Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Friendly Reminder: The "Seven Deadly Sins of the Bitcoin Ecosystem" listed in this article are purely humorous, not intended to smear or undermine the faith attributes of Bitcoin. We respect Satoshi Nakamoto and revere time. If any viewpoints are harsh, we hope the builders of the ecosystem can be forgiving.

Pizza Day celebrates its 14th year, and Bitcoin has today surpassed $110,000, reaching a new high. Bitcoin is on the rise, while the Bitcoin ecosystem seems to be on the decline.

Bitcoin has grown from a white paper to a new anchor for global assets, and the story of the Bitcoin ecosystem has transformed from a simple technical narrative into a complex tapestry interwoven with humanity, market dynamics, power, and faith. Yet, beneath all the noise, the real issues are seldom addressed.

Pizza Day is worth commemorating and reflecting upon. At this juncture, let us take a clearer perspective and review the "Seven Deadly Sins" hidden behind the Bitcoin ecosystem.

The Light of Ideals Shines into the Dilemma of Reality

Bitcoin's market capitalization returned to the trillion-dollar mark in early 2024, and it has been nearly a year and a half since then, but the activity level of its ecosystem is severely imbalanced with its asset size.

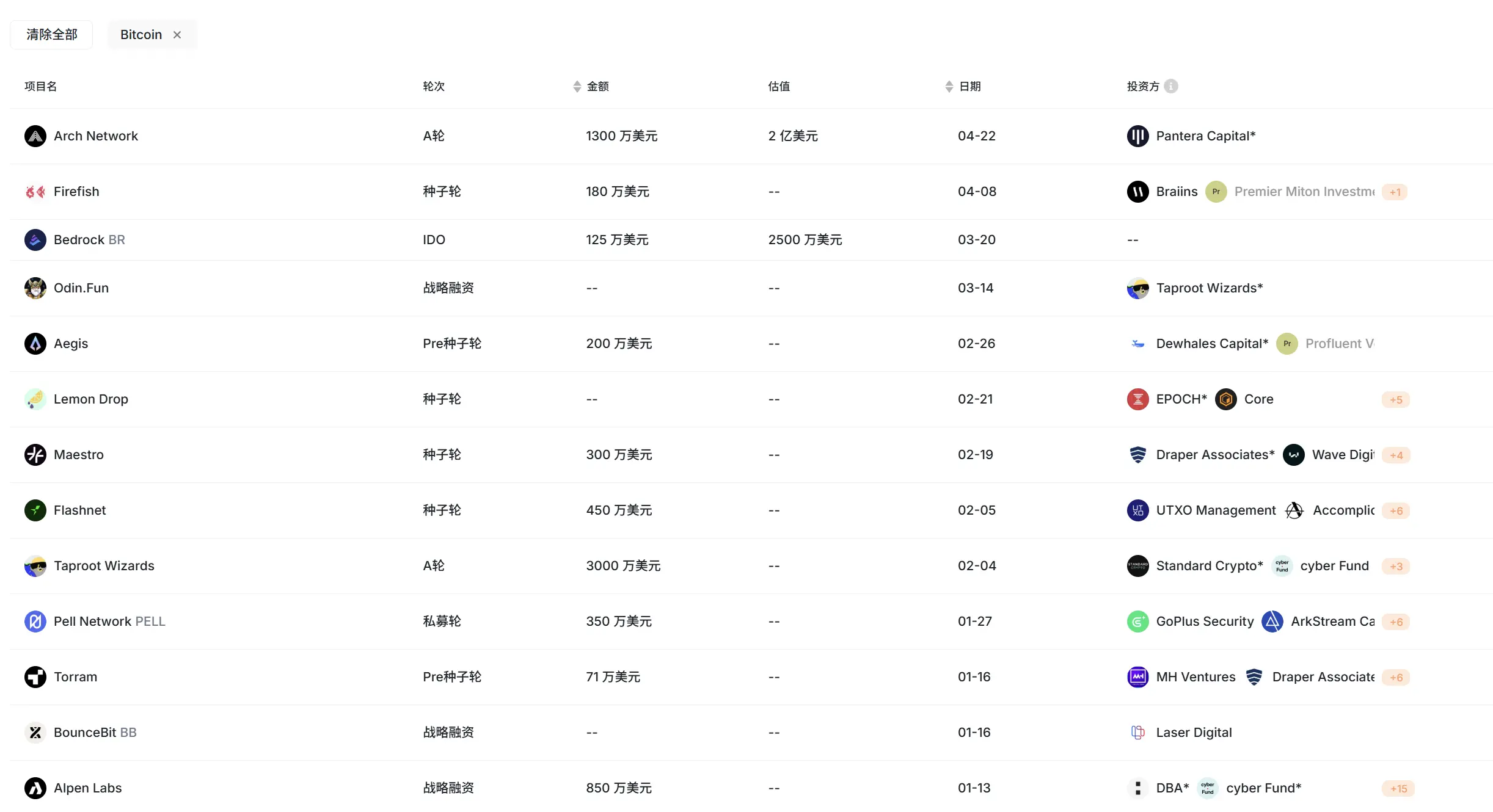

As of now, only 13 projects in the Bitcoin ecosystem have completed financing in 2025, compared to 72 during the same period last year, and a total of 126 for the entire year. The number of financing rounds has nearly halved, and capital enthusiasm has quickly receded.

Source: RootData

Looking at on-chain data, DefiLlama shows that the current TVL of the Bitcoin ecosystem is only $6.3 billion, which is one-tenth of Ethereum's ecosystem ($62.3 billion). Among this, Babylon contributes $5 billion, accounting for over 80%, indicating an extremely concentrated ecosystem structure.

When comparing TVL to token market capitalization, the problem becomes even more glaring: BTC's TVL/market cap ratio is only 0.2%, far below the average level of mainstream public chains. Chains like Ethereum, Solana, and TRON generally maintain above 10%, with significantly higher capital utilization efficiency than Bitcoin.

Source: DefiLlama

In addition, looking back at the star projects of the Bitcoin ecosystem, such as Stacks and Merlin Chain in the L2 direction, Solv Protocol, Babylon, BounceBit in the staking track, and inscription assets like ORDI and SATS, most have continued to perform poorly in terms of price.

Although Bitcoin is the "golden signboard" of the crypto market, in terms of ecosystem construction, it is almost a hollow tower. Below are the "Seven Deadly Sins" we have identified.

First Deadly Sin — The Sin of Ecological Illusion

From the end of 2023 to 2024, the Bitcoin ecosystem has experienced a wave of "grand" awakening narratives. From inscriptions to L2 and re-staking, it seems that overnight, the dormant BTC ecosystem suddenly became a hotbed of innovation. However, when the market frenzy subsides, the real outcomes that have settled down remain sparse.

Many protocols themselves lack disruptive innovation, neither reconstructing existing paradigms nor creating truly new market demands. A large number of projects are merely old concepts repackaged, with weak underlying structures, rough designs, and disconnected from practical use cases. The teams involved vary greatly, with very few possessing the genuine willingness and capability for long-term construction.

As community member @blapta stated: "From a business outcome perspective, these so-called 'technologically advanced' projects have hardly any real implementation. Whether the protocol is established is no longer the focus; after one round of financing, the story is told, and the flags are lowered. This is not only a technical failure but also a cultural silence."

Second Deadly Sin — The Sin of Dogmatism and Infighting

Idealism has never been absent in the Bitcoin ecosystem; however, when it merges with dogmatism, it quietly transforms into closure and self-limitation. In this system that prides itself on "decentralized faith," technical routes, consensus mechanisms, and even development directions can easily evolve into black-and-white factional struggles once they touch upon a certain "fundamentalist" stance.

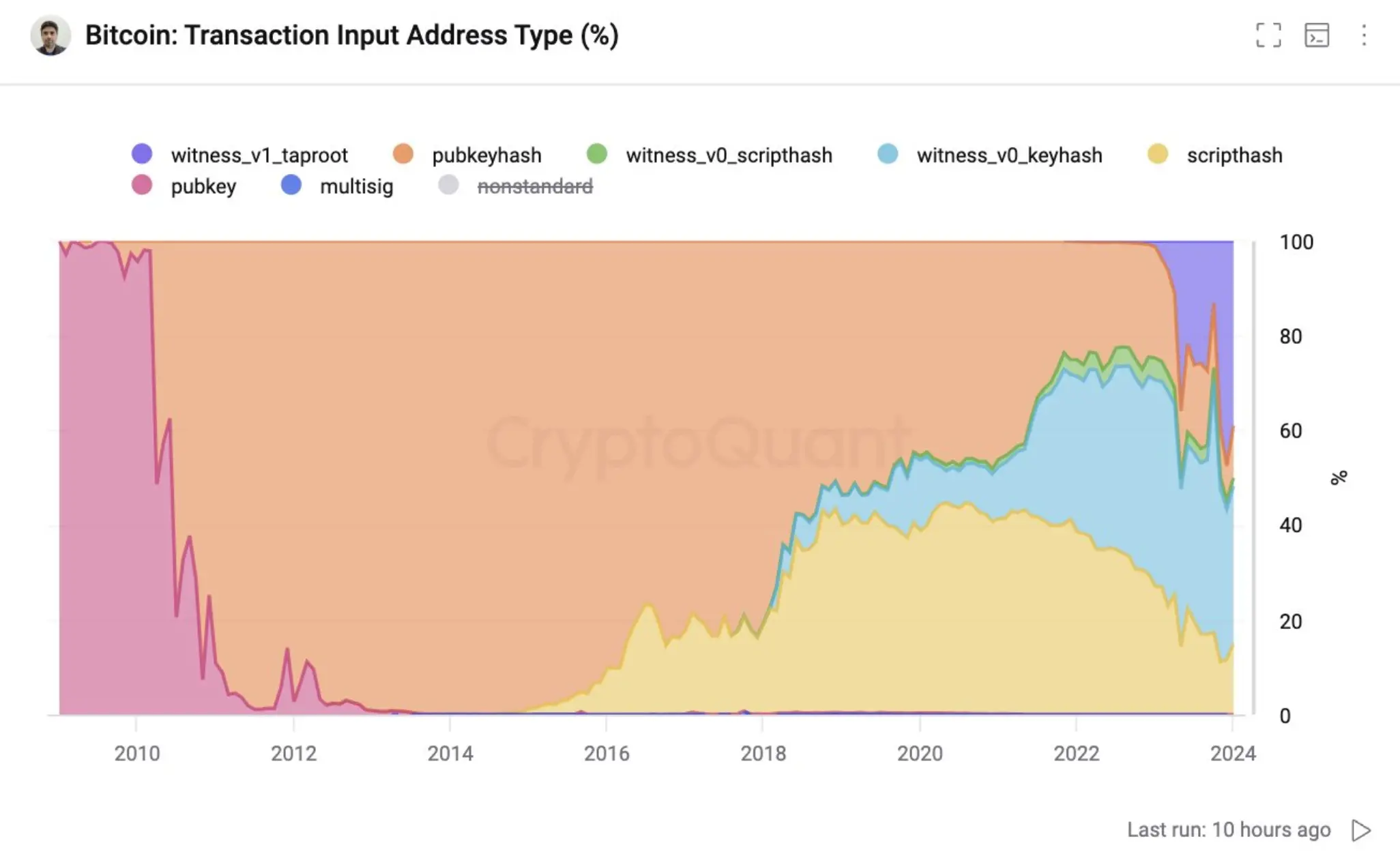

Every major upgrade of the Bitcoin network has almost undergone a long acceptance process. SegWit, two years after its activation, only covered about 50% of transactions, and it took four years to approach 80%; the Taproot activated in November 2021 was similarly slow, with an adoption rate of less than 1% at the beginning of 2023, reaching 39% only by early 2024. Developers and the community are extremely cautious about the evolution of the protocol.

Source: Ki Young Ju, founder of CryptoQuant

Historical events like the BCH and BSV forks also confirm the deep-rooted sources of ideological rifts and factional conflicts within the early Bitcoin community. Meanwhile, some community members hold a resistant attitude towards innovations such as smart contracts and asset issuance, leading to a long-standing game and divergence between "sticking to Satoshi's route" and "promoting functional upgrades."

Third Deadly Sin — The Sin of Talent Drain

If developers are the dreamers and builders of a public chain ecosystem, then Bitcoin is experiencing a chronic talent drain crisis. Unlike the vigorous development enthusiasm and commercial momentum exhibited by ecosystems like Ethereum and Solana, Bitcoin's development landscape appears increasingly thin.

This decline in development power partly stems from its long-term reliance on a donation-driven development model, lacking a stable and sustainable incentive system, making it difficult to attract fresh blood and retain experienced veterans.

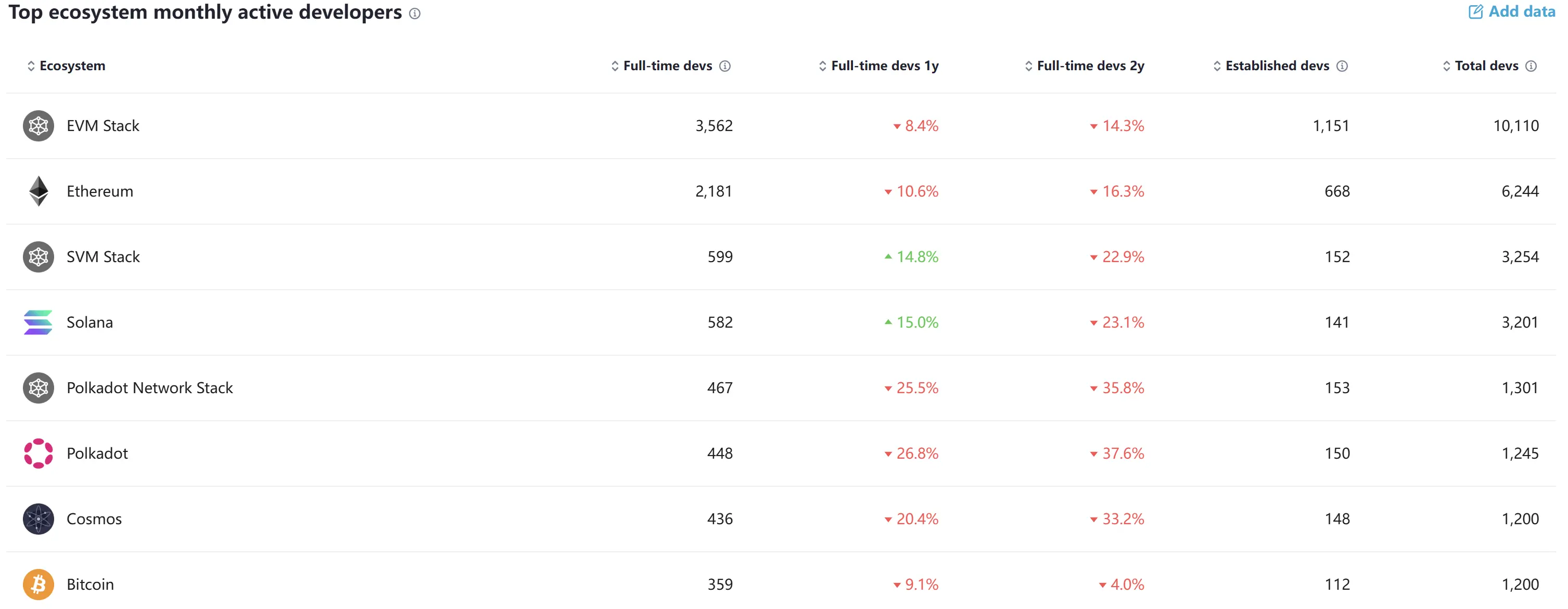

According to DeveloperReport data, there are currently only 359 full-time developers in the BTC ecosystem, with the number of full-time developers with one year of experience decreasing by 9.1%, and those with over two years of experience also decreasing by 4%. Counting only main chain developers (excluding EVM and SVM stacks), Bitcoin ranks fifth among all chains, far below Ethereum, which ranks first with 2,181 developers, making Ethereum's developer count six times that of Bitcoin.

More notably, among the limited developers, as much as 42% focus on scaling solutions, indicating that manpower for Bitcoin's native application layer and other areas is even scarcer.

Source: Developerreport

Fourth Deadly Sin: The Sin of Value Stagnation

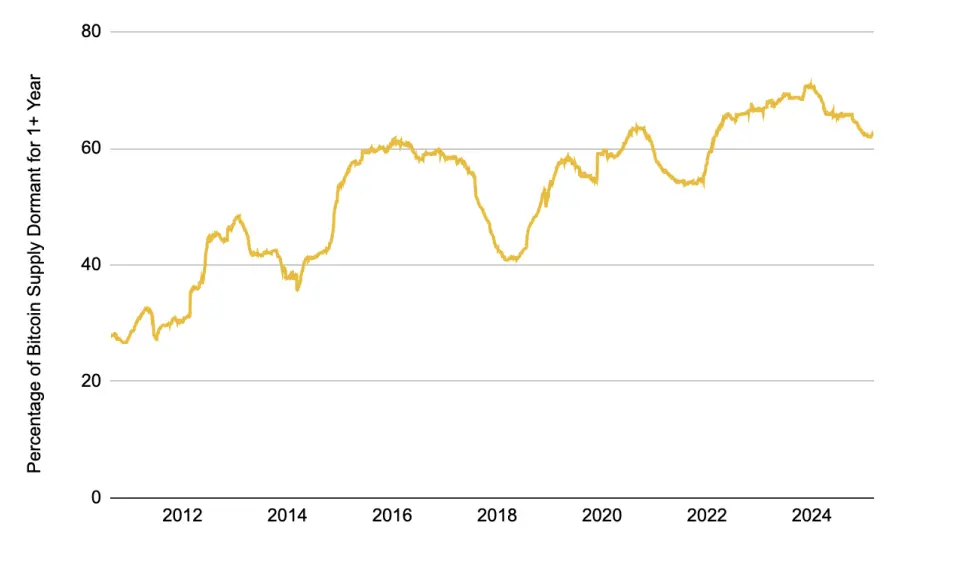

The vast amount of BTC in circulation has not been transformed into financial productivity but has instead settled as "dormant capital" on the chain. According to the latest research from Binance Research, only 0.79% of BTC is actually used in DeFi, while over 60% of Bitcoin that has not been transferred in the past year accounts for the total supply, and this proportion continues to rise.

Proportion of Bitcoin that has not been moved in the past year, Source: Binance Research

This reflects the further solidification of Bitcoin's "digital gold" positioning while exposing a serious gap in its ecosystem regarding financial usability. BTC holders have very limited ways to utilize their assets, mainly concentrated in centralized lending platforms or cross-chain generated WBTC, but these paths generally face issues such as low yields, high centralization risks, and insufficient security, lacking attractiveness.

In contrast, Bitcoin's financial ecosystem has yet to establish a sustainable asset utilization mechanism that can meet investors' multi-layered needs for yield acquisition, risk management, and strategy deployment. This "value stagnation" is becoming a key shackle limiting the evolution of the Bitcoin ecosystem.

Fifth Deadly Sin: The Sin of Attention Mismatch

Recent discussions on upgrades within the Bitcoin community have fallen into a "high heat, low efficiency" vicious cycle: truly technically deep and development-potential proposals are rarely brought up, while some "trivial" topics are repeatedly debated.

Take BIP177 as an example; although it is merely an adjustment regarding unit display, it has sparked prolonged disputes within the community. In contrast, proposals that could genuinely elevate protocol capabilities, such as the CTV + CSFS combination for asynchronous payments and optional payment paths, and BIP360 (anti-quantum attacks) to address future security challenges, have received little attention.

The BIP system, which is already not very efficient in Bitcoin's governance mechanism, has become increasingly rigid under this attention mismatch. Core upgrades that truly need extensive testing, evaluation, and collaborative promotion have quietly fallen silent amid the struggle for discourse. Community member @blapta expressed: "I hope the community discussions around Bitcoin can return to normal soon; if this drags on, the developers will age."

Sixth Deadly Sin: The Sin of Narrative Closure

In the fast-paced crypto industry, the narrative of the Bitcoin ecosystem appears particularly monotonous. The "digital gold" narrative has played a role in solidifying consensus and conveying value, but it should not evolve into a framework that limits innovation and expands imagination.

In contrast, other chain ecosystems continuously stimulate new interests and narratives around Restaking, Meme, DePIN, AI, etc., driving sustained community vitality and capital attention.

Although Taproot Assets, Ordinals, and others briefly sparked imaginative space, the lack of sustained narrative promotion and systematic support ultimately failed to form a stable growth curve.

Seventh Deadly Sin: The Sin of Lack of Investability

In a capital-driven market system, "investability" determines the ultimate flow of funds. Speculation is the most genuine and honest flow logic of on-chain funds. However, the Bitcoin ecosystem has a glaring shortcoming in this regard: complex deployment, weak liquidity, and primitive trading mechanisms make it difficult for market makers, arbitrageurs, and hot money to enter and exit efficiently.

Data also reflects this: aside from the brief capital attention attracted by the Ordinals and Runes craze in 2024, the financing performance of the Bitcoin ecosystem in other years has been lackluster. Notably, large financing projects exceeding ten million dollars are extremely rare, directly reflecting mainstream investment institutions' doubts and reservations about the "investability" of the BTC ecosystem.

Confronting Problems, We Can Go Further

We look back at our original intentions and confront reality. Today's Bitcoin ecosystem is both a mid-term review of a technical experiment and a mirror reflecting culture and order. The term "Seven Deadly Sins" is merely a jest; the true starting point is the hope that the ecosystem can rejuvenate and find a direction for sustained growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。