撰文:1912212.eth,Foresight News

加密市场绝不是赌博和投机的圣地,它仍有非常多的真实痛点仍未被满足,众多资金利用效率仍有待充分挖掘和释放。BTC 资本效率最大化即是其中之一,万亿市场的比特币流动性生意被一众区块链项目看中并涌入,Lorenzo 作为发展得不错的 BTCFi 一度引领市场风头,2024 年与 20 多条链以及 30 多个 DeFi 协议集成,为价值超 6 亿美元的 BTC 资产提供稳定收益服务。不过,庞大的加密市场并不仅仅只有比特币,随着稳定币、DeFi、RWA 不断增长,专注于比特币单一资产仍远远不能满足市场需求,随着机构需求的增长和 CeFi 与 DeFi 融合趋势加速,向链上投行演进成为其必然选择。

DeFi 自 2020 年以来总锁仓量一度突破 2500 亿美元,成为加密市场的核心引擎。然而在链上资产管理与收益生成领域,复杂的操作、高昂的 Gas 费用以及协议间的割裂使得机构与普通用户难以广泛参与,DeFi 的收益模式多依赖短期激励,缺乏长期稳定性,难以满足机构对风险管理与稳定回报的需求。

与此同时,链上收益基础设施的建设远远滞后于加密资产的增长。以太坊等 PoS 链虽支持质押,但跨链流动性与资产管理的整合不足,导致资金效率低下。PayFi 兴起推动了链上支付与金融服务的融合,而传统金融产品的代币化需求激增。稳定币的交易量现已超过 Visa 和 Mastercard 的总和,链上流通的稳定币超过 1600 亿美元,然而,用于管理并部署这些资金以获取收益的基础设施仍然缺失。机构投资者渴望将 CeFi 的成熟金融工具引入 DeFi,但现有平台缺乏统一的框架来实现这一目标。

Lorenzo Protocol 从中看到了更大市场机遇 ,顺理成章进军「链上投行」,以承接更复杂的资产结构与更高阶的金融服务需求。

从 BTCFi 到机构级链上资管,迈向金融抽象层

基于其过往比特币流动性生态中沉淀的技术以及资金,Lorenzo Protocol 进一步升级为机构级链上资产管理平台,通过将 CeFi 金融产品代币化并与 DeFi 场景深度整合,填补链上资管的空白,为机构与高净值用户提供安全、高效且透明的解决方案。简而言之,就是将比特币等核心加密资产从单一的价值存储转变为链上资管的金融原语,为用户提供一站式的资产管理体验。

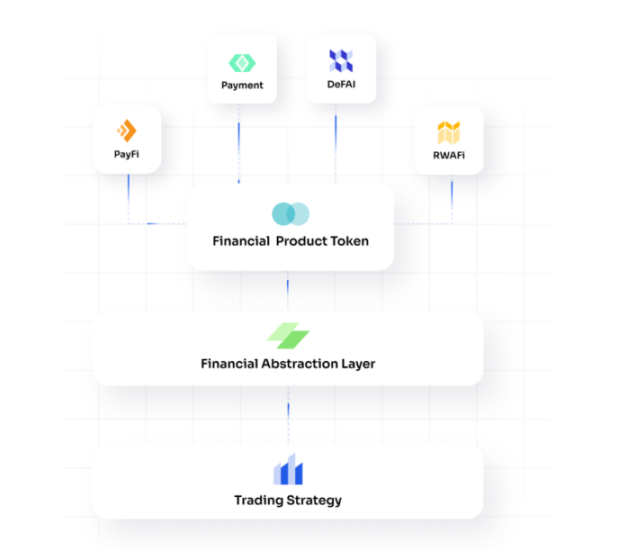

Lorenzo 的核心优势在于其通用金融抽象层(Financial Abstraction Layer, FAL),一个模块化的金融框架,能够抽象化资产管理与收益生成的过程。它支持 BTC 等资产的代币化,生成可流通的链上代币。同时,Lorenzo 将资产托管、收益生成与策略管理转化为链上原生的标准化组件,从而实现 CeFi 金融产品与链上金融场景之间的无缝衔接。

Lorenzo 更像是「链上投行」,接收比特币、稳定币等资产后,通过策略如质押、套利以及量化,将其打包成标准化的收益产品,供钱包、PayFi 或者 RWAFi 等合作方等一键集成。

2025 年 4 月 18 日,Lorenzo Protocol 通过币安 Wallet 与 PancakeSwap 完成 IDO,发行治理代币 BANK(总供应量 21 亿枚,初始流通 4.25 亿枚)。TGE 吸引了超 3500 万美元的认购,整体认购额度超额 18,329%,在上线后不到一分钟即完成募资目标。自 IDO 后,Lorenzo 已从「专注于比特币流动性金融层」进化为机构级链上资产管理平台,专注于 CeFi 金融产品的代币化,并将其与 DeFi 融合。

Lorenzo 通过统一的金融框架,抽象化链上资产管理与收益生成,为机构与用户提供无缝交互体验、此外,Lorenzo 聚焦于真实收益与可持续商业模式:Lorenzo 通过 DeFi 收益聚合及代币化金融产品提供稳定回报,其收入来源于协议费用、跨链桥接费用与生态合作分成,BANK 代币的治理机制(veBANK)进一步激励社区参与,确保长期稳定性。

后续,Lorenzo 计划通过技术优化、生态扩展以及社区赋能(等级系统与任务奖励)巩固其领先地位。

运转逻辑

Lorenzo 的产品设计与技术架构围绕机构与链上资管的核心需求,涵盖资产代币化、收益生成、跨链流动性和风险管理。

Lorenzo 构建了一条清晰且可持续的资产流转路径:首先,用户将链上资产如稳定币等存入 Lorenzo 与合作方(如 PayFi 或 RWAfi 平台)的共管账户,作为基础输入。这些资产通过 Lorenzo 内部设计的策略模块被部署到多个链上协议中生成稳定的收益,形成资产增值的第一层价值。

随后,这些带收益能力的资产(或标记凭证)被标准化封装,作为可组合的资产模块进一步集成到 PayFi 产品、钱包收益账户、借贷协议的存款端以及 RWA 平台等,从而完成收益再利用与价值放大。在整个过程中,用户获得持续收益,而 Lorenzo 协议则实现资产流入、收益生成与再流通的逻辑闭环,提升了系统的复用效率和资本利用率。

Lorenzo 的核心产品主要包括三个部分。首先是 Vault 模型,它分为简单策略池和组合策略池两类。简单策略池中,每个 Vault 对应一个特定的收益策略,结构清晰、执行透明;而组合策略池则是在此基础上进一步聚合多个简单池,由个人、机构,甚至 AI 进行动态管理和调仓,从而实现更灵活的收益优化。

第二部分是模块化 API 输出,Lorenzo 提供一系列接口,面向客户端输出收益计算与分发的逻辑、资产 Value 状态数据,以及可直接集成的前端 UI 组件,便于生态项目快速对接。

最后一部分是金融服务的代币化能力,覆盖从链上募资,到链下实际操作,再回到链上的资金结算流程,打通了传统金融服务与链上资产管理之间的连接通道。

小结

Lorenzo Protocol 通过代币化 CeFi 金融产品并与 DeFi 场景深度整合,成功填补链上资管的空白。其通用金融抽象层释放了 BTC 等资产的流动性与收益潜能,为机构与高净值用户提供了安全、透明且高效的资管方案。从「比特币流动性基础设施层」一路发展至今,再到上线 IDO 一度吸引市场目光,Lorenzo 并未停止自己的步伐。在迈向「金融抽象层」的旅途中,Lorenzo 真正展现了长期建设的决心与前瞻性视野。

Ethena 作为本轮周期中的稳定币龙头项目之一,其代币化美元 USDe 市值不断飙涨。代币化单一金融资产即可达到数亿美元的市场规模,支持多种金融产品代币化并加以充分整合利用之后,Lorenzo 或有望成为链上资管的先锋,引领加密金融的新浪潮。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。