Supreme Court Ruling Sparks Relief Rally Across Retail and Industrials

U.S. equity markets closed at 4 p.m. EST with broad gains, reversing early losses tied to disappointing economic data and sticky inflation readings. A landmark 6-3 Supreme Court decision curbing the White House’s tariff authority under the International Emergency Economic Powers Act injected a dose of relief into risk assets—at least temporarily.

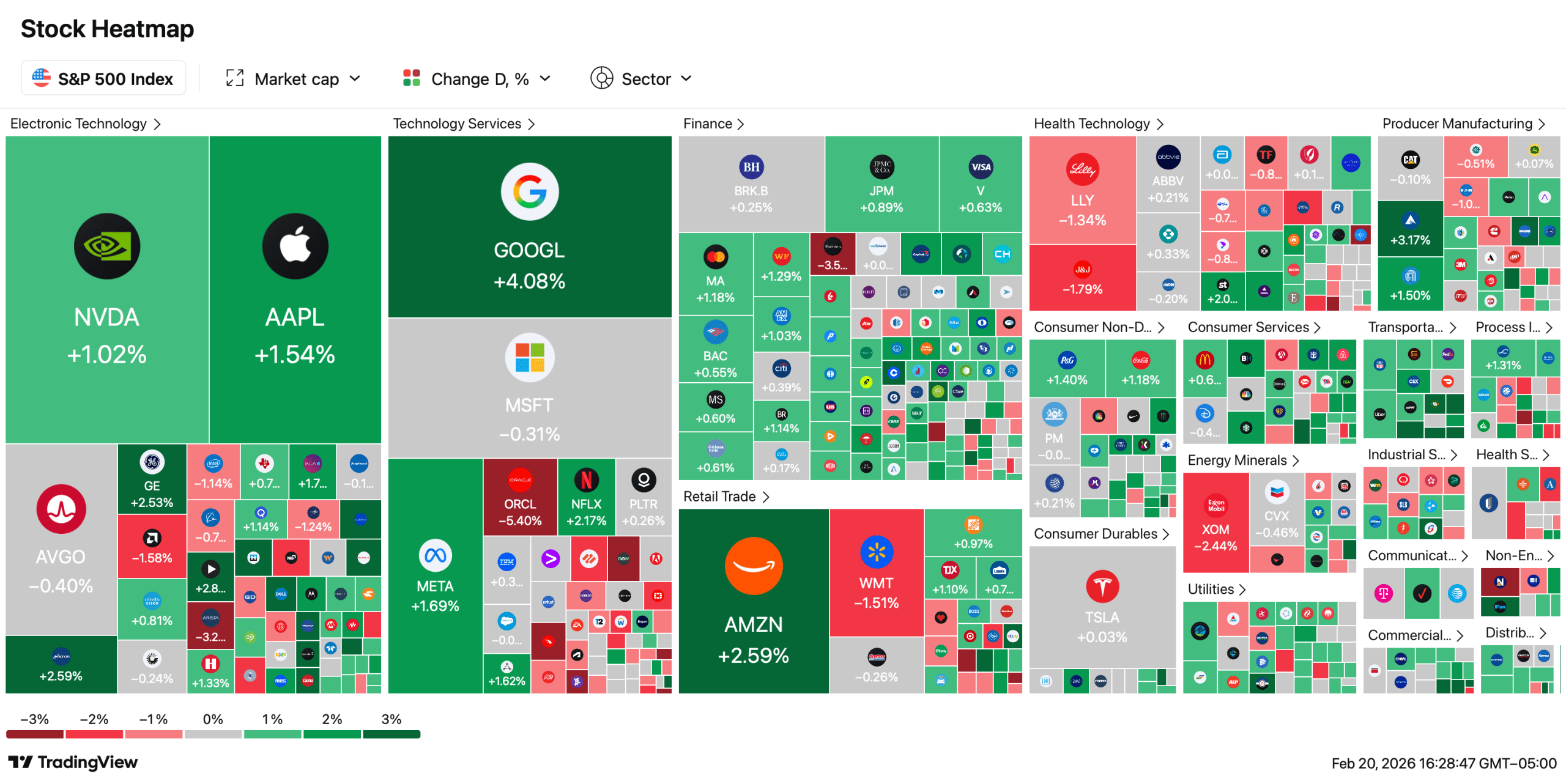

S&P 500 on Feb. 20, 2026.

The Nasdaq Composite led the charge, climbing 0.90% to 22,886.07. The Dow Jones Industrial Average rose 230.81 points, or 0.47%, to 49,625.97 after swinging from a roughly 200-point deficit earlier in the session. The S&P 500 advanced 0.69% to 6,909.51, marking its highest close in more than a week.

The NYSE Composite finished at 23,452.60, up 94.32 points, reflecting broad participation in the rebound. As the reference image shows, all major indexes ended the day firmly in green territory, despite a choppy intraday path.

For the shortened trading week, the S&P 500 gained about 0.7%, the Dow rose 0.3%, and the Nasdaq added 0.9%, snapping a multiday losing streak for tech-heavy equities. Market breadth improved, with advancers outpacing decliners by roughly 58% to 37% on the NYSE.

Supreme Court Delivers a Trade Shock

In a majority opinion authored by Chief Justice John Roberts, the court ruled that President Trump exceeded his authority under IEEPA when imposing broad “reciprocal” tariffs on nearly all U.S. trading partners. The majority held that the statute is intended for genuine national emergencies involving foreign threats—not as a blank check for sweeping trade policy.

The decision raised the prospect of more than $200 billion in tariff refunds, though the matter now returns to lower courts. Dissenting justices warned of disruption to existing trade deals and potential financial complications for businesses and consumers.

President Trump responded swiftly, calling the ruling “terrible” and announcing plans to pursue a new 10% global tariff under Section 122 authority. He also signaled possible expansions under Sections 232 and 301, aiming to keep tariff revenue flowing at similar levels in 2026.

“The Supreme Court’s Ruling on TARIFFS is deeply disappointing! I am ashamed of certain Members of the Court for not having the Courage to do what is right for our Country,” Trump wrote on Truth Social.

The U.S. President added:

“Foreign Countries that have been ripping us off for years are ecstatic, and dancing in the streets — But they won’t be dancing for long!”

Relief Rally Meets Reality

The initial market reaction was clear: tariff-sensitive sectors popped. Industrials and consumer defensives each rose more than 1%, with companies such as Caterpillar and Walmart benefiting from reduced near-term import cost concerns.

Retailers including Amazon and Home Depot gained roughly 2%, as investors weighed potential refunds against the risk of fresh duties. Energy stocks edged higher as oil hit a six-month high amid U.S.-Iran tensions, offering a tailwind to the sector but raising fresh inflation questions.

Technology, however, slipped 0.3%, reflecting an ongoing rotation away from pure artificial intelligence plays and into so-called real-economy stocks. Small caps, as measured by the Russell 2000, rose 0.31%, extending year-to-date gains for that segment. The price of bitcoin also saw gains, jumping a modest 1.2% on the day.

Economic Data Keeps Pressure On

The rally unfolded despite uninspiring economic data. Fourth-quarter GDP printed at 1.4%, well below expectations, weighed down in part by a government shutdown. December personal consumption expenditures inflation held at 3%, reinforcing the Federal Reserve’s cautious stance on rate cuts.

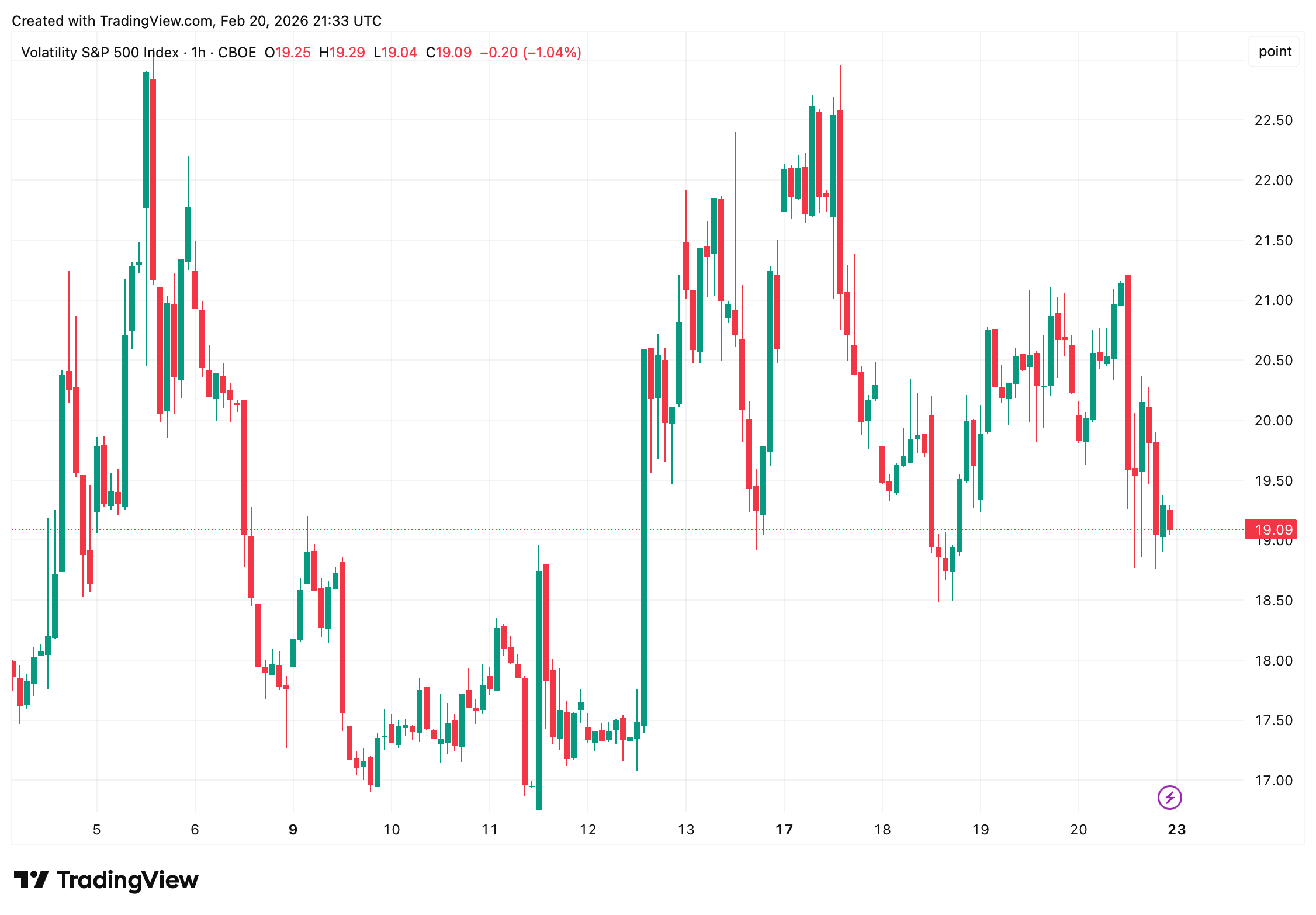

Cboe’s VIX on Feb. 20, 2026.

Purchasing managers’ indexes softened, consumer confidence missed forecasts and U.S. equity outflows reached $52 billion year to date—the fastest pace since 2010. Investors have increasingly funneled money into overseas markets such as South Korea and Brazil.

Oil prices, meanwhile, climbed on geopolitical tensions, complicating the inflation picture. The VIX eased toward 20 but remained elevated, underscoring that volatility has not disappeared.

What Comes Next for Markets?

Analysts now see the Supreme Court ruling as a potential catalyst for the S&P 500 to test the upper end of its recent 6,730 to 7,000 trading range. Bulls are eyeing a push toward 7,000, while bears warn that renewed trade action could quickly reignite turbulence.

Treasury Secretary Scott Bessent indicated tariff revenue could remain “virtually unchanged” under alternative authorities, suggesting policy uncertainty will linger. Investors will parse upcoming consumer sentiment data, housing starts and retailer earnings for clues about demand resilience.

No Federal Reserve rate cuts are expected in the near term, and sticky inflation continues to limit policymakers’ flexibility. If trade tensions flare anew, markets may find that Friday’s relief rally was merely an intermission, not a finale.

For now, Wall Street closes the week cautiously optimistic—cheered by judicial restraint but fully aware that in Washington, the tariff story rarely ends with a single headline.

FAQ ❓

- Why did stocks rise on February 20, 2026?

Markets rallied after the Supreme Court struck down broad emergency tariffs, reducing near-term trade uncertainty. - What did the Supreme Court rule on tariffs?

The court ruled 6-3 that President Trump exceeded his authority under IEEPA when imposing sweeping reciprocal tariffs. - How did major indexes perform?

The S&P 500 closed at 6,909.51, the Dow at 49,625.97, and the Nasdaq at 22,886.07, all posting gains. - Will new tariffs affect markets next week?

Investors expect continued volatility as the administration explores alternative tariff authorities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。