Global liquidity is the key factor driving Bitcoin prices.

Written by: fejau

Translated by: Luffy, Foresight News

I want to write down some thoughts that I have been pondering repeatedly, which is how Bitcoin might perform during a significant shift in capital flow patterns that it has never experienced since its inception. I believe that once the deleveraging process ends, Bitcoin will present an excellent trading opportunity. In this article, I will elaborate on my thoughts in detail.

What are the key driving factors of Bitcoin prices?

I will draw on the research conducted by Michael Howell regarding the historical driving factors of Bitcoin price movements, and then use these findings to further understand how the interwoven factors may evolve in the near future.

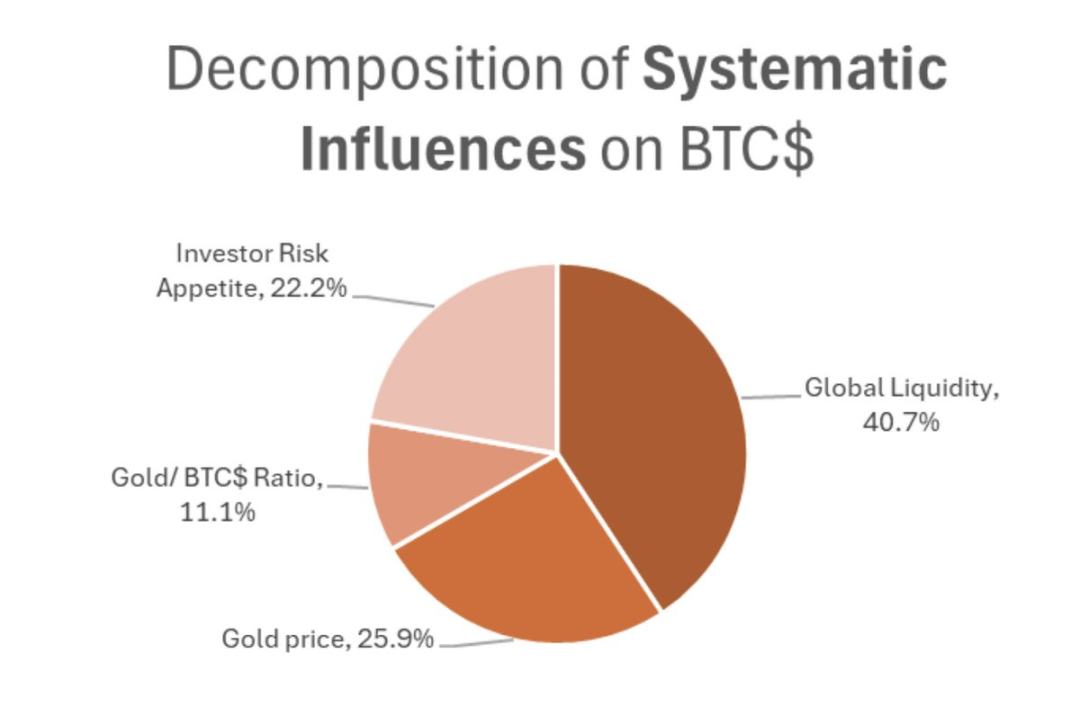

As shown in the above chart, Bitcoin prices are driven by these factors:

- Overall investor preference for high-risk, high-beta assets

- Correlation between Bitcoin and gold

- Global liquidity

Since 2021, I have understood that a simple framework of risk preference, gold performance, and global liquidity is to observe the ratio of fiscal deficit to Gross Domestic Product (GDP) as a quick observation indicator to gain insight into the dominant fiscal stimulus factors in the global market since 2021.

Mechanically, a higher ratio of fiscal deficit to GDP leads to increased inflation and rising nominal GDP, which means that for companies, since revenue is a nominal indicator, their earnings will also increase. For those companies that can enjoy economies of scale, this is a positive for their profit growth.

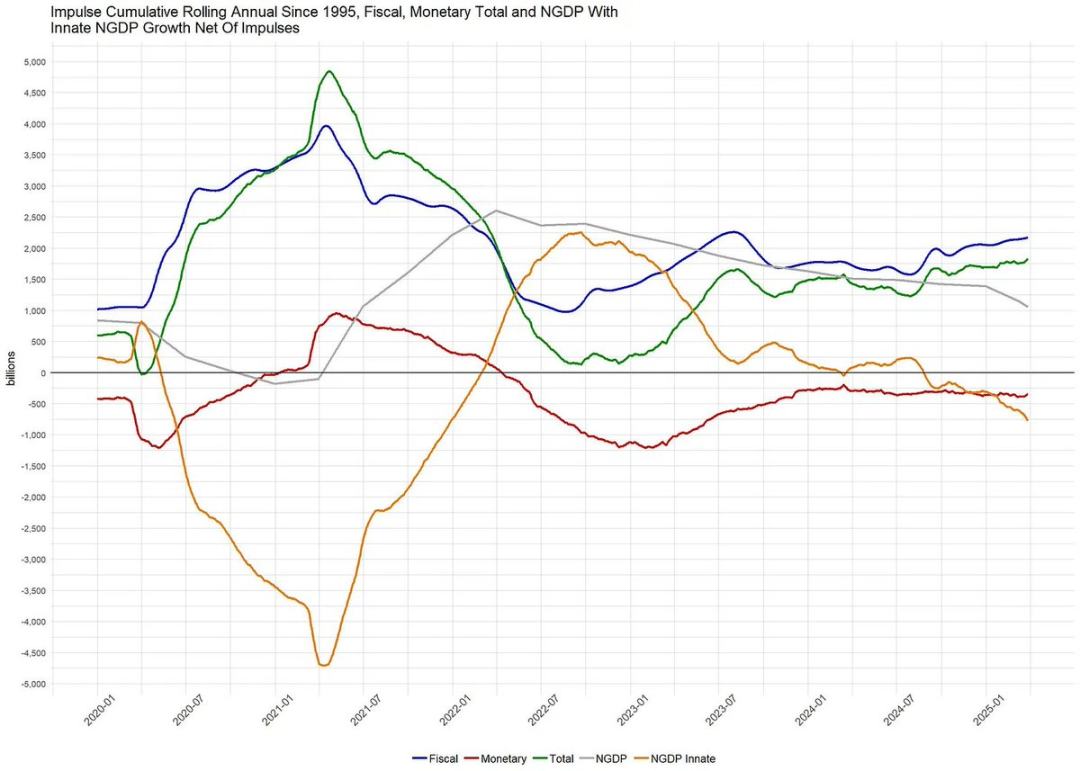

To a large extent, monetary policy has remained secondary in the face of fiscal stimulus, with fiscal stimulus being the main driving force behind risk asset activity. As shown in this chart frequently updated by George Robertson, U.S. monetary stimulus has been very weak compared to fiscal stimulus, so I will not consider monetary stimulus factors in this discussion.

From the chart below, which represents major Western developed economies, we can see that the U.S. fiscal deficit as a percentage of GDP is far higher than that of other countries.

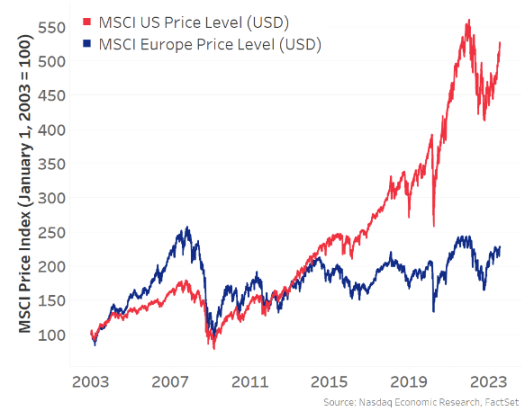

Due to such a large fiscal deficit in the U.S., revenue growth dominates, making the U.S. stock market perform better relative to other economies:

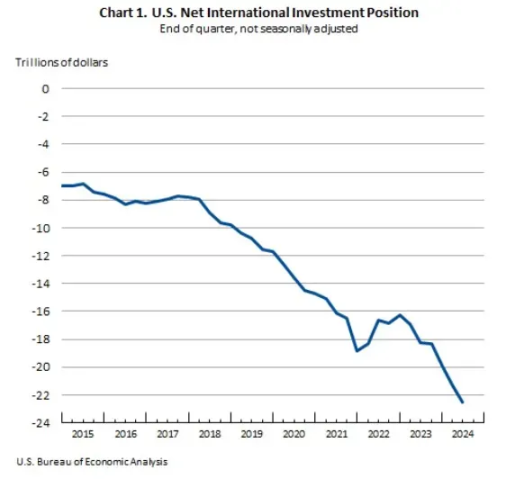

The U.S. stock market has been the main marginal driver of risk asset growth, wealth effect, and global liquidity, thus becoming a gathering place for global capital, as capital is treated best in the U.S. This dynamic of capital inflow into the U.S., combined with a massive trade deficit, leads the U.S. to exchange goods for foreign-held U.S. dollars, which these foreigners then reinvest in dollar-denominated assets (such as U.S. Treasuries and the "Seven Giants" tech stocks), making the U.S. the main driver of risk preference globally:

Now, returning to the research by Michael Howell mentioned earlier. Over the past decade, risk preference and global liquidity have been primarily driven by the U.S., and since the COVID-19 pandemic, this trend has accelerated due to the U.S. fiscal deficit being extremely large compared to other countries.

Because of this, although Bitcoin is a global liquidity asset (not just related to the U.S.), it has shown a positive correlation with the U.S. stock market, and this correlation has been increasing since 2021:

Now, I believe that this correlation between Bitcoin and the U.S. stock market is spurious. When I use the term "spurious correlation," I mean it in a statistical sense, indicating that I believe a third causal variable not shown in the correlation analysis is the true driving factor. I think this factor is global liquidity, which, as mentioned earlier, has been dominated by the U.S. over the past decade.

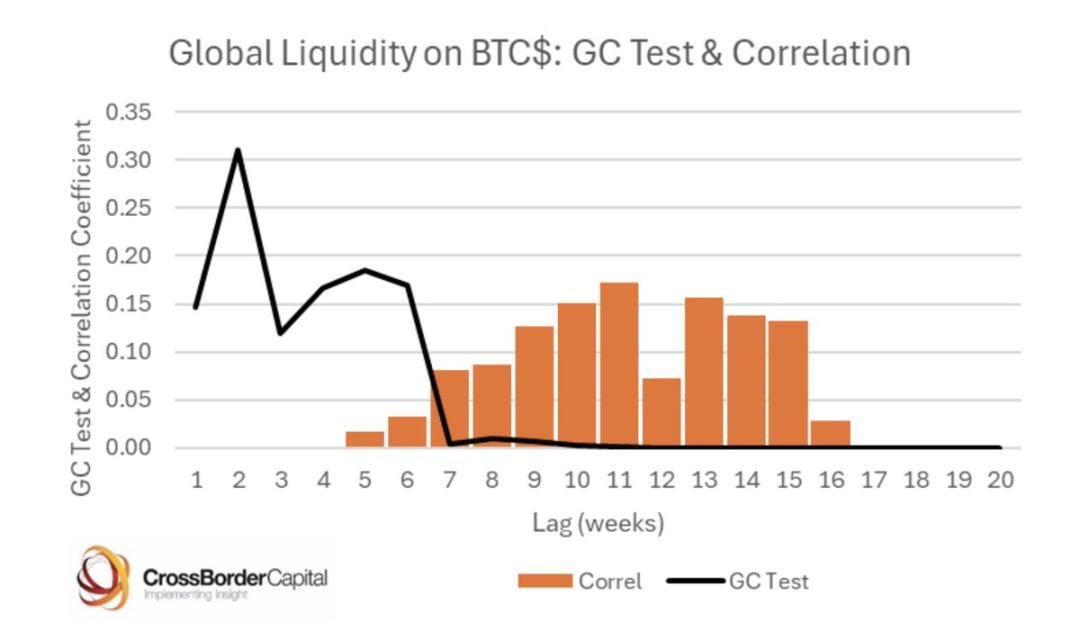

When we delve into statistical significance, we must also determine causality, not just positive correlation. Fortunately, Michael Howell has also done some excellent work in this area, establishing the causal relationship between global liquidity and Bitcoin through the Granger causality test:

What conclusions can we draw from this as a benchmark for our further analysis?

Bitcoin prices are primarily driven by global liquidity, and since the U.S. has been the dominant factor in global liquidity growth, a spurious correlation has emerged between Bitcoin and the U.S. stock market.

In the past month, as we have all been speculating on Trump's trade policy objectives and the restructuring of global capital and commodity flows, several major viewpoints have emerged. I will summarize them as follows:

- The Trump administration aims to reduce trade deficits with other countries, which, mechanistically, means that the flow of U.S. dollars to foreign countries will decrease, and these dollars would have been reinvested in U.S. assets. To avoid this, trade deficits cannot be reduced.

- The Trump administration believes that foreign currencies are artificially undervalued, the dollar is artificially overvalued, and they hope to rebalance this situation. In short, a weaker dollar and stronger foreign currencies will lead to rising interest rates in other countries, prompting capital to flow back home to capture these interest rate gains, as these gains will be better from a currency-adjusted perspective, while also promoting the development of domestic stock markets.

- Trump's "shoot first, ask questions later" approach in trade negotiations is prompting other countries to escape their relatively thin fiscal deficit situations compared to the U.S. and invest in defense, infrastructure, and overall protectionist government investments to make themselves more self-sustaining. Regardless of whether tariff negotiations ease (such as those with China), I believe "the genie is out of the bottle," and countries will continue this effort without easily turning back.

- Trump wants other countries to increase their defense spending as a percentage of GDP, as the U.S. has borne a significant amount of this cost. This will also increase fiscal deficits.

I will set aside my personal views on these points for now, as many have already commented on them, and I will simply focus on the potential impacts if these viewpoints develop logically:

- Funds will leave dollar-denominated assets and flow back to their home countries. This means that the performance of the U.S. stock market will lag behind that of other regions, bond yields will rise, and the dollar will depreciate.

- The countries to which these funds flow back will no longer be constrained by fiscal deficits, and other economies will begin to spend heavily and print money to fill the increasing fiscal deficits.

- As the U.S. continues to shift from a global capital partner to a protectionist role, holders of dollar assets will have to raise the risk premium associated with these previously considered high-quality assets and must set wider safety margins for these assets. When this happens, it will lead to rising bond yields, and foreign central banks will be interested in diversifying their balance sheets, no longer relying solely on U.S. Treasuries, but turning to other neutral assets like gold. Similarly, foreign sovereign wealth funds and pension funds may also make such diversification adjustments to their portfolios.

- The opposing view to these points is that the U.S. is the center of innovation and technology-driven growth, and no other country can replace this position. Europe's bureaucracy and socialist tendencies are too strong to develop capitalism like the U.S. I understand this viewpoint, and it may mean that this will not be a long-term trend, but rather a mid-term trend.

Returning to the title of this article, the first round of trading is to sell off the globally over-allocated dollar assets and avoid the ongoing deleveraging process. Due to the severe over-allocation of these assets globally, when large fund managers and more speculative participants like multi-strategy hedge funds hit their risk limits, the deleveraging process may become chaotic. When this happens, it will be similar to days of margin calls, where a large number of assets need to be sold to raise cash. The key now is to survive this process and maintain sufficient cash reserves.

However, as the deleveraging process stabilizes, the next round of trading begins. Diversifying the portfolio to include foreign stocks, foreign bonds, gold, commodities, and even Bitcoin.

In the market rotation and on days without margin calls, we have already begun to see this dynamic gradually forming. The U.S. Dollar Index (DXY) is falling, the U.S. stock market is underperforming compared to stock markets in other regions, gold prices are soaring, and Bitcoin is showing surprisingly strong performance relative to traditional U.S. tech stocks.

I believe that as this situation unfolds, the marginal growth of global liquidity will shift to a state completely opposite to what we have been accustomed to in the past. Other regions of the world will take up the banner of increasing global liquidity and risk preference.

When I think about the risks of diversifying investments in this context of a global trade war, I worry that deeply investing in risk assets in other countries may bring tail risks, as there could be negative headlines regarding tariffs that could impact these assets. Therefore, in this transition process, gold and Bitcoin have become my top choices for global diversification investments.

Gold is currently performing extremely well, setting new historical highs every day. However, although Bitcoin has shown surprisingly strong performance throughout this shift, its beta correlation with risk preference has so far limited its gains, failing to keep pace with gold's excellent performance.

So, as we move towards a global capital rebalancing, I believe the next trading opportunity after this round of trading lies in Bitcoin.

When I compare this framework with Howell's correlation research, I find that they align well:

- The U.S. stock market is not influenced by global liquidity but only by liquidity measured by fiscal stimulus and some capital inflow effects. However, Bitcoin is a global asset that reflects the broad state of global liquidity.

- As this viewpoint gradually gains acceptance and risk allocators continue to rebalance, I believe risk preference will be driven by other regions of the world, rather than the U.S.

- Gold's performance is excellent, and Bitcoin has some correlation with gold, which aligns with our expectations.

Taking all these factors into account, I see for the first time the possibility of Bitcoin decoupling from U.S. tech stocks. I know this is a high-risk idea and often marks local peaks in Bitcoin prices. But the difference this time is that significant and lasting changes in capital flows may occur.

Therefore, for a macro trader like me who seeks risk, Bitcoin feels like the most worthwhile trade to participate in after this round of trading. You cannot impose tariffs on Bitcoin; it does not care which country's borders it is within. It offers high beta returns for the portfolio and has no tail risks associated with U.S. tech stocks. I do not need to judge whether the EU can solve its problems, and it provides exposure to global liquidity, not just U.S. liquidity.

This market pattern is precisely the opportunity for Bitcoin. Once the dust of deleveraging settles, it will be the first to take off and accelerate forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。