1. This Week's Market Overview

This week, the cryptocurrency market continued to exhibit extreme panic, with the Fear and Greed Index dropping to 9, marking a new stage low. The total market capitalization receded to $2.29 trillion, down 1.86% over 24 hours, with downward pressure remaining unchanged. BTC and ETH maintained a weak consolidation, with short-term indicators showing slight rebound and fluctuation signals, but the medium to long-term remains in an oversold weak pattern. ETF funds continued to show a net outflow, with a slight slowdown in Bitcoin outflow and an expansion in Ethereum outflow, as institutional risk aversion persists. The derivatives market showed divergent trends, with a slight increase in futures hedging demand, while perpetual contracts continued to de-leverage, keeping market risk appetite low and in a weak bottoming state.

On the macro level, expectations of the Federal Reserve tightening liquidity and ongoing global economic uncertainties continued to disrupt the market, suppressing the performance of crypto risk assets. In terms of regulation, many countries are accelerating their compliance and risk management for cryptocurrencies, with the U.S. advancing negotiations on crypto regulatory bills, and Hong Kong issuing compliance standards for RWA cross-border asset tokenization. At the industry level, the technical iteration of Ethereum and the R&D of Layer 2 are advancing steadily, with on-chain trading tools for AI being put to use; while institutions have withdrawn funds in the short term, they continue to lay out compliant crypto products and stablecoin tracks, not changing the long-term trend towards compliance and institutionalization in the industry despite short-term market volatility.

2. Core Market and Fund Dynamics

This week, the overall cryptocurrency market maintained an extremely weak bottoming pattern, with market sentiment further deteriorating. The total market capitalization continued to dip, hitting new stage lows, and mainstream coins displayed narrow consolidation, with clear divergences in short and long-cycle indicators. ETF funds continued to show net outflows, while the derivatives market persistently de-leveraged, with strong risk aversion among market participants, indicating that the bottoming process is still incomplete.

In terms of market sentiment, the Crypto Fear & Greed Index dropped slightly from last week's 11 to 9, remaining in the extreme fear zone with pessimistic sentiment further spreading. Although mainstream coins showed minor signs of repair, the capital avoidance trend has not changed. Coupled with macro and regulatory uncertainties, investor confidence is low, with no signs of sentiment recovery, as the market remains in a weak phase under concentrated pressure.

Regarding core market capitalization, the current total market capitalization of cryptocurrencies stands at $2.29 trillion, down 1.86% over 24 hours, continuing the recent accelerated downward trend and hitting new stage lows. The buying pressure in the market remains insufficient, and the trend of market capitalization shrinking has not changed, with a clear bearish downtrend in the short term, and the bottoming process has not yet initiated.

Specifically for the two major coins, BTC and ETH both exhibit short-term consolidation and medium to long-term weakness. BTC is currently priced at $67,251.77, down 0.41% over 24 hours and down 6.03% over 7 days, with a slight decrease in market share to 58.43%. Short-term indicators are divergent and in a consolidation state, while medium to long-term is still oversold but the weak pattern remains unchanged; ETH is currently priced at $1,970.16, down 0.26% over 24 hours and down 7.61% over 7 days, with market share falling to 10.31%. There is short-term rebound momentum, but it is close to resistance, with a clear downward trend in the medium to long term. Both require cautious operations, with strict control of positions and stop losses.

In terms of fund flows, the ETF market maintains a net outflow pattern, and institutional risk aversion has not subsided. Bitcoin ETF outflows have narrowed slightly compared to last week, with a slowing withdrawal pace; Ethereum ETF outflows have further expanded compared to last week, and the overall funding situation remains suppressive for the market, with no signs of institutional capital returning.

The derivatives market exhibits weakness and continued de-leveraging. The open interest in futures slightly increased, with a small rise in capital hedging demand; open interest in perpetual contracts significantly dropped, as high leveraged capital continued to clear out, shrinking market risk exposure while trading activity remains relatively low.

Overall, the current cryptocurrency market is in a stage of extreme pessimism, with persistent capital pressure and a weak bottoming phase, where mainstream coins struggle to escape medium to long-term weakness, and institutional capital withdrawal and deleveraging continue. It is necessary to wait for signs of sentiment easing, capital inflows, and stabilization of support levels, focusing on defensive strategies and rationally responding to short-term fluctuations.

3. Selected Trading Strategies List

1. High-Yield Strategy Selection

Core Highlights:

- Extreme win rate: 100% historical win rate, no losses in all trades, extremely high signal accuracy.

- Strong earning potential: Actual returns exceed 200%, perfectly fitting high volatility trends of small coins.

- Acceptable risk-reward ratio: Sharpe ratio of 32, achieving basic balance between returns and risks.

- Reasonable trading frequency: 81 trades, moderate strategy execution frequency, fitting the MEME coin rotation pace.

Applicable Scenarios:

Suitable for traders with high risk tolerance seeking high win rate and high returns on small coins, specifically designed for hotspot currencies in the MEME sector like PEPE, especially suitable for impulse trends such as MEME coin concept speculation and capital rotation. Can serve as an elastic allocation strategy for small coins, not suitable for long-term stable capital or extreme downward trends.

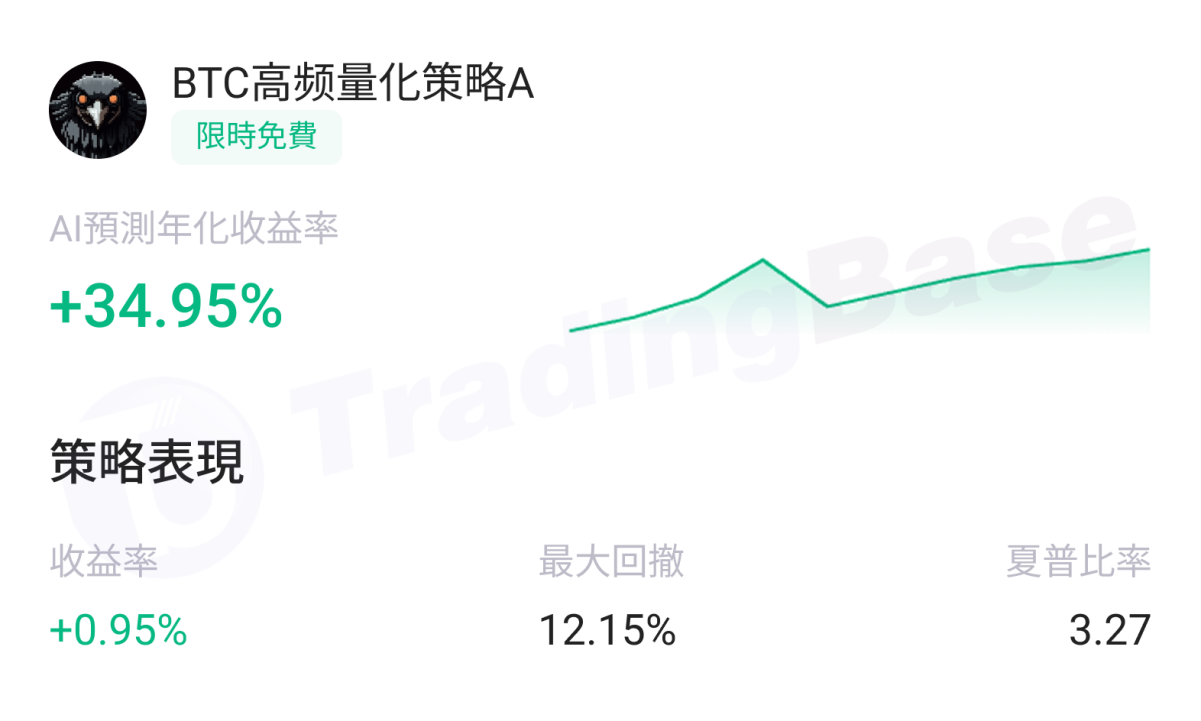

2. High-Frequency Trading Strategy Selection

Core Highlights:

- Outstanding risk-reward ratio: Sharpe ratio of 27, performing excellently in high-frequency strategies, with attractive returns corresponding to risks.

- Stable performance: Smooth return curve without large fluctuations, strong strategy stability, suitable for funds pursuing compound interest.

- Adapted for high liquidity targets: Designed for BTC, ensuring strategy execution and sustainability based on its deep market.

- Considerable annualized returns: AI predicts annualized returns exceeding 30%, having strong appeal among similar high-frequency strategies.

Applicable Scenarios:

Suitable for investors with medium risk tolerance seeking low volatility and stable returns, specifically designed for high liquidity mainstream coins like BTC, adaptable for quantitative arbitrage and swing trading in fluctuating markets, serving as a stable base strategy for funds, especially suitable for those seeking to avoid unilateral fluctuations and pursue stable compounding, not designed for extreme downward trends.

3. High Stability Strategy Selection

Core Highlights:

- Extreme win rate: 100% historical win rate, no losses in all trades, extremely high signal accuracy.

- Excellent drawdown control: Maximum drawdown of only 75%, with very low volatility in mainstream coin strategies, highlighting capital security.

- Considerable earning elasticity: Actual returns exceed 100%, showing impressive performance in strategies for mainstream coins like ETH.

- Acceptable risk-reward ratio: Sharpe ratio of 90, achieving good balance between returns and risks under low drawdown conditions.

Applicable Scenarios:

Suitable for traders with medium risk tolerance seeking low volatility and stable returns on mainstream coins, specifically designed for high liquidity mainstream public chain currencies like ETH, adaptable for trend and reversal trading in fluctuating markets, serving as a robust enhancement strategy for mainstream coin allocation, especially suitable for those seeking to avoid extreme fluctuations and pursue stable returns, not suitable for extremely conservative long-term capital or extreme unilateral downward trends.

Download TradingBase.AI for one-click following of quality strategies:

https://app.tradingbase.ai/downLoad

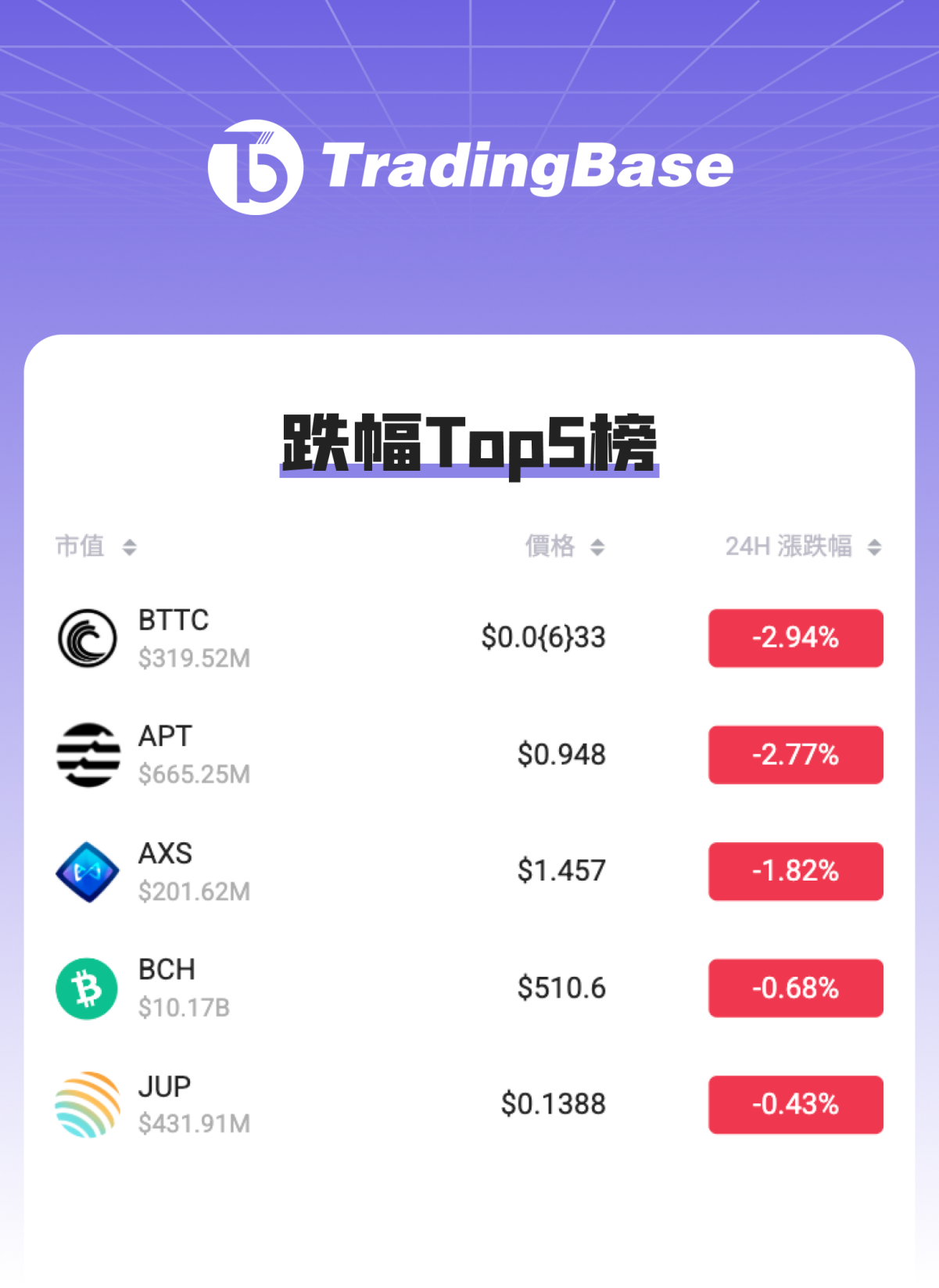

4. 24h Coin Top Gain and Loss Rankings

Top 5 Gainers:

Top 5 Losers:

5. Conclusion

This week, the cryptocurrency market was under the dual pressure of extreme panic, continued outflows from ETFs, and macro uncertainties, maintaining a weak bottoming pattern overall, with mainstream coins showing divergent fluctuations and continued deleveraging in the market, while short-term selling pressure has not been fully released. However, industry compliance development is steadily progressing, and technological iterations are ongoing, with the long-term layout logic of institutions remaining unchanged, laying a solid foundation for the market's medium to long-term recovery. Going forward, attention should be paid to the stabilization of key support for BTC, signals of ETF capital return, and macro liquidity trends. In the medium to long term, structural opportunities can be focused on compliant crypto products, mainstream chain upgrades, and stablecoin tracks, with strict control of positions and rational responses to short-term fluctuations. Please continue to follow this column for the latest market interpretations and strategy analyses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。