Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Four years ago, crypto companies were still scrambling to see if they could list on Nasdaq; today, Coinbase has reached the pinnacle of the global capital market. This platform, once plagued by regulatory doubts and public controversies, will officially become a member of the world's most influential index, the S&P 500.

Behind this is a massive demand for passive funds, an accelerating institutional entry, and a significant symbolic leap. A new era has quietly begun.

13 Years of Struggles to Reach the Mainstream Capital Market

From its founding to being included in the S&P 500, Coinbase has traveled 13 years. On this day in 2012 (May 13), Coinbase was officially established, at a time when Bitcoin was merely an experimental currency among geeks. Nine years later, on April 14, 2021, Coinbase went public on Nasdaq under the ticker COIN, with the stock price peaking at $429.54 on its first day, and its market capitalization reaching as high as $85 billion, marking a milestone event in the crypto industry.

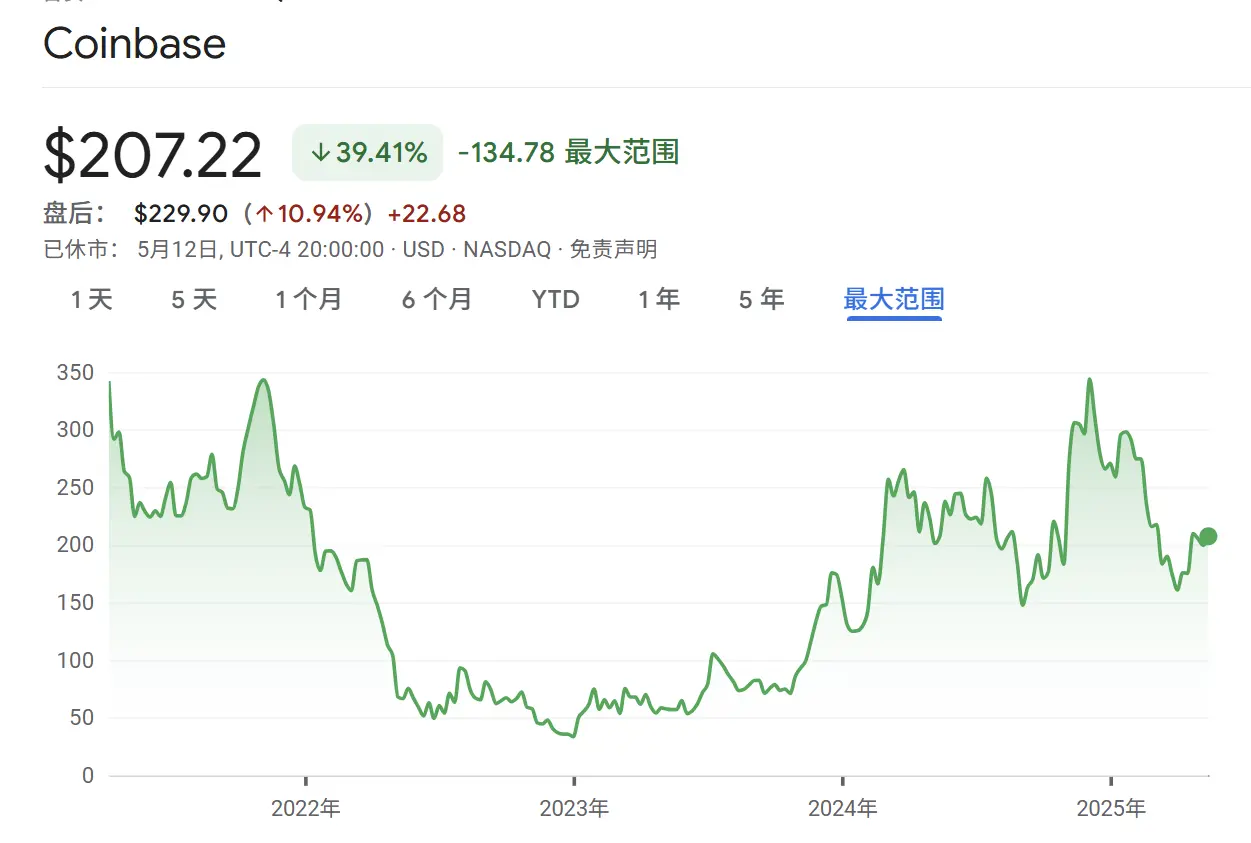

Coinbase's stock price trajectory is deeply tied to the bull and bear cycles of the crypto market. In 2022, amid a significant market correction, COIN's stock price fell to $33, with an annual decline of 86%. By October 2023, as market sentiment gradually warmed, the stock price re-entered an upward trajectory.

Now, on the 13th anniversary of the company's founding, Coinbase is once again welcoming a historic moment: it will replace Discover Financial Services and become the first crypto company included in the S&P 500. Following the announcement, COIN's stock price surged 8% in a single day, currently reported at around $207, with a total market capitalization of $52.78 billion. The era of institutionalization in crypto finance is quietly taking shape.

Image source: Google Finance

Profitability and Market Value, Coinbase Meets the Standards

The constituents of the S&P 500 index are selected by the index committee, with adjustments made every March, June, September, and December. According to the latest standards from March this year, candidate companies must meet a minimum market capitalization of $20.5 billion, good liquidity, and a high proportion of freely tradable shares. Additionally, the company must have achieved profitability in the most recent quarter, with a positive cumulative net profit over the past four quarters.

As early as February this year, Oppenheimer analyst Owen Lau predicted that Coinbase was likely to be included in the S&P 500, maintaining a "buy" rating on COIN and raising the target price to $388.

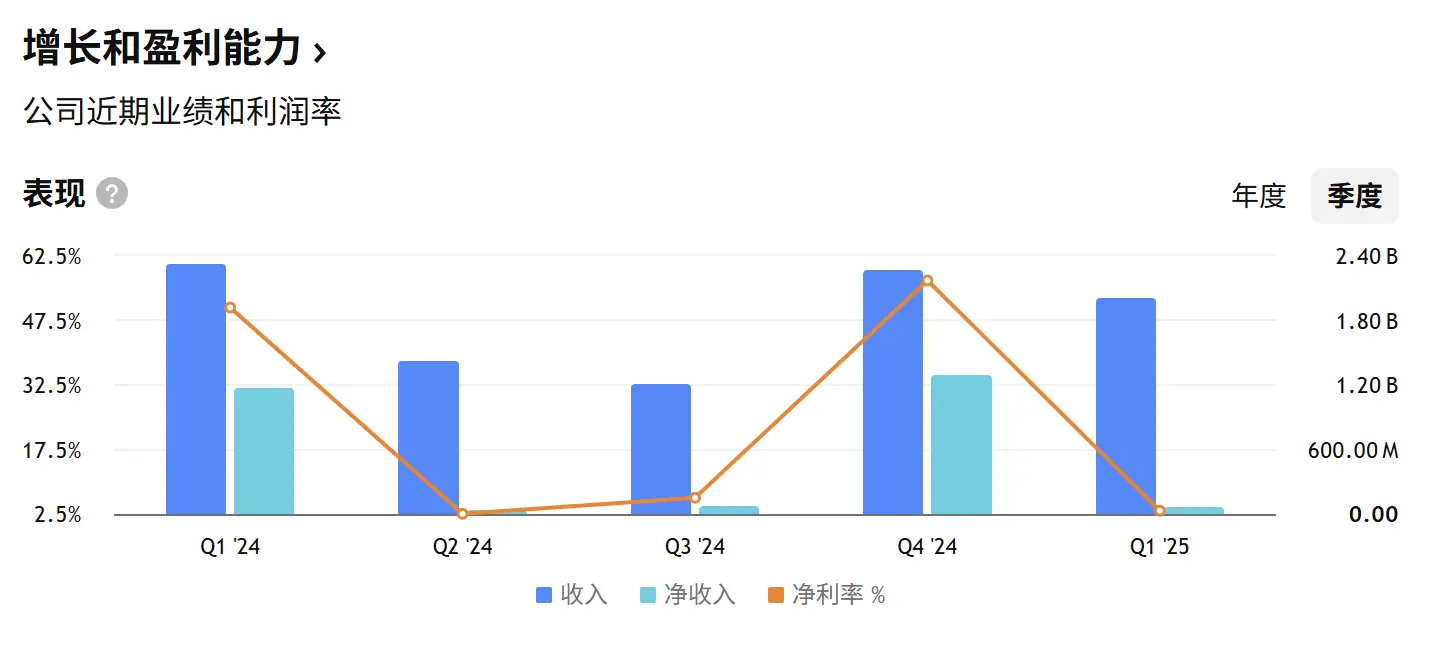

According to the latest financial report disclosed on May 9, Coinbase recorded $2 billion in revenue for Q1 2025, slightly lower than the previous quarter's $2.3 billion; net profit was $66 million, which, despite a significant decline from $1.2 billion in the same period last year, still maintained positive profitability. More importantly, Coinbase has achieved profitability for five consecutive months, with a free float share ratio as high as 95%, meeting all the inclusion criteria for the S&P 500.

Coinbase Financial Information

In addition to Coinbase, several companies involved in crypto business are already part of the S&P 500, such as Block, PayPal, and Visa. Notably, Strategy (formerly MicroStrategy), which holds a large amount of Bitcoin, was included in the Nasdaq 100 index last December. Some analysts believe that although the company has not fully met the profitability standards, it is expected to qualify for inclusion in the June S&P 500 quarterly adjustment with the implementation of new accounting standards in January 2025.

What Does Coinbase's Inclusion Mean?

Coinbase's successful entry into the S&P 500 is not only a significant breakthrough in its company history but may also trigger a series of profound changes in the cryptocurrency industry. From market impact to industry trends, and to the enhancement of symbolic significance, Coinbase's inclusion provides a new perspective for the industry.

Inflow of Passive Funds and Surge in Trading Volume

From a market impact perspective, Coinbase's inclusion may significantly boost its stock trading volume. Bitwise's senior investment strategist Juan Leon pointed out that entering the S&P 500 will increase COIN's daily trading volume to seven times its current level.

Juan Leon used Discover Financial as an example, noting that the company's current weight in the S&P 500 is about 0.10%. Considering that the S&P 500 has approximately $13.5 trillion in assets tracking it, the corresponding passive allocation demand could reach $13.5 billion. Meanwhile, COIN's average daily trading volume over the past three months was only $1.85 billion, indicating that a large amount of funds will flow into the stock passively.

Accelerating the IPO Boom in the Crypto Industry

Several crypto companies that previously planned IPOs, such as Circle, eToro, and Kraken, are advancing their IPO plans. Currently, Circle, eToro, Bgin Blockchain, Chia Network, Gemini, and Ionic Digital have submitted S-1/F-1 filings, with a high likelihood of going public in Q2 2025; BitGo, Kraken, Bullish Global, Consensys, and Figure have indicated IPO plans or are in advisory negotiations, with significant potential for listing in 2025-2026.

At the same time, Hong Kong crypto investment company Animoca Brands also plans to go public in the U.S., with a valuation of nearly $6 billion in 2022, currently holding $300 million in cash and stablecoins, and $538 million in digital assets.

Coinbase's success provides strong market confidence for these companies, and the IPO boom may heat up again.

(Related reading: U.S. Crypto Companies Entering a Frenzy Era: Mergers, IPOs, and Tokenization Boom)

A Sign of Crypto Moving Towards the Mainstream

The inclusion criteria for the S&P 500 not only focus on hard indicators such as market capitalization, profitability, and liquidity but also emphasize industry representation. Included companies must represent significant industries in the U.S. economy and undergo comprehensive evaluation by the index committee.

Coinbase's successful inclusion reflects the growing importance of the crypto industry in the U.S. economic landscape. Dan Dolev, a senior payment analyst at Mizuho Securities, commented: "This is a sign of the times, indicating that cryptocurrency stocks have been accepted by mainstream financial markets."

Coinbase's inclusion in the S&P 500 marks a turning point in an era. It symbolizes the transition of the crypto industry from experimental finance to institutional recognition, with the ensuing capital restructuring, IPO boom, and regulatory dialogue becoming important components of this wave of transformation.

As more "crypto-native forces" knock on Wall Street's door, a new chapter in financial history is being opened.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。