Play and earn various passive income from BERA.

Written by: 1912212.eth, Foresight News

Bitcoin has surpassed $100,000, and the altcoin market is heating up again. The emerging public chain Berachain's token has risen from a low of $2.7 for three consecutive days, peaking around $4.7. If you have a portion of BERA that you don't plan to sell in the short term and want to earn higher returns, this article will explore some passive income opportunities for you.

First, it is necessary to explain the three native tokens of Berachain again. BERA is the Gas token used to pay transaction fees and is also the core asset for liquidity mining and staking. BGT is the governance token, obtained by staking BERA or providing liquidity, used for participating in ecological governance and sharing protocol revenue.

BGT cannot be purchased or transferred on the market; it can only be earned by providing liquidity. Users can exchange BGT for BERA at a 1:1 ratio, but this process is one-way, meaning BERA cannot be exchanged back for BGT. HONEY is the native stablecoin, pegged to the US dollar, used to reduce market volatility risk and commonly used in lending and yield optimization scenarios.

Participate in Infrared for double benefits

Infrared is a liquidity staking protocol on Berachain, with its total TVL reported to have risen above $900 million. In March of this year, it completed a $16 million Series A funding round led by Framework Ventures, bringing its total funding to $18.75 million, with YZi Labs having participated in its investment in June 2024.

Currently, Infrared has launched a points program to incentivize user participation before the token launch. The official announcement suggests that tokens may be issued in Q3, so contributing to Infrared's liquidity proof vault, providing liquidity for key trading pairs on decentralized exchanges (such as Kodiak and BEX), and staking iBGT and iBERA can earn points, which will later be rewarded with official airdrops.

Infrared has tailored its wrapped tokens, iBGT and iBERA, for BGT and BERA to enhance market liquidity.

Participate in BERA or iBGT staking

Users can directly stake BERA on the Infrared website, receiving its wrapped token iBERA. BERA is staked to the validator network, generating staking rewards. iBERA can also be used for liquidity on decentralized exchanges, lending, or as collateral, allowing users to continue earning staking rewards while earning other returns. It is worth noting that currently, Infrared does not support unstaking, so if you need to unstake, you will have to wait for the official launch of this feature.

According to the official website, the current staking TVL has risen to $340 million, with an annualized rate of 4.8%. In contrast, Binance's flexible wealth management yield is only around 3%.

BGT is a governance token that cannot be transferred or traded; however, iBGT is not. It provides a more flexible and practical "liquidity" version of BGT, which can be freely bought, sold, and used within the Berachain ecosystem.

By staking iBGT on Infrared, users can earn rewards generated by the underlying BGT, which are distributed in the form of HONEY. Additionally, users can add iBGT to liquidity pools on decentralized exchanges like Kodiak or engage in lending operations on platforms like BeraBorrow, Gummi, and Dolomite.

According to the official website, the total TVL of iBGT has reached $28.73 million, with an annualized rate as high as 245%, of which 9% is distributed in HONEY and 236% in WBERA.

Build liquidity pools on Infrared

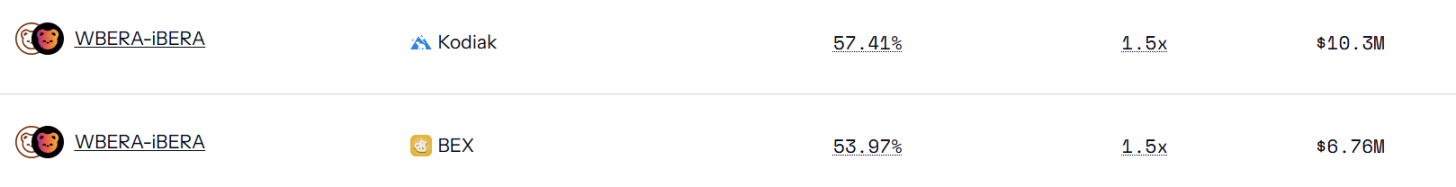

Building liquidity pools not only allows you to earn trading fees but also to earn significant interest income passively. For example, on DEX, the WBERA-iBERA pool on Kodiak and BEX currently has an annualized rate exceeding 50%. Additionally, participating in Infrared offers a 1.5x points multiplier. (https://infrared.finance/portfolio)

The basic annualized yield of this liquidity pool is 1.4%-2.26%, with the 50% annualized yield distributed in the form of iBGT.

On the management page, users can periodically claim their HONEY, WBERA, and iBGT, and then stake the rewards again (for example, staking iBG rewards to earn HONEY and WBERA rewards).

When participating in building liquidity pools, it is also necessary to observe the situation. If the annualized rate is extremely high but the TVL is not, it often leads to a rapid decrease in the annualized yield as large amounts of capital flow in later.

DEX protocol Kodiak liquidity pool

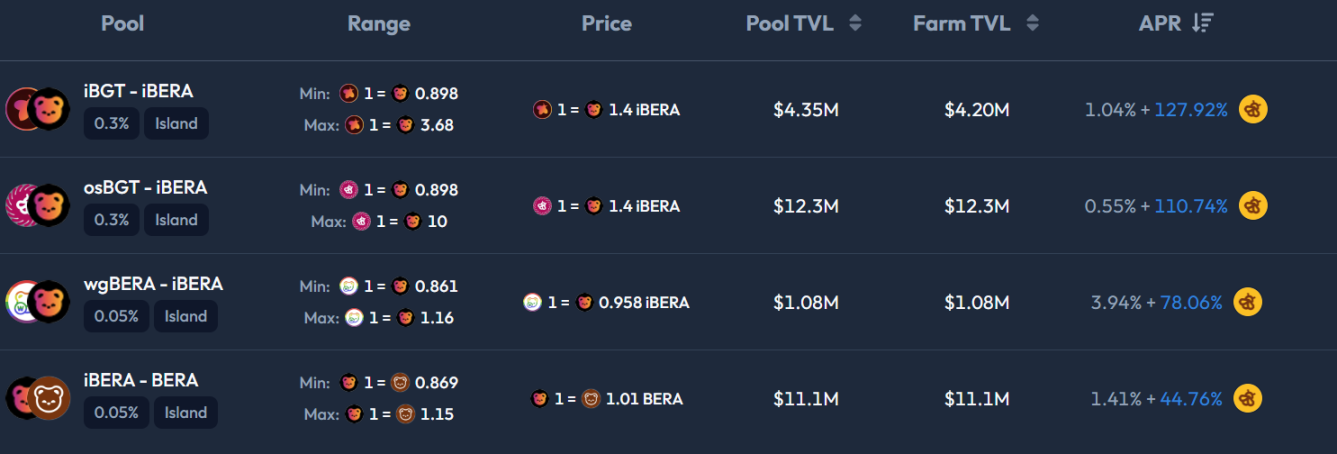

Kodiak is the DEX protocol of the Berachain ecosystem, with its TVL currently reported to be $538 million. (https://app.kodiak.finance/#/liquidity/pools?chain=Berachain_mainnet)

Users can earn significant returns through gradually building liquidity pools, such as the iBGT-iBERA yield pool, which earns a 1.04% trading fee and an annualized yield of 127.91% calculated in HONEY. The iBERA-BERA pool's trading fee yield reaches 1.41%, while the HONEY yield is relatively low at only 44.76%.

Deposit BERA on the lending protocol Dolomite

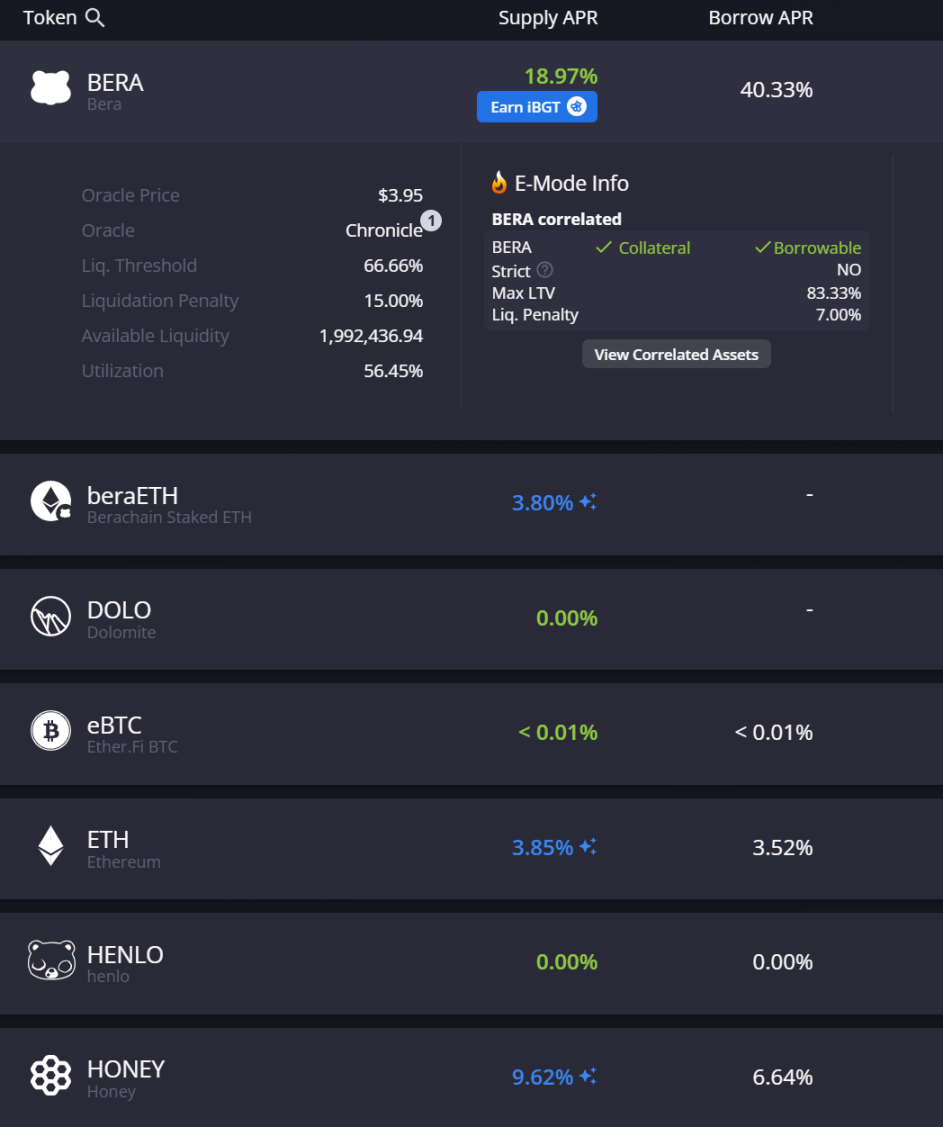

The Berachain lending protocol Dolomite has launched its native token, with the official website showing an annualized yield of 18.97% for lenders. Users can deposit to earn high returns in iBGT. (https://app.dolomite.io/balances)

Additionally, if users want to seek higher returns, they can borrow HONEY at an annualized rate of 6.64% and then deposit it again at an annualized yield of 9.62%, earning the difference.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。