The so-called dTAO upgrade is actually more like providing OGs with an opportunity to exit liquidity.

Written by: Thinking Weird

I’m starting a long post to document my thoughts: why #Bittensor is a scam and $TAO is heading towards zero?

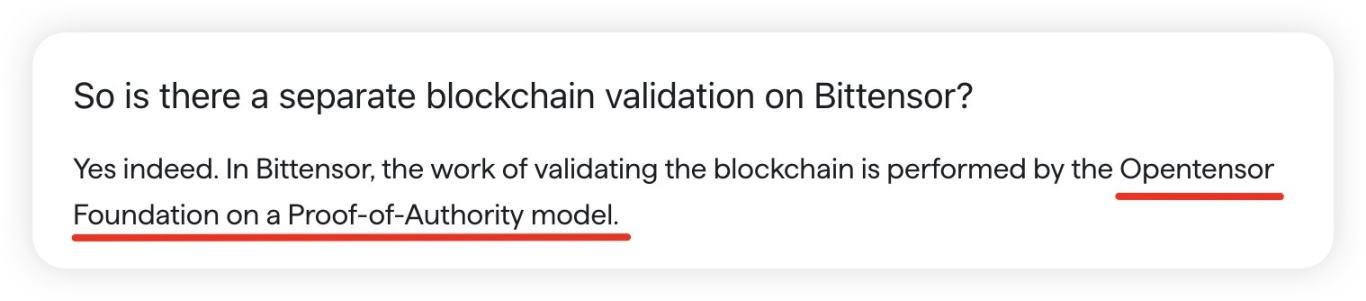

First of all, although Bittensor officially touts itself as a "fair mining" project, the underlying Subtensor is neither a PoW public chain nor a PoS public chain; it is a single-chain managed by the Opentensor Foundation (the foundation of Bittensor), and the mechanism is very opaque.

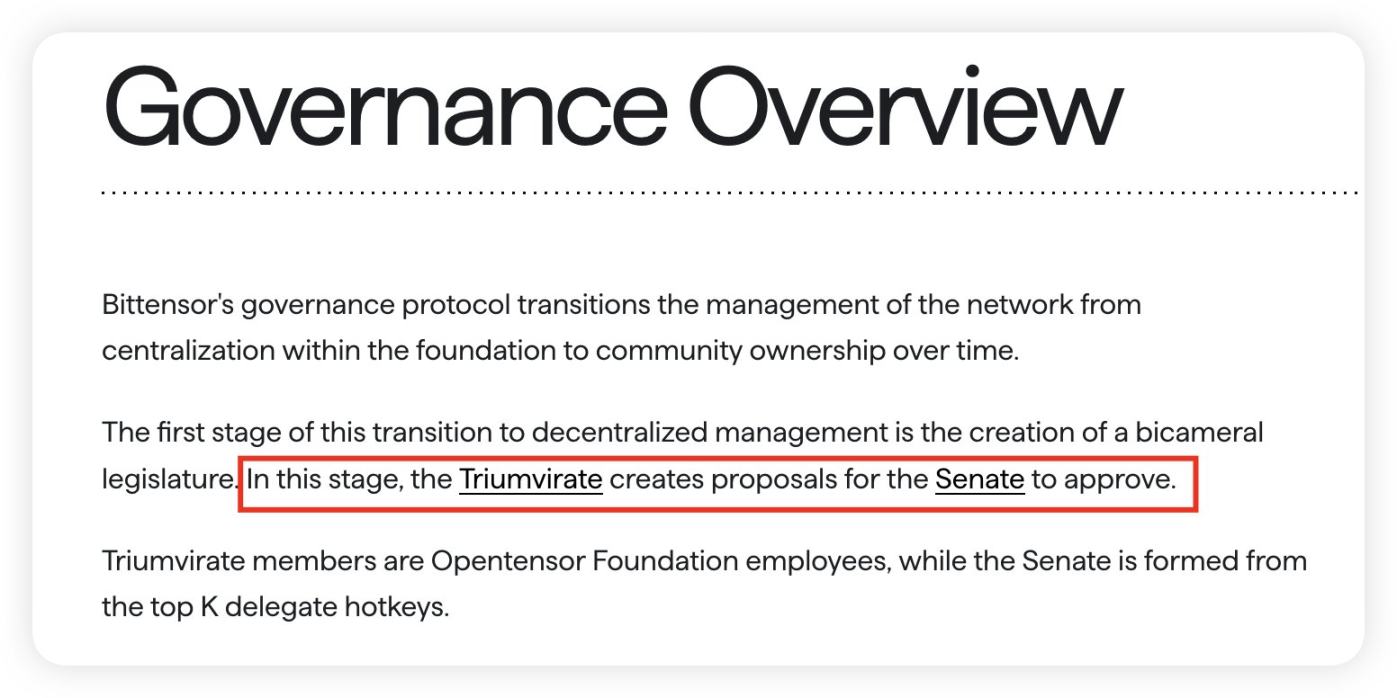

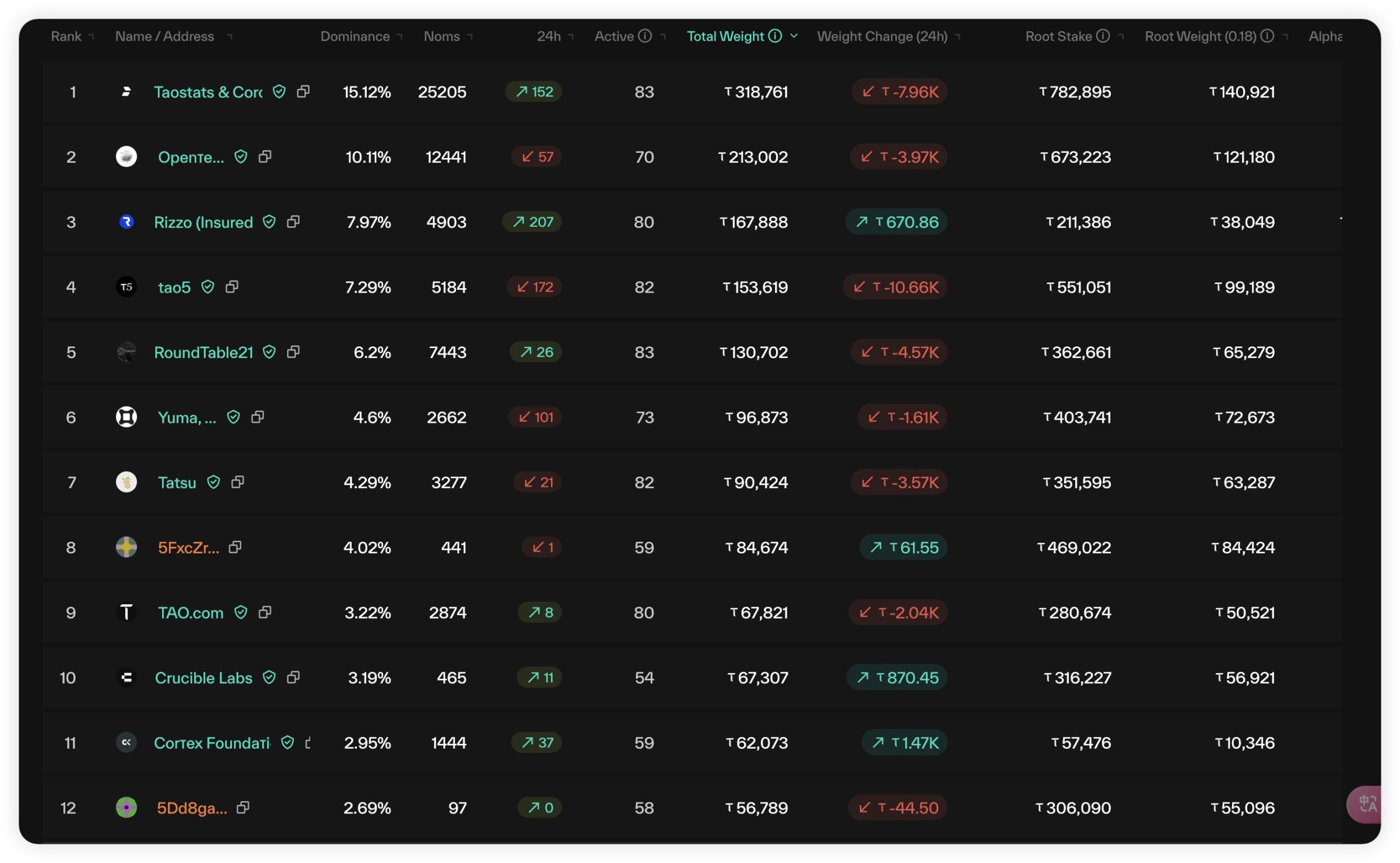

As for the so-called "three giants + Senate" dual governance structure, the three giants are three employees of the Opentensor Foundation, and the Senate consists of the top 12 validating nodes, all of whom are insiders or stakeholders.

Secondly, the release of "Kusanagi" on January 3, 2021, marked the activation of the Bittensor network, allowing miners and validators to start receiving the first batch of TAO rewards. From the network activation to the launch of the subnet on October 2, 2023, over the span of 2 years and 9 months, Bittensor has mined a total of 5.38 million TAO. However, there are no documents or materials explaining the rules for the distribution of tokens generated during the period from January 3, 2021, to October 2, 2023, when the subnet went live, nor their final destination.

It can be reasonably speculated that this portion of tokens has been divided among internal members and interest groups, as Bittensor is not like Bitcoin; it is incubated and invested by VCs.

If we divide this portion of tokens by the current issuance of 8.61 million, it means that at least 62.5% of TAO is in the hands of internal members and interest groups. Additionally, the Opentensor Foundation and some invested VCs also operate validating node businesses on Bittensor, so the proportion of chips in their hands is likely to be more than this 62.5% figure.

Like the OM that collapsed a few days ago, all those projects whose market value you don’t understand why it’s so high often have distorted market caps created by poor liquidity.

Billions market cap backed by poor liquidity.

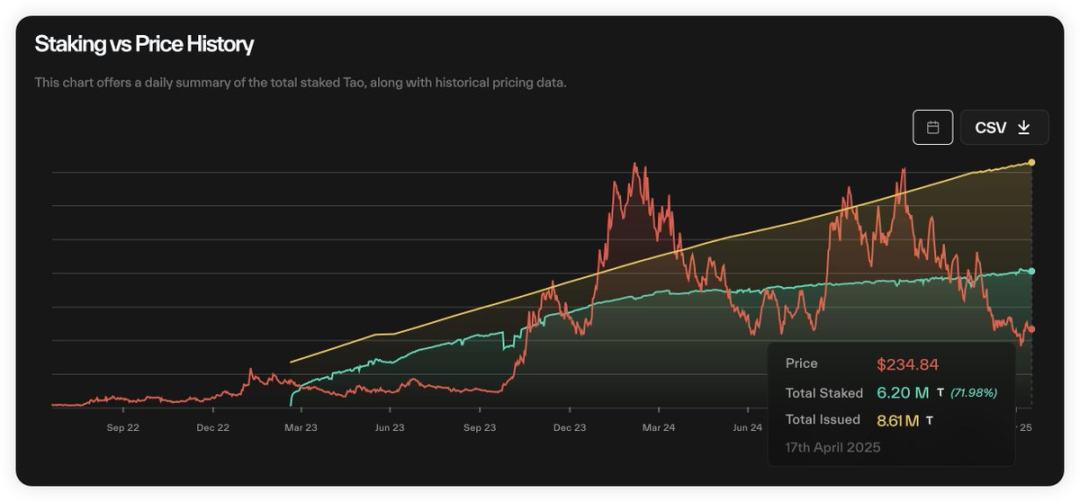

The following chart shows the historical staking situation of TAO; do not be deceived into thinking that the staking rate of TAO has gradually increased from low to high. It is drawn this way because TAO is experiencing severe inflation.

In fact, the staking rate of TAO has never been below 70%, and at its highest, it was close to 90%. Based on TAO's current market cap of $2 billion, this means that at least $1.4 billion worth of TAO has never participated in circulation. The actual market cap of TAO is only $600 million, while the corresponding FDV is as high as $5 billion, a typical low liquidity, high market cap project.

The so-called number one AI project by market cap, how the bubble has been inflated by the main players, please savor it.

Finally, the so-called dTAO upgrade is actually more like providing OGs with an opportunity to exit liquidity. It allows you to buy subnet tokens with high multiples, taking over the TAO in the hands of interest groups.

According to the three plate theory, the dTAO upgrade of Bittensor in February this year was introduced under the circumstances where the "dividend plate" was difficult to sustain, necessitating the introduction of new Ponzi scheme models "split plate" and "mutual aid plate" to deleverage. The core purpose is to fabricate a new narrative to attract new external liquidity to continue to extract, as the old narrative weakens and external liquidity is quickly exhausted.

First is the "split plate": by allowing all subnets to issue tokens, TAO successfully positions itself as the base currency for all Bittensor subnet tokens, its value supported by dozens of (and increasingly more) subnet tokens.

Due to the shallow depth of trading pools, subnet tokens often experience astonishing increases. Through this, Bittensor presents a facade to the outside world that the ecosystem can provide high ROI opportunities. The exaggerated nominal ROI provided by subnet Alpha tokens artificially creates significant buying pressure for TAO and provides cover for the root network validating nodes to sell TAO.

Unfortunately, Bittensor's closed ecosystem, combined with the market environment shifting from bull to bear, has resulted in the dTAO upgrade failing to attract sufficient external liquidity, and even internal liquidity (those TAO staked in the root network) has not been adequately mobilized.

At the same time, the lowering of entry barriers for subnets and the lack of limits on their number have led to excessive and rapid token issuance, diluting the already limited overall liquidity of the Bittensor ecosystem.

Next is the "mutual aid plate." Unfortunately, the token issuance of Bittensor's subnets cannot establish a mutual aid plate model like http://Pump.fun on Solana, where funds can circulate highly, because Bittensor's network infrastructure is very poor, and even different subnet tokens cannot be exchanged, making it difficult for participants of subnet tokens to migrate liquidity between different subnets. This further exacerbates the liquidity dilution problem caused by high split rates, making it impossible to keep funds continuously participating in speculation within the venue.

Once the large stakers of the root network start to collectively flee, liquidity both on and off the market will quickly dry up.

The moment you sell, game over.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。