Original Title: Building Permissionless Neobanks

Original Author: Jay Yu

Original Translation: Ken, ChainCatcher

This is a 4,000-word research report on storing, consuming, appreciating, and lending funds within the cryptocurrency space.

Introduction

Today, no matter which bank or fintech application you use — whether it's Bank of America, Revolut, JPMorgan Chase, or SoFi — browsing their user interface reveals that it is almost uniform: accounts, payments and transfers, earning yields. This design exposes a potential commonality: banks serve as interfaces for the four fundamental relationships we have with money:

Today, no matter which bank or fintech application you use — whether it's Bank of America, Revolut, JPMorgan Chase, or SoFi — browsing their user interface reveals that it is almost uniform: accounts, payments and transfers, earning yields. This design exposes a potential commonality: banks serve as interfaces for the four fundamental relationships we have with money:

Storage: A place to keep assets

Consumption: A means for transferring funds for daily expenses

Appreciation: A set of tools for managing wealth either passively or actively

Lending: A place to borrow funds

In the past decade, mobile technology has driven the rise of "neobank" applications like SoFi, Revolut, and Wise, which democratize financial services and redefine what "banking" means, replacing physical branches with intuitive, always-online digital interfaces.

Now, as cryptocurrency enters its second decade, it offers a new blueprint for future developments. From self-custody wallets to stablecoins, to on-chain credit and yields, the permissionless and programmable characteristics of blockchain enable a global, instantaneous, and composable banking experience. If mobile technology fostered neobanks, then cryptocurrency has introduced permissionless neobanks: a unified, interoperable, self-custodial interface for storing, consuming, appreciating, and lending funds in the on-chain economy.

History of Neobank Development in Fintech

Similar to cryptocurrency, neobanks rose rapidly after the 2008 financial crisis. Unlike traditional banks that replicate the layout of physical branches, neobanks operate as technology platforms, providing banking services through mobile interfaces. Most neobanks collaborate with partner banks behind the scenes to offer deposit insurance and compliance infrastructure while maintaining front-end customer relationships. With swift registration processes, transparent fees, and digital-first designs, many neobanks have become the preferred platforms for users to store, consume, and appreciate funds.

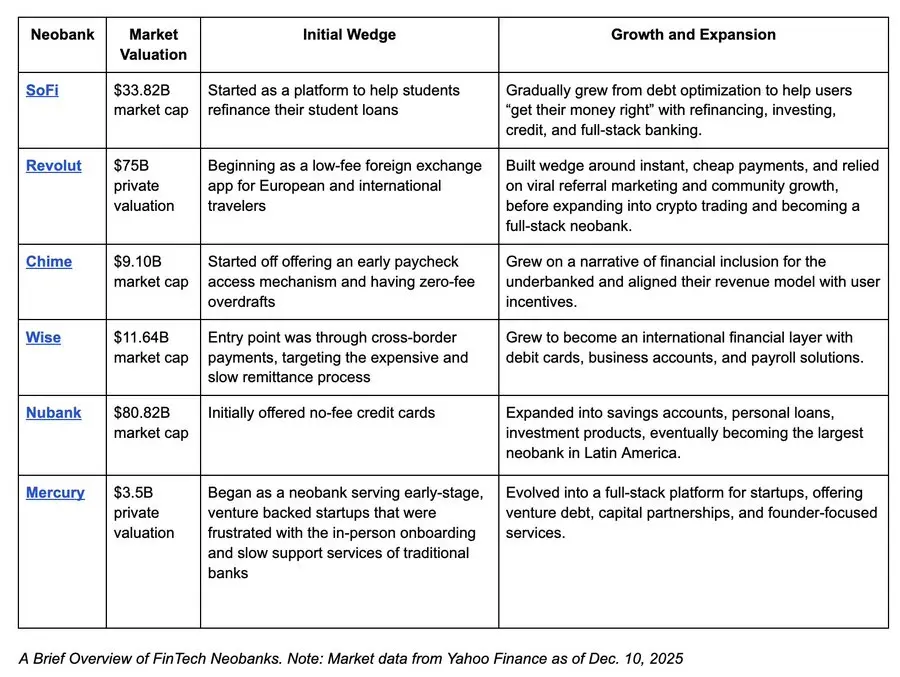

As we observe the development journey of these billion-dollar valued neobank startups, we find their commonality in seizing customer relationships through unique digital products (such as refinancing, early wage access, and transparent forex rates), initiating a user-driven volume flywheel, and then expanding product lines by marketing high-value products to users. In short, the success of fintech neobanks lies in controlling the interactive interface between users and funds, changing the media through which users store, consume, appreciate, and lend funds.

Today, the phase of cryptocurrency development is quite similar to the development phase of neobanks 5-10 years ago. Over the past decade, cryptocurrency has developed its unique advantages: censorship-resistant asset storage through self-custody wallets, convenient digital dollar transactions via stablecoins, permissionless credit markets based on protocols like Aave, and global capital markets capable of turning network memes into wealth. Just as mobile infrastructure ushered in a new banking era, programmable blockchains now provide a permissionless financial infrastructure.

The next step naturally involves integrating these permissionless backends with the seamless frontends of neobanks. The first wave of neobanks moved the bank's front end from physical stores to mobile interfaces while retaining the bank's backend; today, cryptocurrency neobanks reverse this trend: they retain the convenient mobile front end but alter how funds flow from traditional banking channels to stablecoins and public blockchains. In other words, if neobanks have recreated the front end of banking on mobile platforms, cryptocurrency now offers the opportunity to rebuild the backend on permissionless platforms.

New Landscape of Cryptocurrency Neobanks

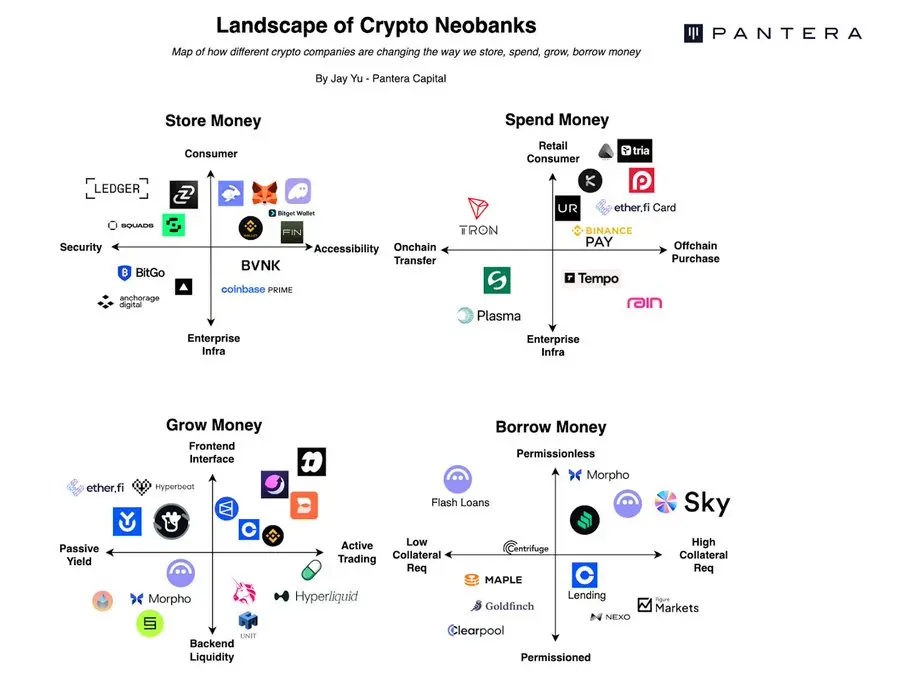

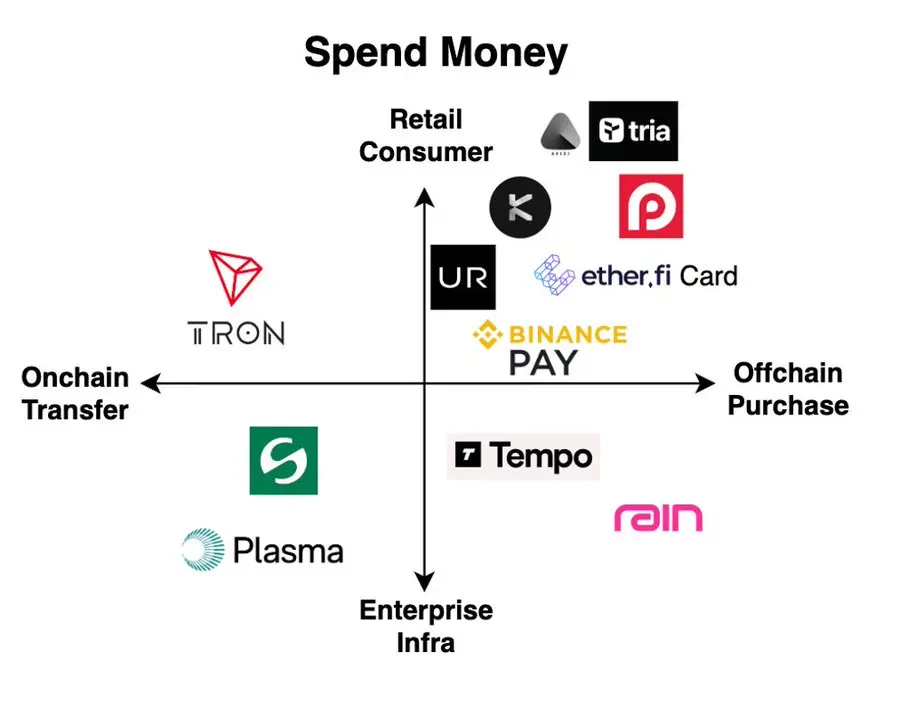

Caption: Overview of Cryptocurrency Neobanks

Today, many different projects are converging towards the vision of "cryptocurrency neobanks." It is already evident that many basic banking functionalities, such as storage, consumption, appreciation, and lending, have been realized on permissionless cryptocurrency platforms — with self-custody possible through Ledgers, consumption via EtherFi cards or Bitget QR codes, fund appreciation through trading on Hyperliquid, and lending through Morpho. Additionally, many relevant participants support the underlying infrastructure, such as wallet-as-a-service, stablecoin settlements, licensing permissions, localized deposit and withdrawal partners, and routing facilities.

Moreover, in some cases, cryptocurrency exchanges like Binance and Coinbase have made substantial progress, increasingly resembling fintech neobanks, gradually assuming more and more relationships between end users and their assets. For example, Binance Pay has supported over 20 million merchants globally, while Coinbase allows users to automatically earn up to 4% rewards simply by holding USDC on the platform.

Therefore, in light of such a complex landscape of cryptocurrency neobanks, it is worthwhile to carefully analyze how different cryptocurrency platforms are vying for the primary financial relationships with users and how they are penetrating the ways users store, consume, appreciate, and lend funds.

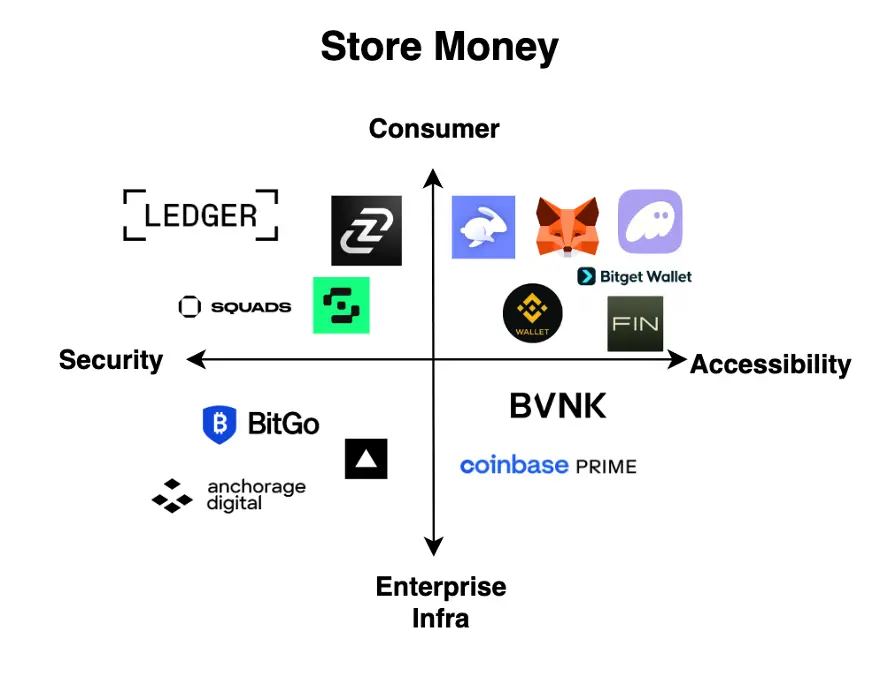

Using Cryptocurrency to Store Funds

To properly self-custody cryptocurrency assets and interact with the blockchain, users must have some form of cryptocurrency wallet. Broadly speaking, the cryptocurrency wallet market can be categorized into two dimensions: "security and usability," and "consumer applications and enterprise infrastructure." Each dimension has emerged with strong distributors: Ledger offers secure, reliable consumer hardware wallets; Fireblocks and Anchorage provide secure enterprise-grade wallet infrastructure; consumer wallets like MetaMask, Phantom, and Privy focus on enhancing usability and user experience; while Turnkey and Coinbase Prime capture more user-friendly enterprise-grade infrastructure markets.

One of the key advantages of building new banks on wallet applications is that wallet front ends — such as MetaMask and Phantom — often control the entry points for users to interact with their cryptocurrency assets. This "fat wallet theory" posits that the wallet layer occupies most of the consumer distribution and order flow, and the switching cost for end consumers regarding wallets is extremely high. In fact, it is currently estimated that 35% of Solana trading volume occurs through the Phantom wallet, thanks to its excellent mobile user experience and user retention, creating a strong moat. Furthermore, because consumers (especially retail ones) often prioritize convenience over price, wallets like Phantom and MetaMask can charge fees as high as 0.85%, while token exchange protocols like Uniswap may only charge 0.3% in fees.

On the other hand, building a complete digital bank with just a wallet is much more challenging than expected. This is because, for a wallet to achieve profitable scale, users not only need to store tokens but also need to actively use them within the wallet. While Phantom, MetaMask, and Ledger are household names, if users treat their crypto wallets simply as cash boxes hidden under the bed, they cannot be monetized. In other words, wallets must become active trading platforms to convert distribution into revenue.

MetaMask and Phantom both seem to be moving in this direction. For instance, MetaMask recently launched the MetaMask Card, designed to provide value-added services to its existing cryptocurrency-native user base, and aims to become the preferred solution for cryptocurrency payments. Phantom has also followed suit by launching Phantom Cash and integrating with Hyperliquid to offer in-app perpetual contract trading features, venturing into the "fund appreciation" arena. As Blockworks puts it, "While Drift or Jupiter might be popular homegrown platforms on Solana, Hyperliquid is where the money really flows." This lesson applies to all companies in the wallet space — you need to not only win users' wallets but also control the volume of funds flowing in and out of wallets through consumption, appreciation, and lending.

Using Cryptocurrency for Consumption

The second type of competing cryptocurrency neobank is platforms that allow users to spend cryptocurrencies. Similar to the case of "using cryptocurrency to store funds," these cryptocurrency consumption applications can also be categorized along two dimensions: on-chain transfers to off-chain purchases (e.g., buying coffee), and from retail-facing applications to enterprise-grade infrastructure.

Interestingly, many of the emerging "neobank" projects that have gained attention in recent months, such as Kast, Tria, Tempo, and Stable, have attempted to address the challenge of cryptocurrency consumption. Notably, hotspots of the neobank trend are primarily focused on two areas of "cryptocurrency consumption": (1) retail spending applications integrating stablecoin cards, such as Avici, Tria, Redotpay, and EtherFi; (2) blockchain-centric on stablecoins, such as Stable, Plasma, and Tempo, aimed at providing infrastructure for enterprise use cases.

The first type of retail-focused "consumption application" fundamentally makes cryptocurrency applications very similar to traditional banks and neobank applications in terms of user experience and interface, with familiar tabs like "home, bank, card, and investment".

As cryptocurrency card issuers like Rain and Reap become increasingly mature, along with Visa and Mastercard's expansion of stablecoin support, cryptocurrency cards are gradually becoming a homogenous product. True differentiation rests on how to drive and maintain transaction volume — whether through innovative cashback mechanisms, localized operations, or attracting non-cryptocurrency native users to these platforms. This developmental trajectory parallels the rise of fintech neobanks, whose success lies not in issuing cards or developing applications but in winning over specific customer segments — from students (SoFi) to low-income families (Chime) to international travelers (Wise and Revolut) — and building trust, loyalty, and expanding transaction volume on that basis. If executed properly, these "payment-first" neobanks are expected to become significant drivers of cryptocurrency adoption, thereby promoting the adoption of blockchain infrastructure.

Cryptocurrency neobanks may guide users toward the next generation of payment systems that transcend traditional card payment systems. Card-based consumption may only be a temporary transitional model, still relying on the payment systems of Visa and Mastercard, inheriting their centralized limitations. Early signs of future trends are emerging: wallets like Bitget Wallet have already introduced QR code-based stablecoin payments in pilot projects with merchants in Indonesia, Brazil, and Vietnam, indicating that future cryptocurrency-native settlements may entirely bypass traditional card issuers.

The second recent "neobank" applications are stablecoin infrastructure projects built for enterprises, including Stable, Plasma, Tempo, and Arc, often referred to as "stablecoin chains." Their emergence can be primarily attributed to growing demands from institutional participants — traditional banks, fintech companies like Stripe, and existing payment networks — for more efficient channels of capital flow. Many "stablecoin chains" are designed with similar functionalities, such as stablecoin Gas tokens (support for using stablecoins to pay Gas fees), simplified consensus mechanisms (to handle simple, large payments from A to B via "fast lanes"), enhancing the privacy of token transfers through trusted execution environments (TEE), and customizable data fields to better meet international payment standards like ISO 20022.

However, merely having these technical improvements does not guarantee mainstream adoption.For payment chains, the true moat lies in merchants. The key is how many merchants and businesses decide to migrate their operations to a specific payment chain. For instance, Tempo aims to leverage Stripe's vast merchant customer base and payment channels to drive transaction volume, adoption, and revenue growth, thereby onboarding a whole new batch of merchants into the cryptocurrency space. Other payment chains, such as Plasma and Stable, are focused on becoming "first-tier partners" for Tether (USDT) to facilitate the movement of this stablecoin between different institutions.

One of the most enlightening case studies is Tron, which handles about 25-30% of global stablecoin transaction volume. The rise of Tron is largely attributable to its dominance in emerging markets like Nigeria, Argentina, Brazil, and Southeast Asia. With low fees, fast final confirmations, and global coverage, Tron has become a common settlement layer for many merchants, remittances, and dollar savings accounts. For all emerging payment chains, Tron is the benchmark that they must surpass. This requires a tenfold improvement over already low-cost, fast, and globally covered payment chains — a task that necessitates focusing on merchant onboarding and network scale rather than minor technical improvements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。