Strategy Inc. (Nasdaq: MSTR), the world’s largest bitcoin treasury company, shared on social media platform X on Feb. 15 that it can withstand a decline in bitcoin’s price to $8,000 and still maintain enough assets to fully cover its outstanding debt.

The firm wrote:

“Strategy can withstand a drawdown in $ BTC price to $8K and still have sufficient assets to fully cover our debt.”

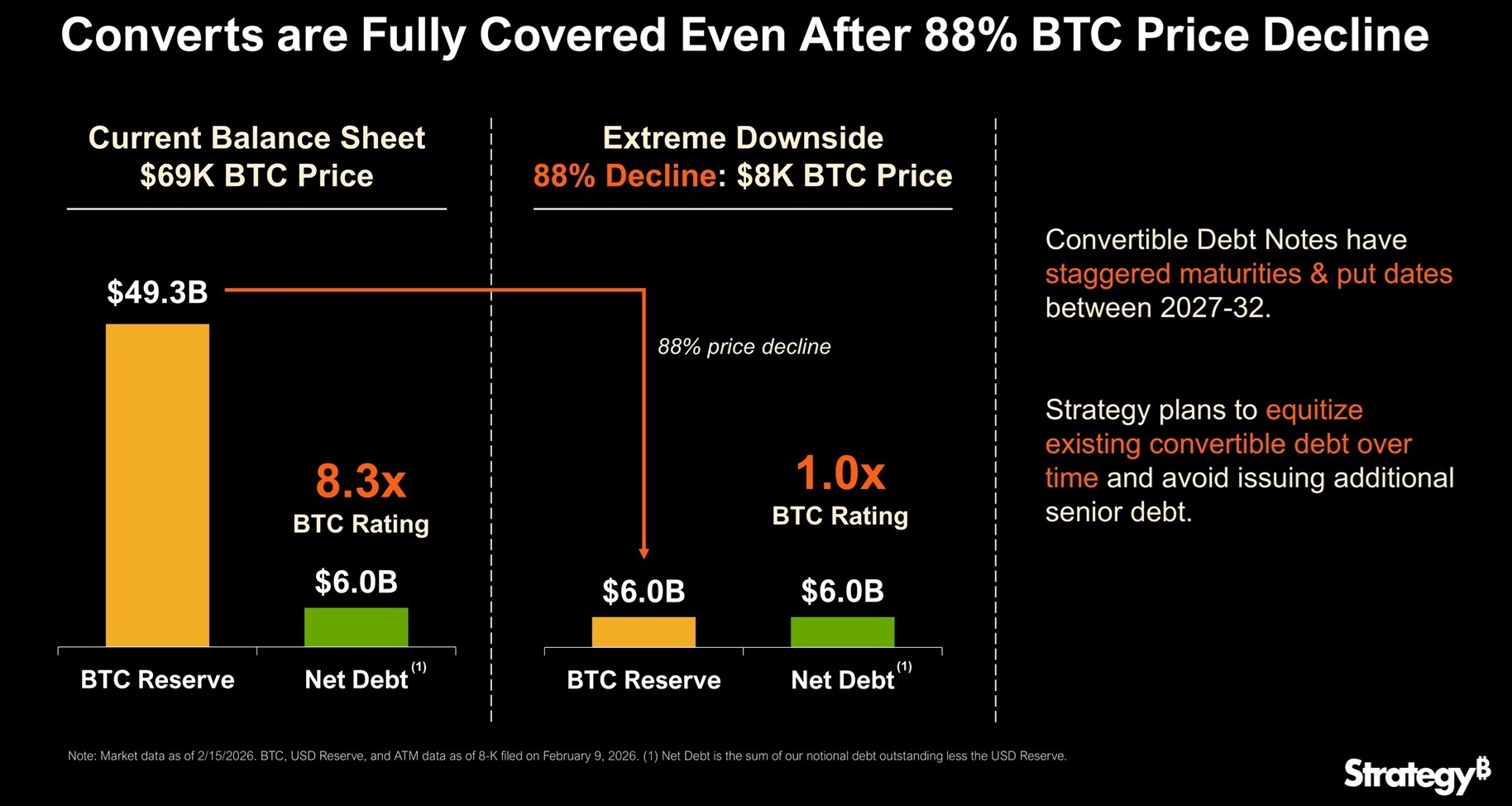

“Convertible Debt Notes have staggered maturities & put dates between 2027-32,” the company detailed: “Strategy plans to equitize existing convertible debt over time and avoid issuing additional senior debt.”

An accompanying chart showed that at a $69,000 bitcoin price, Strategy holds about $49.3 billion in bitcoin reserves against $6.0 billion in net debt, reflecting an 8.3x coverage ratio. Under an extreme 88% decline to $8,000 per bitcoin, the graphic indicated reserves would still total roughly $6.0 billion, matching net debt and implying 1.0x coverage.

During a CNBC interview last week, Strategy CEO Phong Le addressed the company’s $17 billion unrealized quarterly loss and outlined when selling bitcoin could potentially become a consideration. “My message is to hold on. We’ve been through bitcoin downturns in the past,” he said, emphasizing prior 50% to 75% drawdowns. He described the loss as a mark-to-market accounting impact rather than a cash shortfall, stating: “It’s a GAAP loss.” Le added:

“If bitcoin goes down to $8,000 for 5 years, maybe then we start to have issues around whether we need to sell bitcoin, but the GAAP loss isn’t really something we’re concerned about.”

He pointed to approximately $2.25 billion in cash and 10% to 12% leverage, characterizing Strategy’s position as a “fortress balance sheet,” while Executive Chairman Michael Saylor reiterated a long-term accumulation approach.

- Can Strategy cover its debt if bitcoin falls to $8,000?

Yes, Strategy says its bitcoin reserves would still match its $6.0 billion in net debt at that price. - What is Strategy’s bitcoin coverage ratio at $69,000?

At $69,000 per bitcoin, Strategy reports an 8.3x coverage ratio against its net debt. - Why did Strategy report a $17 billion quarterly loss?

The loss was described as a GAAP mark-to-market accounting impact, not a cash shortfall. - When might Strategy consider selling bitcoin?

CEO Phong Le said prolonged prices around $8,000 for five years could potentially force that discussion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。