Behind the sideways fluctuations of Bitcoin's price is a fierce clash of opinions among Wall Street analysts, on-chain experts, and seasoned traders regarding the bottom support level. After experiencing a corrective rebound from around $60,000, Bitcoin has been consolidating in the $70,000 range for several days, and market sentiment has turned chaotic.

In a silent liquidation at the beginning of the year, the cryptocurrency market saw over $2.58 billion liquidated within 48 hours, with Bitcoin's price briefly dropping below $76,000. Now, the only question investors care about is: where exactly is the bottom?

1. Institutional Perspectives: Divergence in Predictions Between Traditional Financial Giants and Cryptocurrency Institutions

● Jurrien Timmer, Global Macro Economic Research Director at Fidelity Investments, believes that Bitcoin's historical high of $125,000 reached in October may mark the peak of the current four-year halving cycle, in terms of both price and time.

● He predicts that the Bitcoin winter usually lasts about a year, and 2026 could be a "rest year" for Bitcoin, with a support level in the $65,000 to $75,000 range.

● In stark contrast to Fidelity’s cautious view, Citibank provides a more optimistic forecast. Citibank expects Bitcoin to reach $133,000 by the end of this year and soar to $181,000 by the end of 2026.

● Barclays Bank offers a more pessimistic analysis, suggesting that without significant catalysts, the cryptocurrency market may face a "down year" in 2026, with decreasing trading volumes.

The divergent views of these traditional financial institutions reflect a lack of consensus in the market regarding the future trajectory of cryptocurrency assets.

2. Technical Analysis: The Signal Game of Historical Indicators and On-Chain Data

● Market observers are closely watching the key support levels in the technical charts. Analyst @alicharts notes that Bitcoin is approaching the 200-week moving average, a line that has historically served as a bottom and accumulation area during bear markets over the past 12 years. The current 200-week moving average is at $58,000.

● On the other hand, Bitcoin's historical bottoms are usually near the -1.0 MVRV pricing range, which is currently at $52,040. Chinese on-chain analyst Murphy combines the on-chain metric CVDD, indicating that the current CVDD is $44,904 and is rising at a dynamic rate of $540 per 30 days. This implies that the current bear bottom is unlikely to drop below $45,000.

● On-chain analysis shows that an indicator known as CVDD has performed well in predicting historical cycle bottoms. It converts "coin days destroyed" into dollar value, and the currently rising trend reflects that the Bitcoin bottom is gradually elevated as the network matures.

3. Market Structure: Confrontation Between Long-Term Holders and Short-Term Selling Pressure

● Changes in the microstructure of the market are reshaping the pricing logic of Bitcoin. Glassnode analyst Chris Beamish states that the cost basis heatmap of long-term holders shows a dense support level for Bitcoin above $60,000, where long-term holders are highly concentrated.

● Further up, near $80,000 there is a dense supply creating a key resistance level. This range defines the current competitive landscape of supply chains. On-chain data shows that about 4,900 Bitcoins have recently been withdrawn from exchanges, worth around $50 million. Such large withdrawals are often seen as bullish signals, indicating that holders tend to prefer long-term accumulation over short-term trading.

● Current exchange balances have dropped to 2021 levels, and tightening market liquidity may amplify price volatility.

● According to TradingView data, Bitcoin's price rebounded after hitting a low of $85,293 on January 29, 2026. This price level is important because it is both a key resistance that transformed into support when the price broke through in December 2025 and overlays with the 200-day moving average.

4. Pattern Predictions: A Showdown Between Rules of Thumb and Key Support Levels

Notable trader and chart analyst Peter Brandt, who successfully predicted the Bitcoin crash in 2018, has made an intriguing point.

● He believes that if Bitcoin penetrates the "banana peel" support as it has in previous bear markets, the bottom could be just slightly below $42,000. Brandt considers the lower edge curve of the banana peel to be Bitcoin’s strongest and most critical long-term support area, as the bottoms of several significant bear markets in history have generally been close to or slightly below this line.

● The peculiarity of this Bitcoin adjustment is that during the rise, it never successfully touched the upper edge of the "banana line".

● The BTCC analyst team, based on technical and fundamental analysis, provides three scenario forecasts: the base scenario is that Bitcoin holds the $85,000 support; the optimistic scenario is that it breaks the previous high of $97,271; the pessimistic scenario is that it falls below the $82,000-$83,000 support zone and could test the psychological level of $80,000.

5. Divergence in Outlook: Bear Market Cycles and the Power of Emerging Narratives

● The market also has differing views on the duration of the crypto bear market. Coin Bureau CEO Nic predicts that Bitcoin has closed below the 100-week moving average for three consecutive weeks. Based on historical data, BTC remains below the long-term trend line for an average of 267 days after breaking below it. The shortest instance was 34 days during the COVID-19 pandemic.

Bitcoin's price has now been below the long-term trend line for 13 consecutive days.

● Meanwhile, some institutional investors remain optimistic about cryptocurrencies. Grayscale Investments believes that 2026 could be a key year for the crypto market to enter the "institutional era". The company points out that factors such as regulatory clarity and macroeconomic pressures may change the four-year crypto cycle, shifting it towards more stable capital inflows and deeper integration with traditional finance.

● Tom Shaughnessy, co-founder of the crypto research firm Delphi Digital, expects that after investors regain confidence from the record $19 billion crypto market crash in early October, Bitcoin will reach a new historical high in 2026.

6. Sentiment Tracking: Market Mentality and Dynamic Games

● Market sentiment suffered a blow after Bitcoin fell below $85,000. According to data from market intelligence platform Santiment, bearish statements have dominated social media platforms like X, Reddit, and Telegram since then.

● Meanwhile, the best-performing traders in the crypto industry, tracked as "smart money" on the Nansen blockchain intelligence platform, are betting that most mainstream cryptocurrencies will drop in the short term.

● Nansen data shows that although "smart money" traders hold a net short position of $123 million in Bitcoin, this group is simultaneously betting on an increase in Ethereum prices, with a cumulative net long position of $475 million.

● According to CryptoQuant data, Bitcoin miner holdings have dropped to 1.8 million coins, the lowest level since 2021. This phenomenon of "pre-halving selling" has occurred in the previous three halving cycles and often signals that the price bottom is forming. The next halving is expected to occur in May 2026, and historically, prices tend to rise significantly 6-12 months after the halving.

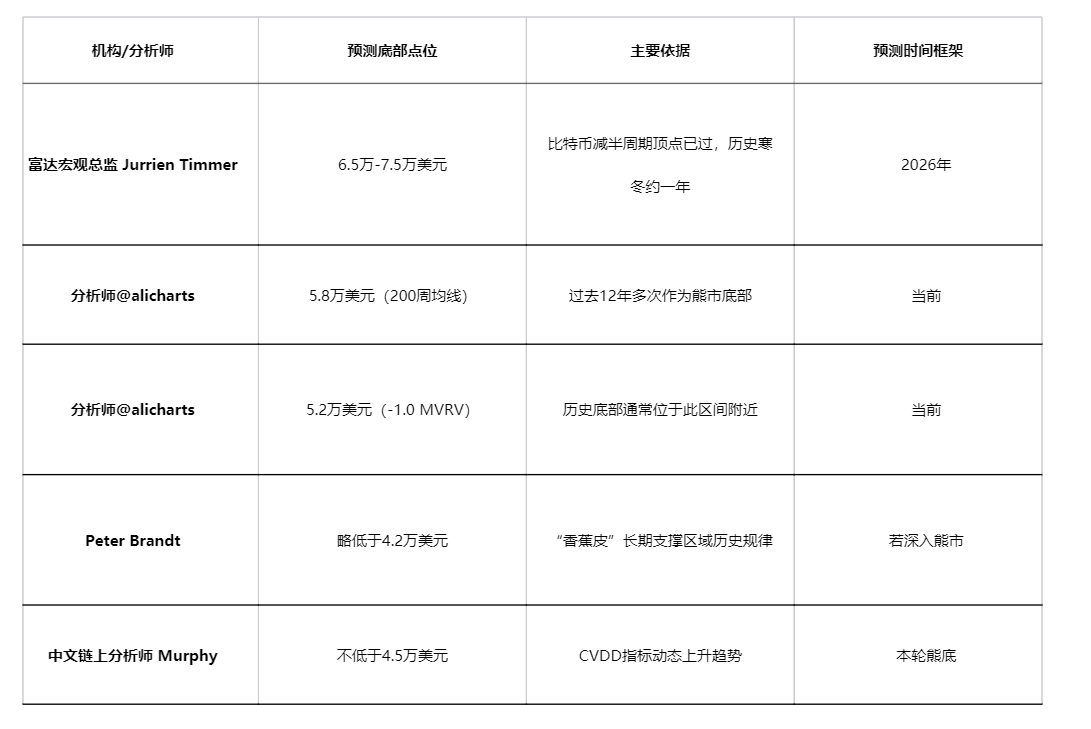

Summary of Major Institutions/Analysts' Predictions for Bitcoin's Bottom

A consensus is quietly forming in the market: the fundamental attributes of Bitcoin are being redefined. It is shifting from being a "technology asset" highly correlated with the Nasdaq index to an alternative commodity more attached to supply and demand dynamics, with its volatility characteristics beginning to converge with those of gold and commodities.

Major institutions’ predictions for the bottom point span a wide range from $42,000 to $75,000, reflecting the current market's high uncertainty. Technical analysts are focused on the "banana peel" support line and the 200-week moving average, on-chain experts are tracking the dynamic changes in the CVDD indicator, while institutional investors are making judgments based on macro cycles.

Market prediction platform PolyMarket shows that some traders are still betting that Bitcoin may test the $75,000 to $80,000 range by the end of February. This short-term optimism starkly contrasts with the overall bear market consensus, suggesting that the market may continue to seek direction amid the tug-of-war between bulls and bears.

The price story of Bitcoin is far from over, but the language used to tell this story is changing.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Welfare Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Welfare Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。