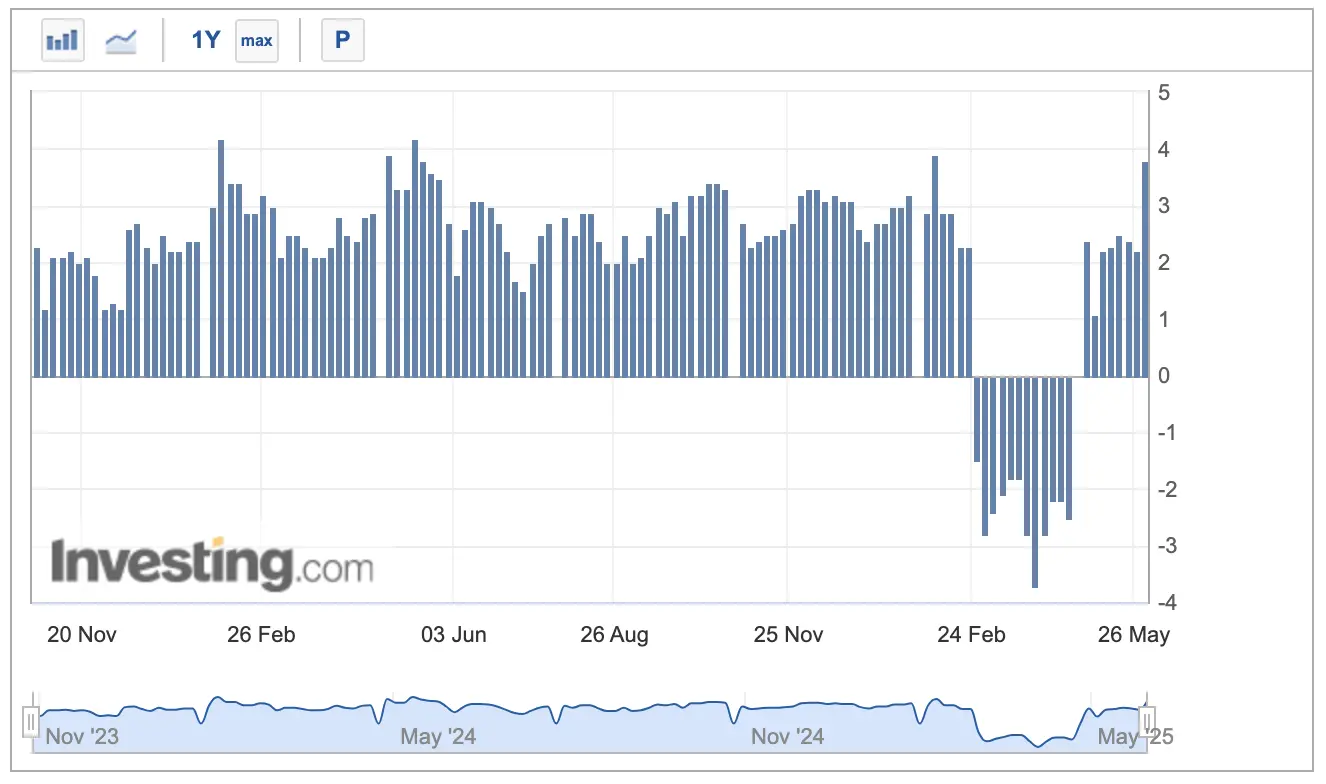

After several months of underestimation, GDP soft data recorded a rebound. The GDP Now data released by the Atlanta Federal Reserve shows that since the end of April, data has returned above the zero axis, reaching 3.8% by the end of May, reflecting optimistic sentiment following the slowdown of the tariff war.

GDP Now Data

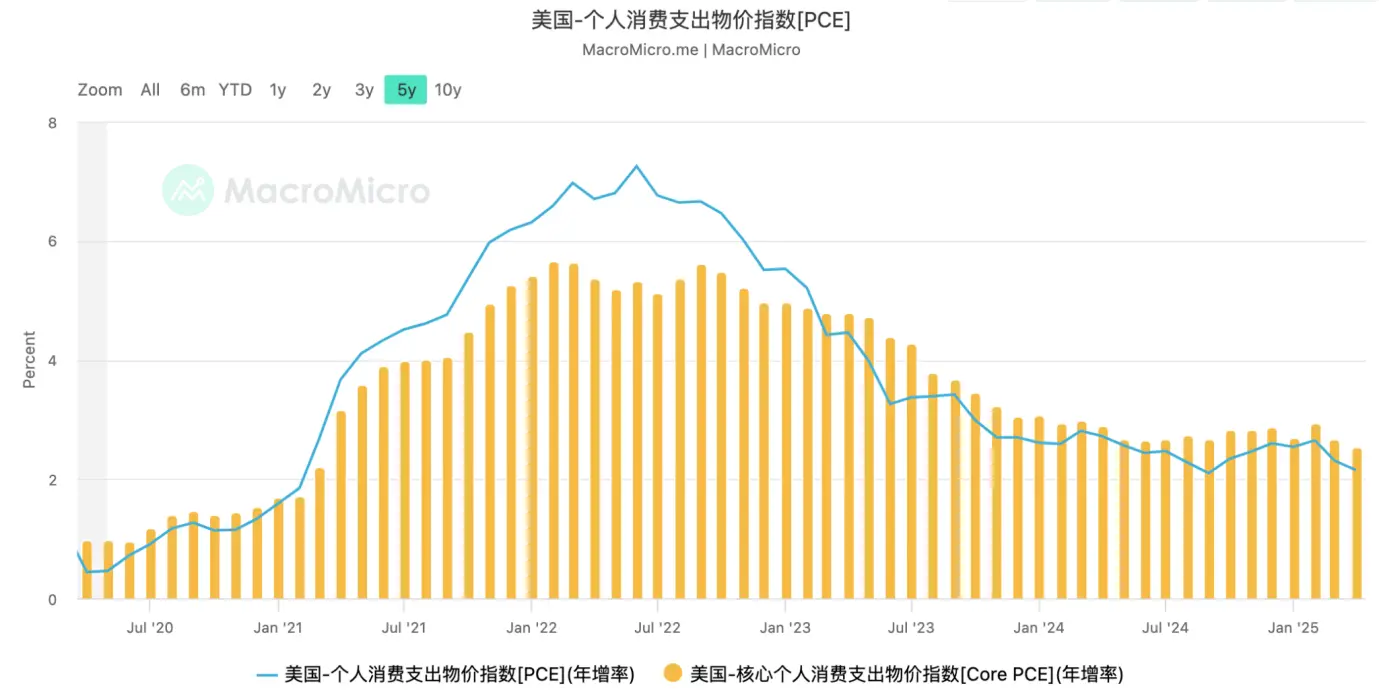

The PCE data, which the Federal Reserve pays the most attention to, released in May shows that inflation continues to slow, with the PCE annual rate dropping for three consecutive months to a low of 2.15%, and core PCE falling to 2.52%, the lowest since the pandemic, gradually approaching the 2% target that the Federal Reserve aims for.

U.S. PCE Data

Employment data exceeded market expectations. In early May, the U.S. Bureau of Labor Statistics reported that non-farm payrolls increased by 177,000 in April 2024, higher than the market expectation of 138,000. As of the week ending May 24, 2025, the number of initial unemployment claims was 240,000, an increase of 14,000 from the previous week (revised to 226,000), exceeding the market expectation of 230,000. The strong performance of employment data has, on one hand, alleviated market concerns about a recession in the U.S. economy, and on the other hand, has kept the Federal Reserve focused on its goal of "reducing inflation."

This month, the Federal Reserve's interest rate meeting decided to pause rate hikes for three consecutive months. Although the Federal Reserve had released some "dovish" statements during the "triple kill" of stocks, bonds, and currencies, after the financial market stabilized, it withstood the immense pressure from President Trump to remain inactive and emphasized that the uncertainty caused by tariffs could lead to a rebound in inflation data.

The strong performance of the financial market, combined with the ongoing "reciprocal tariff" war and the potential for inflation to rebound, has led the market to judge that the Federal Reserve is unlikely to restart rate cuts in the first half of the year. The latest CME FedWatch data indicates that traders are betting that the U.S. will only cut rates twice this year, in September and December, each by 25 basis points. This expectation has effectively "curbed" the space for a significant rise in U.S. stocks and crypto assets driven by liquidity.

Based on current data and circumstances, we expect U.S. stocks and BTC to likely maintain oscillation over the next two months until the anticipated rate cuts in August may drive U.S. stocks and BTC to reach new historical highs. This judgment includes an optimistic conclusion to the "reciprocal tariff war" and a relatively "mild" recession in the U.S. economy.

The U.S. GDP recorded a contraction of -0.21% in Q1, while in Q2, the decline in consumer confidence and market turmoil caused by the "reciprocal tariff war," if it leads to a slight decline in Q2 GDP, will meet the criteria for a "mild recession." Therefore, starting rate cuts in September may be a more cautious expectation.

Crypto Assets: Strong Capital Inflows Drive BTC to New Historical Highs

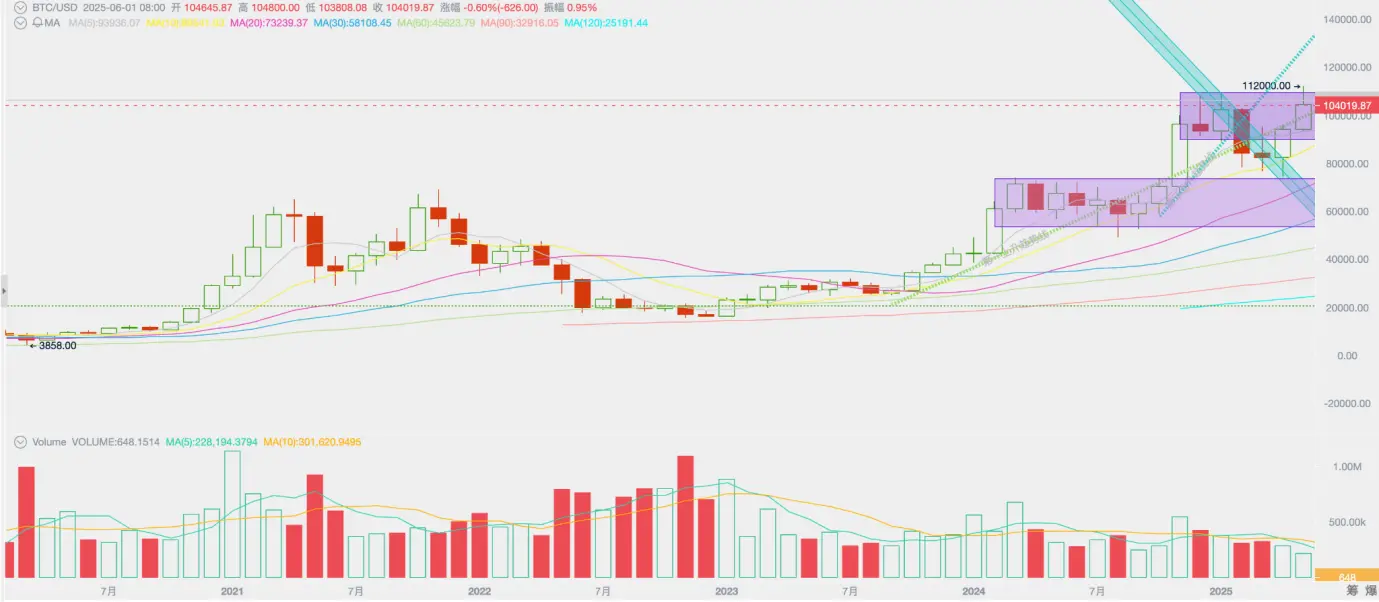

In May, BTC opened at $94,182.55 and closed at $104,645.87, rising by $10,463.33 or 11.11% for the month, with a volatility of 19.79% and trading volume declining for two consecutive months.

BTC Monthly Price Chart

From the technical indicators we continuously monitor, after BTC prices returned to the "Trump bottom" ($90,000~$110,000) in April, it set a new historical high of $112,000 and surged above the "first upward trend line of the bull market."

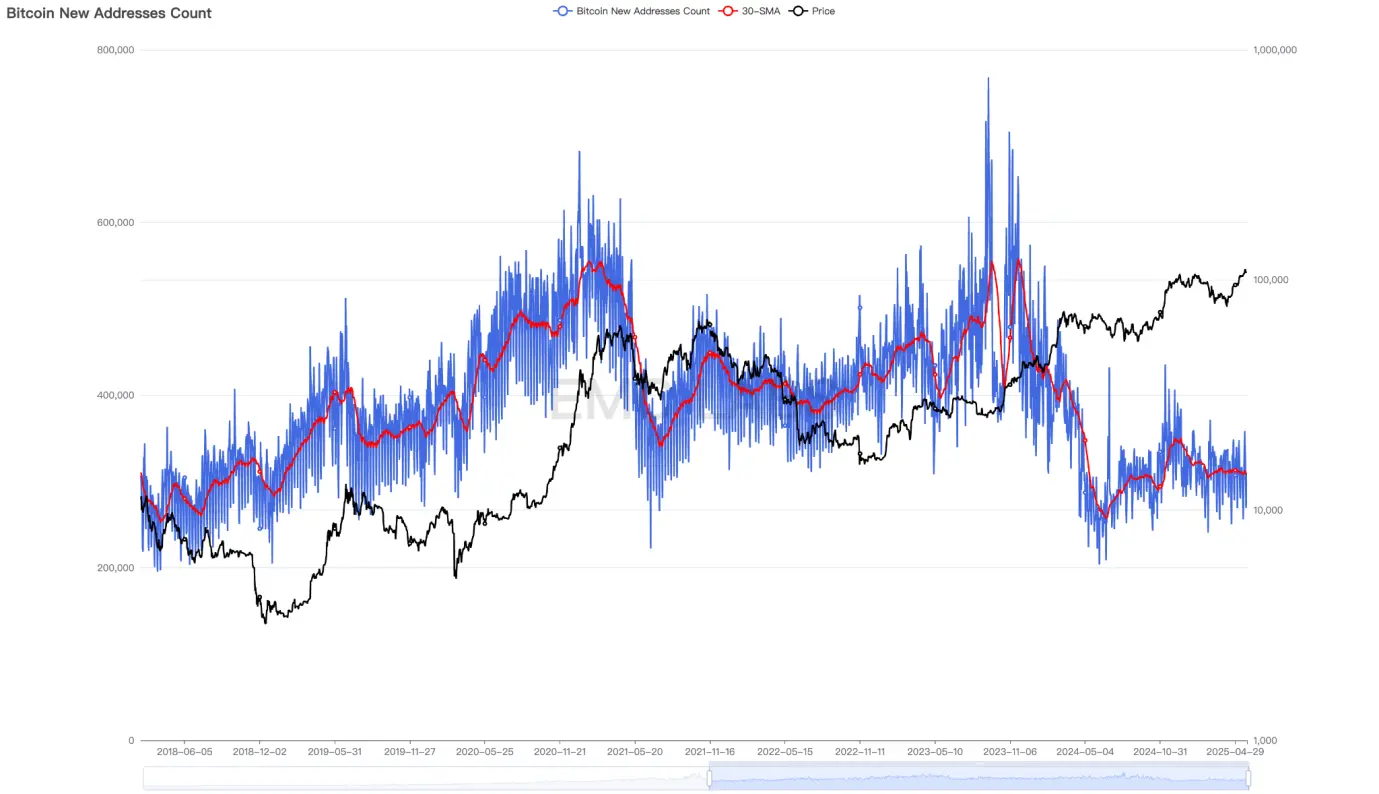

In a high-interest-rate environment, retail investors have not formed a truly decisive buying power; in fact, since March of last year, the daily new addresses for BTC have dropped to a low level.

BTC New Addresses (Daily)

In the rebound since April, the decisive force has come from institutions.

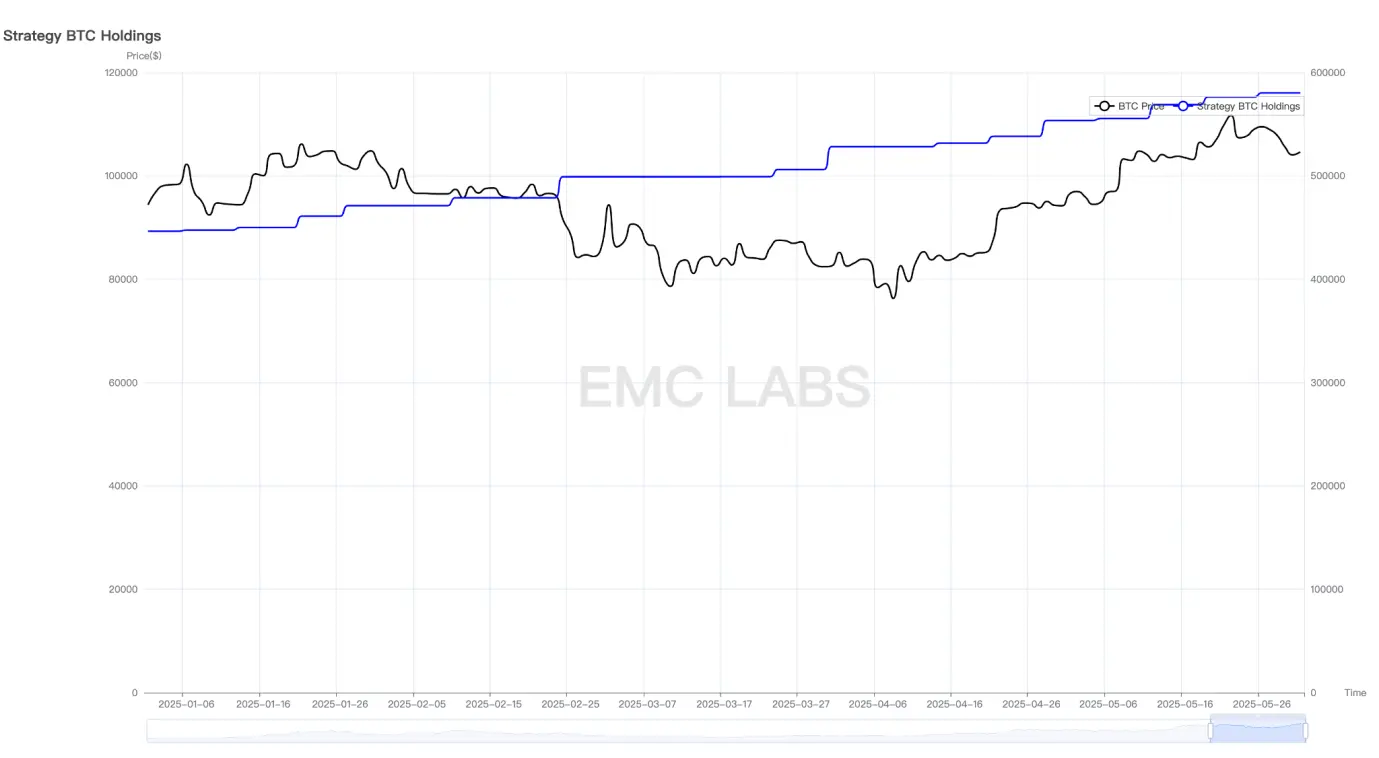

Strategy Company Holdings Statistics

Based on the announcement data from Strategy Company, which is included in the Nasdaq 100, it has increased its holdings by 133,850 BTC since 2025, bringing its total holdings to 580,250 BTC.

Since January 2024, 11 BTC Spot ETFs have been approved, and in May 2024, the U.S. House of Representatives passed the "Financial Innovation and Technology Act" (FIT21), gradually establishing crypto assets and blockchain technology as key development areas in the U.S. Subsequently, the adoption of crypto assets, represented by BTC, has further mainstreamed in the U.S.

In March 2025, President Trump signed an executive order establishing a "strategic Bitcoin reserve," designating approximately 200,000 BTC held by the government as national reserve assets.

After that, over 20 states in the U.S. began proposing state-level Bitcoin reserve bills. This demand also made breakthroughs in May. On May 7, the Governor of New Hampshire signed a bill, becoming the first state in the U.S. to officially include cryptocurrency in its strategic reserves. The bill allows the state treasurer to invest up to 5% of state government funds in cryptocurrency. Related Bitcoin reserve bills in Texas and Arizona have also passed Senate votes and are awaiting the governors of both states to sign into effect.

On the blockchain and Web3 front, the "GENIUS ACT," which regulates the development of stablecoins, passed procedural voting in the Senate with a result of 66 votes in favor and 32 against, paving the way for the final signing of the bill. In the same month, the Hong Kong Legislative Council officially passed a draft regulation to establish a licensing system for fiat-backed stablecoin issuers on the 21st.

Several major banks in the U.S. are exploring collaborations to launch a joint stablecoin. Currently, this involves JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and others.

With an issuance scale exceeding $240 billion, stablecoins are entering a compliant development era. Beyond BTC, stablecoins are likely to become the second most widely adopted crypto asset and are also likely to become the first killer application in the Web3 space to break the 1 billion user mark. This lays the foundational use case for the vigorous development of blockchain, especially smart contract platforms.

After being incorporated into the compliance system, BTC and blockchain are becoming a technological high ground that the U.S. must occupy. The investment and speculative sentiment triggered by this trend are spreading. Following Strategy, many companies worldwide, including Trump Media Group, are initiating accumulation plans for BTC and other crypto assets (such as ETH, SOL).

The expansion of use cases, along with the FOMO sentiment and purchasing power stimulated by compliance breakthroughs, has become the fundamental driving force behind the price increases of BTC and other crypto assets.

Capital: Optimistic Pricing + Expanded Use Cases

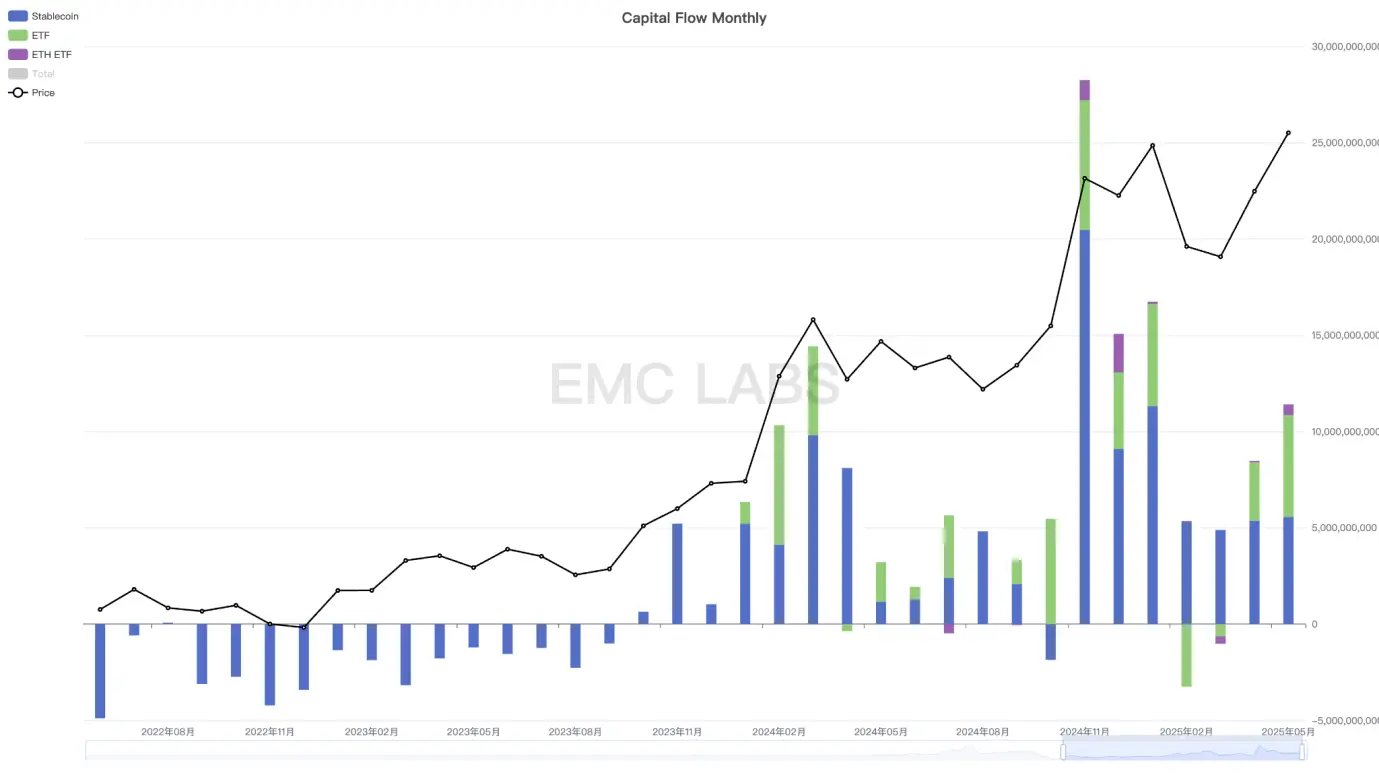

During the sharp decline of U.S. stocks in March and April, the inflow of BTC Spot ETFs came to a halt, causing BTC to adjust over 30% alongside the U.S. stock market (the largest correction in this cycle). However, since April and May, with a strong rebound in U.S. stocks, the buying power of BTC Spot ETFs has also strongly recovered, with inflows of $605 million and $2.775 billion, respectively, driving BTC to recover all its losses and reach a new historical high of $112,000.

Capital Flow (Monthly)

In terms of stablecoins (not all used for crypto trading), there has also been an increase, with inflows of $5.375 billion and $5.567 billion in April and May, respectively, but the changes in funds from the BTC Spot ETF channel were relatively small.

Previously, we pointed out that the pricing power of BTC has shifted from on-exchange funds to funds from the BTC Spot ETF channel and institutions like Strategy. These institutions exhibit a long-term subjective bullish attribute, primarily due to the continuous breakthrough progress of BTC and crypto assets at the policy level in the U.S. This is not only the reason BTC was able to rebound quickly in April and May and surpass the Nasdaq to set a new historical high but also serves as the underlying logic for long-term optimism in the market.

However, it is important to note that U.S. stocks have currently priced in an extremely optimistic scenario regarding the tariff war, which may imply that the U.S. economy will not experience a significant recession. It is currently difficult for the U.S. to break new highs, and oscillation is inevitable. Although institutions like Strategy continue to flow in, the BTC Spot ETF is unlikely to develop an independent trend distinct from the Nasdaq, making it overly optimistic to expect BTC to reach new highs in the short to medium term.

Chip Structure: Continuous Decline in BTC Holdings on Exchanges

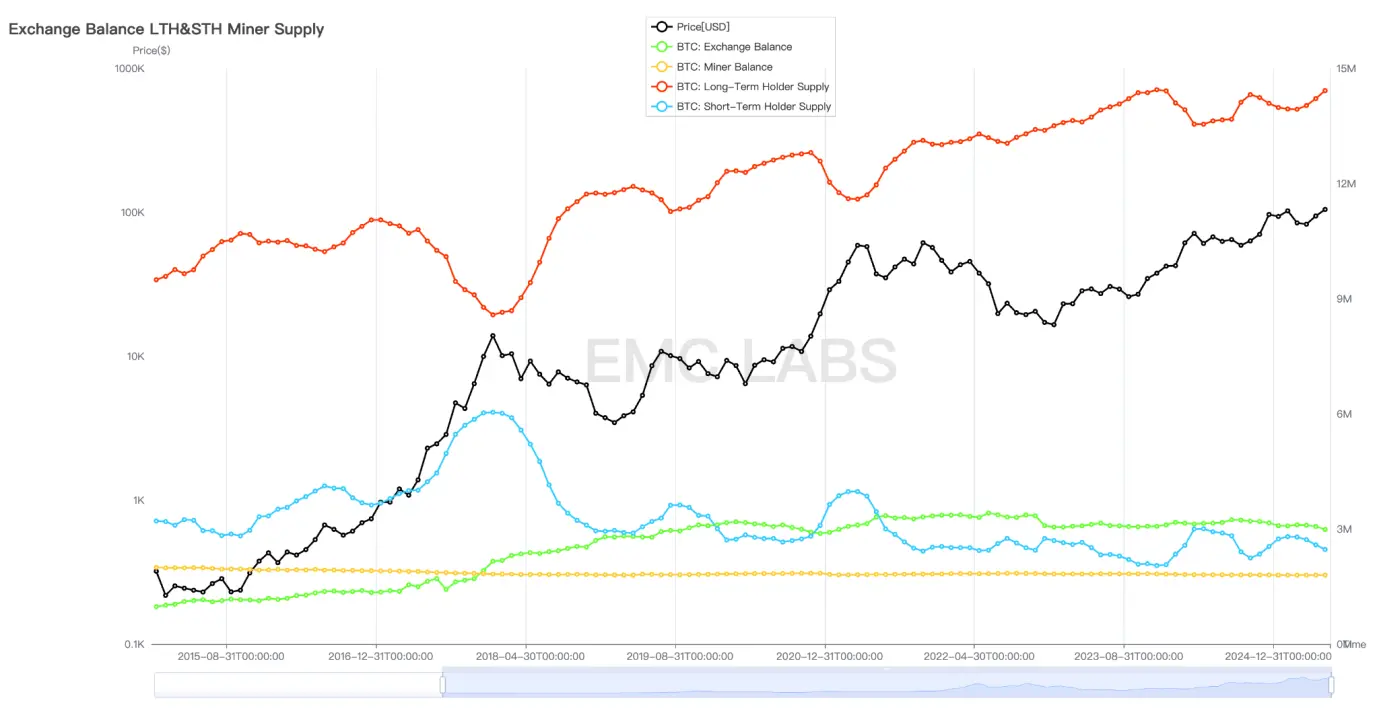

During the decline in March and April, long-term investors once again began to increase their holdings, objectively serving as a balancing force to reduce market selling pressure.

Long and Short Position Structure (Monthly)

By the end of May, the long positions reached 14.4199 million BTC, close to historical highs, while the corresponding stock on centralized exchanges continued to decline, now only 2.9882 million BTC, approaching levels seen at the end of November 2020.

In the previous cycle, when liquidity surged, long positions chose to sell, which objectively restrained price increases. However, during price declines in the cycle, long positions would slow down selling or even increase their holdings, and this cycle is no exception.

The difference from previous cycles is that the "secondary sell-off" by long positions in the past would end the bull market, whereas in this round, after the "secondary sell-off," the market chose to continue upward. We interpret this as the inclusion of institutions like Strategy in the long position structure, which has triggered changes in market trends. Whether this change is permanent or temporary needs close monitoring.

Conclusion

While we hold an optimistic long-term view on the expansion of BTC use cases and its long-term trajectory based on long-termism, the strength of BTC prices and the intensity of its movements in the short term still exceed our most optimistic estimates.

The reason lies in the excessive optimism of the risk market, including U.S. stocks, and the investment and speculative frenzy triggered by the significant expansion of BTC use cases in the U.S. We are confident about the latter, but we believe the pricing of the U.S. stock and BTC markets regarding the "reciprocal tariff war" is overly optimistic, and there are bound to be many twists and turns along the way. Additionally, we have lowered our expectations for the Federal Reserve's interest rate decisions.

In the March report, we anticipated that BTC would begin a reversal trend in the summer, but the market reacted beyond expectations, reaching a new high in May. Considering various uncertainties and delayed liquidity expectations, we believe that over the next two months, BTC will likely oscillate alongside U.S. stocks, and reaching new highs to elevate prices further is a low-probability event.

If all goes smoothly, the next step up should be a story for the third quarter!

EMC Labs was established in April 2023 by crypto asset investors and data scientists. It focuses on blockchain industry research and investments in the crypto secondary market, with industry foresight, insights, and data mining as core competencies, aiming to participate in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and crypto assets for humanity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。