Today’s Crypto for Advisor newsletter is coming to you from Consensus Toronto. The energy is high as digital asset policy makers, leaders and influencers gather to talk about bitcoin, blockchain, regulation, AI and so much more!

Attending Consensus? Visit the CoinDesk booth, #2513. If you are interested in contributing to this newsletter, Kim Klemballa will be at the booth today, May 15, from 3-5 pm EST. You can also reply to this email directly.

In today’s Crypto for Advisors, Harvey Li from Tokenization Insights explains stablecoins, where they came from and their growth.

Then, Trevor Koverko from Sapien answers questions about the status of stablecoin regulations and adoption with regulations in Europe in Ask an Expert.

Thank you to our sponsor of this week's newsletter, Grayscale. For financial advisors near Chicago, Grayscale is hosting an exclusive event, Crypto Connect, on Thursday, May 22. Learn more.

Stablecoins - Past, Present and Future

When major financial institutions — from Citi and Standard Chartered to Brevan Howard, McKinsey and BCG — rally around a once-niche innovation, it’s a good idea to take note, especially when the innovation is stablecoins, a tokenized representation of money on-chain.

What email was to the internet, stablecoin is to blockchain — instant and cost-effective value transfer at a global scale running 24/7. Stablecoin is blockchain’s first killer use case.

A Brief History

First introduced by Tether in 2015 and hailed as the first stablecoin, USDT offered early crypto users a way to hold and transfer a stable, dollar-denominated value on-chain. Until then, their only alternative was bitcoin.

Tether’s dollar-backed stablecoin made its debut on Bitfinex before rapidly spreading to major exchanges like Binance and OKX. It quickly became the default trading pair across the digital asset ecosystem.

As adoption grew, so did its utility. No longer just a trading tool, stablecoin emerged as the primary cash-equivalent for trading, cash management, and payments.

Below is the trajectory of stablecoin’s market size since inception, a reflection of its evolution from a crypto niche to a core pillar of digital finance.

Usage at Scale

The reason stablecoins have been a hot topic in finance is their rapid adoption and growth. According to Visa, stablecoin on-chain transaction volume exceeded $5.5 trillion in 2024. By comparison, Visa’s volume was $13.2 trillion while Mastercard transacted $9.7 trillion during the same period.

Why such proliferation? Because stable dollar-denominated cash is the lifeblood for the entire digital assets ecosystem. Here are 3 major use cases for stablecoin.

Major Use Cases

1. Digital Assets Trading

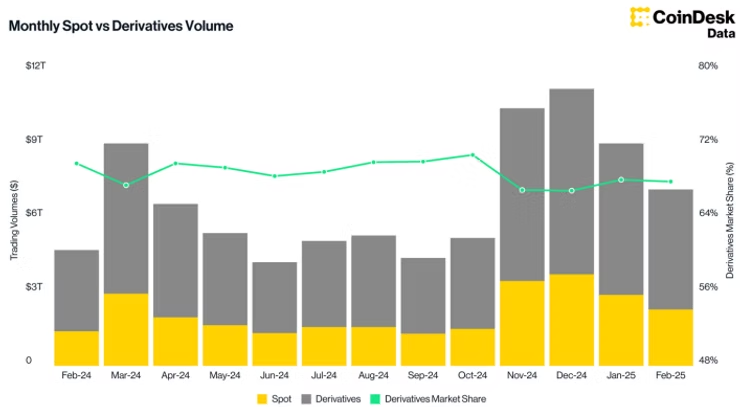

Given its origins, it's no surprise that trading was stablecoin’s first major use case. What began as a niche tool for value preservation in 2015 is now the beating heart of digital asset trading. Today, stablecoins underpin over $30 trillion in annual trading volume across centralized exchanges, powering the vast majority of spot and derivatives activity.

But stablecoin’s impact doesn’t end with centralized exchanges — It is also the liquidity backbone of decentralized finance (DeFi). Onchain traders need the same reliable cash equivalent for moving in and out of positions. A glance at leading decentralized platforms, such as Uniswap, PancakeSwap, and Hyperliquid, shows that top trading pairs are consistently denominated by stablecoins.

Monthly decentralized exchange volumes routinely hit $100-200 billion, according to The Block, further cementing stablecoin’s role as the foundational layer of the modern digital assets market.

2. Real World Assets

Real-world assets (RWAs) are tokenized versions of traditional instruments such as bonds and equities. Once a fringe idea, RWAs are now among the fastest-growing asset classes in crypto.

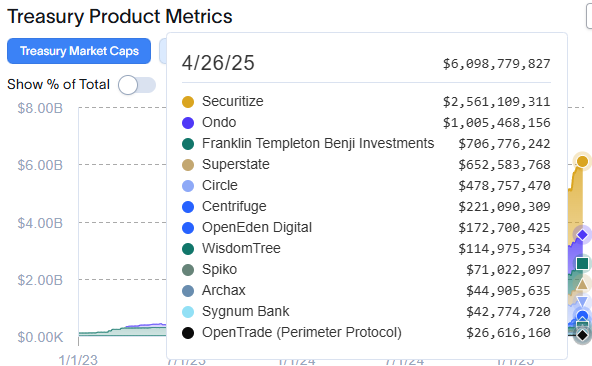

Leading this wave is the tokenized U.S. Treasury market, now boasting over $6 billion AUM. Launched in early 2023, these on-chain Treasuries opened the door for crypto-native capital to access the low-risk, short-duration US T-Bills yield.

The adoption saw a staggering 6,000% growth according to RWA.xyz: from just $100 million in early 2023 to over $6 billion AUM today.

Asset management heavyweights such as BlackRock, Franklin Templeton, and Fidelity (pending SEC approval) are all creating on-chain treasury products for digital capital markets.

Unlike traditional Treasuries, these digital versions offer 24/7 instant mint/redemptions, and seamless composability with other DeFi yield opportunities. Investors can subscribe and redeem around the clock, with stablecoin liquidity delivered in real time. Circle’s facility with BlackRock’s BUIDL and PayPal’s integration with Ondo’s OUSG are just two prominent examples.

3. Payment

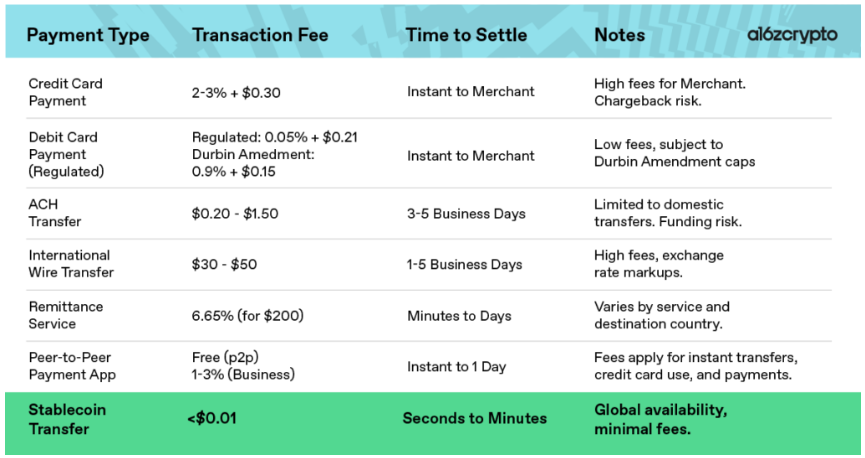

A major emerging use case for stablecoins is cross-border payment, especially in corridors underserved by traditional financial infrastructure.

In much of the world, international payments remain slow, expensive, and error-prone due to dependency on correspondent banking. By contrast, stablecoins offer merchants and consumers an alternative with its instant, low-cost, always-on transfers. According to research from a16z, stablecoin payments are 99.99% cheaper and 99.99% faster than traditional wire transfers and they settle 24/7.

The shift is gaining momentum in the West, too. Stripe’s $1 billion acquisition of Bridge and subsequent introduction of Stablecoin Financial Account signal the start of mainstream global adoption. Meanwhile, PayPal’s rollout of yield on PYUSD balances highlights stablecoin’s rise as a legitimate retail payment vertical.

What was once a crypto-native solution is fast becoming a global financial utility.

- Harvey Li, founder, Tokenization Insight

Ask an Expert

Q. In light of the recent news from Europe regarding stablecoins and Tether, can you explain how stablecoin investment is valuable to an individual?

A. In the inherently volatile and highly risky world of cryptocurrencies, stablecoins provide individuals with a capital-efficient way to gain exposure to digital assets. Pegged to fiat currencies like the euro or commodities like gold, these digital assets provide stability and a hedge against crypto’s volatility. Crypto individuals can park their funds safely in stablecoins during times of uncertainty without having to exit the market and deal with TradFi.

This is why stablecoins dominate crypto. Their combined market cap has surpassed $245bln, a massive 15x growth over the last five years.

Q. Given current market trends in Europe, are stablecoins more or less susceptible to market fluctuations?

A. While stablecoins are inherently less volatile than typical crypto assets, they remain sensitive to regulatory developments and issuer credibility. When it comes to Europe, specifically, stablecoins have become less susceptible to market fluctuations due to stringent regulatory measures.

This includes the implementation of the Markets in Crypto-Assets (MiCA) regulation, which provides a clear legal framework that requires stablecoin issuers to maintain adequate reserves and comply with strict governance standards. Such rules reduce the risk of de-pegging and enhance overall stability. However, this leads to market consolidation, a lack of competition, and reduced innovation at the same time.

Q. Is Europe becoming a new stablecoin hub as it becomes more receptive to crypto?

A. Europe has been signalling a friendly approach to crypto through MiCA, the first comprehensive crypto framework globally that introduces licensing requirements for digital asset service providers and AML protocols. The aim is to create a structured and harmonized regulatory environment for the crypto market, protect customers, and ensure financial stability.

Through its evolving MiCA regulations, Europe could certainly enhance institutional confidence and attract more stablecoin issuers. However, that would require overcoming licensing (a lengthy and costly process) issues, effective implementation at national levels, and adapting to the fast-progressing crypto space.

Europe is currently not a global leader in stablecoin adoption, but with clearer rules coming into place and its openness to compliant entities, it is well-positioned to emerge as a key hub for compliant stablecoin innovation.

- Trevor Koverko, co-founder, Sapien

Keep Reading

- New Hampshire became the first U.S. State to pass a Strategic Bitcoin Reserve Bill into law.

- SEC Chair Paul Atkins says his priority is to "develop rational regulatory framework for crypto."

- Will Missouri become the first state to exempt capital gains on bitcoin profits among other investments?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。