Years later, facing a sUSDe yield curve below 3%, that once-mighty DeFi miner would remember the distant afternoon he first deposited ETH into EigenLayer, just as he often reminisced about the glory of DeFi Summer during the last bear market.

In the neighboring contract market, a "trader" with 75 times leverage watched helplessly as his position was liquidated by a spike, silently closing the screen.

The old ways of making money have failed, while an ancient financial tool just happens to provide an escape for them.

Interest Rate Decline

Where does the excess yield from mining come from?

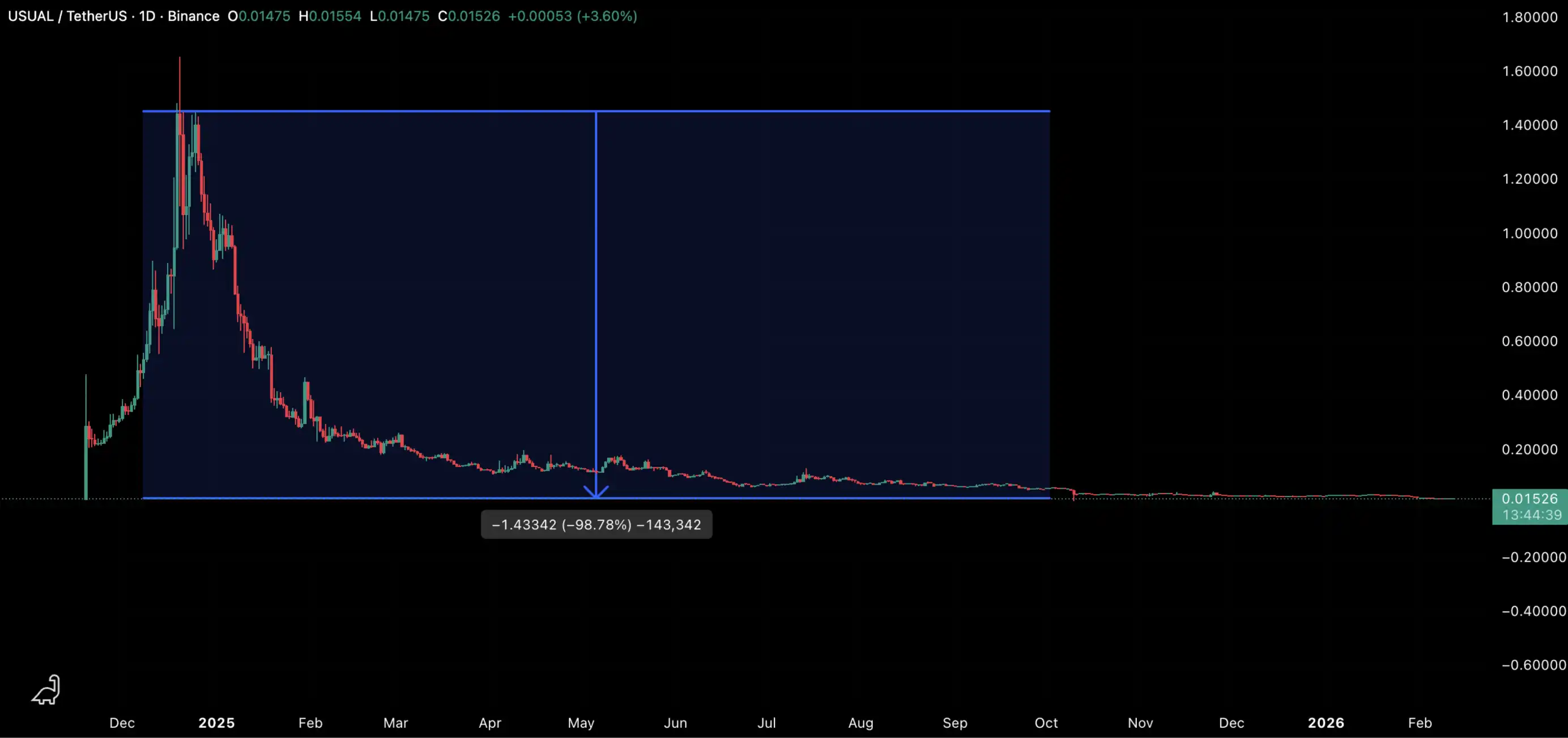

First, from the token rewards issued by new projects (subsidizing early users through token inflation). The premise of this logic is that there are buyers willing to take over the tokens. Now, the continuous bloodletting of altcoins has severely impacted the value of airdrops, and project teams are also reluctant to indiscriminately issue tokens as rewards for mining.

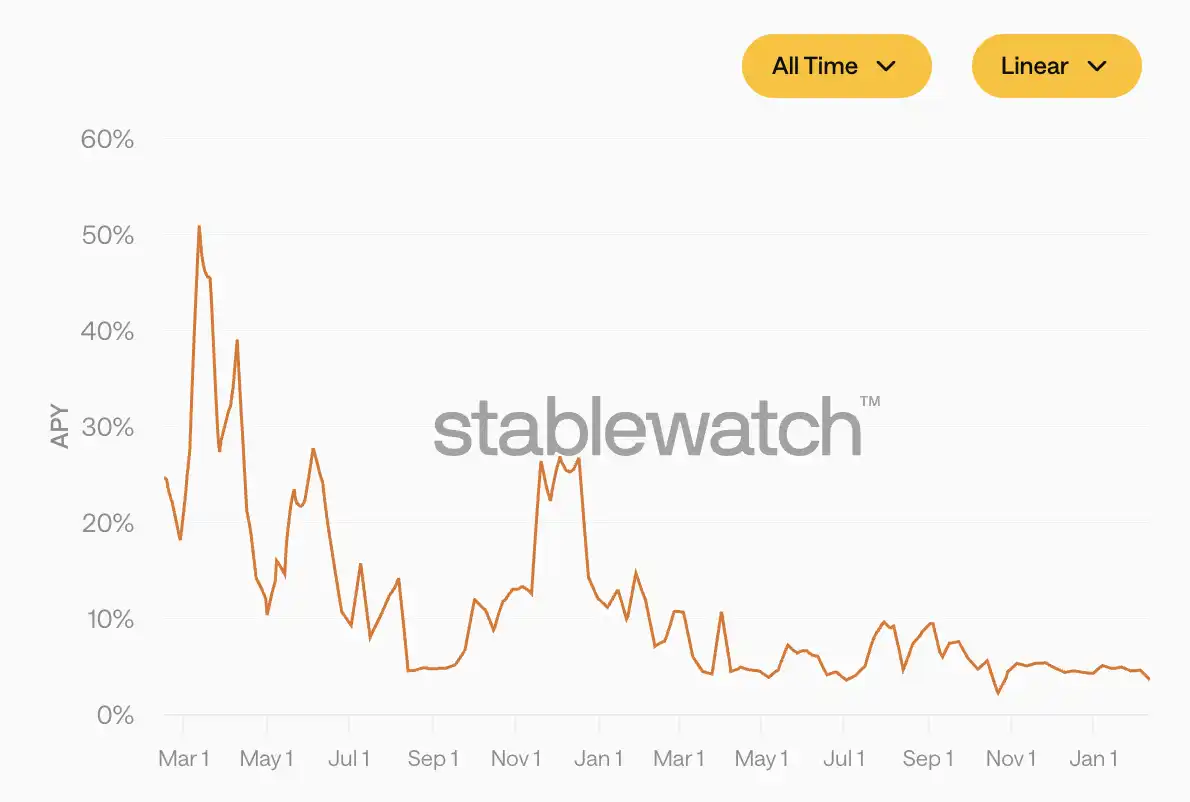

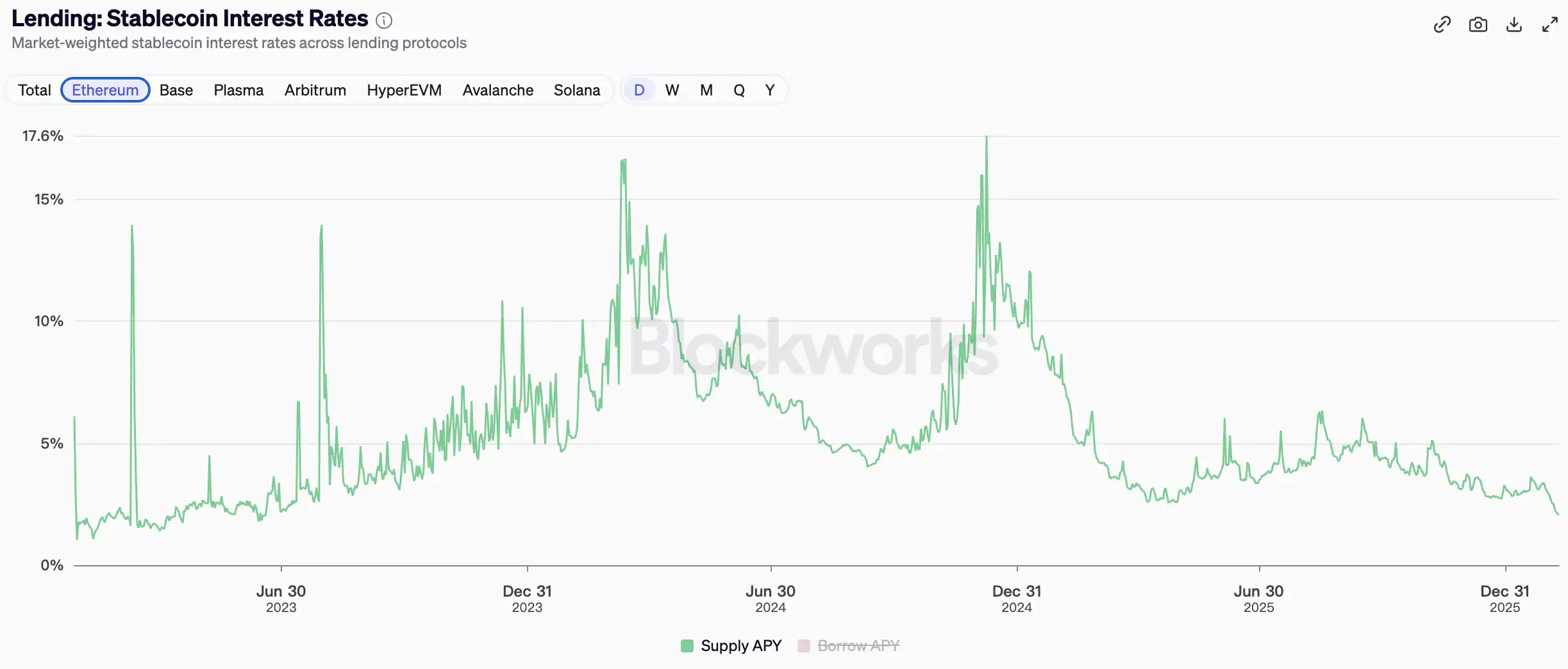

Second, the long-standing positive funding rate has created arbitrage opportunities, but this portion of the yield has been nearly fully absorbed by projects and institutions like Ethena. The APY of sUSDe has dropped below 4% today, compared to over 40% in early 2024;

Third, there is real borrowing demand. During the bear market, trader's exposure to on-chain assets has shrunk, and interest rates have plummeted. The stablecoin loan rate has fallen back to 2.3%, marking a new low in recent years.

The mines are still there, miners are still there, but the gold is gone.

In the "post-DeFi era," where the Ponzi flywheel is stuck and yields have dried up, capital is looking for the next destination that can provide sustainable returns.

The "Inherent Flaw" of Perpetual Contracts

Sharing the same roof as DeFi miners is a group of reckless Degens.

Degens do not mine, do not store coins, and do not calculate APY. What Degens want is leverage, direction, and simply "betting on up or down." Perpetual contracts are tailor-made tools for them: if they think the market will rise, they go long; if they think it will fall, they go short, leveraging their profits, where being right for just one night can multiply returns.

But excessive leverage has fostered a market that devours its participants.

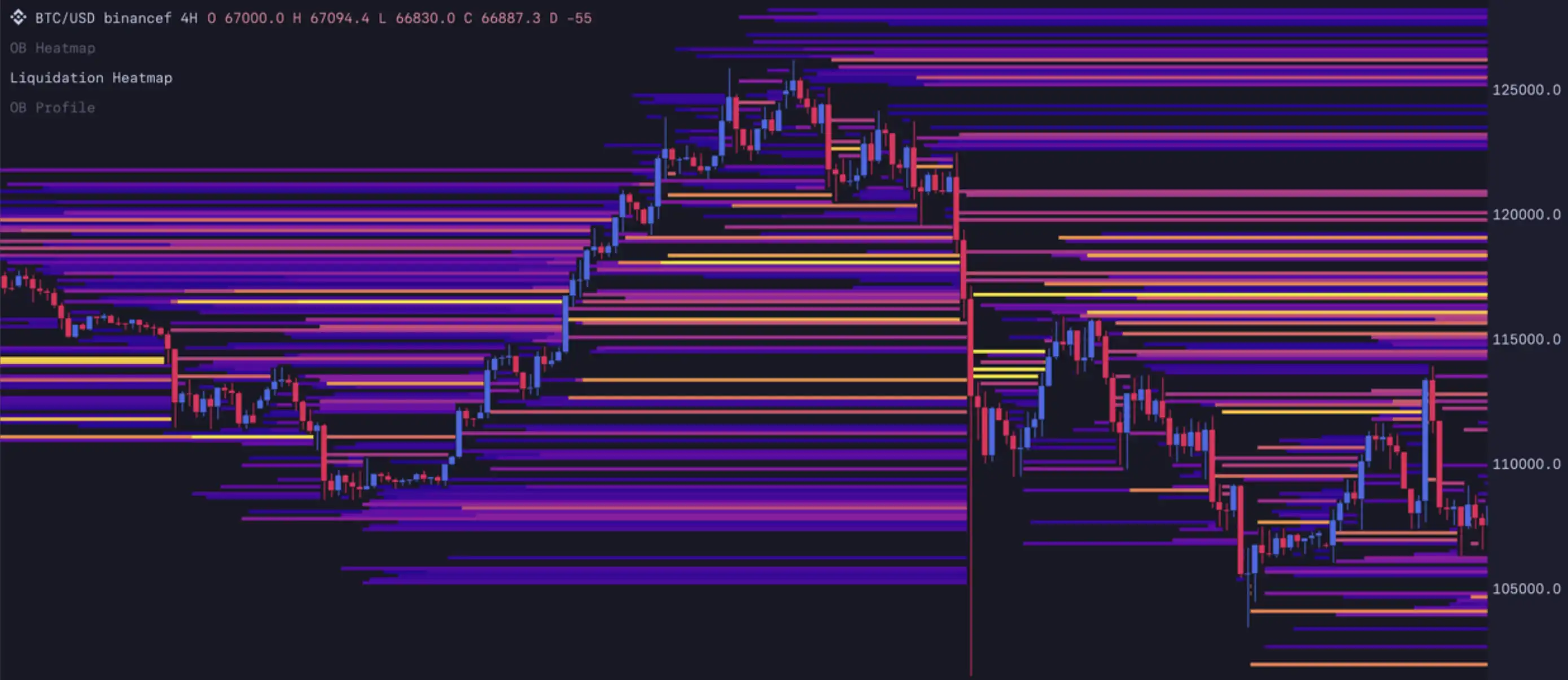

In contract trading, liquidations do not require prices to move far in the opposite direction. The other bad news is that when buying and selling pressures are similar, prices tend to move towards the direction that captures more liquidity. In other words, the market actively seeks to hit your stop-loss and liquidation levels.

This is an inevitability dictated by market structure.

On October 11, we experienced a brutal liquidation event. Countless long traders were liquidated in the spike, and although prices quickly rebounded afterward, their positions could not be restored.

Signal of a major reshuffle: Unfilled contracts of altcoins surpass Bitcoin

Simply getting the direction right is not enough; you must also ensure you are not thrown off the train before reaching the destination.

Probability of liquidation for different positions, holding times, and leverage multiples (data collected in 2021)

Two groups of people, two kinds of anxiety. Miners’ yields are dwindling, while Degens’ positions are being hollowed out. Apparently unrelated dilemmas, yet they point towards a new frontier.

An Insurance Policy, A Money Printer

To explain to readers unfamiliar with options in the simplest way: an option is like an insurance policy.

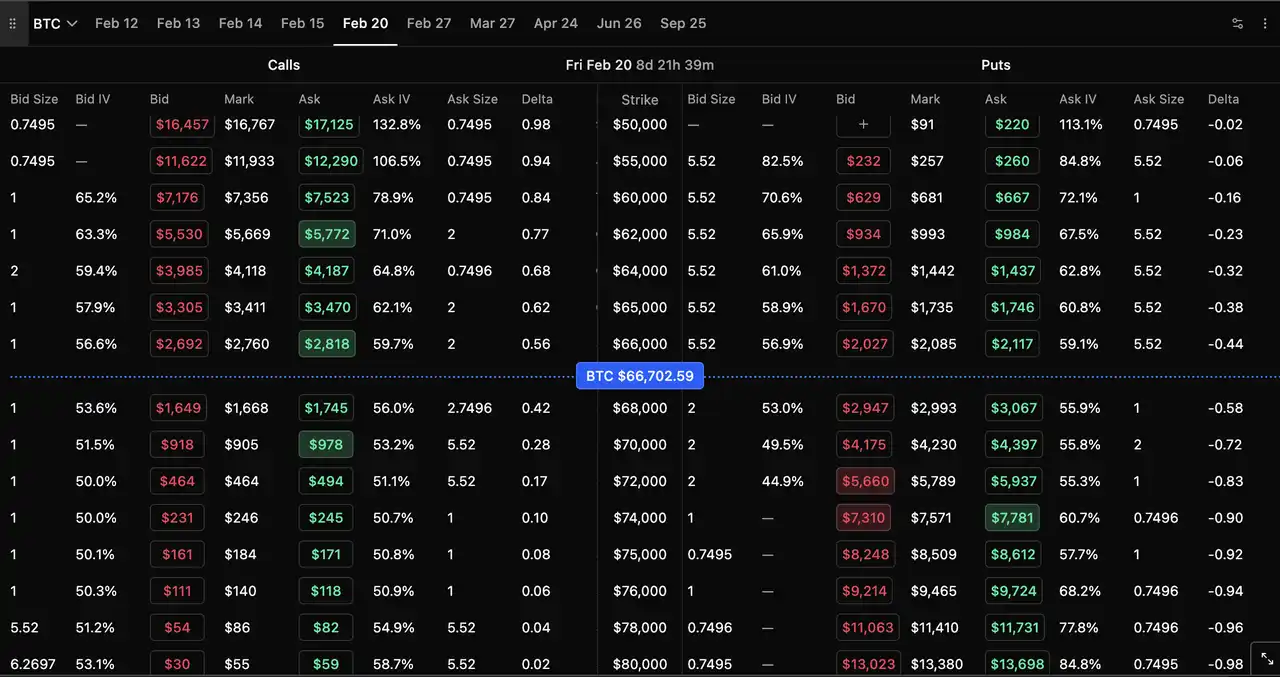

Suppose you think BTC will rise to $80,000 in the next month, but you are afraid of being liquidated in between due to a spike. You can spend $1,000 to buy a call option—this $1,000 is your "premium". No matter how BTC fluctuates throughout the month, even if it drops 20% one day and rebounds, your maximum loss is always just this $1,000. As long as at expiration, the BTC price is higher than the strike price, you will make a profit.

In simple terms, the option buyer locks in the maximum loss, obtaining a kind of "path-independent" profit—regardless of how the path unfolds, only the endpoint matters.

This is the value of options for contract players. Specifically, it offers two paths:

Protective puts (insuring contract positions). You opened a long BTC position, while spending a little money to buy a put option. If the market suddenly plunges due to a spike, your contract position incurs losses, but the gains from the put option can offset most of the losses—equivalent to insuring your position.

Directional gambling (betting small for big). With a small premium, you gain high exposure to the rise of BTC. If you're right, the return can be 5x or 10x; if you're wrong, you lose only the premium. This experience is nearly as thrilling as "betting on up or down" in contracts, but you will never be liquidated.

The brilliance of options also lies in their being a two-sided market. When someone buys insurance, someone else needs to sell it.

This is precisely the value of options for DeFi miners.

The role of option sellers is akin to that of "insurance companies." You deposit funds into the options protocol, providing liquidity to those on the market who buy insurance, in exchange for the premiums paid as profit. Sellers earn the volatility premium—the insurance fee that market participants are willing to pay to hedge risk or engage in directional speculation.

For Farmers accustomed to the "deposit coins to earn interest" model of DeFi mining, this rent-collecting logic is very familiar. The difference is that the yield from DeFi mining is dwindling, but as long as the market is still volatile and people still need hedging, the volatility premium will never disappear.

An insurance policy, a money printer. Buyers will never face liquidation, and sellers have a sustainable source of income. Degens and Farmers at opposite ends of the options market each obtain what they need—this is a closed loop that contracts and Yield Farming cannot provide alone.

Why Haven't On-Chain Options Gained Popularity?

With such a great concept, why have options in the crypto market been "sitting on the sidelines"?

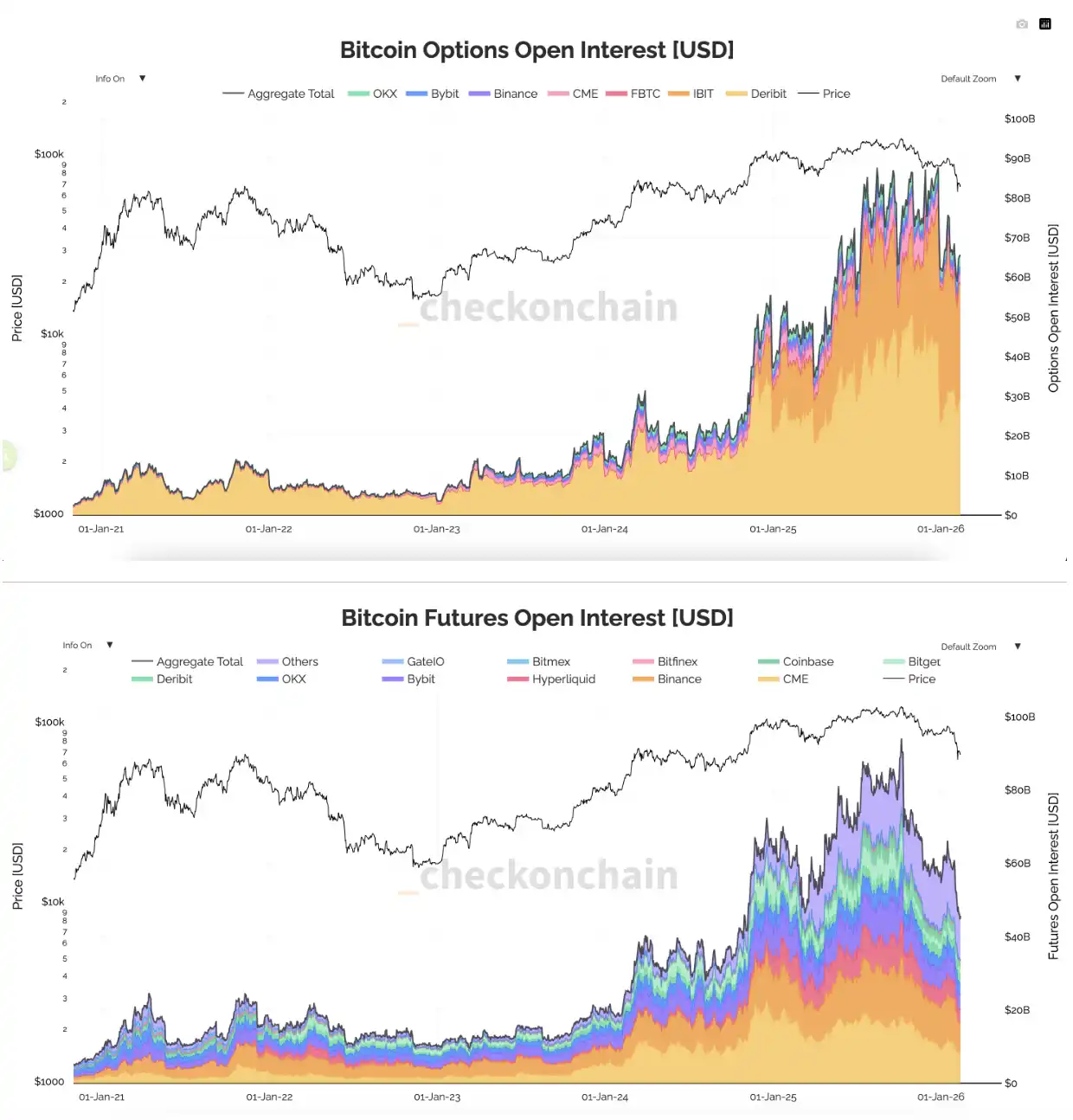

In reality, this is our misconception. The open interest in options has exceeded that of futures for some time now. It is not the options in the crypto market that are sitting on the sidelines, but rather "on-chain" options.

The data speaks volumes. The total trading volume of on-chain options protocols accounts for less than 0.2% of centralized exchanges like Deribit and Binance, and this does not include the data from IBIT options. In contrast to the fierce encroachment of Perp DEX on CEX, on-chain options are severely lagging behind.

The problem lies on the supply side—market makers are unwilling to come in.

Early on-chain options protocols, whether using CLOB or AMM, face the same "adverse selection" issues faced by DEX. When the prices on off-chain centralized exchanges fluctuate, the pricing of on-chain options often lags due to delayed oracle updates or slow block confirmations. Arbitrageurs can exploit this price difference to arbitrage before prices update on-chain, damaging the interests of liquidity providers.

As arbitrage losses cannot be avoided, and token incentives are nowhere near as generous as DEX liquidity mining, the on-chain options market remains trapped in a "market makers/LPs lose money → liquidity dries up → poor trading experience → users don’t come → liquidity continues to flee" vicious cycle.

This is similar to the predicament faced by early DEX. However, DEX broke through thanks to massive subsidies from liquidity mining and innovations in AMM, while on-chain options have yet to see their moment.

Breaking the Deadlock?

With the qualitative change of underlying infrastructure—quicker block confirmations, lower gas fees, and the rise of application chains—new generations of on-chain options protocols are unlocking this impasse with more sophisticated mechanisms.

Derive

Derive (formerly known as Lyra) has shifted its core strategy from a pure on-chain native model to a hybrid architecture that is closer to CEX.

It introduced an RFQ (Request for Quote) mechanism—when traders want to buy or sell options, the system sends a request for quotes to professional market makers. After calculating the latest risk exposure and market price off-chain, market makers submit confirmed quotes on-chain. Market makers have the right to "reject a trade." If they determine that the current market is experiencing significant volatility, they can choose not to quote. This effectively blocks the path for arbitrageurs to "sneak attack" market makers by exploiting price delays, thereby attracting professional institutions like FalconX to provide liquidity.

Alongside the RFQ, Derive runs an order book model on its self-built L2 application chain, making it easier for small traders to place orders and trade directly like in CEX. The RFQ service customizes large trades, while the order book service caters to retail.

Hyperliquid HIP-4

Hyperliquid's HIP-4 directly integrates "result trading" (including binary options and prediction markets) into its core trading engine, HyperCore.

The greatest value of HIP-4 lies in "unified margin." In the current market, if you want to simultaneously trade perpetual contracts and options, you need to put money on different platforms. After HIP-4 goes live, users can use the same margin in the same account to trade options and perpetual contracts at the same time. Market makers and traders can manage cross-market risk exposure in one place—for example, going long with perpetual contracts while buying protective put options. Capital efficiency is greatly improved, and market-making costs are significantly reduced.

A Game of "Dopamine"

"Retail investors hate options because they are too complex."

Look at the rebuttal given by the US stock market: In 2024, over 50% of the trading volume of S&P 500 index options comes from "zero-days-to-expiration options" (0DTE, options that expire the same day). Most buyers of these options are retail investors. They don't engage in complicated Greek calculations; they simply bet on whether the market will rise or fall with a small capital. If they are right, they could make 5x or 10x; if they are wrong, they only lose a limited premium.

Users do not hate options; the barrier lies in the obscure terminology and complex interfaces.

New generation on-chain options projects are racing toward this direction. Euphoria has created an interactive model of "click trading": users see a grid on the price chart, with each box representing a price range. They only need to click on the box they believe the price will touch; if the price really reaches it, they receive the corresponding reward. No need to understand what a strike price is, no need to calculate Delta, no need to choose an expiration date. Instant results, pure dopamine. This project is set to officially launch on the MegaETH mainnet on February 16.

Euphoria operation interface

On the distribution side, on-chain options protocols can cross the river by feeling the stones, following the "front store, back factory" model verified by Perp DEX. Derive recently opened its Builder Codes, allowing developers to use Derive's infrastructure to build custom front-end applications and directly earn fees from transaction flows. It can be anticipated that more and more front-end applications will incorporate options modules into their stacks.

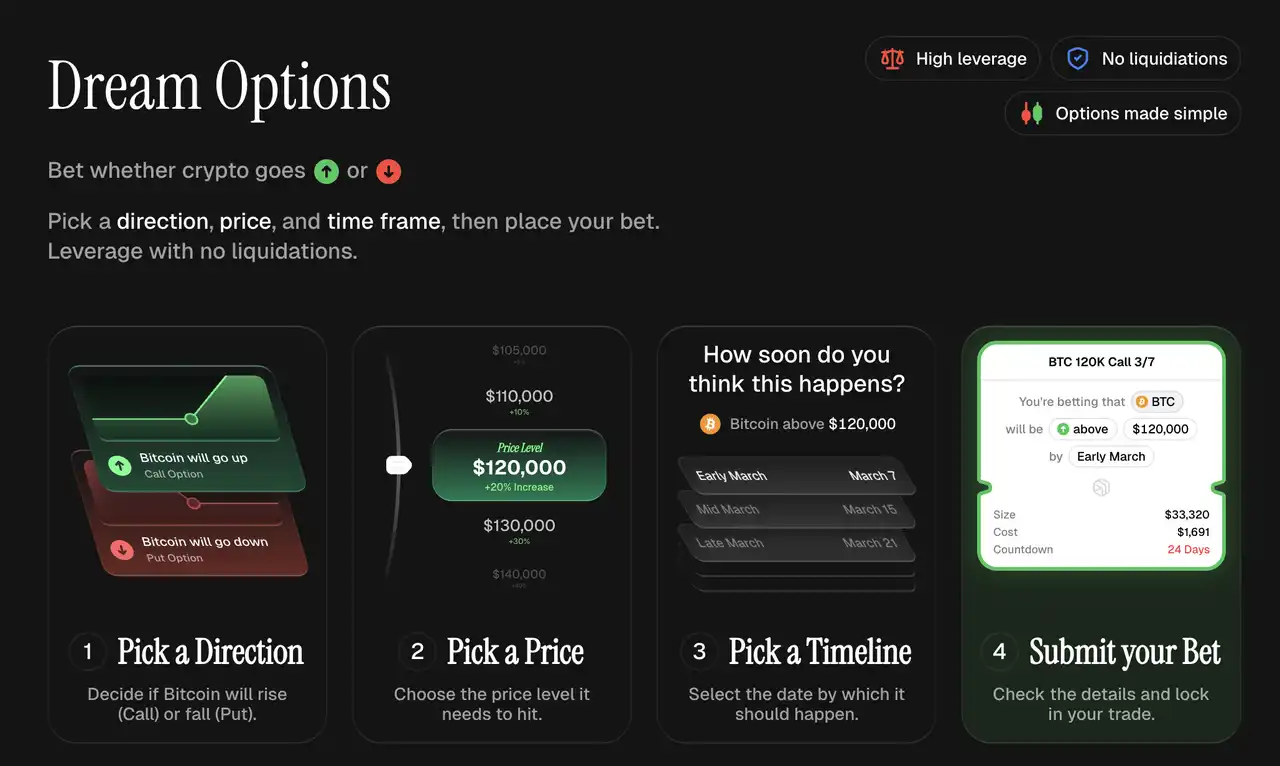

Options trading APP Dreaming based on Derive Builder Code

Conclusion

The current volume of on-chain options is still just a drop in the bucket compared to Perp DEX. There are still numerous obstacles to overcome for true explosive growth, including insufficient market maker depth, lack of retail education, and ambiguous regulatory frameworks.

However, the direction is clear.

On-chain options trading volume hit a new high a few days ago

In a world no longer offering free lunches, yields will converge towards the essence of "mapping risk."

With changes in market conditions, improvements in infrastructure, and a surge in retail demand, options are on the verge of becoming a core component of the on-chain financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。