Original Title: Building Permissionless Neobanks

Original Author: @0xfishylosopher

Translater: Peggy, BlockBeats

Editor's Note: A decade ago, fintech neobanks improved the banking experience through mobile applications, without changing the underlying system of capital flow. Today, cryptography is attempting to reach deeper transformations, reconstructing "how money flows."

This article examines the development path and competitive landscape of crypto neobanks from four dimensions: storing, spending, growing, and borrowing. The author Jay Yu (a member of the Pantera Capital research and investment team) suggests that focusing on the speed of capital circulation, breakthroughs for crypto neobanks may first appear in high-frequency, high-turnover scenarios of value addition and borrowing, gradually extending to payments and storage.

Before issues of privacy, compliance, real-world connections, and credit systems are fully resolved, crypto neobanks remain in the early exploration stage. However, it is certain that they are not merely new financial applications, but are attempting to build an entirely new track for capital operation.

The original text is as follows:

Introduction

No matter which banking or fintech application you open today—be it Bank of America, Revolut, Chase, or SoFi—when you scroll down the interface, you will feel a sense of familiarity: accounts, pay & transfer, earn yield. These interfaces can almost be interchangeable.

This high degree of similarity in design reveals the underlying logic of banking operations: banks, in essence, are a visual representation of the four core relationships we establish with "money":

Store: A place for storing and keeping assets.

Spend: A mechanism for daily expenditures and transfers.

Grow: A set of tools for passive or active wealth management.

Borrow: A channel for obtaining external funds and leveraging.

In the past decade, the popularity of mobile technology has propelled the rise of neobank applications such as SoFi, Revolut, and Wise. They have made financial services more inclusive and redefined the meaning of "going to the bank"—replacing physical branches with intuitive, always-online digital interfaces.

And today, as cryptocurrency technology enters its second decade, a new paradigm is emerging. From self-custodial wallets and stablecoin payments to on-chain lending and yield mechanisms, the permissionless and programmable nature of blockchain makes bank-like experiences global, instantaneous, and composable.

If mobile internet gave rise to neobanks, then the crypto technology currently incubating is giving rise to permissionless neobanks: a unified, interoperable interface at its core focused on self-custody, allowing users to achieve storage, payment, value addition, and borrowing in the on-chain economy.

History of Fintech Neobanks

Similar to the crypto industry, the rise of neobanks occurred after the financial crisis of 2008. Unlike traditional banks that replicate physical branch layouts, neobanks resemble technology platforms that offer banking services to users through mobile interfaces.

Most neobanks collaborate with traditional banks in the background, with the latter providing deposit insurance and compliance infrastructure, while the neobanks themselves manage front-end user relationships. With rapid account opening processes, transparent fee structures, and designs centered on digital experience, many neobanks have gradually become the preferred entry point for users to save money, spend, and manage wealth.

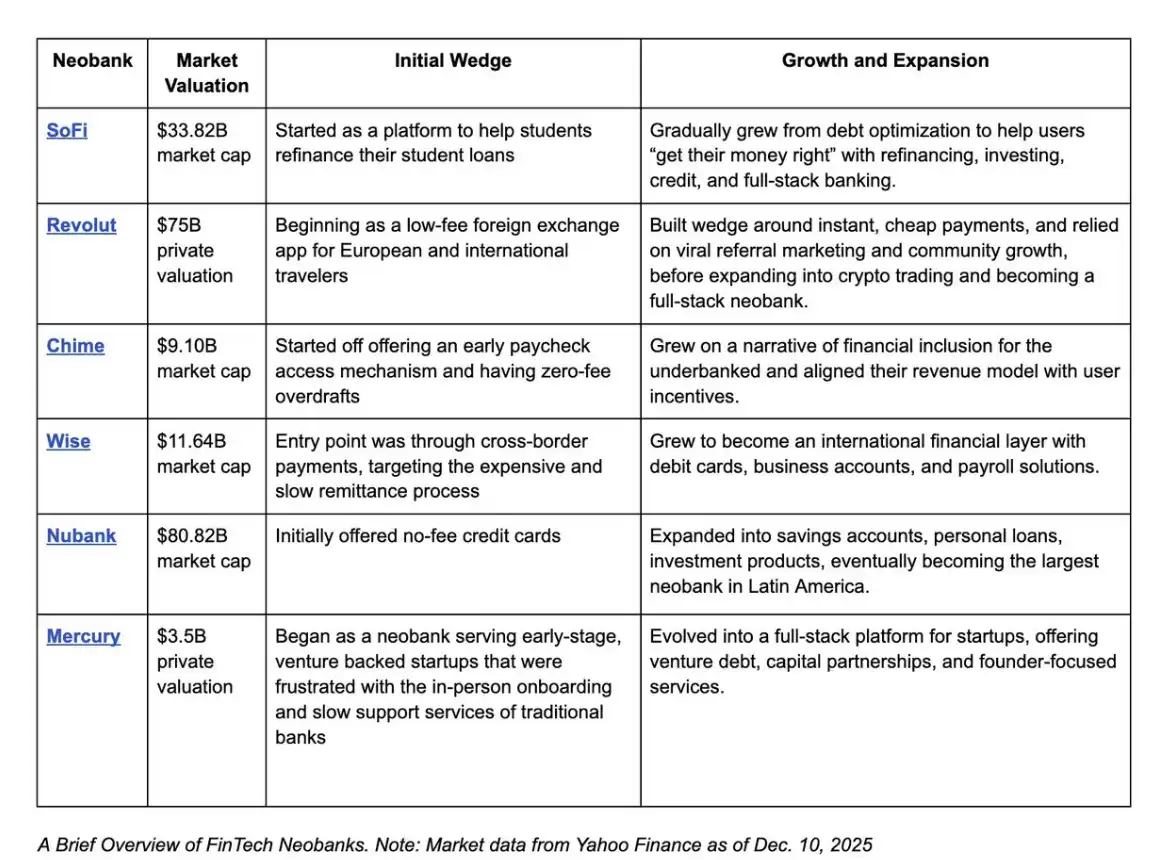

Reviewing the growth paths of these neobank startups valued in the billions, a commonality emerges: they master user relationships through unique digital product forms, whether it's refinancing services, early payday access, transparent foreign exchange rates, or other differentiated features, initiating a user-centric transaction volume flywheel before gradually expanding the product matrix to monetizing existing users.

Simply put, the success of fintech neobanks lies in their grasp of "the entry point to money": by reshaping the medium through which users save, spend, invest, and borrow money, they firmly occupy the interface layer of capital interactions.

Today, the crypto industry is at a similar juncture as neobanks were 5-10 years ago. In over a decade of development, cryptocurrency has birthed a series of its own "wedge products":

Anti-censorship asset storage through self-custodial wallets.

Low-barrier digital dollars provided through stablecoins.

Permissionless credit markets represented by protocols like Aave.

Moreover, a 24×7 global capital market that can even convert internet memes into wealth vehicles.

Just as mobile internet infrastructure ushered in the era of neobanks, programmable blockchain is providing a permissionless financial layer.

The next logical step is to combine these permissionless back-end capabilities with the user-friendly front-end akin to neobanks. The first generation of neobanks moved the bank's front-end from physical branches to mobile screens, while retaining the traditional banking system as back-end; today's crypto neobanks, in contrast, retain the convenient mobile experience while beginning to change the underlying path of capital flow: from traditional banking tracks to stablecoins and public blockchains.

In other words, if neobanks rebuilt the front-end of banking over mobile internet, then crypto technology is providing an opportunity: to rebuild the back-end of banking over a permissionless track.

The Landscape of Crypto Neobanks

The Landscape of Crypto Neobanks

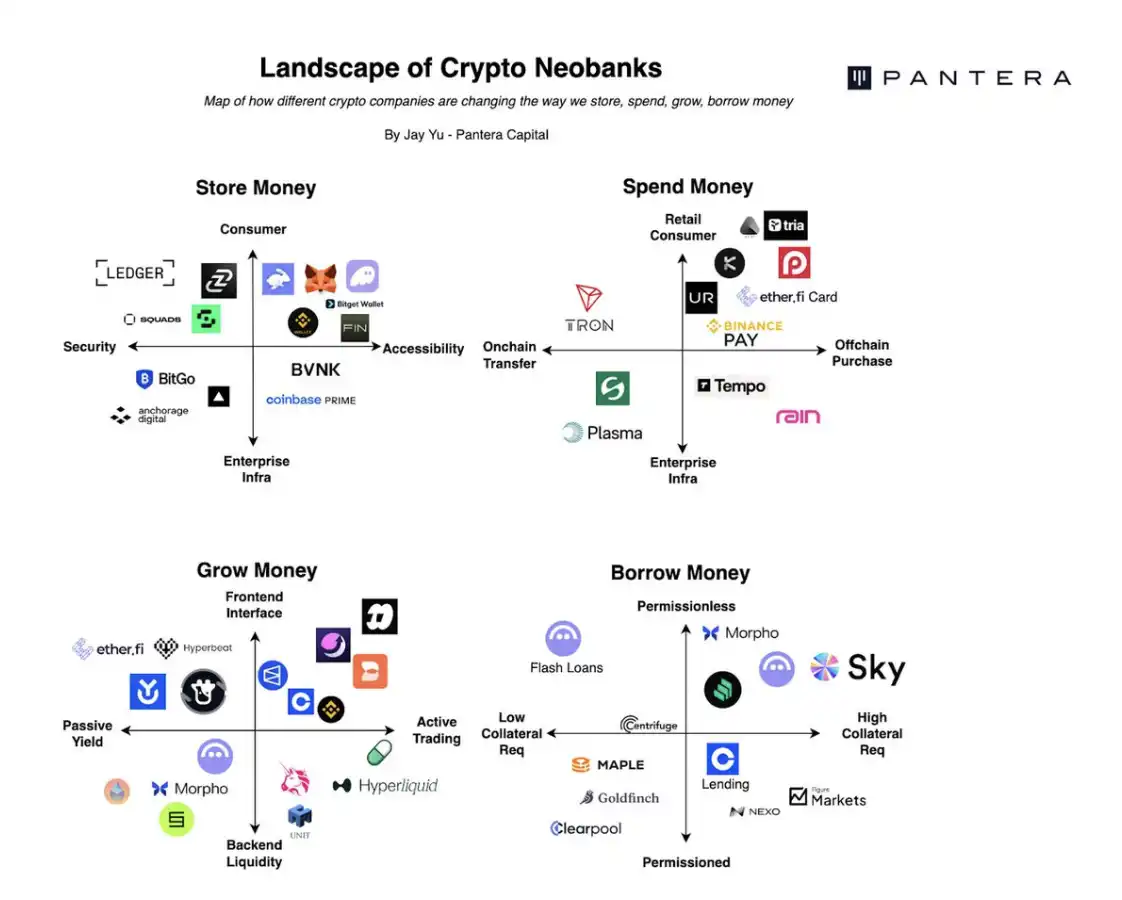

Today, an increasing number of projects are gradually converging under the vision of "crypto neobanks." We have already seen foundational capabilities around the four financial relationships of storing, spending, growing, and borrowing gradually taking shape on a permissionless crypto track:

Self-custodial asset storage realized through hardware wallets like Ledger.

Daily payments facilitated through cards like Etherfi or QR codes from Bitget.

Asset value increases achieved through trading on platforms like Hyperliquid.

On-chain lending accessed through protocols like Morpho.

At the same time, a large number of ancillary players support foundational infrastructure, including: Wallet-as-a-Service, stablecoin settlement systems, compliance licensing services, localized deposit and withdrawal channel partners, as well as cross-protocol orchestration routers.

Additionally, in certain instances, crypto exchanges themselves, like Binance and Coinbase, are also moving closer to fintech neobanks, attempting to further grasp the core relationship between users and their assets.

For instance, Binance Pay has provided payment support to over 20 million merchants globally; Coinbase allows users to earn up to 4% rewards just by holding USDC on their platform.

In such a complex and multi-layered crypto neobank ecosystem, it is necessary to systematically outline this landscape: how are different crypto platforms competing to become the "primary financial relationship interface" for users? Which particular segment are they targeting in users' saving, spending, investing, and borrowing?

Saving Money with Crypto

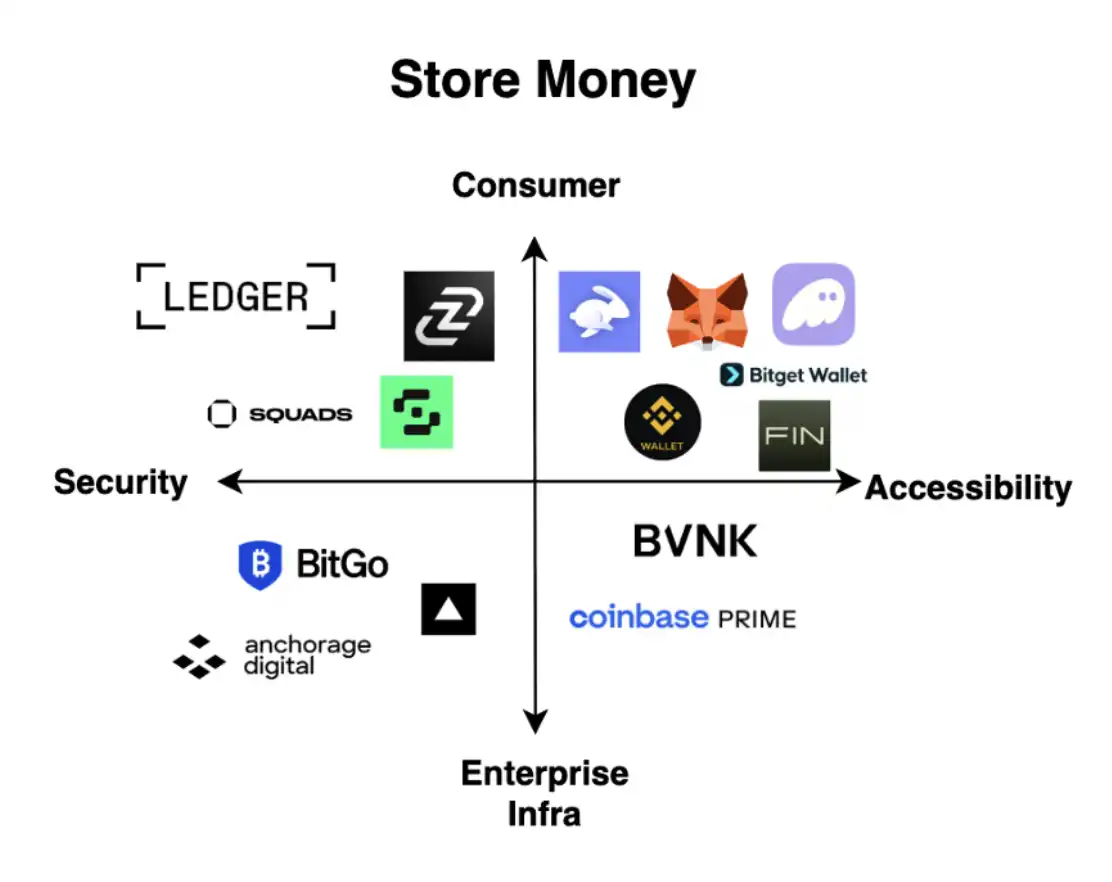

To truly achieve self-custody of crypto assets and interact with the blockchain, users must first possess some form of crypto wallet. Broadly speaking, the crypto wallet ecosystem can be divided along two dimensions: one is the axis of security ↔ usability, and the other is the axis of consumer-grade applications ↔ enterprise-level infrastructure.

In different quadrants, differentiated winners with strong distribution capabilities have emerged:

Ledger represents consumer-focused hardware wallets known for security;

Fireblocks and Anchorage provide secure enterprise-level wallet infrastructure;

MetaMask, Phantom, and Privy are consumer-oriented wallets that prioritize usability and user experience;

Turnkey and Coinbase Prime occupy more of an "high accessibility + enterprise-grade" infrastructure position.

Using wallet applications as a beachhead for building neobanks has a core advantage: wallet front-ends—like MetaMask and Phantom—often control the entry layer for users interacting with crypto assets. The so-called "fat wallet thesis" suggests that the wallet layer captures the vast majority of consumer-facing distribution capability and order flow, while the cost of switching wallets for end users is extremely high.

This is indeed true: around 35% of Solana's transaction volume is completed via the Phantom wallet. This moat, built of excellent mobile user experience and user stickiness, is substantial.

Moreover, since consumers (especially retail users) often prioritize convenience over price, wallets like Phantom and MetaMask can charge as much as 0.85% in fees; in contrast, exchange protocols like Uniswap may charge only around 0.3% per token swap.

On the other hand, however, building a complete, profitable neobank using a single wallet platform is surprisingly difficult. The reason is that, to achieve scalable profitability, users not only need to "store" tokens but also must use those tokens frequently within the wallet.

Phantom, MetaMask, and Ledger may enjoy widespread brand recognition, but if users merely treat their crypto wallets as "cash boxes under the bed," they can hardly achieve monetization. In other words, wallets must transform into active trading and payment platforms to convert distribution advantages into revenue.

It is clear that MetaMask and Phantom are both pushing in this direction.

For example, MetaMask recently launched the MetaMask card, attempting to monetize value-added services on its existing base of crypto-native users, becoming the default solution for "spending crypto." Phantom has also quickly followed suit with Phantom Cash, further venturing into the space of "growing money"—integrating Hyperliquid's builder codes to provide perpetual contract trading functionality within the app.

As Blockworks noted: "While Drift or Jupiter may be the local darlings of Solana, true capital has flowed to Hyperliquid."

This serves as a universally relevant lesson for the entire wallet track: you not only need to master the wallet itself, but you must also understand the scale of capital flowing in and out through actions like "spending, growing, and borrowing."

Spending Money with Crypto

The second type of competitor in crypto neobanks are those platforms that allow users to make payments using cryptocurrencies.

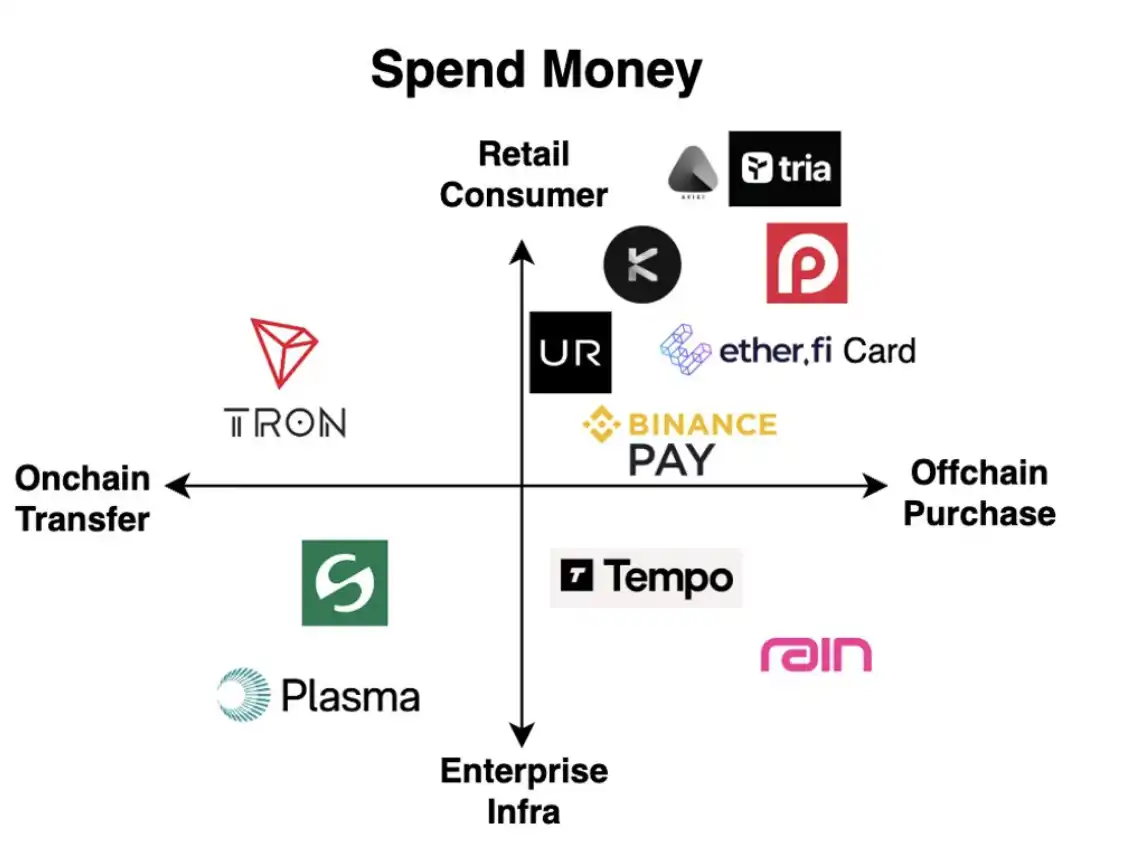

Similar to "saving money with crypto", we can also categorize applications for "spending money with crypto" along two dimensions: one is from on-chain transfers to off-chain consumption (like buying a cup of coffee); the other is from applications targeting retail consumers to infrastructure for enterprises.

Interestingly, many "neobank" projects that have gained market attention in recent months—such as Kast, Tria, Tempo, and Stable—are almost all targeting the "payment with cryptocurrencies" entry point. Particularly, market enthusiasm is especially concentrated in two major directions:

Applications integrating stablecoin cards aimed at retail consumers, like Avici, Tria, Redotpay, and EtherFi;

Stablecoin public blockchains or stablecoin infrastructure designed for enterprise scenarios, such as Stable, Plasma, and Tempo.

Retail End: Making Crypto Applications More Like Banks

The first type of "payment-oriented applications" targeting retail users is essentially bringing consumer experiences of crypto applications closer to traditional banks or fintech neobanks: familiar interface labels such as "Home, Banking, Card, Invest" are all present.

With the maturity of crypto card issuers like Rain and Reap, as well as the expansion of Visa and Mastercard's support for stablecoins, crypto cards have gradually become commoditized. True differentiation does not lie in "issuing a card", but in the ability to continuously drive and retain transaction volume—whether through innovative cashback mechanisms, localized marketing abilities, or attracting non-crypto-native users to the platform.

This trajectory is highly similar to the rise of fintech neobanks: success has never just been about "issuing cards" or "creating apps" but has relied on mastering a specific user group, from students (SoFi) to low-income households (Chime) to international travelers (Wise and Revolut), and building trust, loyalty, and scalable transaction volume on that basis.

If the path is correct, these "payment-first" crypto neobanks may potentially become an important entry point for driving large-scale adoption of blockchain infrastructure.

Furthermore, crypto neobanks may guide users toward a new generation of payment systems that transcend traditional card tracks.

Bank card-based consumption might only be a transitional stage—it still relies on the clearing networks of Visa and Mastercard, inheriting their centralized constraints. New signals are already emerging: for example, Bitget Wallet has initiated QR code-based stablecoin payment pilots in Indonesia, Brazil, and Vietnam. This points toward a potential future: an inherently crypto settlement system that might entirely bypass traditional issuing institutions.

Enterprise Side: Stablecoin Infrastructure and "Stablecoin Chains"

The second category of recently emerging neobank applications are stablecoin infrastructure projects built for enterprises, including Stable, Plasma, Tempo, and Arc, often referred to as "stablecoin chains."

The emergence of these is underpinned by traditional banking institutions, fintech companies like Stripe, and pre-existing payment networks demanding more efficient capital tracks.

These "stablecoin chains" often share similar characteristics:

They use stablecoins as gas tokens, avoiding fee instability caused by fluctuations in custom gas token prices;

Simplify consensus mechanisms to accelerate high-frequency, large-amount payments from A to B;

Enhance transfer privacy through trusted execution environments (TEE);

Customize data fields to adapt to international payment standards like ISO 20022.

However, technological improvements alone do not guarantee adoption.

For payment-oriented public blockchains, the true moat is the merchants. The key question is: how many merchants and enterprises are willing to migrate their business to a particular chain?

For instance, Tempo tries to leverage Stripe's vast merchant base and payment network to drive transaction volume and adoption, bringing a new group of merchants into the crypto track. Other chains, like Plasma and Stable, aim to become "first-class citizens" of Tether USDT, reinforcing the role of stablecoins in inter-institutional circulation.

In this domain, the most enlightening example is Tron. It accounts for about 25-30% of the global stablecoin transaction volume.

Tron's emergence owes much to its advantages in emerging markets—such as Nigeria, Argentina, Brazil, and Southeast Asia. With low fees, fast confirmations, and global coverage capabilities, Tron has become a common settlement layer for merchant payments, cross-border remittances, and dollar-denominated savings accounts.

For all emerging payment-oriented public chains, Tron is the incumbent competitor that must be faced. To challenge it, one needs to achieve tenfold improvements over an already "cheap, fast, and global" base—often necessitating a focus on merchant expansion and network scale, rather than marginal technical optimizations.

Growing Money with Crypto

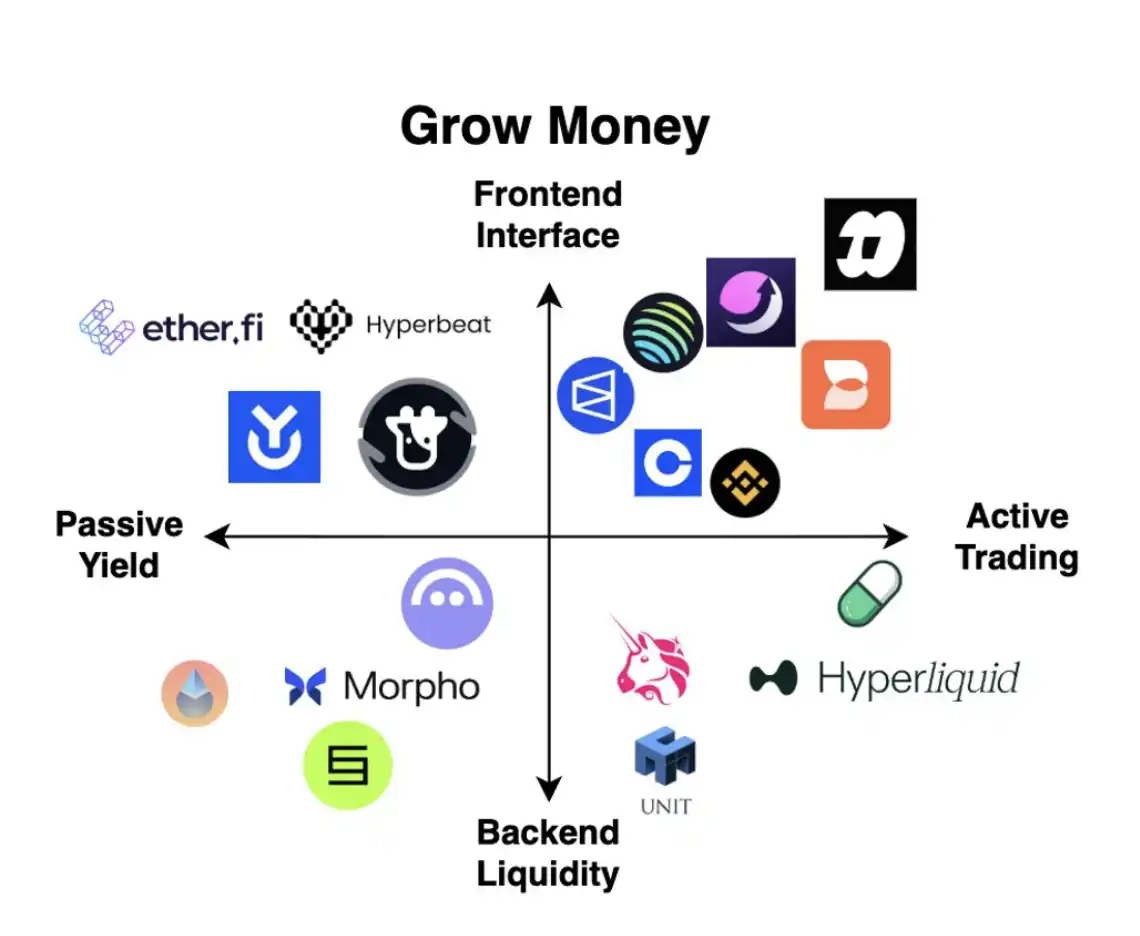

The third relationship that "crypto neobanks" establish with users is helping users grow their funds. This is one of the most innovative segments in the crypto field, spawning various financial primitives from zero to one—ranging from staking vaults and perpetual contract trading to token issuance platforms and prediction markets. Similar to the previous sections, we can categorize applications in the "growing money" space along two dimensions: from passive income to active trading, and from front-end interfaces to back-end liquidity.

A classic case of an application in the "growing money" category evolving into a fully functional neobank derives from centralized crypto exchanges (CEX), such as Binance or Coinbase. What exchanges initially offered was a simple and effective value proposition—"This is where you grow your wealth by trading crypto assets." As trading volumes climbed steadily, exchanges gradually became core venues not only for value addition but also for storing and managing assets.

Both Coinbase and Binance have launched their own blockchains, wallets, institutional-grade products, and crypto cards, leveraging new products and network effects to monetize their core user groups. For example, the adoption of Binance Pay continues to rise, with more and more merchants using it for crypto payments for everyday goods.

A similar pattern has also been validated in DeFi projects. For instance, EtherFi started as a liquidity staking protocol for Ethereum, providing passive income for users who re-stake ETH to EigenLayer. Subsequently, EtherFi launched a DeFi strategy vault called "Liquid," allocating user funds into the DeFi ecosystem to pursue higher yields under controlled risks. The project then expanded into EtherFi Cash—a groundbreaking credit card product enabling users to directly spend their EtherFi balances in the real world.

This expansion path is highly akin to that of fintech neobanks: establishing a foothold through unique product entry (passive staking and income), forming a "best-in-class" solution in a niche, scaling up, and horizontally expanding the product matrix to monetize existing users (like the EtherFi card).

As of today, the crypto space has birthed many innovations supporting user "growing money": for example, perpetual contract platforms like Hyperliquid have become some of the most profitable crypto companies; prediction markets like Polymarket are also gradually moving into mainstream views. It is very likely that the next step for these platforms is to similarly achieve monetization through new product forms—enabling users to save more, spend more, and leveraging network effects for amplification.

Starting from "growing money platforms," particularly active trading platforms, has a significant advantage: they have high transaction frequency and volume. For example, Hyperliquid has handled $30 trillion in transaction volume over the past 18 months. Compared to "savings platforms" and "payment platforms," "growing money platforms" possess stronger user flywheels and stickiness, meaning they control a larger "captured user pool" that can be converted and monetized in subsequent expansions.

However, at the same time, these platforms are also highly dependent on market cycles and are often labeled as "financial casinos." This reputation may limit their reach to a truly global mass user base—after all, people’s psychological expectations of "banks" and "casinos" are inherently different.

Borrowing Money with Crypto

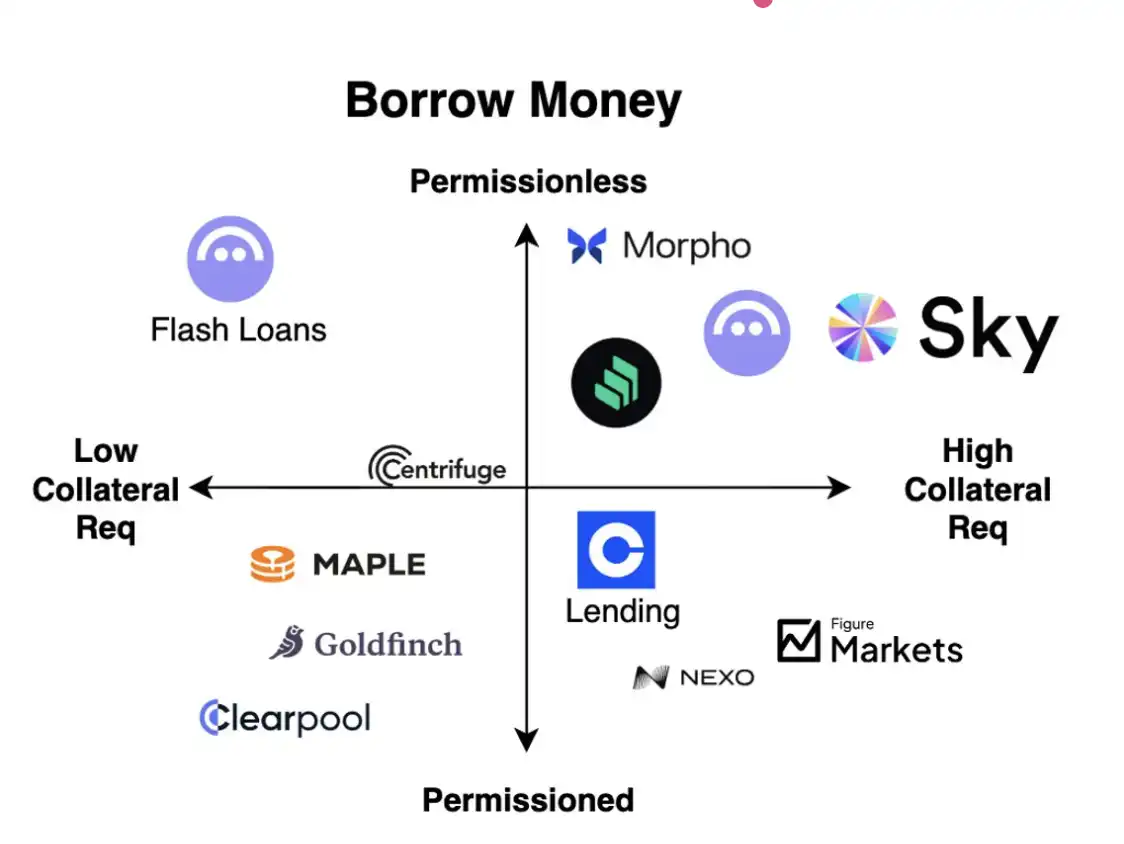

Just like in traditional economic systems, borrowing capability is an important engine for driving growth in on-chain economies. For crypto neobanks, lending is also one of the most crucial and sustainable sources of revenue. In traditional financial systems, lending is a highly licensed activity, requiring multiple checks such as KYC, credit scoring, and lending history; while in the crypto world, lending systems exist in both licensed and permissionless models, corresponding to different collateral capital requirements.

The mainstream model in the current crypto space is a permissionless, on-chain, over-collateralized lending system. DeFi giants such as Aave, Morpho, and Sky (formerly MakerDAO) embody the core spirit of "code is law" in crypto: because blockchains cannot inherently access a user's FICO credit score or social reputation information, they can only ensure repayment capacity through over-collateralization, sacrificing capital efficiency for broader accessibility and safety against default risks.

Among them, Morpho is seen as the next generation evolution of this model. By introducing more modular, permissionless system designs and adopting refined risk pricing mechanisms, it has enhanced capital efficiency while maintaining safety.

On the other end of the spectrum is licensed lending. As more institutional capital allocators enter DeFi through market making and other means, this model is gradually gaining traction. Protocols like Maple Finance, Goldfinch, and Clearpool primarily cater to institutional users, essentially setting up "traditional credit desks" on-chain. They enable institutional borrowers to obtain non-over-collateralized loans through strict KYC and off-chain legal agreements.

The moat for such protocols comes not only from liquidity (like permissionless lending pools) but also from their compliance framework and B2B business development capabilities. Additionally, there are some projects in the licensed lending space—like Figure Markets, Nexo, and Coinbase's lending products—that target retail borrowers while adopting a compliance-first approach. They require borrowers to complete KYC and provide over-collateralized assets, and in some cases, are "packaged" as upper-level products on protocols like Morpho, as seen with Coinbase Lending. In these scenarios, their core appeal often lies in faster settlement speeds and greater capital availability compared to traditional bank loans.

However, the real "holy grail" of crypto lending is consumer-facing non-over-collateralized credit—this is precisely the breakthrough that fintech products like SoFi and Chime excel in, allowing them to cover "unbanked populations." To date, the crypto industry has yet to make substantial breakthroughs in this area and has failed to replicate the "consumer credit flywheel" established by fintech neobanks.

The fundamental reason lies in the lack of a robust, anti-censorship identity system in the crypto world, as well as a lack of sufficiently strong real-world penalties against default behavior. The only exception is "flash loans"—a form of instant, unsecured borrowing that entirely arises from blockchain mechanism characteristics, but they mainly serve arbitrage bots and complex DeFi strategies rather than everyday consumers.

For the next generation of crypto neobanks, the key to competition may lie in advancing toward the "middle ground" of this landscape: preserving the speed and transparency of permissionless DeFi while introducing the capital efficiency of traditional lending. The ultimate winners are likely to be platforms that can address the decentralized identity issue or commercialize it, thereby unlocking consumer credit and allowing crypto to truly reconstruct the financial mechanism of "credit cards." Until then, crypto neobanks may still primarily rely on over-collateralized lending as the core means of supporting DeFi yield.

Making Capital Flow Faster

Fundamentally, the core value proposition of crypto neobanks lies in making capital flow faster—just as fintech neobanks like SoFi and Chime achieved over the past decade through mobile applications. The blockchain track essentially "flattens" the distance between any two accounts: a single transfer can complete the value transfer, without needing to navigate through international banks, SWIFT systems, and numerous complex, outdated intermediaries.

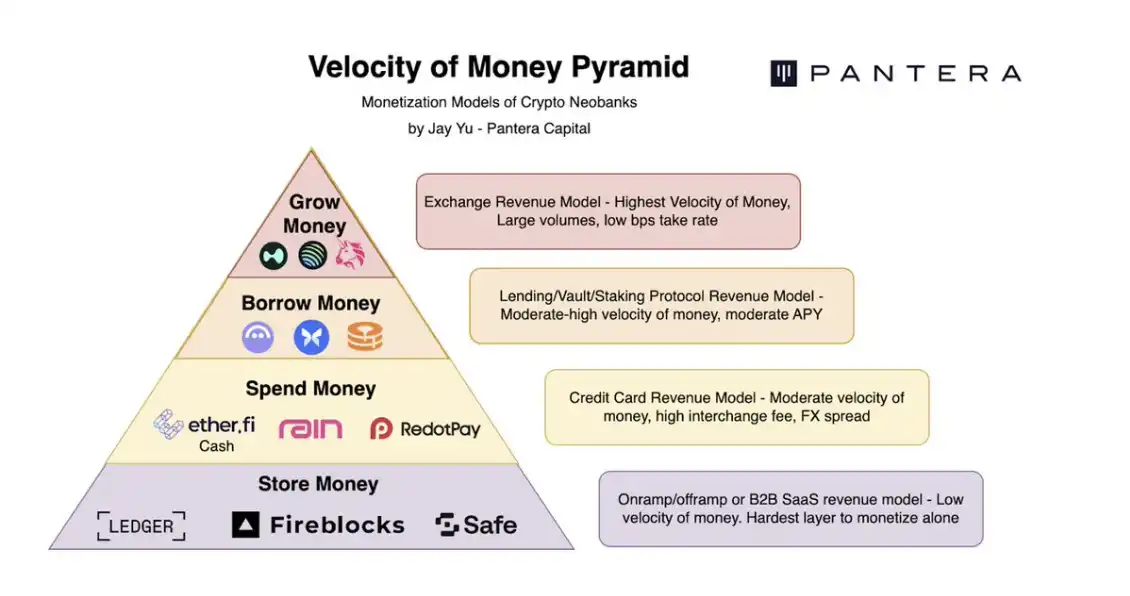

Although the four financial relationships of "saving, spending, growing, borrowing" utilize this "flattening effect" of blockchain in different ways, with corresponding trade-offs and monetization models, I believe that they can ultimately be understood as a pyramid structure defined by **velocity of money**.

At the top of the pyramid is growing money, with the highest capital turnover speed (like transaction fees from Hyperliquid); next is borrowing (monetizing through interest); followed by payments (monetizing through fees and forex spreads); and the lowest layer is storage (mainly monetized through deposit and withdrawal fees and B2B integration).

From this perspective, the easiest path to build crypto neobanks may be to start from the levels of growing money and borrowing—because these tiers possess the highest capital flow speed and user engagement. Protocols that capture "value in motion" first often can subsequently extend downwards along the pyramid, gradually converting existing users into full-stack financial users.

Opportunity Space for Neobanks

So what might the next step for crypto neobanks be? Where truly lies the opportunity to build the next generation of permissionless neobanks?

I believe there are still several (interrelated) directions worth exploring further:

1) Equivalence of privacy and compliance

2) Real-world composability

3) Fully utilizing "permissionlessness"

4) Localization vs globalization

5) Non-over-collateralized lending and consumer credit

1|Equivalence of Privacy and Compliance

Stablecoins and crypto tracks have clear advantages over traditional financial systems in terms of speed and usability. However, if crypto neobanks are to truly compete head-on with fintech neobanks and existing banking systems, they must achieve functional equivalence on two key dimensions: privacy and compliance.

Although privacy is not universally considered a necessity in retail consumer scenarios, and stablecoins have achieved scaling without strong privacy guarantees, as more enterprise-level applications—such as payroll, supply chain financing, and cross-border settlements—transition on-chain, privacy becomes critical. The reason is that the public visibility of B2B transfers may leak commercial secrets and sensitive information. I believe this is also one of the key reasons why several newly launched stablecoin chains have emphasized privacy capabilities in their roadmaps.

Conversely, crypto neobanks also need to consider how to achieve equivalence with their predecessors at the compliance level. This includes gradually building a global regulatory moat and licensing system, and demonstrating to consumers and merchants that crypto solutions are on par with traditional finance in terms of compliance — perhaps utilizing new technological pathways such as zero-knowledge proofs. Only by simultaneously addressing the dual issues of enterprise-level privacy and compliance credibility can crypto neobanks genuinely achieve the scalable expansion that surpasses that of their fintech predecessors.

2|Real-World Composability

Composability is often regarded as a core advantage of crypto tracks—relying on unified standards, frameworks, and smart contracts. However, in reality, this composability is often limited to within the crypto world: among DeFi primitives, yield protocols, and (primarily EVM) blockchains.

The truly challenging composability issue lies in bridging blockchain standards with legacy standards in the real world: for example, international banking systems like SWIFT, merchant POS systems, and standards like ISO 20022, as well as local payment networks like ACH and Pix. With the popularization of crypto cards and increased use of stablecoins in cross-border payments, positive progress has been made in this direction.

Furthermore, currently, most crypto card products primarily serve crypto-native users, essentially serving as withdrawal tools for "crypto whales." However, the real challenge for crypto neobanks is to break through the crypto-native demographic by introducing completely new user groups via real-world composability and genuinely innovative financial primitives. Platforms that successfully address the composability challenge will significantly lead in withdrawal and deposit experiences, thereby efficiently accommodating user scale.

3|Fully Utilizing "Permissionlessness"

Essentially, the aim of crypto neobanks is to reshape a more efficient currency standard: instant settlements, global liquidity, infinite programmability, and free from bottlenecks imposed by any single entity or government.

Today, anyone with a crypto wallet can transact, transfer, or earn yield without intermediaries from fiat systems. Crypto neobanks should fully leverage this permissionless nature to accelerate capital flow and build a more efficient financial system.

On the crypto track, global capital flows at internet speed, with coordination mechanisms no longer being administrative commands, but incentives and games. The next generation of neobanks will leverage the permissionlessness of blockchain to allow new primitives like perpetual contracts, prediction markets, staking, and token issuance to rapidly integrate with existing financial tracks.

In economies with high stablecoin penetration, there are even opportunities to build a permissionless bank card network—a system akin to Visa or Mastercard, but in the opposite direction: no longer converting stablecoins into fiat currency at the consumer end, but defaulting to on-chain settlements; and for compatibility with traditional payment methods, converting fiat "on-chain" into stablecoins.

Furthermore, "permissionlessness" may not only apply to human users but could also give rise to an agentic economy. For AI agents, acquiring a crypto wallet is much easier than opening a bank account; leveraging stablecoins, an AI agent can autonomously initiate on-chain transactions under user authorization or preset rules. Permissionless neobanks are the foundational base and interaction interface of this "human-agent economy."

4|Localization vs Globalization

Crypto neobanks also face a strategic choice: depth vs breadth.

Some may choose a path similar to Nubank, establishing dominance in a single region through deep localization, cultural alignment, and regulatory understanding before expanding outward; while others may adopt a global-first strategy, launching permissionless products on a worldwide scale and doubling down in regions with strong network effects.

Both paths are valid: the former relies on local trust and distribution, while the latter relies on scale and composability. While stablecoins may serve as the "highway" for international payments, crypto neobanks still need "local exports"—deep integration with regional systems like Pix, UPI, Alipay, and VietQR to achieve genuine local usability.

Especially, crypto neobanks have unique opportunities in "serving the unbanked population," providing capital access denominated in dollars or crypto in regions with weak financial infrastructure or unstable currencies. In the future, regional "super applications" and globally composable neobanks may coexist for the long term.

5|Non-Over-Collateralized Lending and Consumer Credit

Finally, non-over-collateralized lending and consumer credit may be the true "holy grail" for crypto neobanks.

This issue compiles multiple challenges mentioned earlier: it requires a robust, anti-censorship identity system; it demands bridging off-chain credit records with on-chain accounts; and it must deal with differences in credit models across regions while being compatible with traditional systems. As a result, non-over-collateralized lending in DeFi is currently mainly focused on institutional private credit, rather than consumer credit—despite the latter being of much larger scale in traditional finance.

Part of the answer may come from innovative mechanism designs. Flash loans are a native, unsecured lending form fostered by blockchain characteristics. Similarly, smart cyclical credit limits, real-time LTV management, automatic liquidation buffers, and yield auto-repayment built around stablecoins and income-generating assets could gradually reduce collateral requirements.

If successful, on-chain consumer credit would significantly elevate capital flow speeds, providing strong on-chain incentives for the unbanked population, and driving overall economic growth akin to real-world credit expansions.

Conclusion

Just as the rise of fintech neobanks a decade ago reshaped the banking industry, crypto neobanks similarly seek to redefine how we save, spend, grow, and borrow in the digital age. However, unlike fintech neobanks that primarily innovate the front-end interface, crypto neobanks attempt to update the bank's back-end itself—constructing a global, composable, anti-censorship value transfer system through stablecoins and public blockchains.

Hence, crypto neobanks are not just application interfaces; they might be the gateway to a programmable financial system.

Of course, this path has just begun. Building a truly "full-stack crypto neobank" goes far beyond launching a crypto card or a wallet protocol with a UI. It requires a clearly defined target user demographic, rapid expansion along the product matrix, and establishing advantages in high capital flow velocity areas.

If future crypto neobanks can continuously break through in privacy and compliance, real-world composability, permissionlessness, local and global strategies, as well as consumer credit, they have the potential to evolve from the peripheral entry points of digital assets into the default operating system of the global economy.

Just as the first generation of neobanks changed the "interface" of banking with mobile internet, this generation may rewrite the underlying logic of money itself using crypto technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。