精选要闻

1、肖风:香港稳定币牌照将不局限于港币稳定币,部署网络可由发行方自行决定

2、Nano Labs 通过可转换债券私募融资 5 亿美元,用于 BNB 储备策略

3、Circle (CRCL) 自上市以来累计涨超 740%,市值已达 USDC 的 103.6%

5、今晚 22 点鲍威尔将「舌战」国会山,特朗普曾希望「国会」敲打鲍威尔

Trending 话题

来源:Overheard on CT(tg:@overheardonct),Kaito

VANECK:今日因与 Pudgy Penguins 一同参与纳斯达克开市敲钟仪式而受到广泛关注,这一事件象征着传统金融与数字资产世界的深度交汇。VanEck 展现出将 Web3 与加密资产融入主流金融体系的坚定决心,引发大量社交媒体讨论与庆祝,许多人期待这一合作将加速机构对加密资产的接纳。

BNB:围绕 BNB 的讨论今日主要集中在一项颇具象征意义的动态上——前 Coral Capital 高管正筹划通过一家纳斯达克上市公司募资 1 亿美元,用于构建 BNB 储备金,模式与 MicroStrategy 的比特币战略相似。该消息引发了市场对 BNB 作为机构资产配置标的的广泛猜想与热议。同时,币安也宣布将为 BNB 持有者发放 Newton Protocol(NEWT)空投奖励,进一步提升市场关注度。BNB Chain 生态近期持续扩展,新项目与合作接连落地,也助力其整体热度攀升。

TURTLECLUB:今日因与 Kaito 集成并推出全新「Yapper 互动排行榜」而受到瞩目,该机制通过奖励机制鼓励用户参与和贡献。该项目因在多个生态中启动流动性,尤其是在 Katana 项目中扮演关键角色而受到认可,也因其平权化的 DeFi 理念而广受称赞。社区正在热烈讨论 TURTLECLUB 重塑加密流动性分发逻辑的潜力,许多用户对通过活跃参与获得奖励的全新机会感到兴奋。

HYPE:今日话题聚焦其强劲的市场表现与战略发展。社区热议其在多个关键财务指标上与其他高成长资产的对比,并指出若其估值水平接近同类项目,潜力不容小觑。其生态系统不断扩展,包括 Ferrofluid 与 Enso Shortcuts 等新集成与 SDK 发布,增强了对开发者的吸引力。HYPERLIQUID 目前在 Web3 收入榜中排名第三,并已启动 $HYPE 代币的战略回购计划。此外,许多讨论将其潜力与 Solana 的爆发式成长作类比,认为其同样具备吸引零售与机构投资者的双重优势。尽管仍有部分声音对中心化与透明度表示担忧,但整体情绪依然积极,社区普遍看好其未来增长前景。

精选文章

1.《降息、停火,利好消息背后是反弹还是反转?|交易员观察》

美联储转鸽声音再现,美联储理事鲍曼发声,其支持最早 7 月降息。自特朗普 4 月 2 日征收关税以来,缺乏明显的通胀压力,这可能使美联储能够重新降息。受伊朗以色列正式停火的利好消息影响,加密市场迎来了大幅反弹,市值较低点回升 6%。美联储的降息预期也提振了市场情绪,降息带来的「放水」有望启动新一轮市场行情。BTC 的后续走势如何,看看市场上交易员们的想法。

2.《阴跌 92%,Celestia 的新提案要革「POS」的命》

如今已无人在意的「质押金铲子」TIA 又一次迎来社区舆论危机。在价格长期阴跌、叙事逐渐边缘化的这段时间里,Celestia 的网络收入持续低迷、DA 赛道的可行性也遭遇挑战,在此背景下,其联合创始人 John Adler 抛出了一项颠覆性治理提案。

链上数据

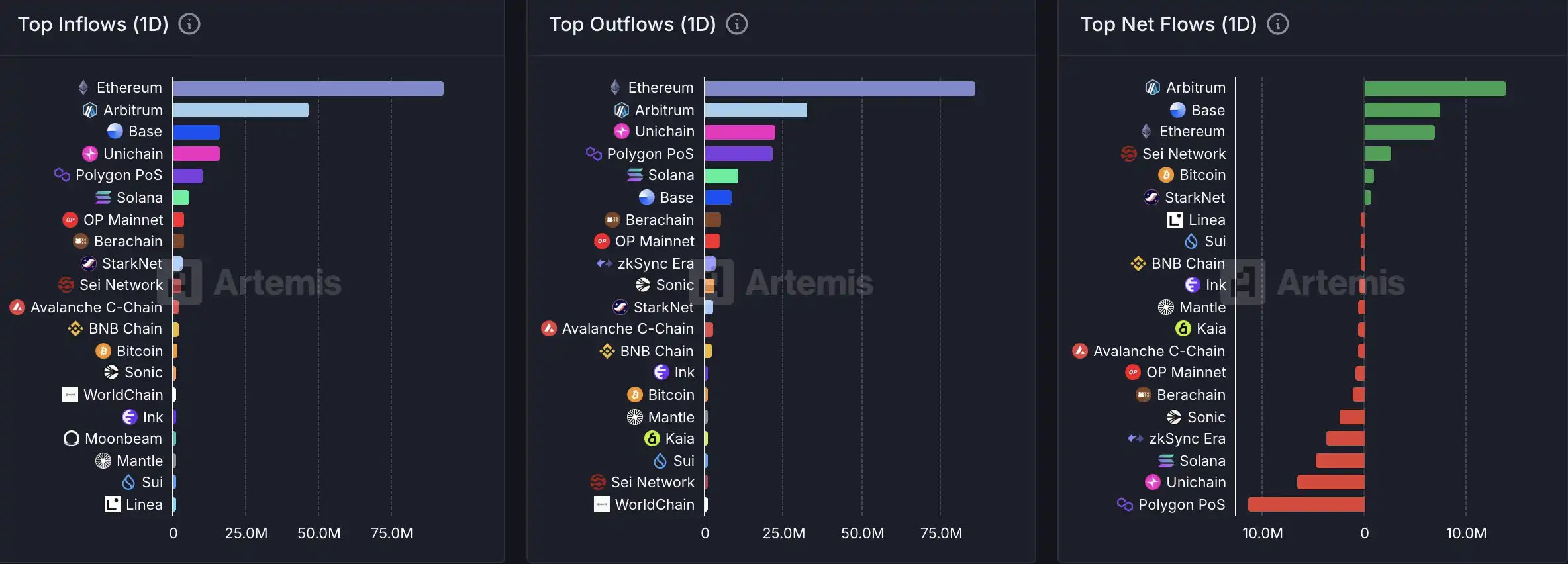

6 月 24 日当日链上资金流动情况

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。