For the second consecutive session, bitcoin ( BTC) breached the critical $66,000 support level, as the cryptocurrency continues its struggle to decouple from a bearish trend that has persisted since mid-January. Data from Bitstamp reveals a deepening correction, with the price tumbling to an intraday low of $65,312 at approximately 10:54 a.m. EST Thursday.

This latest slide has reignited market anxiety over a potential retest of the $60,000 psychological floor. Since Monday, Feb. 9, BTC has surrendered roughly 7% of its value—a drawdown that skeptics argue provides structural evidence for a new “ crypto winter.”

The bearish narrative is becoming so pervasive that it has forced a pivot in institutional outlooks. Most notably, Standard Chartered analysts—once some of the market’s loudest bulls—have aggressively slashed their projections. Previously targeting $150,000 for year-end 2026, the analysts at the bank now warn that BTC could capitulate to $50,000 before any meaningful recovery.

Their revised year-end 2026 forecast now sits at $100,000. According to a report by Lookonchain, this marks the second time in a mere three-month window that Standard Chartered has been compelled to downgrade its expectations, signaling a significant shift in the fundamental outlook for the current market cycle.

A catalyst for Thursday’s lackluster price action was the revelation that U.S. spot bitcoin exchange-traded funds (ETFs) recorded $276.3 million net outflow the previous day. Generally, heavy redemptions from these institutional vehicles have amplified short-term sell pressure and injected heightened volatility into spot markets. Compounding this technical weakness were onchain alerts indicating that a Satoshi-era whale had transferred approximately 12,500 BTC to exchanges, likely for liquidation.

Despite the overhead pressure, the bears do not have total control. The impact of the selling pressure is partially mitigated by data showing a sharp spike in exchange outflows, a metric often associated with whale accumulation and a move toward long-term cold storage. Furthermore, bullish sentiment received a much-needed boost from reports that Binance had finalized a $1 billion BTC conversion for its Secure Asset Fund for Users (SAFU).

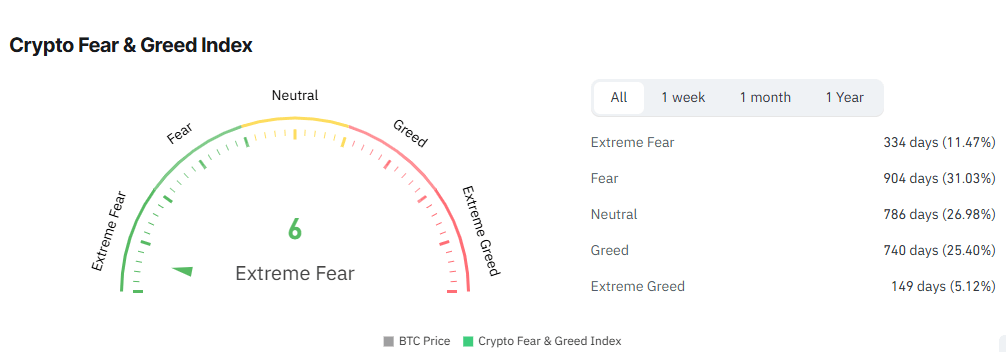

Meanwhile, sentiment on social media around bitcoin was gripped by extreme fear, reflected in the Fear and Greed Index reading of just 6. Furthermore, the buy-the-dip mentality that characterized previous corrections has been replaced by a wait-and-see posture as the market enters a gruelling sideways range.

For the most pessimistic observers, the “pain trade” is not over. Some analysts are now projecting a drop to $40,000, levels last seen at the beginning of 2024.

- Why did bitcoin drop below $66K again? Heavy ETF outflows and whale transfers triggered fresh sell pressure in U.S. markets.

- How far could BTC fall from here? Analysts warn of a possible retest of $60K, with some projecting a slide toward $40K.

- What is Standard Chartered’s latest forecast? The bank now sees BTC at $100K by end‑2026, down from its earlier $150K target.

- How are traders reacting globally? Extreme fear dominates social sentiment, with many shifting to a cautious wait‑and‑see stance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。