Source: Cointelegraph

Original: “Saifedean Ammous: Trump vs. Bond Market, Bond Market Wins”

Analysts criticize U.S. President Donald Trump's import tariffs for their impact on finance, with some arguing that this development highlights Bitcoin's unique economic properties during times of global uncertainty.

Critics state that Trump's suspension of higher reciprocal tariffs for 90 days, restoring tariffs for most countries to a baseline of 10% except for China, exposes the vulnerability of the U.S. bond market.

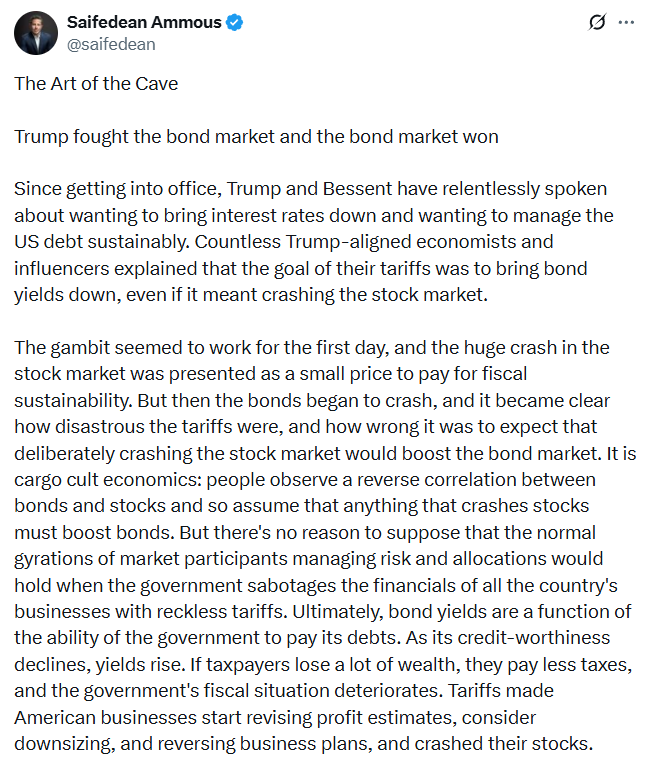

Saifedean Ammous, economist and author of "The Bitcoin Standard," suggests that Trump's decision to cancel higher tariffs may be a response to rising bond yields, indicating that the government was forced to act.

“Trump fought the bond market, and the bond market won,” Ammous said in an X post on April 23. “On the first day, this strategy seemed to work, as the significant drop in the stock market was seen as a small price to pay for fiscal sustainability.

“But then the bond market began to collapse, and people started to realize how disastrous the tariffs were, and how wrong it was to expect that deliberately collapsing the stock market would boost the bond market,” he added.

Source: Saifedean Ammous

Bond yields soared after tariff measures

Following Trump's announcement of tariffs, CNBC data shows that the 10-year Treasury yield surged from below 4% to 4.5% amid a sell-off triggered by inflation and recession fears.

10-year bond yield, 1-year chart Source: CNBC

“The rise in yields is completely contrary to the government's desired outcome, reversing direction just half a day after the tariffs took effect, which is devastating for Trump's negotiating position,” Ammous said.

Some analysts, including Raoul Pal, founder of Global Macro Investor, suggest that the tariff maneuvering may just be a “posture” in the U.S.-China trade agreement.

“Looking back now, all the talk about China yielding under Trump's threats sounds ridiculous, as Trump couldn't maintain his tariffs for even two days,” Ammous said, adding that China had “absolutely no willingness” to extend a hand for an agreement.

According to Nansen analysts, delays in reaching a trade agreement could limit the recovery of stock and cryptocurrency markets, depending on the outcome of trade negotiations.

Meanwhile, Bitcoin's performance is “not like tech stocks, but more like a hedge against economic uncertainty,” Nexo analyst Ilya Kalchev told Cointelegraph after Trump stated he would “significantly reduce tariffs on Chinese goods.”

Trade war reignites demand for Bitcoin standard

This situation has reignited the long-standing proposal of backing the dollar with Bitcoin.

Ammous argues that the U.S. should continue to buy Bitcoin until the government holds enough Bitcoin to fully back the dollar supply, ultimately transitioning to a Bitcoin standard:

“Continue buying Bitcoin until the value of Bitcoin held by the U.S. government is sufficient to support the entire dollar supply, then adopt a Bitcoin standard, where the dollar can be exchanged for Bitcoin, and the government will never spend more than its income.” Historically, the dollar was backed by gold and could be exchanged for a fixed amount of precious metal until 1933, when President Franklin Roosevelt suspended gold convertibility in response to the Great Depression.

In 1971, President Richard Nixon stopped the dollar's convertibility into gold, aiming to protect the U.S. gold reserves and stabilize the economy, marking the beginning of the fiat currency system that still exists today.

Bitcoin's fixed supply, hard-coded in its tokenomics, makes it a popular digital competitor to gold.

Joe Burnett, head of market research at Unchained, predicts that Bitcoin could match or exceed gold's market value within the next decade, expecting Bitcoin's price to surpass $1.8 million by 2035.

Related articles: Bitcoin (BTC) could replicate gold's surge, with prices expected to break the $150,000 mark if the current strong momentum continues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。