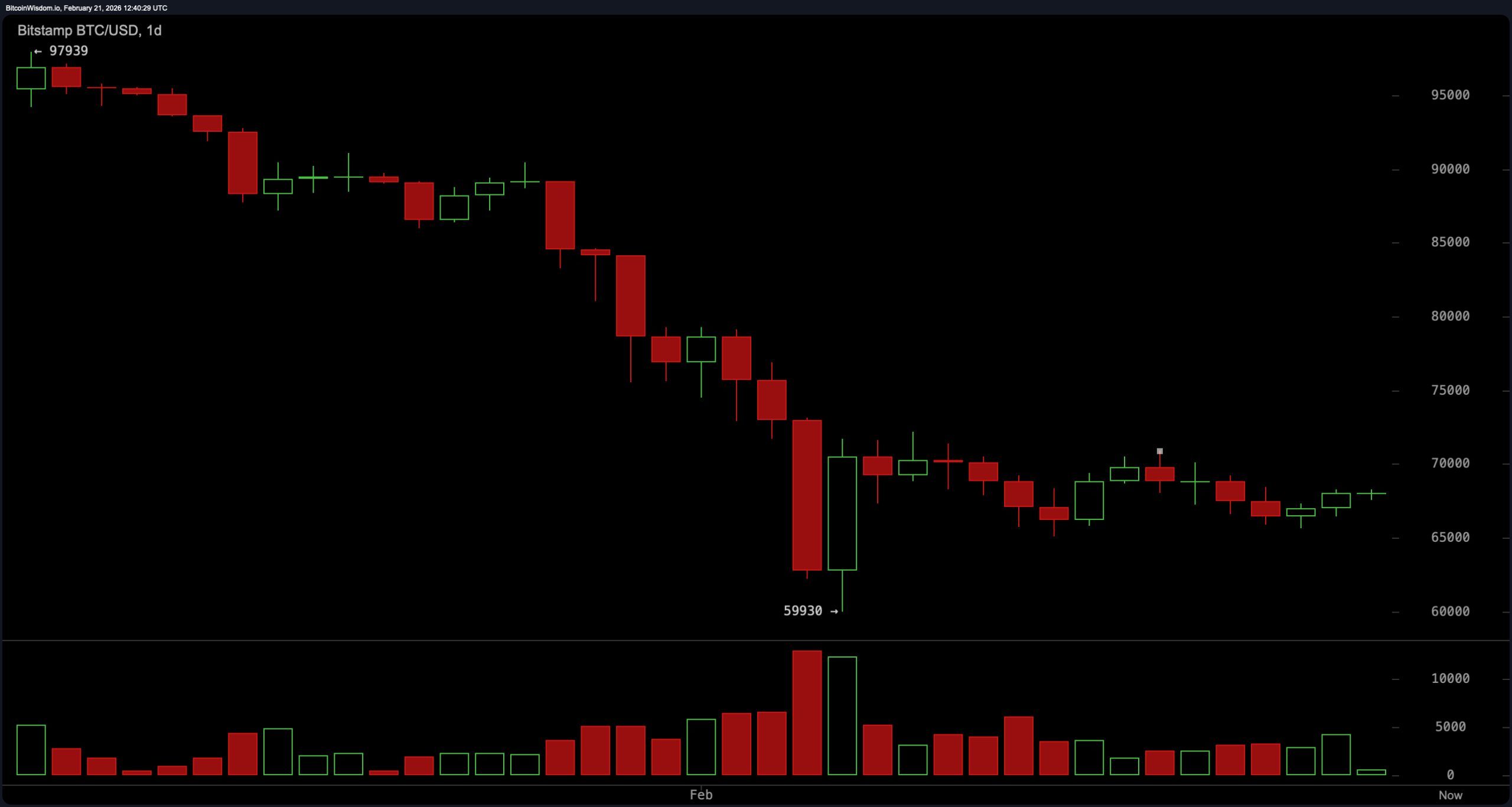

On the daily timeframe, bitcoin remains in a corrective phase that began after the decline from roughly $97,900 to the $59,930 low. The rebound into the high-$60,000s has stabilized price action, but the structure remains capped beneath $70,000 to $71,500, a clearly defined supply zone.

Major support sits at $59,900 to $60,000, with secondary support between $65,000 and $66,000. Until there is a firm daily close above $71,000 accompanied by expanding volume, this price action reflects a relief rally within a broader corrective structure rather than a confirmed macro reversal.

BTC/USD 1-day chart via Bitstamp on Feb. 21, 2026.

The four-hour chart reveals a sequence of gradually higher lows from $65,620, forming a short-term ascending structure. Support is defined between $66,000 and $66,500, while resistance remains concentrated between $68,800 and $69,200. Price repeatedly stalls below $69,000, creating compression beneath resistance. Historically, this kind of tightening range tends to resolve with a decisive expansion. A breakout trigger is clearly marked at $70,000, and failure to sustain above the midpoint near $67,500 would expose the lower support band once again. In short, the coil is tightening; markets rarely stay polite for long.

BTC/USD 4-hour chart via Bitstamp on Feb. 21, 2026.

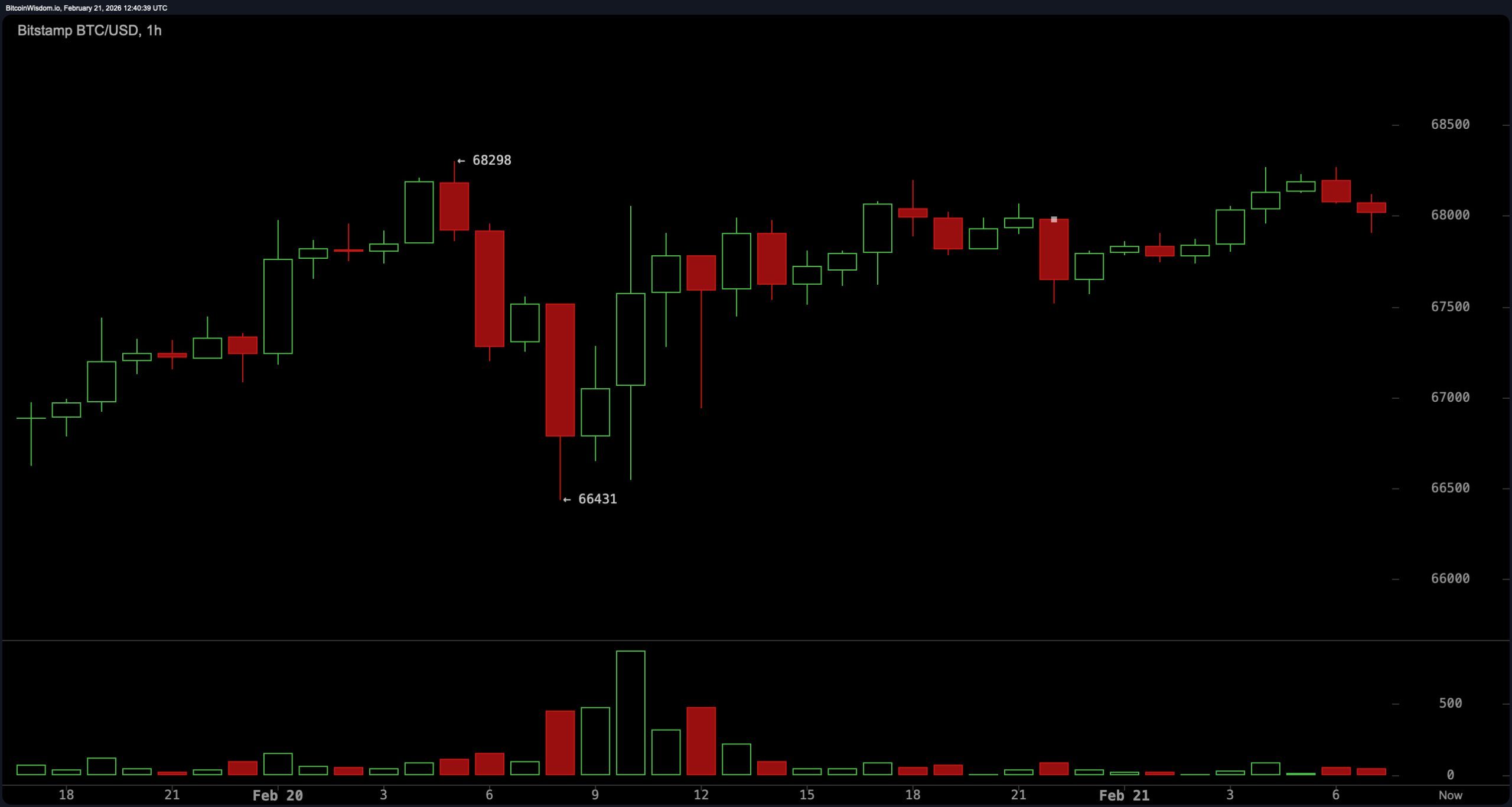

On the one-hour timeframe, bitcoin is locked in tight consolidation between $67,500 and $68,800. Immediate support is $67,600, with a local pivot at $68,000 and resistance between $68,800 and $69,000. Volume is fading, candles are smaller, and volatility has contracted — classic pre-expansion behavior. A break of this micro-range is projected to generate a $1,000 to $1,500 impulse move. In other words, this is the calm before the storm, not a sign that traders have collectively decided to take a nap.

BTC/USD 1-hour chart via Bitstamp on Feb. 21, 2026.

Momentum indicators reflect a neutral-to-constructive short-term posture. The relative strength index ( RSI) reads 37, the Stochastic oscillator stands at 47, and the commodity channel index (CCI) registers negative 42 — all categorized as neutral. The average directional index (ADX) at 58 signals trend strength, though not directional bias.

The Awesome oscillator prints negative 9,297, also neutral. Notably, momentum at 991 and the moving average convergence divergence ( MACD) level at negative 4,012 are positioned positively according to the data. This divergence between price compression and stabilizing momentum adds weight to the probability of an imminent volatility expansion.

The moving average (MA) structure points to the broader corrective backdrop. The exponential moving average (EMA) (10) at $68,289 signals downside pressure, while the simple moving average (SMA) (10) at $67,926 offers slight short-term support. However, the EMA (20) at $70,946, SMA (20) at $69,268, EMA (30) at $73,813, and SMA (30) at $74,708 all reflect firm overhead resistance.

The EMA (50) at $78,242, SMA (50) at $81,761, EMA (100) at $85,528, SMA (100) at $85,565, EMA (200) at $92,565, and SMA (200) at $99,166 reinforce that the longer-term trend structure remains pressured. Until price reclaims the $69,000 to $71,000 corridor decisively, the macro technical posture stays corrective, even as the short-term structure leans constructive.

Bull Verdict:

If bitcoin reclaims and closes decisively above the $69,000 to $71,000 resistance corridor, particularly with expanding volume on the daily timeframe, the structure shifts meaningfully in favor of upside continuation. A sustained move above $71,000 would invalidate the broader corrective narrative and expose $74,000 to $75,000 as the next higher-timeframe resistance band. With the relative strength index ( RSI) stabilizing, the moving average convergence divergence ( MACD) showing constructive positioning, and short-term higher lows developing on the four-hour chart, bullish momentum would likely accelerate quickly. In that scenario, compression resolves upward — and when bitcoin expands, it rarely does so quietly.

Bear Verdict:

Failure to overcome $69,000 to $71,000, followed by a loss of the $66,000 support region, materially increases the probability of a deeper retracement toward $60,000. The daily structure would remain firmly corrective, with overhead pressure from the exponential moving average (20), simple moving average (20), and longer-duration moving averages reinforcing macro resistance. A breakdown below $66,000 would negate the short-term ascending structure on the four-hour timeframe and shift focus back toward the capitulation low near $59,900. In that case, the market would not be coiling for liftoff — it would be preparing for another gravity check.

- What is the bitcoin price on Feb. 21, 2026?

Bitcoin is trading at $67,974 with a 24-hour range between $66,585 and $68,236. - What are the key bitcoin resistance levels right now?

The primary resistance zone for bitcoin sits between $69,000 and $71,500 on higher timeframes. - Where is bitcoin’s strongest support level?

Major support is located at $59,900 to $60,000, with secondary support near $65,000 to $66,000. - Is bitcoin in a bullish or bearish trend?

Short-term structure is constructive, but the daily chart remains in a broader corrective phase below $71,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。