Halving effect, institutional investment, anti-inflation demand, and celebrity endorsements drive Bitcoin.

Author: Alex Carchidi

Source: The Motley Fool

Translation: Baihua Blockchain

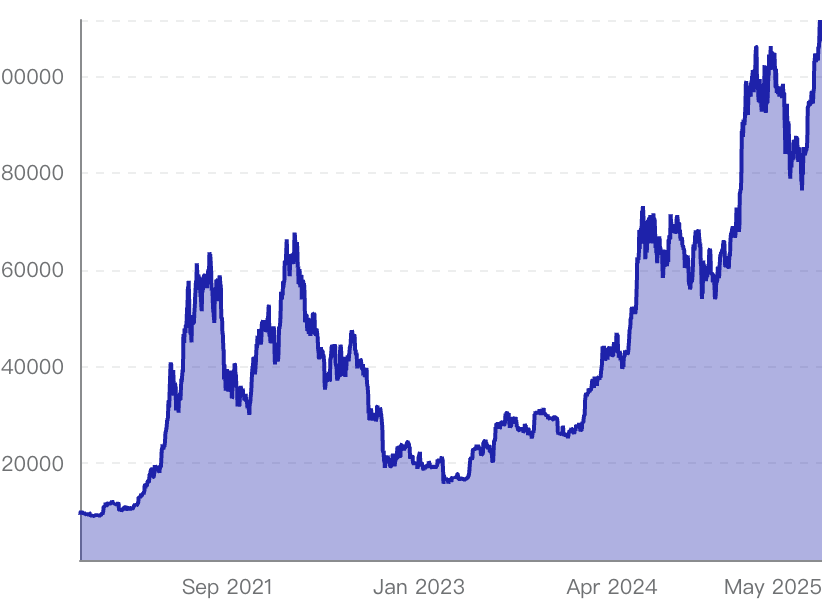

Bitcoin (BTC -0.88%) is currently priced just below $110,000, close to its all-time high, and is in what could be a generational bull market phase. Its price is expected to continue rising in the coming quarters. However, this favorable situation is not coincidental, nor is it the result of a (currently) speculative buying frenzy.

On the contrary, the current level of Bitcoin's price is attributed to four key catalysts. These catalysts will continue to play a role and may drive the price further up. This article will analyze these catalysts one by one for a better understanding of them.

CRYPTO: BTC Bitcoin

1. Last year's halving event

Bitcoin undergoes a halving approximately every four years, with the most recent one occurring in April 2024.

The halving event may be the most significant catalyst for Bitcoin because it determines the reward miners receive for successfully mining a new block. After the halving, the supply of newly created Bitcoin is cut in half. This almost always leads to a supply shock, where the number of Bitcoins in circulation becomes extremely tight relative to buyer demand.

In other words, halving is one of the main mechanisms for Bitcoin's long-term price increase, and the current price is strongly driven by the recent halving. The next halving is expected to occur in April 2028, and investors need to plan ahead.

2. Public and private adoption of Bitcoin

We are currently in a golden age where various wealthy investors are buying or committing to hold Bitcoin. Whenever one of them announces their intentions, it acts as a catalyst for Bitcoin's price.

For example, a "strategic Bitcoin reserve" plan (if implemented) would make the U.S. government a long-term holder of Bitcoin rather than selling it. Other countries are also discussing whether to implement similar policies.

Some states (like Texas) and even certain cities are considering and pushing political processes to establish their own Bitcoin reserves. States like North Carolina are discussing bills that would allow public pension funds to invest partially in Bitcoin. New York City is also considering whether to establish a municipal reserve fund.

Additionally, other institutional investors, such as large banks, are incorporating it into their balance sheets for holding or providing related services to clients.

Against the backdrop of these parties competing to buy more Bitcoin, the price increase is not surprising.

3. Global pursuit of hard currency

In the trend of Bitcoin's widespread adoption, another equally powerful catalyst is: the demand from investors for a store of value that will not depreciate due to inflation.

Take fiat currencies like the dollar as an example; their circulating supply has been on a long-term upward trend, causing the purchasing power of each unit of currency to often decline over time. Investors have become particularly sensitive to this in light of the inflation impacts over the past few years.

In contrast, Bitcoin's situation is the opposite. Due to the halving mechanism, its circulating supply will only become tighter. This makes Bitcoin a logical choice for investors looking to avoid the erosion of value due to inflation. Other similar assets (like gold) are also favored for the same store of value function.

These trends are unlikely to weaken in the short term.

4. Hype driven by well-known buyers

Whether people want to admit it or not, when an asset has well-known proponents, the market often responds positively. Bitcoin has many such "evangelists."

For example, Michael Saylor, the founder of Strategy, seems to be buying hundreds of millions of dollars worth of Bitcoin every week. Strategy currently holds about $59 billion in Bitcoin, and Saylor has committed to never selling unless absolutely necessary to protect his company.

This means he will promote Bitcoin to the public as frequently as possible. This not only brings more enthusiasm to Bitcoin but may also attract new holders. While the impact of this catalyst is not as strong as the other factors mentioned, it remains a relevant factor in driving Bitcoin's price upward.

Article link: https://www.hellobtc.com/kp/du/05/5867.html

Source: https://www.fool.com/investing/2025/05/27/4-catalysts-that-caused-bitcoin-to-hit-its-highest/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。