Author: Luke, Mars Finance

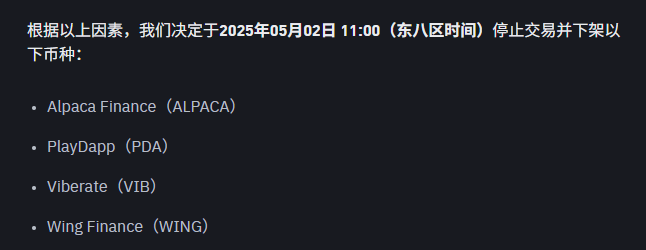

On this day, Binance announced that it would delist ALPACA and three other tokens on May 2, citing that these tokens failed to meet the platform's standards in trading liquidity, network security, and community transparency. Following the news, the price of ALPACA dropped sharply, hitting a low of 0.029 USDT, with a decline of 10.38% within 15 minutes. However, the situation did not unfold as expected—just a few hours later, the price of ALPACA soared to 0.085 USDT, with an increase of 93.16% within an hour. Behind this rollercoaster market movement, was it a failure of the "shorting delisted coins for easy profit" strategy, or a carefully orchestrated counterattack by the market makers?

Delisting Announcement: The Spark of Panic

As the largest cryptocurrency exchange in the world, every delisting decision by Binance is like dropping a heavy bomb in the market. The inclusion of ALPACA in the delisting list was not entirely surprising. During the Binance community vote from April 10 to 16, ALPACA received 6.3% of the "delist votes," ranking sixth among high-risk tokens. This vote served as a preemptive warning to the market, suggesting that ALPACA might face issues with insufficient liquidity or weak community support.

The delisting announcement on April 24 officially ignited market sentiment. The price of ALPACA quickly fell from 0.0329 USDT to 0.029 USDT, with a market cap shrinking to about 5.9 million US dollars. On platform X, traders lamented, with one stating, "Delisted coins are indeed poison; you can't even run away!" Such panic selling is not uncommon—delisting means losing Binance's massive trading volume, and a drop in liquidity is almost a given. Moreover, as a low market cap token (around 6 million US dollars), ALPACA is inherently susceptible to drastic market sentiment shifts.

But the story was just beginning. Just when everyone thought ALPACA would continue to plunge into the abyss, the price chart drew a stunning upward curve. Within an hour, ALPACA surged from 0.029 USDT to 0.075 USDT, an increase of 87.16%. Bitget market data showed that the price once reached 0.085 USDT, with a 24-hour trading volume skyrocketing to 70.77 million US dollars, equivalent to 12 times its market cap. This rebound came too quickly, like a meticulously staged drama, leading one to wonder: was this a frenzy of retail investors bottom-fishing, or a counterattack orchestrated by market makers?

Speculators' Frenzy: The Allure of Low Market Cap Tokens

To understand this price storm, we need to first look at ALPACA's "background." ALPACA is the native token of Alpaca Finance, a DeFi protocol that allows users to engage in leveraged yield farming. Launched in March 2021 with a "fair launch" model (no pre-sale, no investors, no pre-mining), ALPACA was once seen as a community-driven DeFi star. However, the good times did not last long, as ALPACA's price plummeted from an all-time high of 8.60 USDT to its current 0.04887 USDT (according to CoinMarketCap), a staggering decline of 99.43%. With a low market cap and high volatility, coupled with support from futures trading, ALPACA became a playground for speculators.

After the delisting news broke, ALPACA's low price (0.029 USDT) was like a piece of cheese emitting an enticing aroma, attracting countless speculators. On platform X, a user named @BroLeonAus bluntly stated, "With a market cap of 6 million, the short risk-reward ratio is too poor; I’m going long!" His logic was simple: ALPACA's market cap was low enough that there was almost no room for further decline, and the high trading volume (24-hour trading volume / market cap ratio reached 961.13%) indicated extremely high market activity, capable of creating huge waves with just a slight disturbance. Another user, @bigbottle44, pointed out that ALPACA's futures open interest (around 2 million US dollars) accounted for a significant proportion of its market cap, possibly signaling the involvement of speculative funds or institutions.

This speculative logic is not new in the crypto market. Low market cap tokens, due to their small circulation and price sensitivity, often become targets for market makers or large holders. The panic selling triggered by the delisting news pushed ALPACA's price to a low point, providing an excellent opportunity for bottom-fishers. Furthermore, the high leverage nature of the futures market amplified the price volatility. It can be said that this 87.16% surge was both a celebration of retail investors bottom-fishing and a masterpiece of market makers taking advantage of the situation.

Market Makers' Counterattack? Or Market FOMO?

So, was this surge a spontaneous market behavior or a carefully laid plan by market makers? Let's analyze a few possibilities.

Possibility One: Market Overreaction and Natural Rebound

The panic selling triggered by the delisting news may have led to a severe undervaluation of ALPACA's price. The price of 0.029 USDT corresponds to a market cap of just over 5 million US dollars, which indeed seems too cheap for a DeFi project that still has an active community and trading volume. Some traders might believe that the market's reaction to the delisting was excessive, prompting them to quickly bottom-fish and drive the price back up. This "overreaction - rebound" pattern is not uncommon in the crypto market, especially among low market cap tokens.

Possibility Two: Market Makers' Counterattack

Another possibility is that market makers or large holders took advantage of the panic sentiment from the delisting news to deliberately create a low point, and then raised the price through large purchases. ALPACA's 24-hour trading volume reached 70.77 million US dollars, far exceeding its market cap, indicating a significant influx of capital in a short period. On platform X, some users speculated that this surge might have been orchestrated by "main players," aiming to squeeze out high-leverage shorts. ALPACA supports futures trading on Binance, and its open interest accounts for a high proportion of its market cap. Once the price rises rapidly, shorts are forced to close their positions, further pushing up the price and creating a "short squeeze" effect.

Possibility Three: Retail FOMO Driven

Retail investors in the crypto market are often easily driven by FOMO sentiment. When ALPACA's price began to rebound from 0.029 USDT, discussions on social media quickly heated up. Coinbase data showed that 32.18% of posts on X held a bullish view on ALPACA, while CoinGecko indicated that 75% of community members were bullish. Retail investors, seeing the price rise rapidly, might rush in, pushing the price higher. This FOMO-driven market often accompanies high trading volumes but can also easily experience a pullback in a short time.

In summary, this surge is likely the result of a "bullish dance" involving multiple parties: market overreaction provided opportunities for bottom-fishers, market makers or large holders took the chance to pump the price, and retail FOMO sentiment added fuel to the fire. Regardless of who the driving force is behind the scenes, ALPACA's price storm serves as a textbook case in the crypto market.

Community Division: Clash Between Optimists and Cautious Investors

ALPACA's surge not only ignited traders' enthusiasm but also sparked intense debate within the community. On platform X, a clear divide formed between optimists and cautious investors.

Optimists: Low Market Cap Equals Opportunity

For optimists, ALPACA's low market cap and high trading volume are its biggest attractions. They believe that even if Binance delists it, ALPACA can still be traded on other exchanges like Gate.io and MEXC, and liquidity will not completely dry up. Some users even view ALPACA as a potential "double coin," reasoning that its low market cap and high volatility make it suitable for short-term speculation. One user wrote on X, "With a market cap of 6 million and a trading volume of 70 million, isn't this the prelude to market makers pumping the price? I'm all in!"

Cautious Investors: The Shadow of Delisting Lingers

Cautious investors, on the other hand, hold a skeptical view of ALPACA's prospects. As Binance is ALPACA's most active trading platform, its delisting decision could lead to a significant drop in trading volume, thereby increasing the bid-ask spread and liquidity risk. One user commented on X, "After delisting, who will still trade ALPACA on small exchanges? The price will collapse sooner or later." Additionally, the ALPACA team's lack of activity in community communication and project development has led some investors to question its long-term value.

Discussions on Reddit are relatively quiet, with only a few posts mentioning Binance's community vote and the risks of ALPACA's delisting. In contrast, platform X's real-time nature reflects the rapid changes in market sentiment. Whether optimists or cautious investors, the community consensus is that ALPACA's future is fraught with uncertainty.

Future Outlook: Where Will ALPACA Go?

Although this price storm was spectacular, ALPACA's future remains full of variables. In the short term, high trading volume and speculative enthusiasm may continue to drive price fluctuations, but the long-term outlook depends on several factors:

Support from Other Exchanges: ALPACA still has trading pairs on platforms like Gate.io and MEXC. If these exchanges can attract more trading volume, ALPACA's liquidity crisis may be alleviated.

Efforts from the Project Team: The ALPACA team needs to strengthen community communication and release a clear development roadmap to rebuild investor confidence.

Trends in the DeFi Market: As a DeFi protocol, ALPACA's performance is closely tied to the overall trends in the DeFi sector. If the DeFi market rebounds, ALPACA may encounter new opportunities.

Regulatory and Market Risks: Binance's delisting decision may prompt other exchanges to follow suit, and investors need to be wary of liquidity risks and high volatility.

ALPACA's price storm is a typical game in the crypto market. The delisting news ignited panic, speculators bottom-fished, market makers or large holders took the opportunity to pump the price, and retail FOMO sentiment added fuel to the fire. All of this constitutes the unique drama of the crypto market. Some made a fortune bottom-fishing at 0.029 USDT, while others were trapped after chasing the price at 0.075 USDT. Whether you are an optimist or a cautious investor, this storm reminds us that the crypto market is never short of opportunities, nor is it devoid of traps.

Is shorting delisted coins for easy profit a viable strategy? Perhaps it works at times, but when market makers stage a counterattack, shorts can be crushed in an instant. The story of ALPACA continues, and the next price storm may already be brewing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。