You may not have noticed, but Avalanche's C-Chain has recently become popular again.

While the TVL of most ecosystems is slowly declining and market discussions are filled with AI, Restaking, and Memes, the C-Chain has quietly rebounded against the trend: active addresses have increased for three consecutive weeks, mainstream protocol TVL is rising again, and even the "forgotten" old project BENQI has made a strong comeback.

At the same time, Avalanche has launched a Visa virtual card, and the Core wallet now supports gas-free operations, with ongoing upgrades to on-chain infrastructure—these signs all hint at one fact:

The value of infrastructure is being repriced.

And smart money has already quietly boarded the train. They don’t tell stories or chase trends, but they are always ahead of others.

What is "smart money"? Not the richest, but the longest-lasting

Many people think smart money refers to "whales," but in reality, "smart" ≠ the biggest wallet; it means the highest long-term win rate.

Their three major secrets:

Calm betting, neither greedy nor fearful: not aggressive in a bull market, not pessimistic in a bear market. Only those who can survive three rounds of bull and bear markets are truly alive.

Risk control first, returns second: not looking at how explosive the APY is, but only caring whether the protocol's code has been audited.

On-chain transparency, controllable liquidity: not afraid of locking assets, just afraid of being locked without notification; not afraid of price drops, just afraid of not having a place to check data.

These individuals are more like a hybrid of fund managers and hackers in Web3: they understand financial modeling and can read smart contract code. They usually don’t say much, but when they act, they often become the barometer of the ecosystem. For instance, the recent surge in BENQI's liquidity is one of the choices made by these "quietly smart people" on-chain.

The "hedging posture" of smart money: not fanatical, but "Buddhist"

In the turbulent and low-emotion second half of 2024, smart money has begun to position itself in stable yield protocols.

For example, the old project BENQI in the Avalanche ecosystem: its TVL has soared to $520 million, with Liquid Staking's $sAVAX reaching nearly 10 million AVAX, hitting new highs almost daily.

What they chose is not a coin that can "increase tenfold," but rather:

Stable APR: currently about 5.2%

Reusable assets: sAVAX can participate in lending and staking without affecting liquidity

Clear mechanisms and transparent operations: no flashy locking terms

User-friendly interface: non-technical users can easily get started

You may not have seen it, but on-chain data doesn’t lie: there are addresses that have continuously converted AVAX to sAVAX for lending cycle operations, totaling over a million dollars. This "yield - collateral - compound interest" combination is a typical "afraid of dying but not idle" strategy of smart money.

Not a pawn, but a trump card

Many people mistakenly believe that Avalanche's push for Subnets and multi-chains means the main chain C-Chain will be marginalized. But the reality is that the C-Chain is becoming the core of infrastructure development.

Look at these "silent big moves":

Avalanche Visa virtual card launched: USDT / USDC / AVAX can be directly spent, even Alipay can be linked.

Core wallet supports gas-free operations: significantly lowering the user experience threshold for new users.

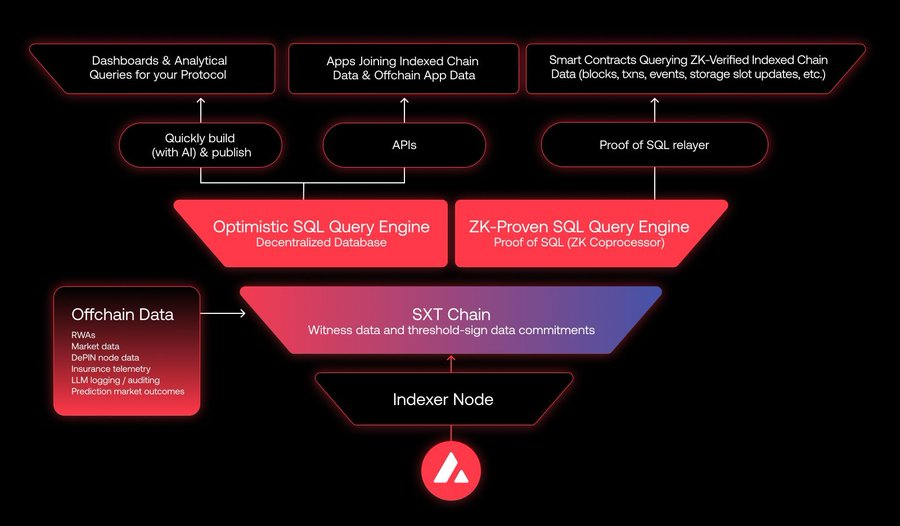

On-chain data service upgrades: developers and investors can query contract and asset data with one click.

The significance behind this is that the C-Chain is not about showing off technology, but about capturing real user and asset inflows.

For smart money, this is precisely the core logic of their bet on Avalanche: while everyone else tells stories, only infrastructure can be the true armor that withstands cycles. And BENQI, as part of the early infrastructure, is gradually being reassessed and repriced.

Stable returns are not just a transitional solution for "waiting for a bull market"

When you broaden your perspective, you will find that smart money is not investing in a specific project, but in a long-term logic:

Stable returns are the moat during market panic.

Whether it’s BENQI’s $sAVAX, Lido’s $stETH, or Frax’s sfrxETH, they are all finding new release paths for "non-trading assets."

You will also find that they are continuously positioning themselves:

Frax focuses on stable pools like sDAI to improve asset utilization;

Pendle's structured yield products continue to be popular, with various APR curve combinations sparking innovative arbitrage strategies;

Maker launches SubDAO to decentralize governance pressure and enhance long-term stability;

EigenLayer uses "Restaking" to leverage new yield layers, attracting TVL back together.

These choices may seem conservative, but they are the foundation for the next bull market—refined, transparent, and sustainable.

Don’t ask for stories, ask for underlying logic

If you are still asking "which coin can increase tenfold," then smart money would tell you:

"The thing that increases tenfold is emotion, not value."

What they truly care about is:

Is the risk exposure of this protocol manageable?

Are the sources of returns real and sustainable?

Is the on-chain liquidity real? Is the TVL data solid?

Is the team continuously iterating? Is the community active and providing feedback?

Only when the answers to these questions are YES will they press that familiar "Confirm" button.

The starting point of the next bull market is not some magical chain or narrative, but these quiet yet firm "smart choices."

Want to be smart? Start with these four things

If you’ve read this far, congratulations, you are already "smarter" than 90% of the market. Here’s a checklist to help you avoid pitfalls:

Look for audits and open source: Does the project have third-party audits, and are the contracts open source?

Check on-chain data: TVL, active wallets, asset structure—can they be verified on-chain?

Analyze asset usability: Can they be lent or used in combination after staking?

Assess team and community vitality: Is there continuous product updates and community dialogue?

The bull market is not far away, but first, learn to be smart.

Opportunities are promising, but the foundation must be solid.

Don’t chase the hype; be smart.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。