The price of bitcoin (BTC) jumped 2% after the U.S. Federal Reserve decided to keep its policy rate in the 4.25% – 4.5% range on Wednesday afternoon sighting concerns over elevated levels of inflation.

Crypto markets were also up 0.95%, reaching a total market capitalization of $2.98 trillion according to Coinmarketcap, and traditional market indices – the S&P 500, Nasdaq, and Dow Jones Industrial Average – all rose 0.43%, 0.27%, and 0.70% respectively.

Economists had braced for the central bank’s decision, partly because U.S. President Donald Trump had publicly lambasted Fed Chairman Jerome Powell for not cutting rates, even threatening to fire him, an action many claim would be unconstitutional. It appears Powell has remained resolute by keeping rates unchanged. As for Trump, he is yet to comment at the time of this writing.

“With the Fed hitting pause, it’s clear there’s no quick fix for the economy, and that uncertainty is likely to stick around,” Pauline Shangett chief marketing officer at crypto exchange Changenow told Bitcoin.com. “That’s exactly when people start turning to assets that aren’t tied to political decisions.”

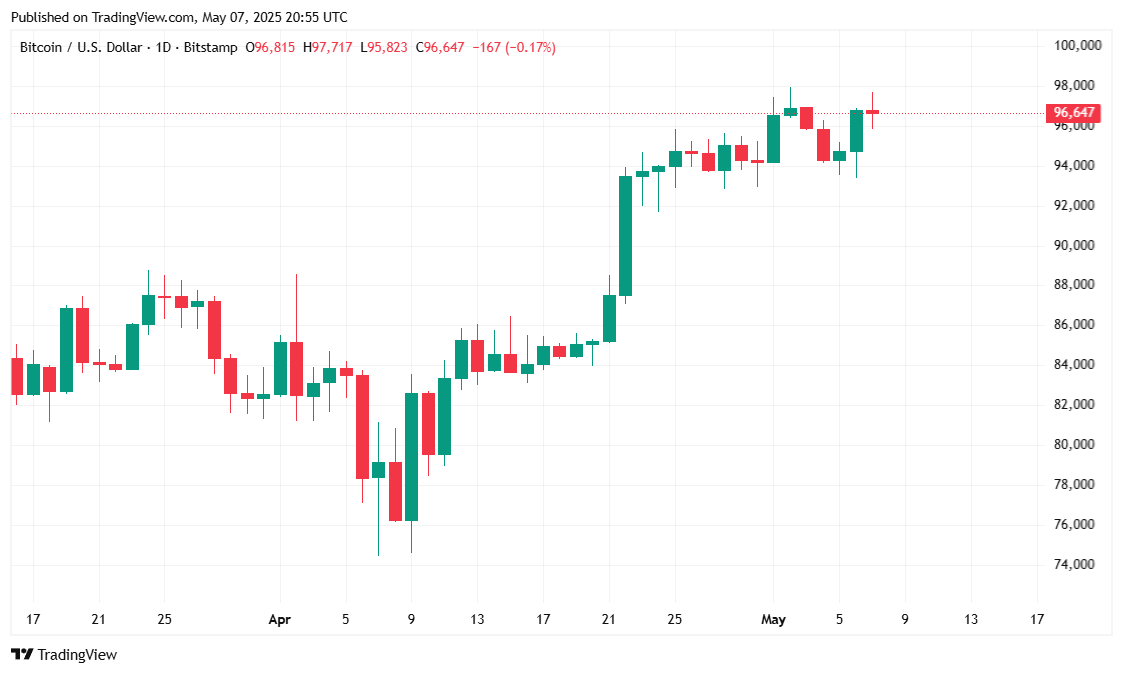

Bitcoin climbed 2.05% to reach $96,664.77 at the time of reporting. The price fluctuated between $94,494.88 and $97,625.81, bringing the cryptocurrency’s 7-day gain to 2.04%, according to data from Coinmarketcap.

( BTC price / Trading View)

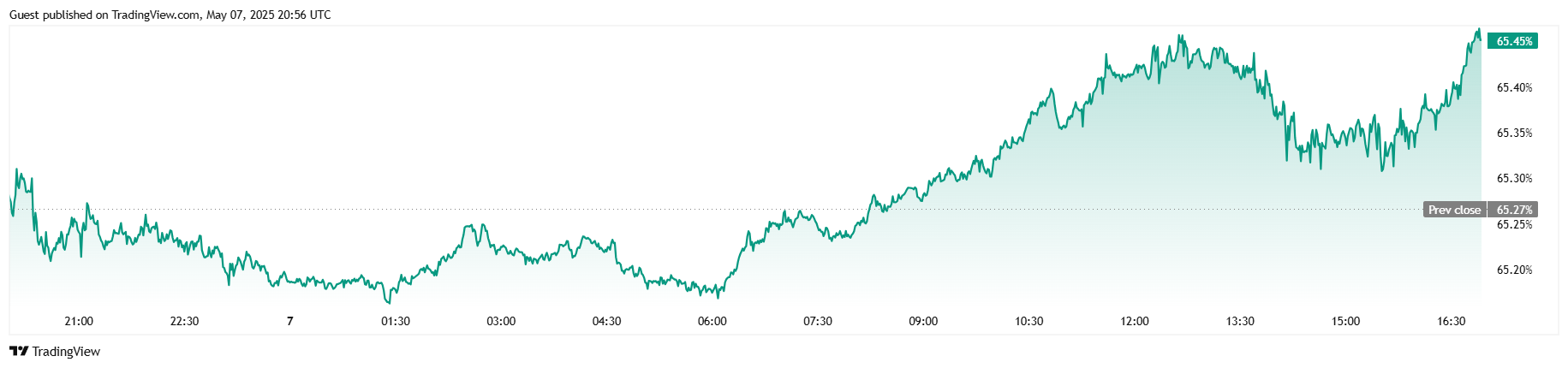

The move was accompanied by a dramatic surge in trading activity, with 24-hour volume skyrocketing 208.93% to $71.54 billion. Bitcoin’s market capitalization followed suit, rising 2.07% to $1.91 trillion. BTC’s dominance in the broader crypto space also increased, up 0.44 percentage points to 65.45%, indicating a growing preference for bitcoin over altcoins in the current cycle.

( BTC dominance / Trading View)

In the derivatives market, BTC futures open interest rose by 1.93% to $64.37 billion, reflecting heightened participation from leveraged traders. Coinglass data shows total liquidations over the last 24 hours reached $273,240, modest by recent standards. Short traders accounted for the majority of that figure at $225,840, compared to just $47,400 in long liquidations, highlighting how bearish traders likely misread today’s market dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。