Selling pressure intensified across crypto exchange-traded funds (ETFs), with investors continuing to pull capital from bitcoin and ether funds in a broad-based retreat. The tone was defensive. And this time, the redemptions ran deep.

Bitcoin spot ETFs posted a steep $410.37 million net outflow, with losses spread across ten funds. Blackrock’s IBIT led the decline at $157.56 million, followed by Fidelity’s FBTC with $104.13 million and Grayscale’s GBTC at $59.12 million. Grayscale’s Bitcoin Mini Trust shed $33.54 million, while Ark & 21shares’ ARKB saw $31.55 million leave.

Additional exits were recorded on Bitwise’s BITB ($7.83 million), Invesco’s BTCO ($6.84 million), Franklin’s EZBC ($3.79 million), Vaneck’s HODL ($3.24 million), and Valkyrie’s BRRR ($2.77 million). Trading volume reached $3.55 billion, and total assets fell further to $82.86 billion.

Ether ETFs followed the same path, logging $113.10 million in net outflows. Fidelity’s FETH accounted for $43.52 million, while Blackrock’s ETHA recorded $28.99 million in redemptions. Grayscale’s Ether Mini Trust and ETHE lost $18.11 million and $13.43 million, respectively. Bitwise’s ETHW shed $6.18 million, and 21Shares’ TETH saw $2.88 million exit. Trading activity totaled $880.37 million, with net assets ending at $10.97 billion.

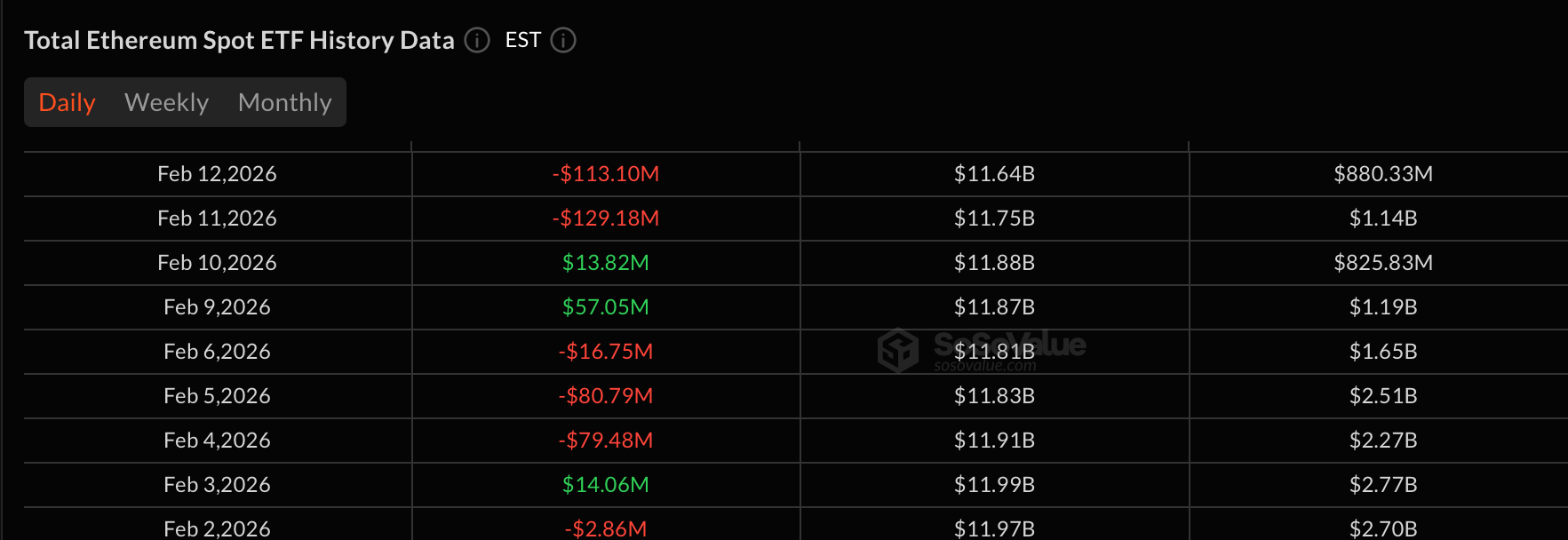

More outflows than inflows for ETH in February so far

XRP ETFs also slipped into negative territory. Although Canary’s XRPC attracted $1.44 million, Franklin’s XRPZ added $737,470, and Bitwise’s XRP saw $303,920 in inflows, these gains were overwhelmed by an $8.91 million outflow from Grayscale’s GXRP. The segment closed with a $6.42 million net outflow, while trading volume stood at $12.52 million and net assets dropped to $970.66 million.

Solana ETFs provided a modest counterbalance. A $2.7 million net inflow was driven primarily by $2.05 million into Bitwise’s BSOL and $340,800 into Grayscale’s GSOL. Trading volume reached $27.12 million, with net assets finishing at $656.29 million.

Overall, Thursday’s session reflected persistent caution across crypto ETF markets. Bitcoin and ether bore the brunt of heavy redemptions, XRP weakened under concentrated selling pressure, and solana stood alone as the only category to close in positive territory.

- Why did bitcoin ETFs see heavy outflows?

Broad-based redemptions across ten funds led to a $410.37 million exit as investors reduced exposure. - How much did ether ETFs lose today?

Ether spot ETFs recorded $113.10 million in net outflows, led by Fidelity’s FETH and Blackrock’s ETHA. - Why were XRP ETFs negative despite some inflows?

An $8.91 million outflow from Grayscale’s GXRP outweighed smaller inflows in other XRP funds. - Which crypto ETF category performed best?

Solana ETFs were the only segment to close green, posting a $2.7 million net inflow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。