Written by: Suvashree Ghosh, Bloomberg

Translated by: Saoirse, Foresight News

Editor's Note:Recently, the global cryptocurrency market has continued to remain sluggish, and China has tightened its regulatory stance on cryptocurrencies and stablecoins, clearly prohibiting the issuance of yuan-pegged stablecoins abroad without approval, directly impacting the construction process of Hong Kong as a digital asset center. This article focuses on the market response and industry impact after the policy implementation, revealing the core contradiction between capital control and cryptocurrency innovation. Against the backdrop of intensified industry reshuffling and accelerated capital withdrawal, the cryptocurrency sector is returning to practical development, and the relevant regulatory boundaries and future trends deserve ongoing attention.

November 26, 2025, a cryptocurrency exchange storefront in Hong Kong. Photo: Lam Yik/Bloomberg

Setbacks in the Digital Realm

Last year, more and more commentators in the cryptocurrency industry believed that China's attitude towards digital assets might show a turnaround.

Since the governor of the People's Bank of China, Pan Gongsheng, proposed the vision that the yuan could challenge the dollar's dominance, there has been a constant buzz about a "policy warming" in the market.

However, on February 7, all such expectations came to an abrupt halt.

During the latest round of cryptocurrency declines, China tightened regulations on cryptocurrencies and the tokenization of real assets, prohibiting domestic institutions from issuing digital tokens abroad; issuance of yuan-pegged stablecoins abroad without approval is also forbidden. Officials stated that these measures are to prevent risks to currency sovereignty.

Angela Ang, head of policy and strategic partnerships for the Asia-Pacific region at blockchain intelligence firm TRM Labs, stated, "China's attitude towards stablecoins is at best tentative, and has become increasingly lukewarm in recent months."

She noted that the central bank's announcement "completely extinguished any hope for introducing offshore yuan stablecoins in the short term—definitely no hope for Hong Kong, and likely none for other regions either."

This represents a significant setback for Hong Kong and its long-standing goal of becoming a digital asset center.

In June last year, Hong Kong's Secretary for Financial Services and the Treasury, Christopher Hui, stated that based on regulatory requirements, the possibility of linking the stablecoin in Hong Kong to the yuan could not be ruled out. Now, the outside world generally believes that he will completely close that door.

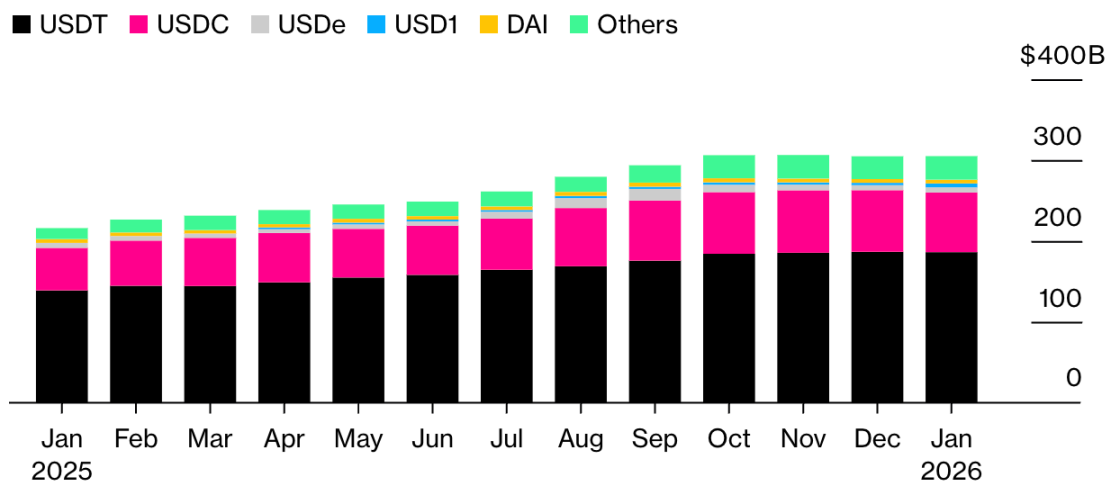

During Trump's Administration, the Supply of USD Stablecoins Soared

Source: Artemis Analytics

As Angela Ang stated, the signal of tightening regulation has long been evident.

As early as last August, China had already asked local brokers and related institutions to stop releasing research reports on stablecoins and hosting related promotional seminars in order to curb overheated market sentiment.

Patrick Tan, chief legal advisor at blockchain intelligence company ChainArgos, said that last week's policy announcement "removed the uncertainty hovering over the market regarding private issuance of yuan stablecoins. Issuers now clearly know where the red lines are."

Institutions applying for licenses can only focus on issuing stablecoins pegged to the Hong Kong dollar.

Bloomberg previously reported that last year, as many as 50 companies in Hong Kong planned to apply for stablecoin licenses, including tech giants Ant Group and JD.com. However, according to reports from the Financial Times in October, these companies were forced to suspend their stablecoin plans after intervention from Beijing.

Neither Ant Group nor JD.com responded to requests for comments from reporters.

As of this Tuesday, Hong Kong has issued licenses to 11 cryptocurrency exchanges, while approving 62 companies to conduct digital asset trading for clients, including institutions with Chinese backgrounds such as CMB International Securities Limited, CITIC Securities (Hong Kong) Limited, and Tianfu Futures Co., Ltd.

However, there are concerns within the industry that if access to the yuan is not possible, the entire layout may become futile.

"The issue has never been with Hong Kong's regulatory framework, but always whether China will tolerate yuan-denominated instruments circulating outside its control," Patrick Tan stated, "Capital controls and the liberalization of stablecoins are fundamentally mutually exclusive."

Market Data Continues to Weaken

Unsettled Contracts of Bitcoin Perpetual Futures Continue to Decline

Source: Coinglass

The unsettled contracts of Bitcoin perpetual futures have not rebounded since they started declining last October, highlighting a lack of confidence supporting this round of recovery. Coinglass data shows that it has dropped by about 50% from the October peak.

Capital Outflow: $3.3 Billion

Bloomberg Intelligence compiled data shows that since the sharp decline in early October, investors have withdrawn about $3.3 billion from US Ethereum ETFs, with withdrawals exceeding $500 million this year. The data indicates that the asset size of Ethereum ETFs has fallen below $13 billion, the lowest level since July last year.

Industry Perspectives

“The market is consolidating around truly effective areas. Even crypto-native venture capital with ample funds is shifting towards fintech, stablecoin businesses, and prediction markets, making it difficult for other areas to gain attention.”

—— Santiago Roel Santos, Founder and CEO of crypto private equity firm Inversion

The venture capital funds in the cryptocurrency industry are shifting their focus to better-performing areas, such as stablecoin infrastructure and on-chain prediction markets, and are expanding into relevant adjacent fields.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。