There's still no deal on the CLARITY Act.

The real development is the paperwork banks brought to the table.

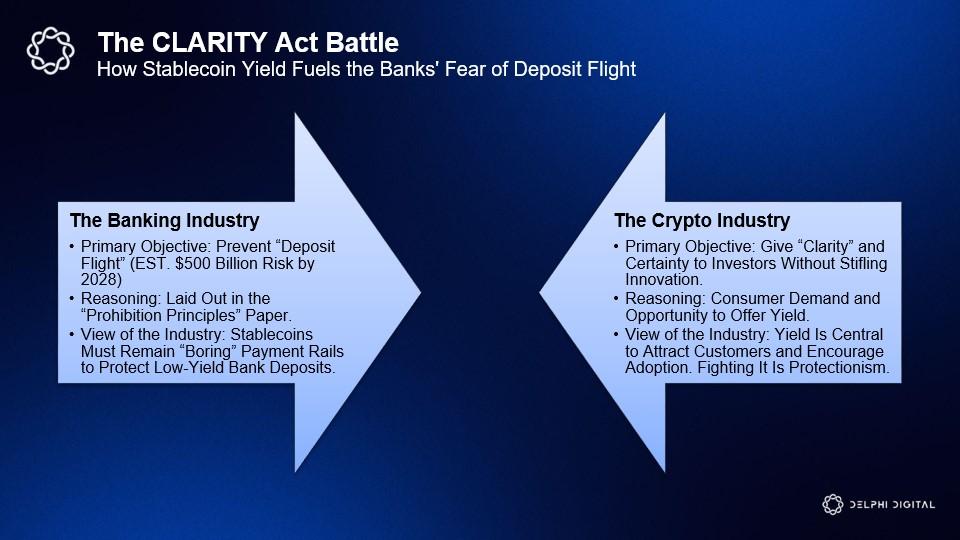

Their "Prohibition Principles" document is designed to eliminate stablecoin yield programs entirely. The concern driving this is deposit flight.

Standard Chartered estimates $500B could leave traditional banks by 2028 if stablecoin rewards become standard.

From the banking industry's perspective, stablecoins should function as payment rails, not yield-bearing competitors to deposit accounts.

Treasury Secretary Bessent has added pressure from the political side, publicly calling Coinbase a "recalcitrant actor" and accusing parts of the crypto industry of being "nihilists" who would rather have no rules than compromise.

The Trump Administration wants to pass a crypto bill. The banks want deposits protected. Both sides are dug in.

What's actually at stake here is control over the interest generated by digital dollars.

March 1st is the key date. If neither side moves by then, this legislative window may close and regulatory clarity remains out of reach.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。