Author: Loyal E Guardian Scof, ChainCatcher

Editor: TB, ChainCatcher

"What happened to Ethereum with a 40% surge in 3 days?" This topic recently surged to the top of Douyin's hot list, sparking heated discussions. The rapid price increase ignited market sentiment and led many to start dreaming of a return to a bull market. However, a single surge does not equate to the start of a new cycle. Looking back at the context and sorting through the logic, we should be asking: Is this rebound driven by emotion, or is it a trend reversal?

Strong Rebound Ignites Market, Resonance of Emotion and Structure

Starting in early May, Ethereum's price rose continuously, breaking through $2,500 from around $1,800, with a gain of over 40% in just three days. This round of increase is not only a price recovery but also an emotional explosion. In the previous months, ETH's performance was weak, and market confidence was low, but this wave of market activity seemed to ignite investors' enthusiasm overnight.

Douyin, Twitter, and KOL analyses flooded in, with voices ranging from "the bull market is here" to "the market is being manipulated." However, unlike previous surges purely driven by market expectations, this increase is compounded by multiple factors such as technical upgrades, ETF discussions, and macroeconomic benefits, forming a structural resonance.

On-chain data shows that funds are gradually flowing out of exchanges and into staking or long-term holding accounts. The staking ratio of Ethereum has exceeded 28%, with most positions built at lower levels, indicating a long-term bullish expectation. Additionally, the number of ETH locked in ETFs is continuously increasing; although the proportion is still small, its symbolic significance for confidence is evident. Emotions are heating up, funds are flowing, and the ecosystem is recovering. This rebound is not as simple as just "shouting orders" to drive the price up.

Pectra Upgrade and Policy Signals, Building Fundamental Support

The core background of this rebound is that the Ethereum mainnet completed the Pectra upgrade on May 7, marking the most significant technical change since the "Merge." It introduced a higher staking cap, account abstraction, and data processing optimizations, lowering the usage threshold while enhancing verification efficiency and L2 operational space. More importantly, these changes improved user experience and provided more flexibility for institutions and developers.

On the eve of the upgrade, Vitalik published a blog proposing to simplify Ethereum to be as "understandable and usable" as Bitcoin over the next five years. Meanwhile, the foundation completed an organizational restructuring, with the new leadership team emphasizing "communication" and "real user value," shifting the focus from a technology-first approach to a user-oriented one. These changes indicate that Ethereum is trying to shed the impression of being technically complex and unclear in its roadmap, redefining its core advantages.

On the other hand, the expectations for staking in Ethereum ETFs are heating up. BlackRock's discussions with the new SEC chairman have sparked expectations for the formal inclusion of staking features in ETFs. Although the SEC has not yet made a statement, the Hong Kong market has already opened staking-type ETFs, indicating a shift in institutional-level policies. Policy easing, institutional communication, and infrastructure improvements collectively form the fundamental support for this round of increase.

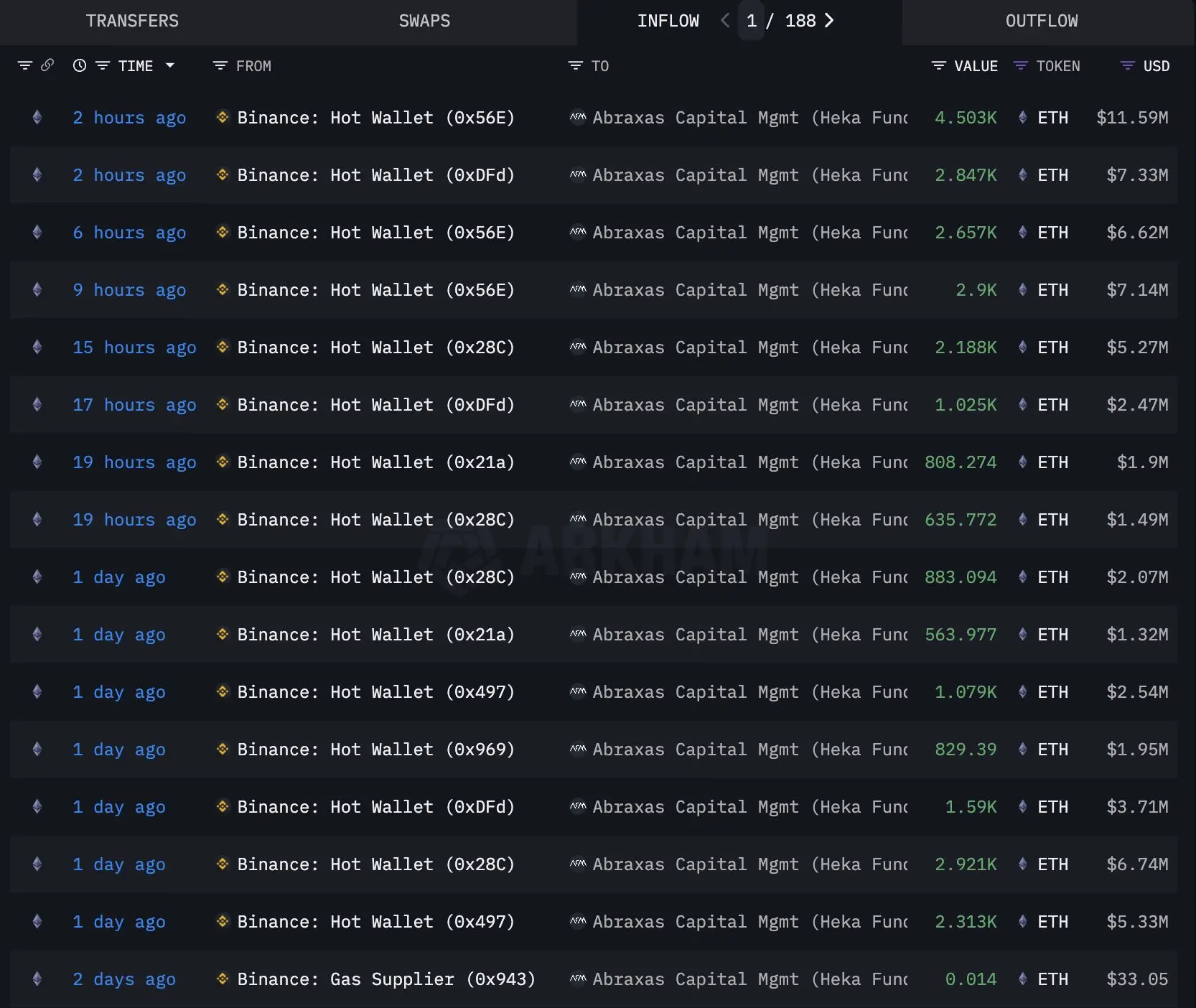

On-chain fund movements also provide a more intuitive perspective. From May 8 to 11, asset management company Abraxas Capital withdrew approximately 185,309 ETH from centralized exchanges, totaling about $399 million. In the days prior, the institution also withdrew 138,511 ETH, worth over $290 million. In just one week, its total accumulation approached $700 million. This concentrated buying period coincides highly with the timing of ETH's technical upgrade and the heating up of ETF staking expectations. Although the motives are unclear, the proactive actions of institutions have already released positive signals.

What Should E Guardians Focus on Next?

Moving forward, what truly determines whether this market trend can be sustained is not how much it has risen, but how much it can retain. For "E Guardians," the most important focus right now is not where the next peak is, but whether these key changes are being realized—after the Pectra upgrade, is the network really more user-friendly? Are wallet interactions, new user onboarding, and developer experiences seeing substantial improvements? Ethereum is not lacking in technology, but history tells us that if upgrades cannot translate into real user retention and developer activity, they are merely victories at the code level.

Another aspect that cannot be overlooked is the speed of advancing the ETF staking mechanism. BlackRock's actions have already provided sufficient hints, but a real statement has yet to come. When will the U.S. follow Hong Kong, and what does it mean for ETH? This is a window period for observing policy tendencies. At the same time, don't forget to monitor on-chain fund movements: Are exchange balances continuing to decrease? Is the staking volume still steadily increasing? These are the true reflections of real confidence.

Two other aspects may determine whether ETH can carve out an "independent market" profile: one is whether there are signs of overheating in the futures market, as soaring funding rates often indicate that short-term risks are beginning to accumulate; the other is whether it has truly established itself as a "financial-grade infrastructure." In the context of the global explosion of stablecoins and RWA, only systems like Ethereum, which possess high availability and resistance to attacks, can potentially serve as the underlying platform for trillion-dollar assets. Compared to new public chains that frequently experience outages, Ethereum's technical resilience, consensus mechanism, and global developer base provide it with the strongest backing to enter national-level financial layouts. Coupled with AI, which will drive exponential growth in on-chain interactions, ETH is also becoming a dual beneficiary of AI + Crypto.

Is a Bull Market Established? More Clear Validation Needed

Although the current data is favorable, whether Ethereum has truly entered a bull market cannot be concluded lightly. On one hand, technical indicators suggest that the market may be overheated in the short term, with the RSI at a high level and some futures positions showing signs of correction pressure. On the other hand, historical experience shows that Ethereum has often experienced "buy the rumor, sell the news" market behavior after positive upgrades, and technological advancements do not always lead to sustained price increases.

Additionally, Ethereum itself faces structural challenges. While Layer 2 scaling has improved efficiency, it has also weakened the transaction activity on the mainnet, impacting ETH's revenue model. Competitors like Solana pose substantial threats in terms of speed, fees, and user experience. The diversity of the ecosystem is an advantage, but the complexity of governance and slow decision-making also weaken execution power.

It is worth noting that while there was a slight net inflow of about $5.2 million into the BTC ETF yesterday, the ETH ETF saw a net outflow of about $17 million. Even so, ETH's price movement was not affected; instead, it continued to rise independently, with price and fund flows decoupling, leading to market speculation about "changing the market maker" or even "Asian market dominance." Although this assertion is not yet conclusive, ETH is showing an increasingly independent price movement logic from BTC.

More importantly, ETH's current price movement is still strongly influenced by the macro market. Expectations of interest rate cuts by the Federal Reserve, a rebound in small-cap U.S. stocks, and a strong rebound in Bitcoin have collectively created a favorable external environment for ETH. Data even shows that the correlation between ETH and the Russell 2000 has recently increased significantly. This indicates that ETH's current rise may be part of a broader "sector rotation" among risk assets rather than an independent bull run.

Conclusion

Ethereum is at a delicate tipping point. It is undergoing transformation, with technological updates, institutional loosening, and ecosystem restructuring all in progress. However, whether it can enter a bull market path still requires more time and factual validation. In the short term, this resembles more of a structural repair market. A true bull market requires sustained capital inflows, a clearer policy environment, and whether Ethereum itself can fulfill its transformation promises.

The market has set an expectation, but whether "E Guardians" can truly turn the tide depends on whether ETH can go further and stand more firmly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。