Author: arndxt

Compiled by: Glendon, Techub News

Why I No Longer Recommend Friends to "Learn About Cryptocurrency First."

Last month, I once again tried to guide a friend who is not in the cryptocurrency space to get started. Ten minutes later, when I explained "choosing a wallet" and "now you need to pay Gas fees with another token," her eyes began to glaze over.

I suddenly realized: what we face is not a knowledge gap, but a design gap.

A harsh reality is that the speculative wave brought the first wave of users but failed to attract the next billion users. True adoption begins when cryptocurrency products become invisible—people can benefit from them without realizing they are using cryptocurrency technology.

With the rise of stablecoins, institutional staking, and the increasing role of AI in the development of the digital economy, the foundation for the mass application of cryptocurrency has been laid. But to unlock such a future, we must stop asking users to learn about cryptocurrency and instead start building crypto products that allow them to use the underlying technology without noticing it.

Here are 8 narrative directions and related projects worth paying attention to in the field of cryptocurrency applications.

The Winning Strategy for Next-Gen Wallets: Single Point Extremity

Currently, wallets are undergoing a structural transformation: users are forming the habit of using two complementary wallets—one for daily use, similar to a fintech app, and another for asset storage, akin to a bank account.

Wallet functions and experiences are diverging. Therefore, developers who try to cram all functionalities into a single interface will ultimately lose to those who focus on (a) frictionless onboarding experiences and (b) high-security storage.

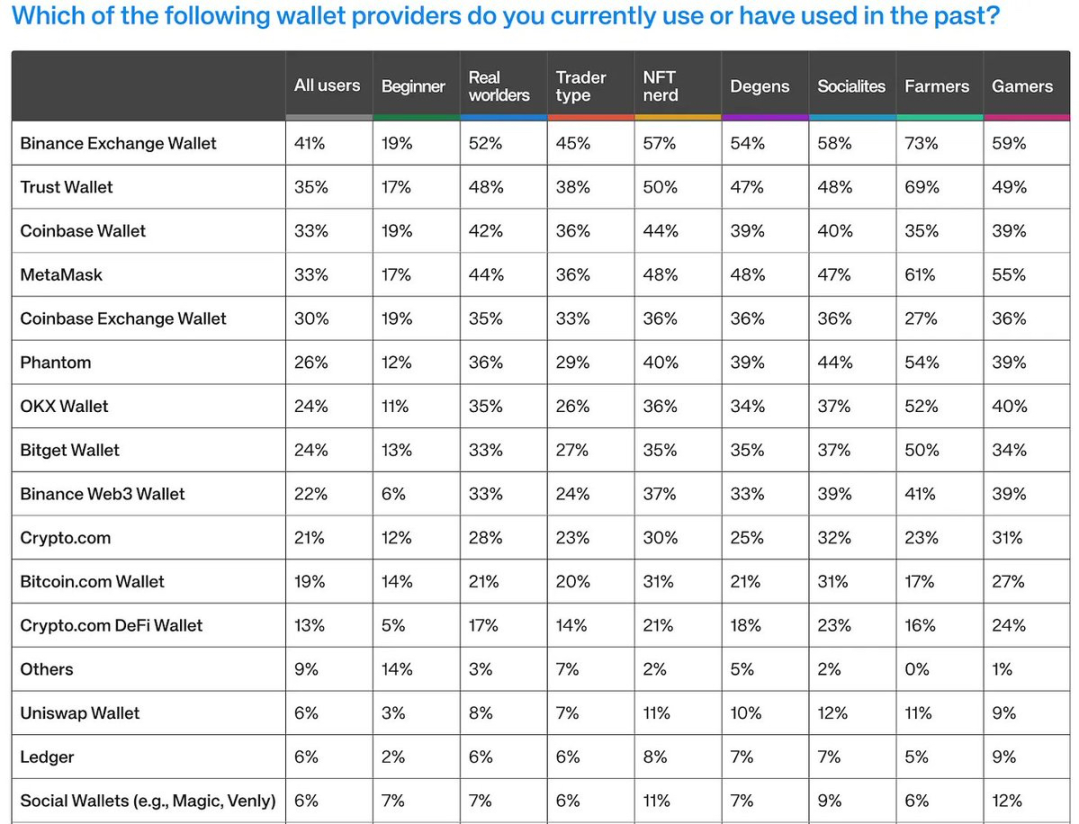

Data shows that most users now use 2-5 wallets, with nearly 48% of respondents indicating this is because each blockchain remains in its own "walled garden" island.

At the same time, wallets also exhibit a top-heavy collection state, with experienced users (those with over 2 years of experience) concentrated on Binance, Coinbase, MetaMask, or Trust (accounting for over 54%), while no single wallet holds more than 20% of the share among novice users.

Moreover, for most users, self-custody remains a daunting prospect. An interesting statistic is that Binance's self-custody solution, "Binance Web3 Wallet," despite offering a familiar brand and a simplified self-custody path, has only attracted a 22% user share, with most users still harboring concerns.

In reality, users do not want to use multiple wallets simultaneously; this is not their subjective preference but a lack of choice.

Clearly, the "seamless multi-chain future" that has been discussed in the industry has not truly arrived. Beyond the 48% of users who have multiple wallets primarily to access different blockchain ecosystems, 44% of users actively split their wallets for security reasons, a significant increase from last year's 33%.

It can be observed that the industry has failed to provide true interoperability, thereby shifting operational complexity onto end users. Meanwhile, these users are becoming increasingly savvy—they no longer blindly believe that a single wallet can handle all scenarios.

Project Examples

Phantom: A popular cryptocurrency wallet supporting Solana and Ethereum.

The Discrepancy Between Behavior and Beliefs

Speculation remains the core driving force. Although 54% of users actually used cryptocurrency for payments or peer-to-peer transfers in the past quarter, when asked about their favorite activities, only 12% of respondents chose payments. Trading (spot, meme coins, DeFi activities) remains the most frequent behavior each week, covering almost all user types. Therefore, speculative behavior will continue to siphon attention away from the future of cryptocurrency payments as a public utility.

The core reasons hindering the development of practical scenarios lie in three major resistances:

- Cost resistance: 39% of respondents believe that high L1 Gas fees remain the biggest barrier to adoption;

- User experience resistance: Only 11% of respondents believe that existing crypto products are friendly to newcomers and sufficient to meet the needs of the masses;

- Network resistance: Payment behavior relies on existing merchants/friends and other social relationships, but the fragmented chain and wallet ecosystem disrupt this cycle.

Project Examples

- Huma Finance: A PayFi cross-border payment pioneer that requires no pre-funding and earns actual returns (APY up to 10.5%) from real-world payment flows;

- Tectum: Enables instant, free cryptocurrency payments through real-time liquidity;

- Alchemy Pay: A fiat and cryptocurrency payment gateway;

- NOWPayments: A payment gateway supporting over 300 cryptocurrencies, including Bitcoin.

Chains as the New Infrastructure Layer, but Users Need Not Perceive Their Existence

The multi-chain ecosystem is essentially a division of labor system. Chain abstraction will become the winning user experience (UX) model, allowing wallet sessions to seamlessly route orders, balances, and identities to any backend that offers the best combination of latency, cost, and security, without requiring users to make choices.

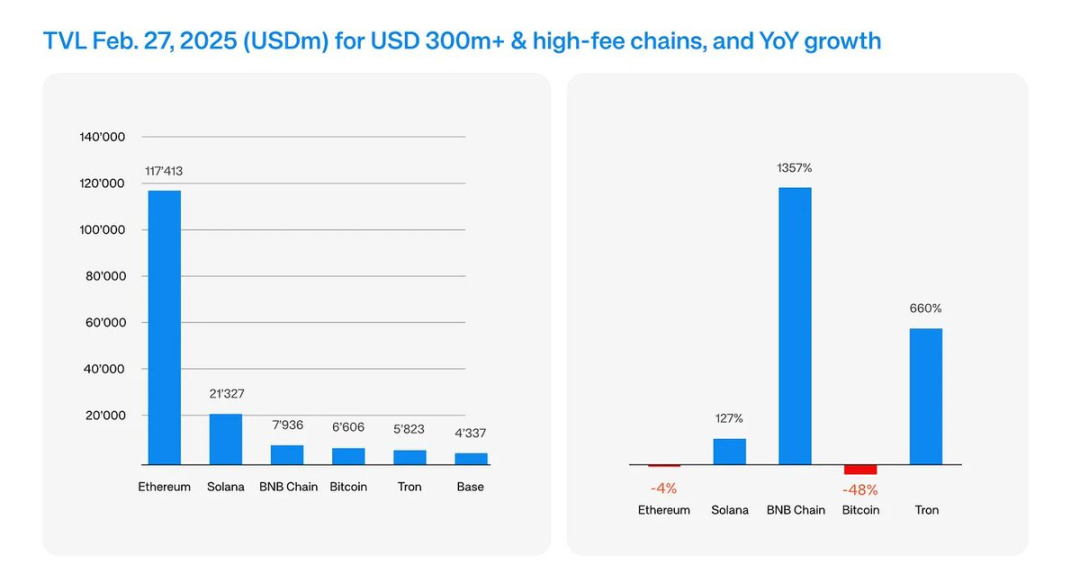

Currently, Ethereum remains the institutional-grade settlement layer, but Solana is rapidly becoming the preferred chain for high-frequency, high-participation retail activities. From the perspective of momentum and growth, Ethereum faces the strongest competitive pressure to date:

- Solana's fees have increased by 3000% year-on-year, and its TVL has grown by 127% year-on-year, leading all L1s;

- This surge has largely been driven by the Memecoin craze, especially in the fourth quarter of 2024, but also reflects Solana's structural advantages in speed and transaction costs.

Surveys show that 43% of respondents indicate Ethereum as their most commonly used chain; 39% say Solana; only 10% primarily use L2, indicating that interoperability remains at the theoretical stage rather than the practical stage.

Project Examples

- Chainlink: Launched the Cross-Chain Interoperability Protocol (CCIP);

- LayerZero: Launched the Omnichain Interoperability Protocol and the Omnichain Fungible Token (OFT) standard;

- Wormhole: A cross-chain messaging protocol;

- SOCKET Protocol: A cross-chain interoperability protocol, with a token launch imminent;

- eOracle: An Ethereum-based oracle platform providing permissionless professional data services for smart contracts.

The Illusion of Enhanced Security

Users claim that on-chain security has improved, but their wallets tell a different story.

So, how do we explain this paradox?

In fact, users conflate personal reinforcement experiences (hardware wallets, multi-signature) with systemic risks. Meanwhile, attackers industrialize "phishing as a service," shortening the lifecycle of malicious contracts by four times.

Current product priorities should focus on "push-based anti-phishing" user experiences (clear signing interfaces, real-time simulations, MPC transaction firewalls), which must shift from advanced add-ons to default configurations, especially in mainstream "daily" wallets.

NFTs as the Infrastructure of Digital Culture

The NFT market is undergoing a necessary healthy adjustment, shifting from speculative profile picture (PFP) projects to experiences driven by real digital assets and practical scenarios. This is also the first time NFTs have begun to show sustainability.

Additionally, the surge in low-cost NFT collectibles on platforms like Base and Rodeo.Club highlights the rise of a low-cost, high-frequency participation model for users, similar to in-app purchases in games rather than traditional art collections.

NFTs are Becoming the Participatory Infrastructure of the Digital Economy

- NFTs will gradually become the default interaction layer for consumer applications: loyalty points, badges, membership benefits—all of these will increasingly appear on-chain in the form of NFTs. Ownership will be transferable and tradable across platforms, no longer limited to a single platform, unlocking secondary value for users and more monetization channels for brands. Imagine Starbucks' loyalty program operating on-chain, where points earned in one app can unlock benefits across an entire network of partner services.

- NFTs are becoming the digital manifestation of cultural capital: NFTs are rapidly becoming a mechanism for users to express identity and cultural belonging in the digital space. As social platforms integrate on-chain assets, NFT ownership will evolve into a primary means of digital self-expression, much like wearing brands in the real world.

- Success will depend on retention rates rather than floor prices: The era of judging NFTs by speculative value is coming to an end. The new metrics are retention rates and participation frequency. How frequently do users interact with NFTs? Are these NFTs related to ongoing experiences, content, or rewards? This will become the primary consideration for builders, who should design NFT ecosystems that encourage repeat participation through unlockable content, evolving token attributes, and real-world benefits.

- AI + NFTs will unlock the next wave of personalized dynamic assets: AI-generated NFTs related to user behavior, emotions, or community events are on the horizon. These dynamic assets will continuously evolve with user engagement, unlocking deeply personalized experiences and creating emotional attachments that static assets cannot achieve.

Project Examples

- Treasure: NFT infrastructure;

- Mocaverse: Infrastructure connecting the Animoca brand ecosystem using the MOCA token;

- Rodeo Club: NFT participation platform;

- NFP: AI-driven UGC platform;

- Good Vibes Club: NFT community;

- Onchain Heroes: Popular collectibles on Abstract;

- Hypio: High-trading and rapidly growing NFT collectibles;

- steady teddys: Popular collectible series on Berachain;

- Pudgy Penguins: One of the leading NFT brands, adopted by the mainstream;

- Bored Ape Yacht Club: A representative collectible with a strong community and ApeCoin token;

- CryptoPunks: The original NFT collectibles, regarded as historically significant digital artifacts;

- Azuki: An NFT series inspired by Japanese anime, featuring the ANIME token and strong brand influence;

- doodles: Colorful NFT collectibles that recently launched the DOOD token on Solana;

- Milady Maker: Features the CULT token and a strong community.

Bitcoin: A New Paradigm for Macro Assets

Bitcoin has evolved from a speculative asset into a macro-level financial tool.

A parallel transformation is underway. Thanks to the maturation of the Layer 2 ecosystem, particularly emerging protocols like the Lightning Network, Ark, and Fedimint, Bitcoin is quietly becoming the invisible transaction layer for global settlement, supporting the next generation of cross-border payments, institutional finance, and sovereign digital reserves.

Macroeconomic Relevance of Bitcoin

- From hedge asset to strategic reserve asset: Countries striving to de-dollarize are quietly exploring Bitcoin as part of their sovereign reserve diversification strategy; institutions and even sovereign entities view it as a necessary insurance policy against systemic financial risks.

- Layer 2 protocols are unlocking Bitcoin's payment utility: The Lightning Network has evolved from a technical experiment into a scalable real-world payment layer, enabling near-instant low-cost cross-border transactions; new solutions like Fedimint and Ark are addressing Bitcoin's user experience and privacy limitations, making it possible for Bitcoin to become a true transactional currency in emerging markets. Builders should focus on leveraging these Layer 2 payment solutions and cross-border financial products, particularly for remittance channels and regions troubled by currency devaluation.

- Bitcoin as collateral, the rise of institutional lending: Major institutions are not only using Bitcoin as a passive investment but also as productive collateral for structured financial products. Bitcoin-backed credit instruments, fund management solutions, and derivatives seamlessly integrated with traditional financial markets are expected to increase.

- A global settlement network is forming: As geopolitical friction intensifies, the demand for neutral, censorship-resistant settlement mechanisms will grow. Bitcoin has a unique advantage in serving as a clearing layer for global trade settlements, complementing rather than competing with fiat currencies. Infrastructure that hides the complexity of Bitcoin transactions from end users, enabling seamless settlements based on Bitcoin at the core, will drive adoption beyond the native cryptocurrency circle.

Project Examples

- Solv Protocol: Launched the first on-chain Bitcoin financialization and banking;

- stacks.btc: Bitcoin Layer 2 network supporting smart contracts and applications;

- Alpen: Bitcoin Layer 2 network;

- Babylon: Bitcoin cross-chain and staking solutions;

- Zeus Network: Bitcoin interoperability protocol;

- corn: A network built for BTCFi.

Institutional Staking: A New Model for Strategic Capital Allocation

As Bitcoin solidifies its position as a macro asset class and a core component of modern financial strategies, institutions naturally pose the next question: How can we make these assets productive?

While retail investors continue to chase speculative gains through Memecoins and high-risk trading, institutional capital is quietly and steadily flowing into structured, yield-generating crypto assets, particularly through Ethereum and Solana staking ecosystems.

Bitcoin may play a dominant role as a macro hedge tool, but staking is rapidly becoming the institutional bridge to productive on-chain capital.

- Bitcoin as a store of value for productive capital: With the emergence of Bitcoin-native staking-like mechanisms (e.g., through the Babylon protocol and upcoming BTC Layer 2 solutions), Bitcoin is beginning to find its place in yield generation strategies without compromising its core monetary attributes.

- The real opportunity lies in infrastructure, not validators: The next billion-dollar influx of institutional capital will come from platforms providing institutional-grade custody, compliance reporting, and risk management staking products.

- Yield diversification in an uncertain macroeconomic environment: As interest rates peak and traditional fixed-income products lose their appeal, staking yields will present a new risk-adjusted yield category, particularly attractive for corporate finance departments looking to diversify assets, escape cash holdings and low-yield bonds, while avoiding exposure to the volatility of speculative crypto assets.

Project Examples

- Core DAO: Bitcoin PoS layer, non-custodial Bitcoin staking solution;

- BounceBit: Institutional staking platform;

- TruFin: Institutional-grade liquid staking platform;

- Archax: UK-regulated institutional exchange.

Regulation, Stablecoins, and AI: The Next Entry Point

Compliance unlocks the stablecoin market, creating real everyday touchpoints for cheap, instant global payments, while verifiable on-chain sources become the trust layer for AI to create value; payments are merely the "beachhead."

- Regulatory optimism: 86% of respondents believe clearer rules will accelerate adoption; only 14% believe it will hinder innovation.

- The appeal of stablecoins: Holding rates have nearly doubled year-on-year to 37%, and they have become the default payment method for payment giant Stripe in over 30 markets.

- The synergistic effect of AI: 64% of respondents believe AI will at least accelerate the development of crypto technology; another 29% expect a "two-way flywheel effect."

Project Examples

- WLFI: The Trump family project WLFI, launching the USD1 stablecoin;

- Ripple: Launching the RLUSD stablecoin and using XRP as the Gas token;

- Ethena Labs: Launching the USDe stablecoin, focusing on TradFi;

- OpenEden: Launching the yield-generating USDO stablecoin;

- cap: A stablecoin protocol with reliable financial backing.

Conclusion: User Experience (UX) 2.0 Determines Success or Failure

Users are no longer deceived by narratives like "Web3"; they expect a Web2-level ease of experience, Web3-level asset ownership guarantees, and AI-level intelligent experiences simultaneously.

Teams that abstract chain choices, lower transaction fee thresholds, and embed predictive safety nets will transform cryptocurrency from a speculative "playground" into a connection point for the on-chain internet. The next billion users may not even know they are using Web3 products, and this "invisibility" will be the ultimate victory of user experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。