Fragmented Implementation of the U.S. Federal Regulatory Framework and Power Games: An Empirical Study

The evolution of U.S. cryptocurrency policy in 2025 is not linear. Although the Trump 2.0 administration sent strong signals at the executive level, the struggle for "liquidity sovereignty" entered a phase of technical detail games in legislative practice.

The "Balkanization" of Executive Power: The National Reserve Path of 200,000 Bitcoins

The executive order on digital assets released in January 2025 fundamentally changed the U.S. Treasury's definition of on-chain assets.

Micro-operations of Strategic Reserves: The executive order signed in March requires the Treasury to officially allocate approximately 200,000 bitcoins previously seized in the Silk Road and Bitfinex cases into a "Digital Asset Vault."

Legal Classification: Bitcoin is no longer viewed as "criminal proceeds" awaiting disposal but is defined as a "sovereign liquidity hedging tool." This shift directly led to at least 12 sovereign wealth funds worldwide beginning to research the micro-paths for incorporating cryptocurrency assets into their balance sheets in the second half of 2025.

The GENIUS Act: Federal Settlement Practices for Payment Stablecoins

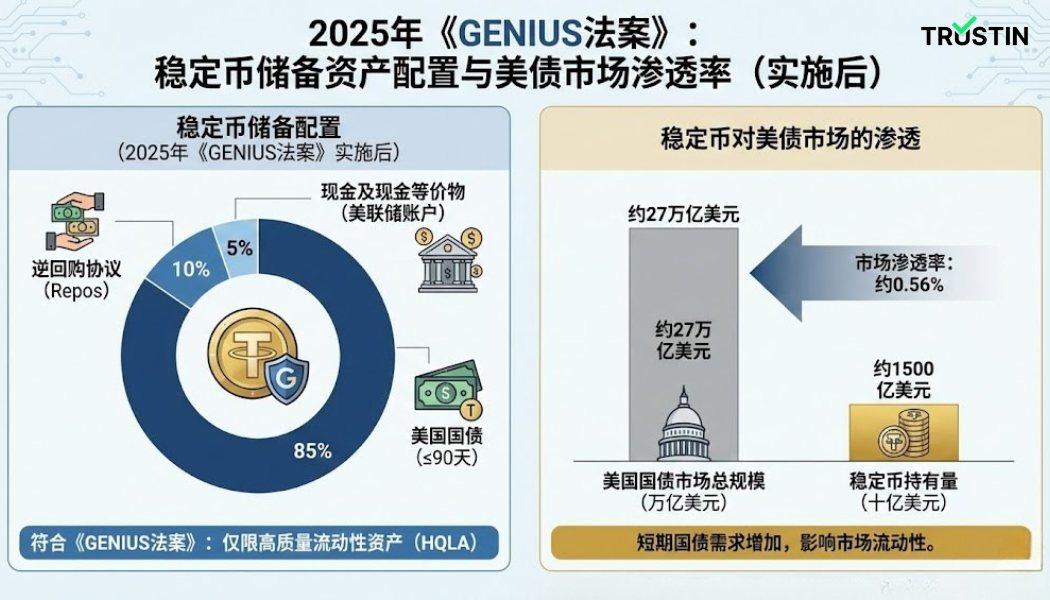

The GENIUS Act (Guidance and Establish National Innovation for US Stablecoins Act), which became effective on July 18, 2025, established the first federal stablecoin framework.

"100% High-Quality Liquidity" Hard Constraint on Reserve Assets

Article 210 of the Act clearly stipulates that federally licensed issuers must allocate reserves to cash, short-term U.S. Treasury securities with maturities of less than 90 days, and Federal Reserve overnight repurchase agreements.

Structural Support in the U.S. Treasury Market: By December 2025, the short-term U.S. Treasury holdings of Circle and Tether had surpassed $240 billion. In the November Treasury auction, the rebalancing trajectories of these issuers were incorporated into the Federal Reserve's Financial Stability Report for the first time, proving that stablecoins had become an organic component of sovereign settlement tracks.

Exclusion of Securities Attributes: The Act formally establishes that payment stablecoins do not fall under the category of securities. This directly led to a shift by traditional institutions such as Bank of New York Mellon concerning the reporting of custodial services for such assets in Q3 2025, transitioning from "asset deduction" to "regular balance sheet items."

Technical Barriers to Accessing the Federal Reserve Master Account

The Act allows non-bank institutions to apply for a Federal Reserve Master Account to access the FedNow system.

Empirical Stress Test Case: In October 2025, the first three applicant institutions faced stringent "instant settlement stress tests." Audits revealed that despite the institutions possessing 1:1 reserves, under extreme redemption pressure, their submission of settlement instructions was delayed beyond the 200-millisecond technical threshold. This failure to meet a micro-technical benchmark resulted in the actual pace of federal licensing rolling out at the end of 2025 being slower than market expectations.

The CLARITY Act: Technical Stalemate in Jurisdictional Division

Although the Act was passed by the House in July, it remained stalled in the Senate Banking Committee by the end of 2025.

The 20% Rule in Determining "Mature Blockchains"

The Act introduced a quantitative decentralized assessment model: If any related group holds more than 20% of a token's circulating supply, that asset will be regulated by the SEC; otherwise, the CFTC will regulate the digital commodity spot market.

Structural Restructuring of Project Governance: A survey of 150 mainstream DAOs in September 2025 showed that about 35% of projects urgently passed a "treasury burn" proposal in Q3. The micro-intent was to artificially reduce the holding ratio of the top 10 addresses, aiming to classify themselves under CFTC regulation before the Senate vote in 2026 to avoid high compliance costs for securities.

The True Touchpoint in Senate Games: Minutes from the hearing on January 14, 2026, revealed that the core of the Senate's delayed vote was "yield distribution." Banking lobbying groups demanded that if the Act allows non-bank entities to issue yields through DeFi protocols, it would trigger a mass flight of commercial bank deposits.

FinCEN's "Priority Management": Two-Year Delay of Investment Advisor AML Rules

On January 14, 2026, FinCEN announced it would delay the effective date of the anti-money laundering rules for investment advisors to 2028.

Compliance Cost Analysis: Research shows that a mid-sized hedge fund establishing a system compliant with BSA standards will incur compliance costs of $1.2 million to $2 million in the first year.

Shift in Risk Priorities: Treasury Deputy Secretary Michael Faulkender made it clear that regulation is focusing on "national security priorities and the highest risk areas." This marks a return to pragmatism in U.S. regulatory thinking from "full-chain census" to "high liquidity shadow node defense" by the end of 2025.

The "Industrialization" of Criminal Pathways: North Korean Hacker Money Laundering Cycle and Shadow Finance Empirical Evidence

At the beginning of 2026, looking back at the crime data from 2025, the most notable micro-characteristic is the shift in attack methods from "finding technical vulnerabilities" to "hunting for management permissions."

Standardized Empirical Analysis of the North Korean Hacker Money Laundering Cycle: 45-Day Rhythm Analysis

In 2025, North Korean hackers (mainly the Lazarus Group) demonstrated strong statistical regularities in the disposal pathways after fund theft.

The Permissioned Shift of Attack Entry Points: A Review of the $1.5 Billion Bybit Case

Hackers no longer looked for contract vulnerabilities, but instead used social engineering to gain personnel permissions.

Impersonating Recruitment and SSO Interceptions: Hackers disguised as recruiters from top AI companies lured victim executives to engage in "technical screening," using malicious code to intercept victims' VPN credentials or single sign-on (SSO) access.

Empirical Effects: In the first quarter of 2025, losses resulting from such intrusions through private key infrastructure accounted for 88% of total industry losses.

The 45-Day Timeline Distribution of the "Standardized Money Laundering Path"

Once asset transfers succeed, North Korean hackers initiate the following processes:

T+1 to T+7 (Liquidity Replacement): The flow of stolen funds to DeFi protocols surged by 370%. Hackers converted stolen coins into USDT/USDC using DEX's permissionless liquidity and simultaneously entered the first-layer mixer.

T+8 to T+21 (Cross-Chain Dispersion and Path Fingerprint Disconnection): Large-scale use of cross-chain bridge services (such as XMRt, with a 141% traffic increase). Empirical data shows that hackers during this stage tend to split funds into small transfers below $500,000, aiming to evade compliance software's "large transaction monitoring" thresholds.

T+22 to T+45 (Specific Channel Exit): Money laundering enters the final stage, focusing on specific Chinese money laundering guarantee services (such as Tudou Guarantee, Huiwang). Tudou Guarantee's share of illegal circulation surged by 1753% in 2025.

Micro-Evolution of VASP Access Mechanisms in Various Jurisdictions and Empirical Analysis of Compliance Cost Benefits

In 2025, the regulatory granularity for global VASPs began to quantify specific numbers related to paid-in capital, audit frequency, and reserve liquidity tiers.

Brazil: Empirical Analysis of Industry Clearance Driven by "Heavy Capital"

In November 2025, the Brazilian Central Bank (BCB) issued resolutions No. 519-521, marking the entry of the South American cryptocurrency market into the "bank-level" regulatory phase. This resolution is not merely an authorization system but achieves a micro-cleaning of the stock market through extremely high financial hard constraints.

Micro-setting Logic of Capital Thresholds: Brazil requires VASPs to have a minimum paid-in capital ranging from BRL 10.8 million to BRL 37.2 million (approximately $2 million to $6.9 million). This figure is not randomly set but is calculated based on the "risk reserve" determined by the risks VASPs faced in handling illegal funds in 2024.

Exit Empirical Evidence for Existing Institutions: By the end of December 2025, approximately 42% of small and medium-sized non-standard platforms in Brazil announced they would cease operations due to their inability to complete capital adequacy before the early 2026 deadline. This "heavy capital" strategy achieved substantial industry consolidation, forcibly directing liquidity to compliant entities with banking backgrounds.

Taxation and Exchange Rate Intervention in Cross-Border Payments: In the second half of 2025, Brazil began implementing micro-taxes on cross-border payments using stablecoins, resulting in a rise of about 4.5% in the costs of illegal offshore fund transfers, forcing many P2P businesses to switch to regulated instant payment systems.

Hong Kong: Construction of Redemption Timeliness and Underlying Asset Liquidity Ladder for Stablecoins

In August 2025, the Hong Kong Monetary Authority (HKMA) implemented a regulatory system for stablecoin issuers, shifting the regulatory focus from merely reserve ratios to a more micro-focused "liquidity redemption guarantee."

Mandatory "1 Working Day Redemption" Indicator: Licensed issuers must prove their ability to complete face value redemptions within 1 working day. To meet this requirement, issuers must establish extremely sophisticated liquidity ladders.

Changes in Reserve Allocation: Research at the end of 2025 showed that stablecoin issuers under Hong Kong licenses raised the proportion of cash and overnight repos (O/N Repo) in their reserves to over 25% of the total. This extreme requirement for the quality of underlying assets, while compressing the profit margin for issuers, demonstrated highly defensive performance during the volatility in the U.S. Treasury market in November, successfully attracting institutional funds from Southeast Asia.

Kazakhstan: Cross-Domain System Design of the Digital Financial Asset (DFA) Banking Law

Kazakhstan's amendments to the banking law, which officially took effect on January 17, 2026, are actually based on extensive technical piloting conducted throughout 2025 at the Astana International Financial Centre (AIFC).

The Three-Tier Classification System for DFA: The law classifies cryptocurrency assets into fiat-currency-supported (stablecoins), asset-backed (tokenized commodities), and electronic financial instruments.

"Risk-Free" Constraints on Reserves: The law mandates that 1:1 full reserves must be deposited in designated secondary bank custodial accounts and strictly prohibits using reserves for any investment activities (including government bonds). This design reflects Central Asian countries' micro-awareness of the potential for on-chain liquidity to trigger traditional bank runs.

Integration Practices in Banking: The law allows commercial banks to hold up to 100% in fintech subsidiaries for conducting cryptocurrency asset custody and payment services. Halyk Bank established Halyk Digital in December 2025, marking the formal integration of on-chain assets into sovereign-level clearing accounts.

Empirical Study of Transparent Audits of Nesting Risks in VASP

In 2025, the "nesting risks" among VASPs became a major hotspot for the development of compliance software and regulatory inspections.

Behavioral Features of Shared Wallets: Many unlicensed small nodes used a facade of compliance by nesting within the shared wallets of large compliant exchanges, conducting high-frequency transfers.

Empirical Identification of Shadow Nodes: In the review of the Bybit incident, technicians analyzed the transaction flows of the entire year of 2025, isolating 28 "shadow nodes" that specifically handled high-risk illegal traffic from the public traffic of compliant VASPs. These nodes exhibited specific "high-frequency diversion" patterns, with funding gaps usually less than 3 seconds, and demonstrated typical structured money laundering characteristics.

Empirical Resistance against Geopolitical "Pressure Release Valves": Public Health and Dark Web Dynamics

In 2025, the geopolitical conflicts and public health crises officially reshaped the cryptocurrency track from "alternative asset" to "sovereign-level financial infrastructure." Illegal actors demonstrated extreme technical resilience this year.

Structural Restructuring of the Darknet Market (DNM): From Abacus to TorZon

In 2025, the total influx of funds into the darknet market approached $2.6 billion. Despite frequent law enforcement crackdowns, cryptocurrency-driven drug transactions showed strong adaptability.

Abacus Market's "Exit Scam": In July 2025, Abacus Market, which dominated the Western darknet market, suddenly went offline, with the administrator absconding under the guise of a DDoS attack.

Liquidity Migration and the Rise of TorZon: Within 30 days post-Abacus closure, traffic quickly shifted to TorZon. This model of "market resupply" and "post-disaster migration" indicates that DNM has evolved into a highly globalized supply network, whereby the closure of a single node can only trigger extremely short-term pauses.

Transformation of Fraud Shops: The activity of fraud shops decreased year-on-year in 2025, driven by law enforcement pressure and the proliferation of compliant custodial payment tools; however, Chinese fraud shops showed a trend towards high-value, wholesale integration.

"On-Chain Early Warning" of the Fentanyl Supply Chain and Health Risk Empirical Research

2025 marks a turning point for the use of blockchain data to support public health. On-chain monitoring found a significant reduction in the flow of funds related to fentanyl precursors in 2025, which correlates positively with declines in opioid interception amounts and mortality rates.

Early Warning Signals: Fluctuations in on-chain data typically precede public health statistics by 3-6 months, formalizing the entry of blockchain analysis tools into the decision-making view of national health organizations.

Transaction Amount and Health Correlation Analysis: Micro-analysis based on Canadian public health data shows that the size of cryptocurrency transaction amounts directly affects health outcomes: large cryptocurrency drug purchase transactions (usually representing wholesale or high-frequency use) correlate with negative health outcomes, whereas small transactions show no significant correlation. This provides law enforcement with micro-priority guidance for "targeted elimination of high-risk procurement nodes."

On-Chain Projection of Geopolitics: Empirical Evidence of Clearing Networks of Sovereign Actors

In 2025, actors like Russia, Iran, and Venezuela established a completely independent clearing loop from the U.S. dollar system on-chain.

Empirical Analysis of Shadow Stablecoin A7A5: The Russian ruble-pegged stablecoin A7A5 processed over $72 billion in transactions in 2025.

Non-USD Clearing Loop: A7A5 is not merely a token but a core medium connecting Russian sanctioned entities with illegal financial services in the Asia-Pacific and Middle East (such as Chinese guarantee services). The underlying A7 wallet cluster is linked to at least $38 billion in transactions, showing its deep integration within a specific shadow banking system.

Venezuela: Empirical Evidence of Dual-Use Rails: In December 2025, a U.S. seizure case involving a sanctions avoidance fuel vessel revealed that Venezuela had begun to use cryptocurrency tracks extensively for energy settlements.

Intersection of Livelihood and Sanctions: Cryptocurrency facilities in Venezuela support legitimate overseas remittances while also serving as a national-level clearing tool to bypass the international banking system. This "dual-use" characteristic poses high micro-recognition difficulty for the enforcement of sanctions targeting the region.

Liquidity Capture: Underlying Reconstruction of Risk Quantification

In 2025, a highly granular new metric—"liquidity capture"—was introduced in anti-money laundering.

Metric Definition: This metric measures how much "deployable capital" illegal entities have captured, rather than simply the number of transactions.

Empirical Data: Although illegal transactions accounted for only 1.2% of the total, illegal entities captured 2.7% of on-chain available liquidity in 2025.

Micro-Conclusion: Illegal funds are far more active and have a higher turnover rate on-chain than ordinary assets. Traditional monitoring software, focusing excessively on "transaction counting," neglected the substantive pollution depth of these active capital on the financial system. The regulatory focus in 2026 will shift entirely to this "liquidity penetration."

Technological Evolution of Regulatory Technology—Real-Time Attribution of Asset Fingerprints and Global Intelligence Alignment: An Empirical Analysis

The core evolution of anti-money laundering technology in 2025 is reflected in the deep extraction and real-time attribution of dynamic asset fingerprints. Due to the complexities faced by national-level attackers and large-scale shadow clearing networks, traditional monitoring methods based on static address tagging show considerable limitations in recognizing highly concealed funding flows. Consequently, the focus of technology development has shifted towards multidimensional behavioral pattern analysis and low-latency response architectures.

Application Practices of Asset Fingerprint Extraction and De-Anonymization Techniques

For mixing protocols and complex transaction paths, anti-money laundering software in 2025 began to widely adopt probabilistic attribution models for monitoring.

Technical Parameters of Probabilistic Attribution Models: This model analyzes the retention behavior patterns of specific amounts of funds (such as single transactions greater than 100 ETH) after entering liquidity pools. Specific parameters include the time lag between deposits and withdrawals, the splitting and combination patterns of asset amounts, and specific gas fee characteristics generated during transaction execution. These data points collectively form a unique asset fingerprint to achieve logical tracing alignment in the absence of direct link associations.

Improvement in Identification Confidence Data: Monitoring data from December 2025 indicates that for money laundering paths where the retention time in complex protocols is less than 48 hours and amount characteristics overlap highly, the accuracy of real-time attribution technology improved from around 60% in 2024 to over 92%. This increase directly diminishes the efficacy of behaviors attempting to obscure fund origins through high-frequency small transactions.

Beacon Network: Effectiveness Analysis of Global Intelligence Real-Time Synchronization

In 2025, the Beacon Network covered about 75% of the transaction volume of global virtual asset service providers. The core function of this system is to eliminate the intelligence delays between enforcement agencies in different jurisdictions.

Physical Delays in Intelligence Exchange: When specific risk nodes in Latin America attempt to liquidate through fiat channels, compliant systems located in Asia or North America can synchronize the risk weights of that node within 300 milliseconds. This increase in efficiency means that restrictions on illegal funds are no longer affected by geographical location or the office hours of different jurisdictions.

Empirical Data: In a large-scale protocol attack incident in September 2025, the system captured early warning signals based on behavioral characteristic codes 18 hours before the execution of malicious code. This large-scale implementation of preventive risk management enabled law enforcement agencies to intervene proactively and disrupt subsequent asset transfer operations.

Deep Reflection: Shifting from "Rule Governance" to "Algorithm Gaming"

Observing the on-chain data for the entire year from the early 2026 perspective, the focus of anti-money laundering efforts appears to be deeply migrating from address tagging to asset fingerprint extraction. The successful capture of 2.7% of available liquid capital on-chain by illegal entities in 2025 indicates that traditional transaction volume ratio analysis cannot cover the true depth of shadow finance networks' penetration into ecosystems.

The final empirical analysis points toward a specific technological trend: the effectiveness of anti-money laundering will depend on the ability to disrupt illegal entities' speed in utilizing available capital. When the blockchain data from 2025 can reflect changes in related drug interception amounts ahead of public health statistics, this data infrastructure has surpassed the realm of financial regulation. The core competition in 2026 will center around extracting deeper asset fingerprints at lower costs and achieving a shift towards low-latency automated interventions at the transaction execution level through real-time path attribution during illegal funds' attempts to access liquidity nodes.

TrustIn — Insight into Risks, Depth in Understanding, and Ensuring Regional Compliance.

TrustIn is an anti-money laundering (AML) infrastructure for stablecoins (USDT/USDC) aimed at the global market.

We provide "white-box" risk control engines covering mainstream public chains globally, which not only support real-time screening against global sanction lists (OFAC, etc.) but also possess deeper data insights in complex transaction networks (shadow intelligence addresses), helping you to reject "false positives" in global operations and ensure safe fund circulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。