Currently, the price of Bitcoin has surpassed $110,000, setting a new historical high. On May 22, coinciding with the annual "Pizza Day," this commemorative day spontaneously formed by the cryptocurrency community once again draws people's attention back to that moment 15 years ago that rewrote history—the pizza worth $11 billion.

1. A Starting Point for Value Enlightenment

In 2010, the Bitcoin network was still in the "primitive society" stage, with the total network computing power being less than one trillionth of today’s. Exchanges had not yet emerged, and most holders were geeks and technology enthusiasts. When Laszlo posted on the forum proposing "to buy pizza with Bitcoin," the "value anchoring" of cryptocurrency was still a blank slate.

On May 22, 2010, American programmer Laszlo Hanyecz purchased two Papa John's pizzas for 10,000 Bitcoins, marking the first time Bitcoin was used as a payment method in the real world. At that time, those 10,000 Bitcoins were worth about $41, averaging just $0.0041 per Bitcoin.

Fifteen years later, based on the price of Bitcoin surpassing $100,000, the value of those two pizzas has reached an astonishing $1 billion. This figure not only becomes a milestone in the early development of Bitcoin but also reveals the epic leap of cryptocurrency from a marginal experiment to a global asset.

2. Bitcoin Price Curve Over the Past 15 Years

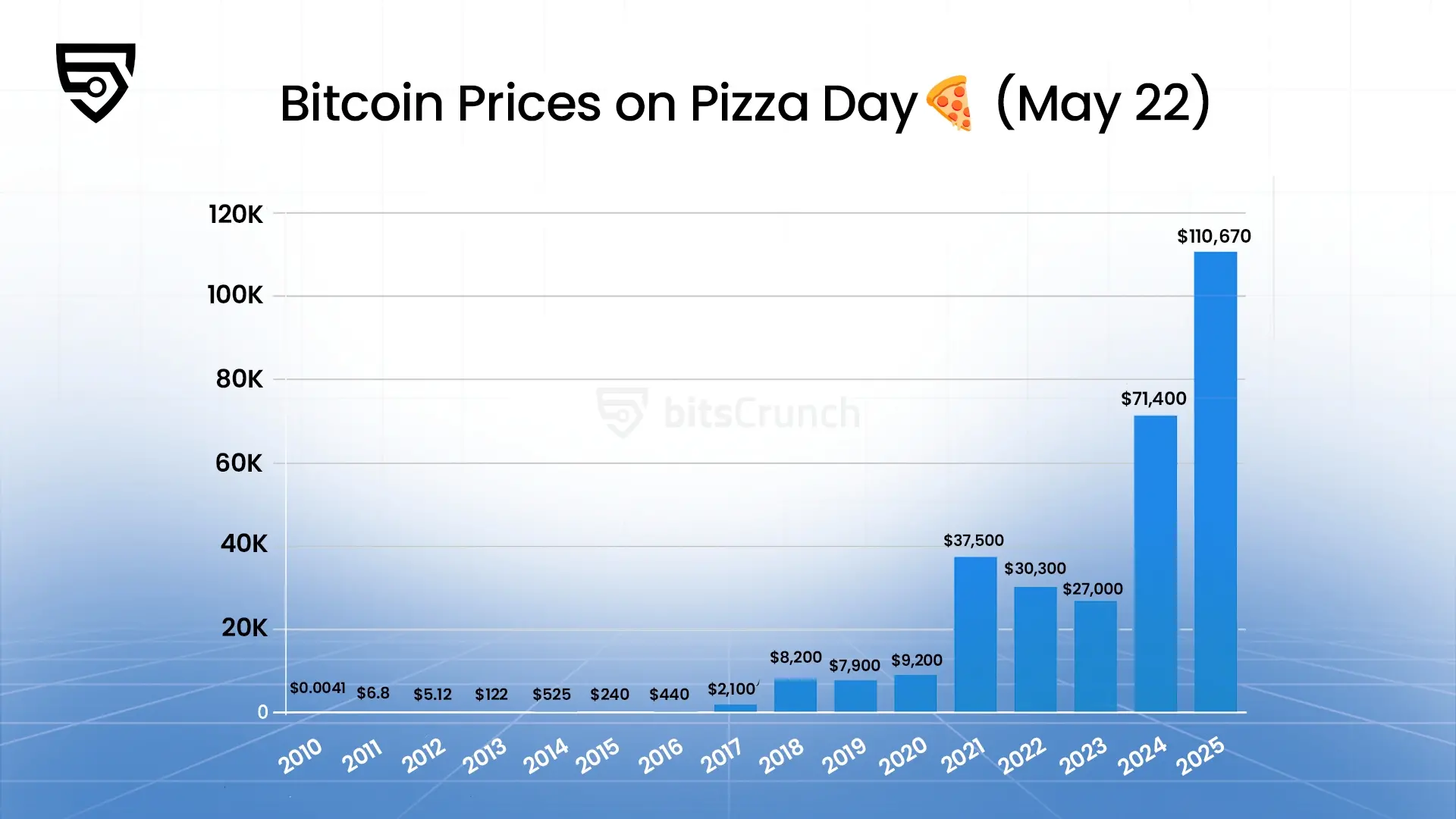

From $0.0041 to $110,000 fifteen years later, by sorting through the historical Bitcoin price data on May 22, according to bitsCrunch.com, we can clearly capture the key cycles and driving logic in its development trajectory. The following chart shows Bitcoin's price performance during past Pizza Days.

Data source: bitsCrunch.com

- Technical Improvement Period (2010-2013): From proof of concept to initial application, Bitcoin proved the feasibility of decentralized currency.

In May 2011, Bitcoin's price climbed to $6.8, and the emergence of the dark web "Silk Road" first showcased its potential for anonymous payments; in May 2013, the price broke through $122, while the Cyprus debt crisis pushed Bitcoin into the mainstream as a "safe-haven asset," with an annual increase of 5,400%.

- Speculative Frenzy Period (2014-2017): The dramatic price fluctuations attracted global attention but also exposed the immaturity of the market.

The 2014 Mt. Gox exchange theft caused the price to plummet from $525 to $240 (in 2015), marking the first large-scale risk education for the market. Subsequently, technological breakthroughs such as Ethereum smart contracts and the Lightning Network promoted ecological expansion, with the price rebounding to $2,100 in May 2017, and soaring to $19,783 in December of the same year due to the ICO frenzy, completing the first "super cycle."

- Institutional Recognition Period (2018-2021): Traditional financial institutions began to take Bitcoin seriously, viewing it as part of digital asset allocation.

During the 2018 bear market, many exited the market, but institutions like Grayscale Trust and MicroStrategy laid the foundation for long-term buying. In May 2021, the price reached $37,500, with Tesla and El Salvador incorporating Bitcoin into their balance sheets; in 2024, the approval of the U.S. Bitcoin spot ETF, the fourth halving, and global fiat currency inflation pressures resonated, pushing the price above $71,400, with an annualized return of 217%.

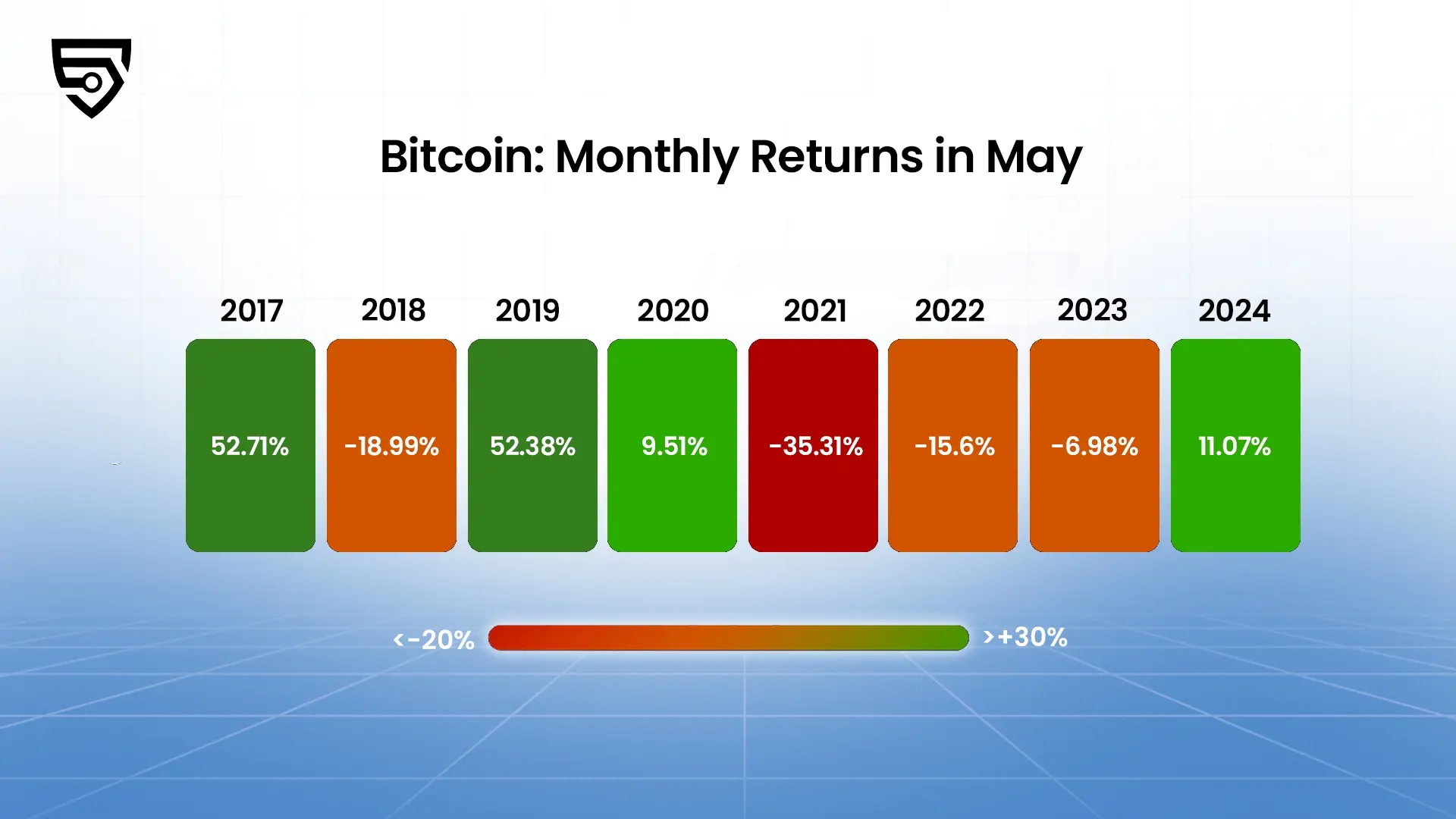

The following chart shows Bitcoin's monthly performance in May from 2017 to 2024.

Data source: bitsCrunch.com

- Mainstream Acceptance Period (2022-2025): Regulatory frameworks are gradually improving, ETFs are approved, and Bitcoin officially enters traditional investment portfolios.

With the advancement of global central bank digital currencies, the maturation of the Web3 ecosystem, and the deep application of blockchain technology across various industries, digital currencies are reshaping our economic system. As the pioneer of this revolution, Bitcoin's value is reflected not only in its price but also in the decentralized ideals and spirit of technological innovation it represents.

3. Structural Changes Behind the Historical High

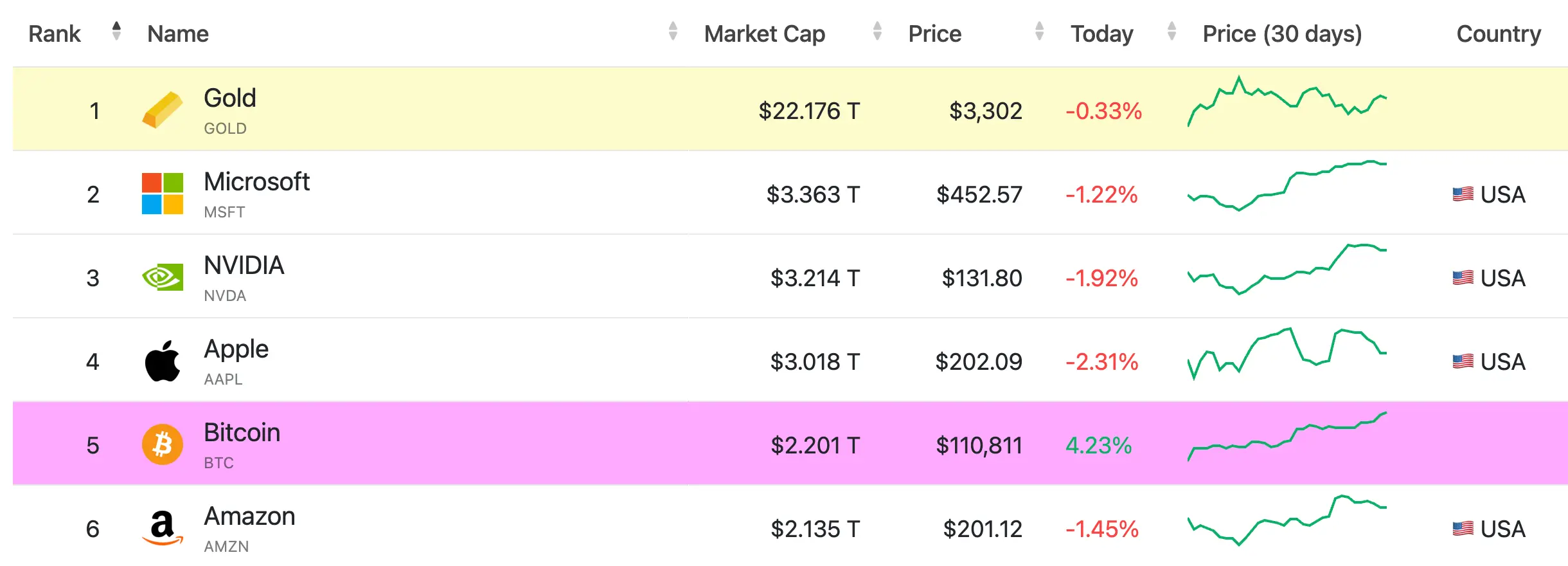

Today, Bitcoin's market capitalization has exceeded $2.1 trillion, surpassing Amazon, making it the fifth-largest asset globally. Its value support logic has undergone essential evolution: first, the strengthening of its macro-hedging attributes; second, the implementation of regulatory legislation in the U.S. and Europe’s crypto markets; third, compliant channels like Coinbase and BlackRock have opened traditional funding entrances.

Laszlo's 10,000 Bitcoins were once mocked as a "foolish transaction," but viewed from today's perspective, this transaction precisely confirms the essence of the Austrian School's "subjective theory of value"—value does not originate from the entity but is a reflection of collective consensus. Over 14 years, Bitcoin has evolved from a code experiment on geek forums to a "freedom currency" believed in by hundreds of millions, and its price fluctuation curve is, in fact, a history of human evolution in understanding decentralized finance.

4. Conclusion: Consensus Creates Value

On social media, the #PizzaDay topic becomes popular every year, with people sharing their pizza photos, reminiscing about Bitcoin's development journey, and looking forward to the future of digital currency. This tradition has transcended simple commemoration, becoming a symbol of cohesion for the entire cryptocurrency community.

Looking back from the historical high of $110,000, Pizza Day has long surpassed mere commemorative significance, becoming a cultural totem of the crypto spirit: it reminds us that the power of technological innovation and institutional reconstruction often begins with the smallest practices. Just as Satoshi embedded the headline "Chancellor on brink of second bailout for banks" from The Times in the genesis block—Bitcoin's ultimate mission may very well be to bring the ideals of freedom behind those two pizzas from 14 years ago into reality.

And we, too, will ultimately become participants in the history of digital currency, witnessing and practicing it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。