Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

As Trump announced a reduction in tariffs on China, global market sentiment quickly warmed up. Bitcoin surged past $94,000, and Solana also broke through $150. Besides the macroeconomic benefits, another disruptive growth engine for Solana seems to be quietly starting.

On April 21, Upexi, a publicly listed company in the U.S., announced it had secured $100 million in financing led by the well-known crypto market maker GSR, with approximately 95% earmarked for establishing and operating a Solana treasury reserve.

After Bitcoin, SOL is becoming the "next pivot" in corporate crypto strategies. Will Upexi's aggressive entry spark a new wave of value for Solana?

Upexi Boldly Moves into Crypto

Since its establishment in 2018, Upexi has focused on the development, manufacturing, and distribution of consumer products, owning several innovative brands, such as the medicinal mushroom product brand Cure Mushrooms, the pet care brand LuckyTail, and the energy gummy line Prax.

In 2024, to focus on high-growth sectors, Upexi undertook a major business restructuring: selling E-core/Neti, Tytan Tiles, and a warehouse in Clearwater, Florida, closing two operational sites in Las Vegas, and streamlining about 30% of its workforce.

To enter the crypto asset market, Upexi established two wholly-owned subsidiaries, ChainBitMiner and QuantumHash, specifically responsible for crypto investment management. Currently, the company's digital asset strategy mainly revolves around Bitcoin mining and the allocation of high-growth potential altcoins. ChainBitMiner will build a diversified cryptocurrency investment portfolio, with 50-70% of assets held in Bitcoin, replacing traditional cash reserves. QuantumHash aims to expand its digital asset portfolio through self-mining, targeting low-risk, leveraged treasury growth.

In Upexi's strategic roadmap for 2025, in addition to crypto mining and investment, Upexi plans to explore blockchain projects related to staking, decentralized lending, and yield generation models. This series of initiatives shows that Upexi is gearing up to make a significant impact in the crypto market.

Upexi's "All In": Is it the New Engine for Solana?

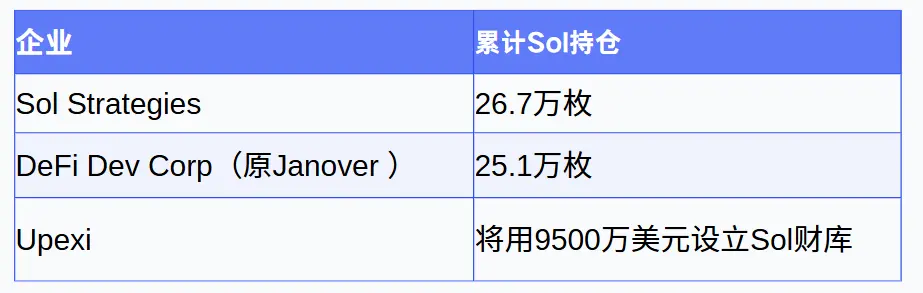

Upexi is not alone in this endeavor; even before it, projects like SOL Strategies and DeFi Dev Corp had already made deep investments in the Solana ecosystem. Here are their SOL holdings statistics:

SOL Strategies has chosen a slow but steady path. Its growth model can be understood as "first inorganic, then organic": initially relying on external acquisitions to expand its business, and later gradually shifting to natural growth driven by its own team and infrastructure.

Upexi's approach is different, directly "going all in on Sol," resembling a micro-strategy for Solana. Upexi has signed securities purchase agreements with some investors to issue and sell 43,859,649 shares of common stock or pre-subscription warrants at a price of $2.28 per share, with expected fundraising of up to $100 million. It plans to allocate about $5.3 million for working capital and debt repayment, while the remaining funds will be used to establish the company's Solana treasury system and increase its Solana assets.

A.G.P./Alliance Global Partners is acting as the exclusive sales agent for this private placement. The transaction is expected to be completed around April 24, 2025, provided that standard closing conditions are met.

If this model of "public companies continuously financing and buying crypto assets" can be successfully replicated with Solana, could SOL see a new wave of growth?

Upexi's Strategy: What Are the Odds of Success?

On the day Upexi announced its purchase of SOL tokens, the company's stock price skyrocketed from $2 to a peak of $22, an increase of 1000%. Although it later fell back to $9, this surge has clearly demonstrated that the move garnered widespread market attention.

Arif Kazi, the business head of Sonic SVM, stated on the X platform that this action signifies a "shift in traditional capital markets' perception of on-chain yields." He emphasized that Upexi's allocation of SOL is not for hedging purposes but is viewed as an "infrastructure investment." This operation could likely represent the largest Solana-native treasury allocation among U.S. publicly listed companies, priced above market value, with no token incentives, no lock-up period, and no convertible bond structure.

"When treasury strategies combine with DeFi primitives, it's not just 'alignment,' it's 'acceleration,'" Arif wrote. "Solana now has an operational manual that capital allocators can directly replicate."

However, the market is not without its criticisms, which quickly emerged.

Some pointed out that Bitcoin, due to its scarcity and the presence of long-term believers, can support strategies that leverage BTC through debt instruments; whereas SOL has no supply cap and is more volatile, making it challenging for traditional institutions to accept a "high-risk, high-volatility, continuously inflationary" asset as a core treasury.

The distribution of SOL on-chain differs from that of BTC. Bitcoin's "belief chain" can continuously convert into holding motivation, but SOL lacks this user structure. Community user @DL_W59 pointed out, "How to stimulate holders' willingness to hold long-term or even increase their positions will be the key to Upexi's strategy's success or failure."

Whether from the Solana community, traditional markets, or crypto VCs and regulators, all eyes are on Upexi's gamble. As traditional capital increasingly delves into the on-chain world, similar stories will continue to unfold. In this era where new and old financial orders intersect, every "all in" is a gamble and a rehearsal for the future financial landscape. This time, Upexi has placed its bet on Solana.

And this spring is writing the answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。