⚡️Spark @sparkdotfi officially launches Spark Prime, a feature that should be liked by all institutions—

In the past year, the market value of stablecoins has risen to over 300 billion, but the utilization rate of the lending market has remained at around 30% for a long time.

The logic of traditional DeFi lending is very simple: the amount of collateral you have determines the corresponding loan limit the system gives you, only recognizing the nominal size of a single position, but not understanding the relationship between positions.

This is sufficient for retail investors but not very friendly for institutions and hedge funds.

Spark Prime attempts to change this by creating a measurement method tailored for institutions and hedge funds—

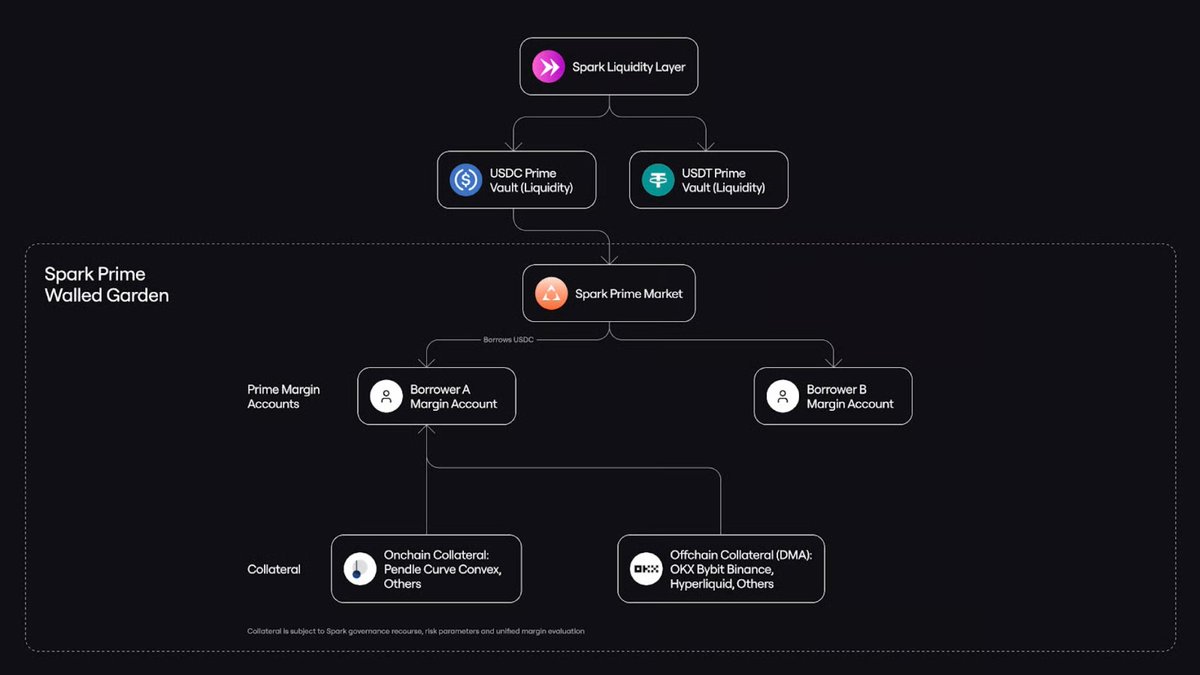

It uses Arkis's risk engine to pull on-chain positions, exchange positions, and custodian account assets into a unified perspective, calculating margins based on portfolio net risk rather than simply stacking nominal sizes.

For example:

If you have 100 million in long positions in spot and simultaneously have 100 million in short positions in a perpetual contract on a CEX, theoretically, the positions hedge each other, and the real risk approaches 0;

Traditional DeFi would see this as "100 million long + 100 million short" as two isolated positions, requiring a large amount of margin to be locked on both sides.

Spark Prime seeks to identify this hedging relationship, calculating margin to more closely reflect real risk rather than based on 200 million nominal positions, making it easier and saving money, greatly freeing up liquidity that would otherwise be unnecessarily occupied.

Currently, it supports recognizing positions on Binance, Bybit, OKX, Hyperliquid, Pendle, and Curve.

Pretty good, with this cross-scenario risk recognition capability, the borrowing logic of DeFi will shift from a simple and crude capital pool model to a balance sheet model.

With the evolution of margin logic, institutions will truly scale up their operations. Otherwise, no matter how many stablecoins are available, they will only be lying on the balance sheet gathering dust.

However, I am now thinking of something more interesting:

Once this path is successfully implemented, the ceiling of DeFi lending may not just be raised but completely redefined. How will other protocols respond and compete?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。