Matrixport's latest weekly report, "Matrix on Target," indicates that since the launch of Ethereum spot exchange-traded funds (ETFs) in the U.S. in the summer of 2024, Ethereum's market dominance has plummeted by nearly 50%. The report delves into the current dynamics of the crypto market, noting that altcoins are unlikely to see a significant surge in the short term, while Bitcoin (BTC) has demonstrated strong resilience due to a significant reduction in regulatory risks, and is expected to stabilize in the range of $80,000 to $90,000 in the near term.

Ethereum's Dominance Declines, Altcoin Narrative "Fleeting"

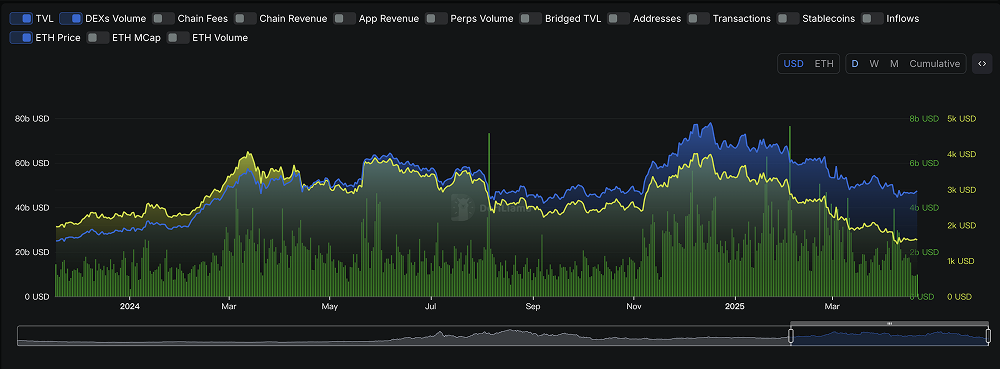

The Matrixport report points out that Ethereum, as the core driving force of the crypto economy, has seen its market influence significantly weakened since the ETF launch. If Ethereum is likened to the "oil" of the crypto market, the current market state resembles a "deep recession." The report analyzes that over the past year, the altcoin market has experienced multiple narrative booms, such as Dogwifhat, Virtual Tokens, and Trump-related theme tokens, but these tokens have all exhibited a typical "pyramid price structure"—rapid increases in the short term followed by swift declines, failing to generate sustained momentum.

The launch of the Ethereum spot ETF was initially highly anticipated, with expectations that it could replicate the success of the Bitcoin ETF and attract more institutional funds. However, the reality has been quite the opposite. The report shows that Ethereum's market cap share has significantly declined, failing to drive a widespread increase in other altcoins. In contrast, Bitcoin's dominance in the market has further solidified. Matrixport believes that for altcoins to achieve a similar surge as seen in the 2020-2021 cycle, they must rely on a surge in real-world use case demand or a massive influx of liquidity, which is currently lacking in the market.

Bitcoin Maintains High Ground, Regulatory Risks Significantly Reduced

In stark contrast to the malaise of altcoins, Bitcoin has shown robust performance during the current market adjustment period. Matrixport predicts that Bitcoin's price will fluctuate in the range of $80,000 to $90,000 in the short term, and it will be difficult to break through this range. The report notes that compared to historical bear market cycles, Bitcoin's current adjustment is relatively mild, primarily due to a significant improvement in the regulatory environment. In the past, Bitcoin's price volatility was often hampered by regulatory uncertainties, but now, the regulatory framework for crypto assets in the U.S. is becoming clearer, reducing market concerns about policy risks.

Additionally, the continued success of Bitcoin spot ETFs has also provided support for its price. Earlier reports from Matrixport indicate that since the beginning of 2024, Bitcoin ETFs have recorded a cumulative net inflow of $39 billion, primarily driven by institutional and high-net-worth investors, rather than widespread participation from retail investors. Despite recent market adjustments due to tightening global liquidity, Bitcoin continues to demonstrate strong resilience.

Liquidity Bottlenecks Constrain the Market, Three Catalysts May Be Key

Matrixport emphasizes that the future trajectory of the crypto market is highly dependent on the recovery of liquidity. The report outlines three potential liquidity catalysts that could drive up Bitcoin and altcoin prices:

- Dovish Signals or Rate Cuts from the Federal Reserve: The monetary policy of the U.S. Federal Reserve has a profound impact on the crypto market. Matrixport notes that if the Fed signals a rate cut or implements easing policies, it will significantly boost the performance of risk assets. However, current Fed Chair Jerome Powell has indicated a cautious assessment of the impact of the Trump administration's proposed tariff policies on inflation, and rates are expected to remain unchanged until the summer of 2025, making a dovish shift unlikely in the short term.

- Micro Liquidity Improvement: This includes an increase in the issuance of stablecoins and leverage in the futures market. The report observes that the recent sharp decline in stablecoin issuance has limited speculative activities and capital inflows in the market. The altcoin boom of 2020-2021 largely benefited from the rapid expansion of stablecoins, but this momentum is currently lacking.

- Macro Liquidity Expansion: Such as growth in the money supply or government stimulus measures. Matrixport analyzes that global liquidity began to decline after peaking in December 2024, and the strengthening of the dollar has further exacerbated pressure on the crypto market. If large-scale fiscal stimulus or a rebound in global liquidity occurs in the future, it could inject new vitality into the market.

Market Status and Investment Insights

According to AiCoin data, as of April 21, 2025, the total market capitalization of the global crypto market is approximately $2.67 trillion, having decreased by 0.03% in the past 24 hours, with trading volume down 21.31% to $58.49 billion, reflecting a decline in market participation and interest. The Matrixport report further indicates that trading volume for Bitcoin ETFs is sluggish, showing that investors are currently more focused on the performance of traditional stock markets and other assets, especially in the context of trade negotiations under the Trump administration and the reshaping of the global order.

For investors, Matrixport's analysis provides several key insights. First, Bitcoin remains the most defensive asset in the current market, with its price stability benefiting from institutional participation and an improved regulatory environment. Second, altcoin investors should exercise caution, as a significant liquidity catalyst is needed for a resurgence similar to that of 2021 in the short term. Finally, closely monitoring Federal Reserve policies, stablecoin market dynamics, and global macroeconomic trends will help in identifying market turning points.

Conclusion: Bitcoin Steady as a Rock, Altcoins Face a Long Road Ahead

This report from Matrixport offers profound insights into the crypto market, highlighting the starkly different performances of Bitcoin and altcoins in the current cycle. Bitcoin, with its continuous inflow of institutional funds and reduced regulatory risks, exhibits a "steady as a rock" quality, while Ethereum and other altcoins struggle due to insufficient liquidity and weak narratives. Investors must fully consider the potential impact of liquidity catalysts when formulating strategies, while remaining highly sensitive to macroeconomic and policy changes. Patience and prudence will be key to success before the next wave in the crypto market arrives.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。