Author: Shouyi, Amelia I Biteye Content Team

On New Year's Eve, the market presented a highly controversial picture: on one side was the A-shares with pre-festival high spirits and favorable policies ; on the other side was the cryptocurrency market caught in a high-level fluctuation, even breaking the "historical iron law".

Various jokes and discussions about "whether to sell coins and buy stocks" are rampant. Faced with these two distinctly different markets, how should investors choose? During this festival season, let's analyze the current investment logic with Biteye in combination with the latest data.

1. Core Conclusion: The Spring Festival Market is not a "one or the other" competition

Before diving into the data, we need to clarify a basic understanding: BTC and A-shares each have their own independent "Spring Festival effect," but a simple horizontal comparison of gains is not scientific.

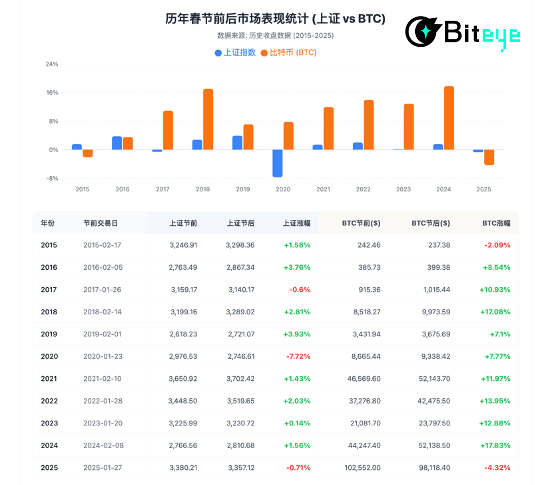

Data as of: 2026-02-14 UTC (based on CoinGecko daily OHLC data for BTC and Shanghai Stock Exchange announcements)Statistical Scope: Unified adoption of closing price from the last trading day before the Spring Festival to the closing price of the first trading day after the festival turbulence (spanning about 7-8 calendar days, excluding weekends), ensuring complete alignment of the time windows for A-shares and BTCKey Observations:

- BTC's Spring Festival Effect: Before 2025, BTC maintained a record of positive returns during the Spring Festival for ten consecutive years (2015-2024), but in 2025 it broke the "iron law" for the first time (declining by -2.3%); 2026 might continue this weak trend. This marks a transfer of BTC's pricing power from Chinese capital cycles to global macro assets.

- A-shares' Policy Red Envelope: The Spring Festival market for A-shares is mainly driven by pre-festival liquidity and post-festival policy expectations. In January 2026, the Tech Innovation 50 achieved a maximum monthly increase of 15.81%, displaying typical characteristics of "spring restlessness".

Learn from history to understand the rise and fall.

By comparing 11 years of historical data, we can observe the evolution of trends.

2. BTC's "Iron Law" is Invalidated

For a long time, the crypto market has experienced a "red envelope market" around the Spring Festival. Within a "small cycle" of seven days (the three days before to the three days after, for example, from February 14 to February 20 in 2026), it has set a record of continuous increases for ten years without fail.

Looking back at this rising "golden decade," the increase went from a slight rise of +0.8% in 2015 to nearly +20% in 2018 and 2024. This is no small "red envelope," it can be called the "year-end bonus" for crypto investors.

However, the capital market has its own way of dealing with various nonconformities.

In 2025, this "iron law" was first broken; during the Spring Festival, BTC fell from $101,332 to $98,997, a decline of -2.3%;in 2026, this curse seems to be continuing and intensifying. Within 31 days from January 15 to February 15, BTC experienced sharp market adjustments. It dropped from a peak of $97,193 to a low of $60,000. Though it rebounded to around $70,000 on Valentine's Day, the maximum drop within this range still reached 38.27%.[1]

What does this mean? In financial markets, a decline exceeding 20% is often regarded as entering a "technical bear market," while a drop approaching 40% falls into the category of deep correction or crash.

According to on-chain data, MVRV (market value to realized value ratio) has dropped to 1.25, and NUPL (unrealized profit and loss ratio) has fallen to 0.20.[2] The low levels of these two indicators show that the recent month of decline has cleared a significant amount of leveraged positions, and the market is currently in a typical deleveraging and risk-averse stage, rather than a frenzy phase.

The invalidation of the red envelope market reflects a fundamental shift in BTC's pricing power. From a cycle driven by Chinese capital, it has shifted to one dominated by Bitcoin ETFs from firms like BlackRock and Fidelity. Its trend is increasingly correlated to U.S. stocks and dollar liquidity, making the traditional seasonal patterns based on the Lunar New Year naturally ineffective.

Relying solely on a calendar strategy to buy coins really needs to change.

3. A-shares’ Policy Red Envelope

Many people believe that the crypto market is currently engulfed in bearish sentiments, while global stock markets soar, even A-shares are making vigorous moves under policy stimulus, punching down Ethereum. Coupled with a strengthening yuan exchange rate, it seems that "switching from coins to stocks" is a wise choice. We will compare from three dimensions:

First is yield and volatility. A-shares are typically policy-driven. Under strong fiscal stimulus, all A-share sector indices recorded significant gains in January, with the Tech Innovation 50 achieving a maximum monthly increase of 15.81%[3], with trading volume significantly expanding, overall presenting a pattern of "steady rise in indices, broad increase in individual stocks"; BTC, however, heavily relies on global liquidity. Although its performance during the Spring Festival was poor, BTC is still in a consolidation phase post-halving. Its underlying logic relates to dollar tides, rather than domestic policies.

Second, long-term compounding. Based on a decade of data comparison from 2016 to 2025, the average annual compound return of Bitcoin is approximately 70.16%; while taking the CSI 300 as a reference, A-shares have an average annual compound return of about 2.93%[4]. A-shares excel in short-term policy bursts, while BTC excels in long-term compounding effects and global liquidity premiums.

Third is exchange rate factors. This is the most critical variable at the moment. On February 13, 2026, as the central bank allowed the yuan to surpass the 6.90 mark before the festival, the yuan to dollar exchange rate reached a near three-year high[5]. This means that holding dollar assets (like BTC/USDT) faces natural exchange rate losses when converted back to yuan. As noted by Sina Finance, the core driver of the recent strength of the yuan is "the concentrated settlement by enterprises before the Spring Festival." This not only implies exchange rate losses but also reveals the flow of funds: real enterprises are selling off dollar positions (including some USDT over-the-counter funds) to meet the yuan payment demands for the Spring Festival. This liquidity's "blood-letting effect" naturally pressures dollar-denominated assets; while holding yuan-denominated assets (A-shares) benefits from both asset appreciation and exchange rate increase, presenting a "Davis double strike". This indeed provides strong logical support for "short-term switch to A-shares".

There is an old saying in China that those who know how to recognize the times are wise. It seems that it really is time to switch from the crypto market to A-shares?

4. Correlation Myth: A-shares and Crypto Market are Two Different Funding Logics

For those who still hold on in the crypto market, is it possible to remain steadfast in your beliefs through the "seesaw effect"? That is: A-shares are currently draining the crypto market, and when A-shares drop, funds will flow back into the crypto market?

The reality is not so.

First, there is a weak correlation between the two. A-shares are influenced by China's central bank monetary policy, while BTC is impacted by the Federal Reserve's interest rate decisions. Although there is some overlap in their funding pools (Chinese investors), at a macro level, they are two independent systems.

Secondly, there exists a certain degree of "extreme co-movement" between the two. In extreme risks, both often experience simultaneous fluctuations. For example, on February 6, 2026, the market staged a classic "triple kill" scenario—U.S. stocks, gold, and Bitcoin plummeted simultaneously. This completely disproves the simple "inverse relationship" logic.

Therefore, it is difficult to expect A-shares to crash and save the crypto market, nor should one blindly increase Bitcoin holdings because A-shares are correcting. There exists a negative correlation only under specific circumstances: that is, domestic funds may undertake cross-market allocations due to risk aversion, but this is limited by capital controls and is hard to form a scale effect.

Conclusion: Only children make choices, adults want them all

Returning to the initial question: Should we invest in stocks or cryptocurrencies during the new year?

The answer should not be a "one or the other" gamble, but a strategic combination based on the Investment Clock thinking.

Consider both domestic and international conditions. Domestic recovery expectations are strong, A-shares beta returns are enticing, making it worthwhile to allocate to capture policy dividends; internationally, inflation expectations remain, and the liquidity turning point has not yet arrived, with BTC as "digital gold" still being a core tool against fiat currency devaluation.

Biteye Suggests: Adopt a "Dumbbell Strategy"

Rather than jumping back and forth between two markets, incurring high fees and the psychological torment of missing out, it is better to build a robust portfolio:

One end of the dumbbell (steady offense): Actively allocate A-share ETFs or quality blue chips. Follow the trends of yuan appreciation and policy push, fully riding this wave of red envelope market, but also stay alert to the central bank's "overheating prevention" signals to avoid blindly chasing high prices.

The other end of the dumbbell (high odds defense): Stick to BTC core holdings. Despite massive short-term fluctuations (like a 38% pullback), considering the historical inertia of the halving cycle, completely liquidating might mean permanently losing the chance to buy at low prices.

The Spring Festival of 2026 might be one of the most "divided" Spring Festivals in recent years. The strong return of the yuan corresponds to a brief winter in the crypto market. But remember, cycles may be delayed, but they never truly miss. Investing in stocks requires looking at the "weather vane" (policies), while investing in coins requires checking the "periodic table" (halving and liquidity). In this bidirectional fluctuating market, hold onto your positions, whether they be red A-shares or orange Bitcoin, surviving is winning, this is the "New Year's attitude" of a mature investor.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。