2026 Week 7 Bitcoin On-chain Data Changes — — Macroeconomic data improved, and liquidity significantly decreased during the Spring Festival.

In the past week, two important macroeconomic data were released, both of which were positive. One was the non-farm payroll data, with the unemployment rate and non-farm employment both improving, indicating that the resilience of the U.S. economy is still quite good, and the U.S. has moved a step further away from an economic recession. However, this also means that the Federal Reserve will pay more attention to inflation data, reducing the expectations of potential interest rate cuts.

Following that, the CPI data released also greatly exceeded expectations. Before the inflation data was announced, the market was overwhelmingly pessimistic, with many institutions, including Goldman Sachs, expecting inflation to surpass previous values and predictions. However, the result showed that inflation data actually decreased, which left investors seeking safe havens the day before quite frustrated.

Even so, investors still hold a very pessimistic view regarding the Fed cutting interest rates in March. Currently, the expectations for a March rate cut given by CME and prediction markets are less than 15%, which has impacted market sentiment and liquidity. However, it is well known that Powell will step down from the Fed Chair position in May, and at that time, there is a high possibility that Waller will call for easing measures from the Fed, so the focus on interest rate cuts should still look towards after June.

BTC and ETH long-term holder NUPL value

From a data perspective, Bitcoin has entered a phase of alternating bull and bear markets, while Ethereum has not only entered a bear market cycle but nearly reached a deep bear state for one day.

A week later, $BTC and $ETH did not show any improvement. Although macroeconomic data has temporarily stabilized investors' confidence in the U.S. economy, it is still difficult to expect additional liquidity without interest rate cuts. Therefore, from the data, BTC is in a transitional phase from bull market to bear market; if there is a significant negative event, BTC may test $60,000 again.

Data for ETH still indicates a bear market state, but it has not reached a deep bear level suitable for bottom fishing. Of course, I do not know if there is still an opportunity to enter the deep bear represented by red, but it is indeed apparent that, at present, ETH offers a better cost-effectiveness for bottom fishing compared to Bitcoin.

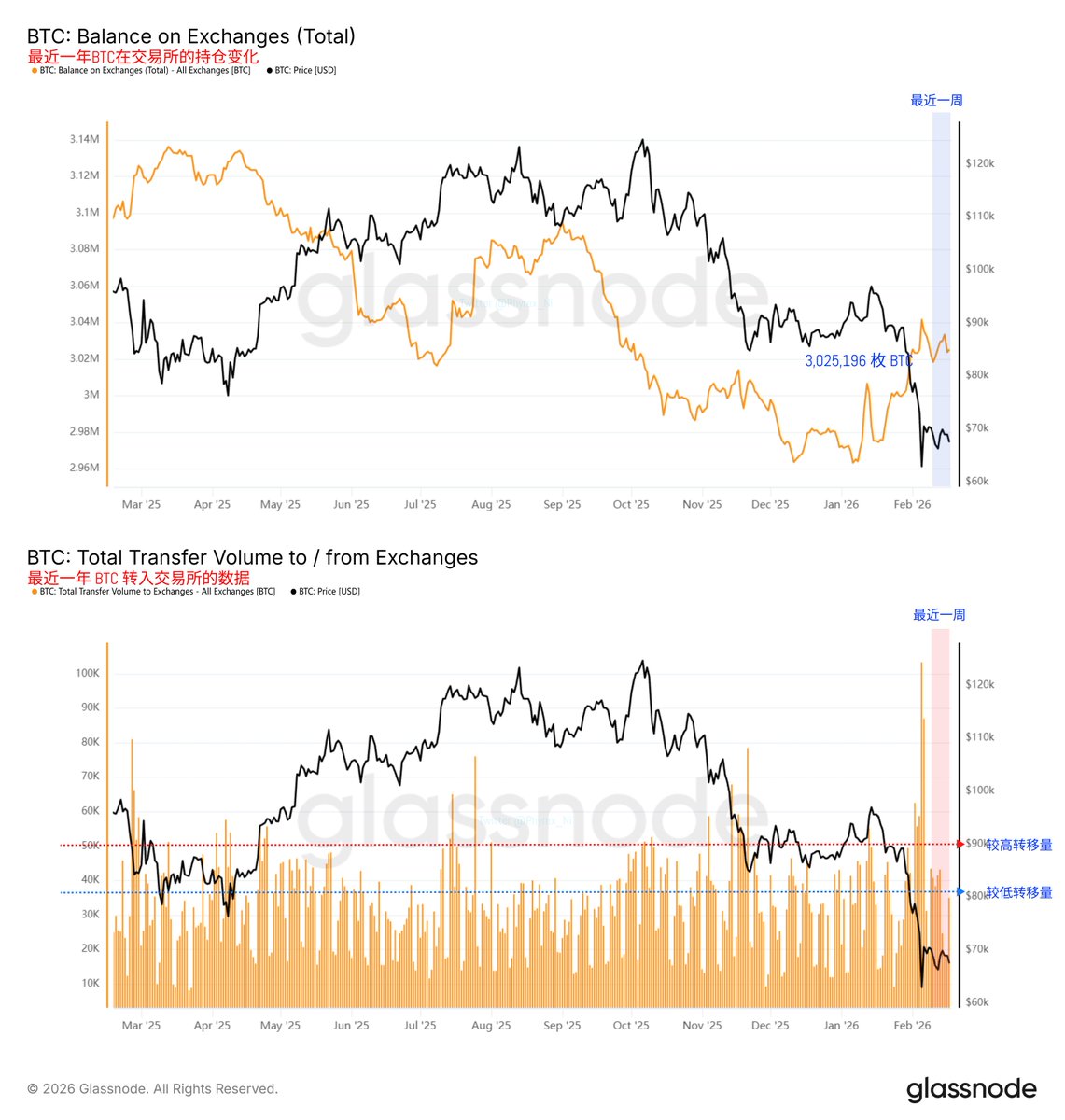

Stock and inflow data for all exchanges holding BTC

This week, in addition to important macroeconomic data, several Asian countries celebrated New Year, especially China's Spring Festival, which significantly impacted the market's liquidity. Furthermore, combined with U.S. holidays, the overall liquidity in the market can be imagined. With the price of $BTC fluctuating around $68,000, even with insufficient liquidity, nearly 10,000 Bitcoin were newly added as assets in exchanges.

Looking at a longer timeframe, since entering 2026, the BTC stock across all exchanges has increased by nearly 60,000 unprocessed stocks. However, based on data showing transfers to exchanges, there has indeed been a decrease in transfer volume recently, indicating that investors wishing to sell have begun reducing before the holiday. This likely suggests that around $60,000 is quite a good entry point.

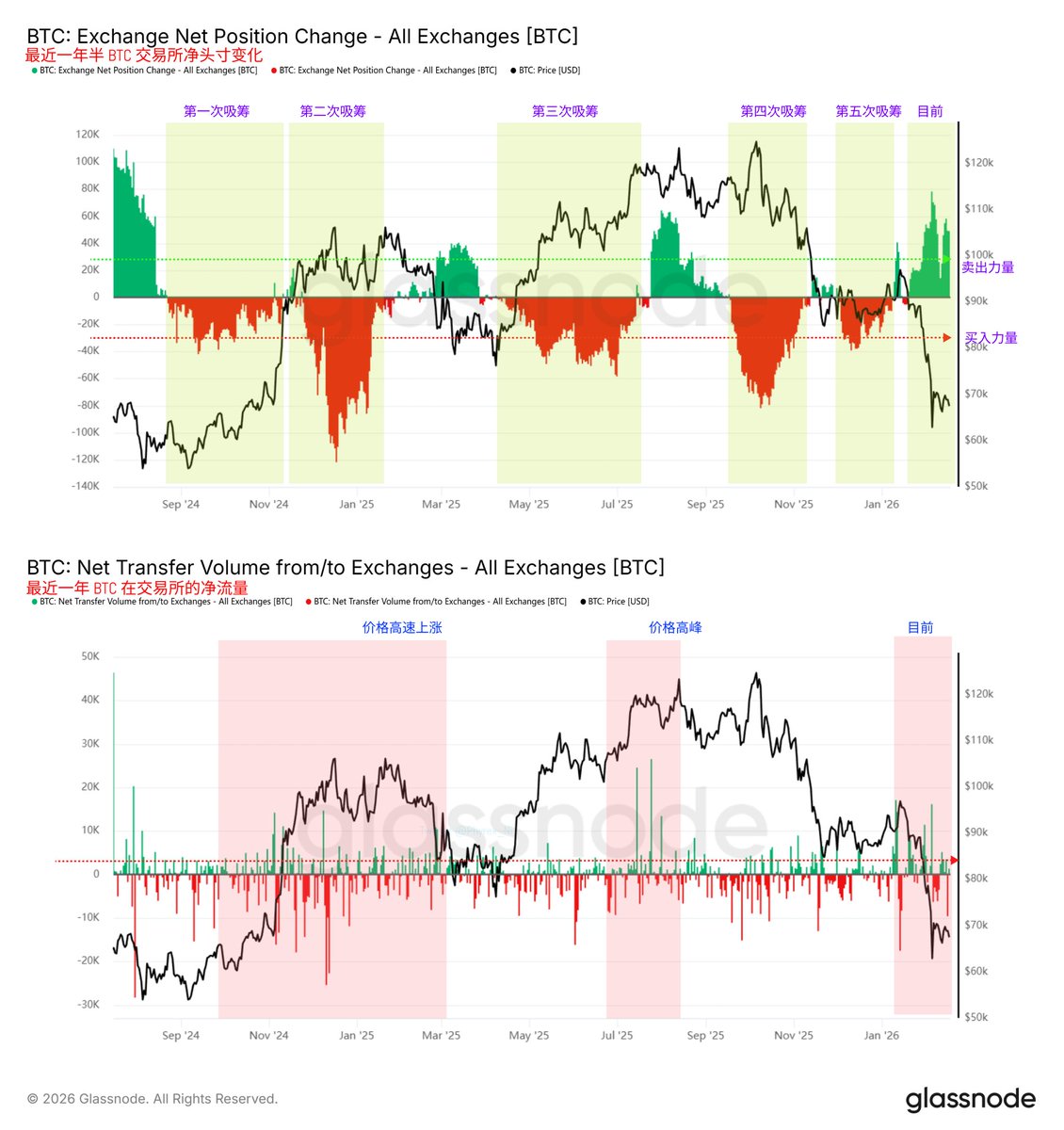

30-day positions of BTC held on exchanges and net flow

However, from the purchasing power data, the market's performance remains abysmal. The 30-day position for $BTC reveals that just a few days prior to the holiday, there were signs of recovery in purchasing power, which then vanished. The current state of BTC in exchanges maintaining a balance between buying and selling is already considered decent, while in reality, the selling pressure during this period has been consistently increasing.

From net flow data, it can also be seen that with the drop in BTC prices, the selling pressure moving into exchanges has indeed been greater than withdrawals from exchanges recently. Investor sentiment and the willingness to invest remain low; unless a strong positive event occurs in the market, it is estimated that it can only experience slow fluctuations alongside the U.S. stock market.

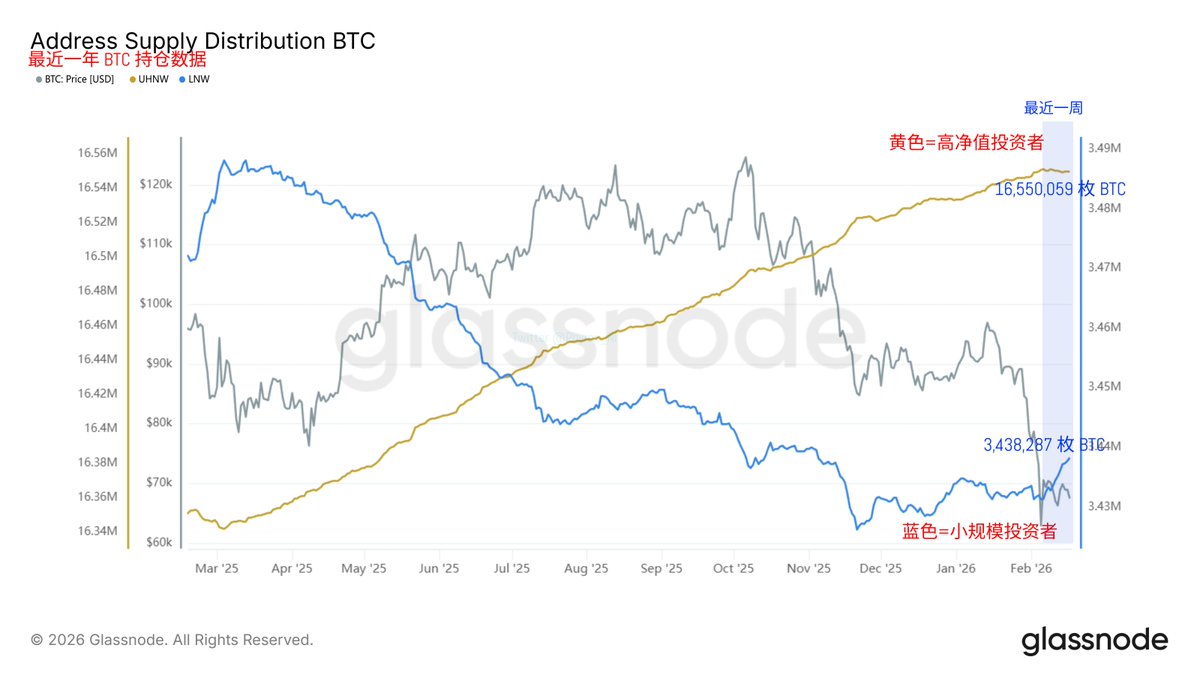

Distribution of BTC holdings over the past year

Although the data indicates that purchasing power is insufficient, from the distribution of holdings, particularly in the past week, small investors holding less than 10 Bitcoin have been brave enough to bottom fish, especially when the price of $BTC fell to around $60,000. The sentiment among small investors has been exceptionally high, similar to the situation where many retail investors are buying up U.S. stocks.

On the other hand, high net worth users holding more than 10 BTC have not seen much change in the past week, with only a reduction of over 500 BTC from a holding of more than 165,000 BTC. More high net worth users are still in a wait-and-see phase.

In summary, the market has been relatively calm this week without generating significant fluctuations. Most investors currently do not have plans to sell or buy, likely wanting to wait for the month-end tariff decrease to materialize or aiming to confirm the ongoing struggle between Trump and the Federal Reserve.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。