This is the worst of times in the crypto world, but it is also the best of times for Bitcoin buyers, on-chain P marshals, and top airdrop players.

Written by: 1912212.eth, Foresight News

"I lost over a million last year," Xiao Su told Foresight News.

As an old player in the crypto space, he bought a lot of VC coins during the last bull market cycle. In 2021, Bitcoin once broke through $67,000, reaching an all-time high, and many VC coins rose along with it, some even outperforming Bitcoin. This was how Xiao Su made his first pot of gold.

However, the market is unpredictable, and this cycle has seen Xiao Su take a hit. Since 2024, several of the VC coins he heavily invested in have performed poorly, continuously declining, and as a forced diamond hand, he simply couldn't hold on any longer and had to cut losses at the lows. After several such instances, he has already given back more than half of his accumulated profits.

"Why is it so hard to make money this time? Who is actually making money in the market?" Xiao Su is quite puzzled. In his view, in previous bull market cycles, one could simply buy coins with their eyes closed and make money while lying down or sleeping. Now, it has turned into a situation where one must "run fast" to make money. Market participants such as VCs, market makers, exchanges, project parties, retail investors, and yield farming studios are all facing significant new challenges.

Xiao Su's experience is not an isolated case. Not only old players like him, but also some well-known crypto VC institutions have recently announced transformations and admitted that their primary investment returns in this cycle have been very disappointing.

However, from the perspective of cryptocurrency history, 2024 to 2025 is expected to be a spectacular year. The approval of Bitcoin spot ETFs has led traditional financial institutions to flock in, and after Trump's return to power, crypto policies have entered an unprecedentedly loose environment. A series of positive developments have pushed Bitcoin's price from a low of $15,000 to over $100,000, setting a new historical high.

Investor expectations for a raging bull market have peaked.

But the other major leader in the market, Ethereum, shattered investors' dreams. Ethereum has not even reached a new historical high in this cycle, and the past two major price boosters, DeFi and NFT, have not seen a resurgence. Its founder Vitalik and the Ethereum Foundation have faced criticism, and with ETH's sluggish performance, narratives around Layer 2, re-staking, and ZK have collapsed, leaving many related ecosystem tokens disappointing.

The only hot topic—the surge of Meme coins—has, to some extent, been a vent for retail investors' dissatisfaction with the high valuations of VC coins. The returns on VC coins had already been largely divided among VCs before the market, leaving only retail investors to take over and face "endless declines."

In this more brutal "casino," only a very small number of savvy traders, insider traders, and token issuance groups have made substantial profits, while most retail investors frantically chasing Meme coins have suffered increasing losses in one lottery scratch-off after another, ultimately realizing that the so-called wealth effect ultimately belongs only to others' "show-off."

So who exactly is the winner? Foresight News interviewed several crypto practitioners in the field with the above questions, and they provided their answers.

Bitcoin Holders: Winning Big

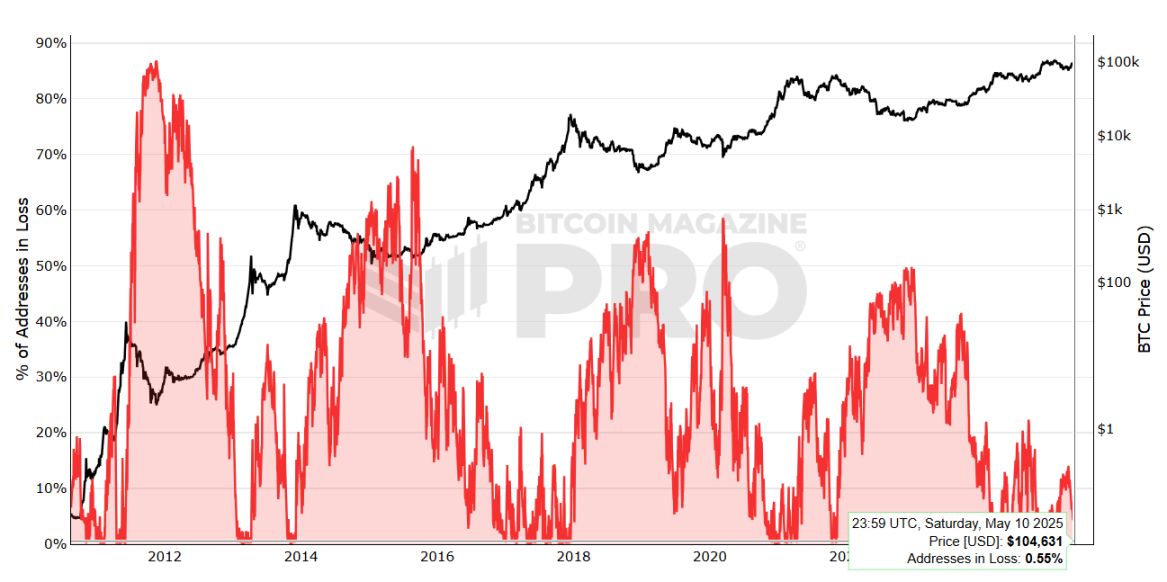

Bitcoin buyers are undoubtedly reaping substantial rewards in this cycle. On May 10, Bitcoin Magazine Pro data showed that only 0.55% of addresses that had purchased Bitcoin were still in a loss state after breaking through $100,000, indicating that most Bitcoin players in the market are in profit. As of the time of publication, Bitcoin has surpassed $110,000, setting a new historical high, and no one has lost money from buying Bitcoin; all buyers have achieved profits.

The NDV (NextGen Digital Venture) fund, established in 2022, is one such example. Its founder Jason (@jhy256) told Foresight News that the first phase of the NDV fund was fully liquidated in February this year, achieving a total return of 3.75 times, and recently launched the financing for the second phase of the fund.

Jason has extensive experience in the venture capital field, having worked at Huaxing Capital, Qiming Venture Partners, and other institutions. In 2023, at the age of 34, he chose to leave the family office Blue Pool Capital, co-founded by Jack Ma and Cai Chongxin, to establish NextGen Digital Venture.

Jason stated, "In a broader world, there are still many external buyers; many institutions don't even have a 0.1% allocation, so they might just buy 0.1% first, which is not sensitive to price fluctuations. If traditional large funds allocate 1% of their capital to Bitcoin, it would be quite significant for this asset class." In the first year, he allocated most of the fund's positions to GBTC, and after a strategic shift last year, he turned to crypto-related stocks like Coinbase and Strategy. These moves undoubtedly aligned with market trends.

When discussing Bitcoin's price increase, he analyzed that the launch of spot ETFs has played a crucial role. "Traditional financial money can flow directly from ETFs to BTC, which is also an important reason why BTC can continue to outperform many altcoins. Perhaps Trump's election and token issuance will provide new opportunities for other digital currencies."

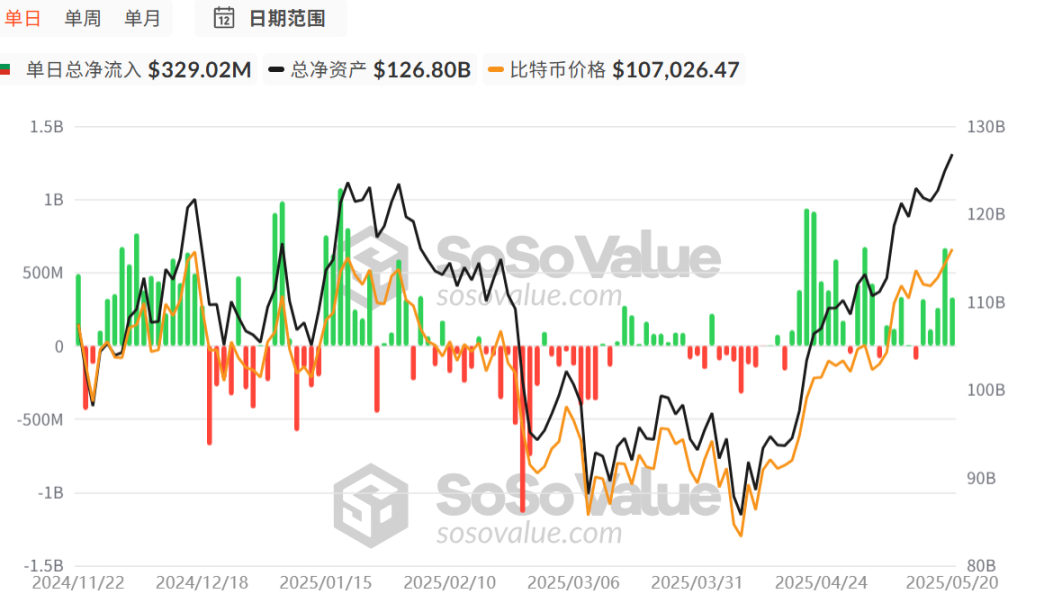

In January 2024, the approval of Bitcoin spot ETFs became a milestone event in this cycle. So far, the total net inflow into Bitcoin spot ETFs has exceeded $42.7 billion. Institutions represented by BlackRock and Fidelity have made significant purchases of Bitcoin spot ETFs, becoming clear winners in the market due to their early entry, low costs, and steady holdings. These funds mainly come from hedge funds, pension funds, and family offices, marking a shift in the crypto market from retail speculation to institutional investment.

Moreover, various listed companies have also joined the ranks of Bitcoin buyers and have made substantial profits.

The US-listed company Strategy, with its aggressive purchasing style, has not only seen its stock price soar but also its company profits have been astonishing. As of May 18, 2025, Strategy holds 576,230 Bitcoins, with a total purchase price of approximately $40.18 billion, averaging about $69,726 per Bitcoin. After Bitcoin broke through $109,700, its unrealized gains once exceeded $23.039 billion. The Japanese listed company Metaplanet has accumulated 7,800 Bitcoins, with a historical average purchase price of 13.51 million yen per coin (approximately $94,165.7). Based on Bitcoin's price of $109,000, the Bitcoins held by Metaplanet have unrealized gains of $12.1 million.

Since its inception, Bitcoin has consistently rewarded every diamond hand player, and even the Bitcoin held by the island nation of El Salvador, which has been continuously increasing its holdings, has unrealized gains exceeding $357 million.

Naturally, mining machines, crypto infrastructure companies, and financial derivatives derived from BTC have also reaped substantial rewards. Taking Canaan Creative as an example, financial reports show that in the fourth quarter of 2024, revenue grew by 80.9% and mining revenue grew by 312.5%. The company mentioned that customer orders for the first quarter of 2025 have already been scheduled into the second quarter, indicating a continued momentum in mining machine sales.

Meme Big Winners: Making Millions on Single Coins

"My total profit has reached a hundred times, mainly from last year's AI, deSci, and TRUMP," yuyue told Foresight News.

The well-known on-chain KOL yuyue became famous for seizing the TRUMP opportunity, making millions of dollars. According to circulated community images, she spent $158,000 to purchase TRUMP, with unrealized gains exceeding $2 million at one point.

She entered the crypto space in March 2022, initially just looking for an internship. Later, through airdrops and community interactions, she got to know more people and reviewed market opportunities. Ultimately, when the opportunity arose, she dared to take a position and achieved significant results.

In the past year, the most wealth-generating sector in the crypto world has undoubtedly been "Meme." Since the beginning of 2024, Meme coins have sparked an unprecedented wave in the crypto market. From WIF and BONK on the Solana chain to PEPE and TURBO on Ethereum, and even the rapidly rising DEGEN and MOCHI on the Base chain, every hot topic has quickly attracted tens of thousands of retail investors and speculators.

Meme has become more than just entertainment; it has turned into a new experimental ground for wealth distribution mechanisms. According to statistics from CoinGecko and Dune Analytics, the total market capitalization of Meme coins soared from less than $2 billion to over $60 billion throughout 2024, with an annual increase of over 2900%. Among them, the market capitalization of Meme coins on the Solana chain accounted for more than one-third. WIF surged from an initial market cap of less than $1 million to over $3 billion, with early holders even achieving returns exceeding 100,000 times. Some users purchased a new Meme coin BOME for less than $200 in April 2024, and within just 72 hours, the account value skyrocketed to over $2 million.

These Meme coins often lack traditional technical backgrounds and do not even rely on complete project white papers; they can ignite millions of dollars in trading volume with just a catchy slogan or a simple dog avatar.

The most insane wealth effect from Meme coins belongs to the TRUMP coin before Trump officially took office. Traders like 0xSun, Dayu, Lengjing, and CryptoD made tens of millions of dollars on single coins, igniting the entire crypto circle, leaving countless people in awe. However, only a very small number of players have made such enormous profits on single coins. Position management and risk preference are also a significant area of study.

Yuyue admitted that she is quite flexible in position management and does not hold any long positions other than Bitcoin. In terms of trading style, "there are currently two distinct styles: the sweeping chain style and the second-stage style, but I lean more towards the second-stage style, which emphasizes narrative."

She stated that market participants must have their own judgment on the targets. For example, if focusing on the second stage, one needs to pay attention to the narrative and market cap estimation range, and trade based on these foundations. The narrative here is not something imagined but can be supported by K-lines and market conditions.

On-chain OG player "Bitcoin Factory" has also made a fortune in the Meme coin gold rush. He told Foresight News, "After achieving dozens of times returns with SHIB in just a few weeks during the last cycle, I started my on-chain trading journey. In the recent one to two years of Meme trading, I've made profits in the millions, seizing opportunities with ORDI, GOAT, TRUMP, and other targets."

However, achieving high returns is not easy. "Those around me who have obtained significant returns often invest considerable effort in on-chain research and time; they deserve it, while the average person may not be able to do so," he lamented.

Trading Meme coins tests players' skills more than mainstream coins. The Bitcoin Factory stated that Meme trading requires grasping the big players, big trends, and big narratives, with major hot topics being crucial. Searching for keywords or contract addresses on Twitter can also be used to observe short-term popularity.

His profits from Meme coins are also used to purchase Bitcoin. "Currently, Bitcoin accounts for 85% of my positions, Ethereum and BNB are around 13%, with some altcoins and Meme coins making up the rest."

The wealth myth of Meme coins temporarily dimmed under a sluggish market, and even large share displays were rare on social media. Many Meme coin players, harboring dreams of getting rich, faced repeated setbacks in lottery-like events, anxiously oscillating between zero and selling off. Some chose to return to mainstream altcoins, while others ventured into different sectors to seek profits.

Perhaps every Meme player unwilling to leave is waiting for the altcoin market to fully recover. Some market players have achieved significant results through effective strategies and perseverance; they are the airdrop players.

Airdrops from Heaven: From Nationwide Celebration to Competitive Involution

"In 2023, the Arbitrum airdrop became my most rewarding project, amounting to about 30 million RMB," said well-known airdrop player Feng Mi to Foresight News.

He has spent over a decade in traditional finance, working in hedge trading and investment banking. He entered the crypto space in 2017 due to ICOs and discovered yield farming opportunities through DeFi in 2020, leading to a rapid accumulation of wealth that even surpassed mining or trading coins.

After that, "In 2024, Wormhole brought even higher paper profits, with the corresponding value at TGE exceeding ARB. Unfortunately, I didn't grasp the timing of receiving and selling, resulting in only a glorious paper profit with limited actual gains."

The golden age of airdrops is not far from us. During the crypto bull market from 2020 to 2021, the surge of DeFi, NFTs, and Layer 1/Layer 2 projects provided fertile ground for yield farming. Airdrop activities from DeFi protocols like Uniswap, 1inch, and dYdX often brought in thousands of dollars in profits, attracting a large number of retail investors and early studios. During this period, the barriers to entry for yield farming were low, allowing ordinary users to participate through simple wallet operations or social tasks. It was indeed the golden age of yield farming. At its peak, top yield farmer Feng Mi told Foresight News, "The airdrop rewards for ENS tokens exceeded 100,000 RMB per single address, and multiple addresses directly led to wealth. For PSP (Paraswap), one address started at $10,000."

Subsequently, the yield farming industry gradually shifted from wild growth to specialization. Studios improved efficiency by creating accounts in bulk and using automated scripts. However, even so, the industry still had plenty of airdrop wealth effects.

Airdrops from testnet projects like Aptos and Sui further fueled the yield farming craze, with some studios earning millions of dollars through "multi-account strategies." To prevent "witch attacks" (Sybil Attacks), project teams generally raised the barriers for airdrops, such as introducing identity verification, on-chain behavior analysis, or community contribution requirements. This made it more challenging for retail investors to yield farm, while studios with technical advantages and resources gradually took the lead.

When discussing his insights, Feng Mi candidly stated that first and foremost, choosing the right projects is crucial. "Airdrops that can truly change lives must come from projects with products, innovation, capital, and vision. It's not something that can be compensated for by spamming 100 low-quality activities. It's better to heavily invest in three well-chosen projects than to scatter across 30 uncertain ones." Secondly, participants must learn to understand what kind of people they want to filter out, grasp the protocol logic, and understand the characteristics of the protocol, maintaining a very clear overall perspective. The more one resembles a "real user" and adopts a "developer's perspective," the easier it will be to be included in high-quality weight distribution rules and reward models in the future. Additionally, just like professional traders' sensitivity, one must be decisive when it comes to cutting losses and should abandon positions cleanly.

In his view, yield farming is not an isolated activity but a typical structural arbitrage method. Participants can treat yield farming as a "left hand" for stable returns: low cost, high odds, and exchanging time for opportunities. Meanwhile, they can use their "right hand" to allocate positions in the secondary market, holding foundational assets like BTC/ETH or boldly betting on some long-term high-volatility speculative projects like Meme coins. "Currently, this is the more stable and cyclical combination method in my eyes."

The airdrop sector remains hot in 2024. Projects like Starknet, Hyperliquid, Magic Eden, and Pudgy Penguins have distributed hundreds of millions of dollars in tokens through airdrops. Subsequently, the market conditions changed dramatically, shifting from a peak to a trough. Those who initially chose to sell maintained significant profits, while those who held on and waited became the "fast players" who exited the liquidity.

In this regard, Feng Mi reflected, "Yield farming has never been a mechanical operation on an assembly line. Behind every account, every transaction, and every project token is my careful interaction, recording, waiting, and even losses. They are not just numbers; they resemble a series of strategic and luck-based games, infused with intense emotional investment. A project requires a lot of effort and time, gas fees, and capital. Because of this, it is an emotional investment. But it is precisely this 'emotion' that became my biggest blunder this time: I hesitated to sell when I should have, and I kept watching when I should have left. As a result, I handed over the profits that were already in hand to the market, merely accompanying it for a while."

Market players experience both wins and losses, and the winners are always a minority. Subsequently, whether individuals or studios, they were repeatedly counter-farmed. When airdrops from zkSync, LayerZero, and others were released, the market was filled with cries of despair. Retail investors received meager airdrops, and yield farming studios suffered heavy losses, with some even forced to shut down. Project teams faced intense criticism, but they maintained a strong stance. From then on, most projects in the market began to follow suit, issuing fewer or even no airdrops.

Feng Mi told Foresight News, "The wild era of yield farming has long ended. The window for everyone to extract their first pot of gold from the chain has closed. It is no longer a stage where rewards can be earned by simply interacting with a few buttons."

When yield farming players generally find it difficult, persisting becomes even harder. Many players miss wealth opportunities due to a lack of patience. Feng Mi analyzed that the root cause of many players' inability to persist lies in "the airdrops being delayed, continuous gas investments, tedious interactions, increasingly formalized tasks, and rampant points. When returns are long overdue, doubts gradually erode execution power, leading to complaints. But the real big results often lie just beyond the point where you almost want to give up, just when you think it’s ineffective. You must believe—results do not happen first; they are first believed in before they can be realized."

Feng Mi also shared a failed case he encountered during his yield farming process, "I made a large number of BTC staking interactions on Babylon, investing considerable funds and attention. The result was an extremely limited airdrop distribution, with profits that were painfully disappointing." Additionally, he heavily invested in the entire Move ecosystem, including Aptos, with over $4 million at its market cap peak, only to see the ecosystem projects collectively underperform, with no standout projects and the official team lacking direction and top operational capabilities.

Airdrops come with various ups and downs.

However, compared to buying coins, yield farming through airdrops may still be one of the few avenues where one can make significant money from a small initial capital. Multi-account strategies and premium account strategies remain practical methods, but they also require more careful approaches. The game of outsmarting project teams still tests the cognition and execution ability of yield farming players.

Conclusion

The only constant in the crypto market is change. A day in the crypto world is like a year in the real world; although it may seem exaggerated, it reflects the rapid pace of change. If you can't grasp opportunities, they will slip away. For those continuously pursuing more wealth in the industry, this is undoubtedly the most torturous experience.

However, the most captivating aspect of the crypto space is that every time market participants believe they have reached the end of the wealth effect, there will always be a thriving area in some inconspicuous corner, nurturing the potential for future rises. Through another astonishing wealth effect, it continuously attracts curious young people to join the gold rush.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。