作者: Imran Lakha

编译:Tim,PANews

比特币企稳:受益于资金流动、政策与宏观顺风支撑

比特币在投资者注意力回归和有利的宏观环境支持下,正再次逼近历史最高点。

4月份,现货比特币ETF吸引了近30亿美元的净流入,而5月至今又吸引了16亿美元。美国商品期货交易委员会CFTC数据显示,杠杆基金并未显著增加空头头寸,这表明大部分资金流动属于方向性押注,而非套利交易。

在政策层面,相关动向正日益升温。新罕布什尔州成为美国首个通过战略比特币储备法律的州,另有19个州也在酝酿类似法案。与此同时,亚利桑那州正在同步推进加密货币托管和战略储备领域的立法进程。

在联邦层面,参议院阻止了《GENIUS法案》这一稳定币监管法案,但加密市场却不以为然,市场风险偏好依然稳固。

宏观经济也发出支持性信号。特朗普的关税政策修订被视为促进增长的举措,提振了股市和美元,同时压低了黄金、日元的价格,并降低了衰退几率。市场波动性有所降温,VIX指数目前已回落至其过去12个月平均水平。

简而言之,比特币正受益于三大因素:机构需求攀升、政策环境利好,以及宏观格局转暖。从仓位布局来看,投资者正在积极做多。

比特币将波动性的主导权转交给以太坊

比特币的实际波动率回升了约8个百分点,并重新突破10万美元大关。以太坊则更为抢眼,其实际波动率飙升至90%,短短两日内价格跳涨30%。比特币短期隐含波动率小幅走低,而以太坊因价格剧烈波动导致隐含波动率飙升了20个波动率点。

比特币的持仓成本回归中性,但以太坊的持仓成本转为深度负值,Gamma卖方遭受重创。

比特币的上涨行情仅有一次突破了隐含高点(在10万关口),而以太坊则实现了多次向上突破。看来比特币已将势头主导权移交给了以太坊,这种情况能否持续尚待时间验证。

比特币波动率期限结构趋平,看涨期权溢价再度显现

随着市场反弹,偏斜曲线趋平,看涨期权权利金回升。

比特币的波动率偏斜在整个期限结构上保持在2-3个波动率点左右,表明市场存在押注价格上涨的看涨资金流,但隐含波动率水平仍处于相对低位。

以太坊期权波动率偏斜出现下移,整体呈现温和看跌倾向(但短期合约端除外)。如果以太坊能够守住近期涨幅并有效突破2800美元关口,市场可能会重新涌现看涨期权的持续性买盘。当前阶段,投资者仍保持谨慎态度。

从长期来看,以太坊相较于比特币仍有差距需要弥补。

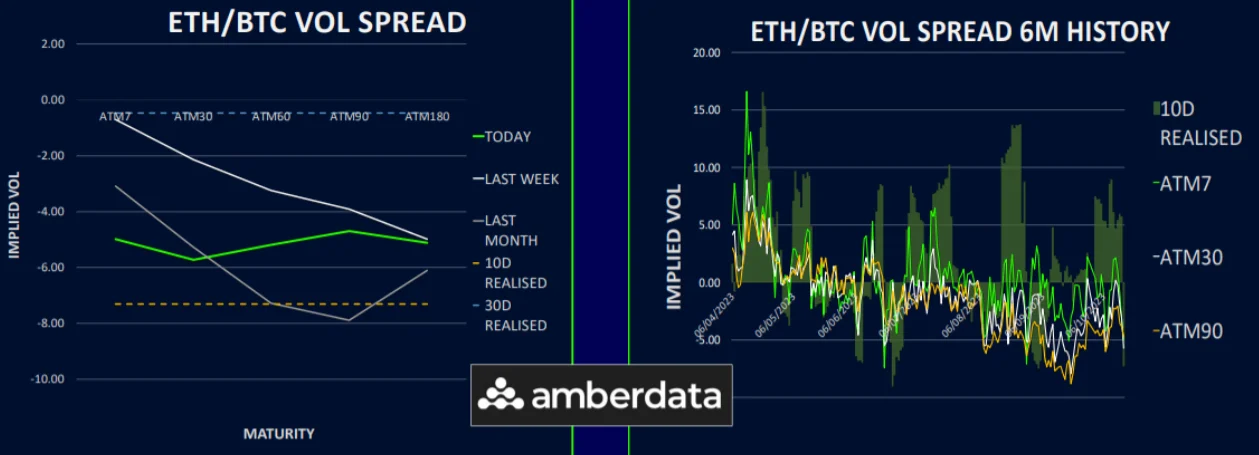

前端波动率价差急剧扩大

ETH/BTC在过去一周飙升33%,目前正测试0.025关键下行趋势阻力位。随着以太坊在已实现波动率上表现极为突出,其短期波动率溢价已飙升至35个波动率点。

与此同时,其远端波动率价差维持在15个波动率点附近,说明反应不大,这一现象支持了长期VEGA(波动率风险敞口)在当前水平可能适合卖出的观点。

尽管以太坊出现大幅波动,短期期权合约的波动率偏斜进一步向看跌期权溢价倾斜。这表明期权市场尚未完全认可这轮上涨行情。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。